- In his speech today, European Central Bank (ECB) Member Rehn said that they know that inflation is very high and that they should act accordingly by tightening their monetary policy. Another ECB Member, Nagel, said that interest rate hikes should continue after October and that inflation has upside risks due to tensions in energy markets. ECB’s Chief Economist Lane said they agreed that a rate hike would be needed in the next few meetings.

- In Turkey, the Budget Balance for September, announced today, gave a deficit of 78.6 billion TL, and the Primary Budget Balance gave a deficit of 45.5 billion TL. In September, Budget Revenues were 206.9 Billion TL and Expenditures were 285.6 Billion TL. After this deficit, the Budget Deficit for the first 9 months of the year increased to 45.5 billion TL, while the Primary Budget Surplus decreased to 161.6 billion TL.

- The new Finance Minister of the UK, Hunt, in his speech today, said that almost all of the tax measures announced on September 23 with the growth plan will be withdrawn, the income tax rate will remain at 20% indefinitely and the measures announced today will increase to £32 billion. During the statements, there were increases in the GBPUSD parity.

- The New York FED Manufacturing Index, announced in the US for October, decreased by 7.6 points from -1.5 to -9.10. A reading below zero indicates a contraction in the manufacturing sector, and a reading above zero indicates growth in the manufacturing sector.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

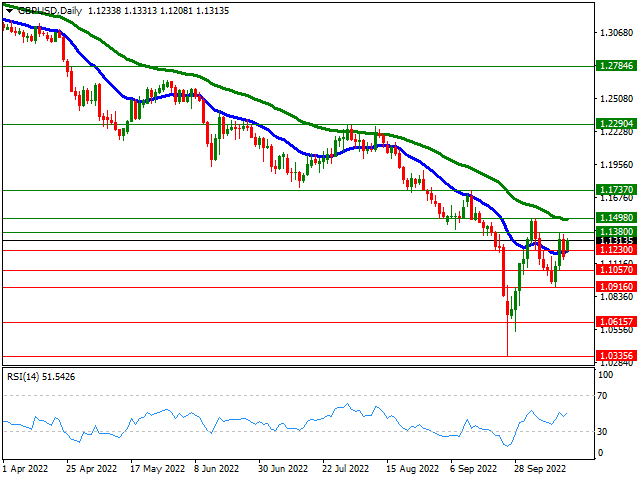

GBP/USD

GBP/USD – The pair found support from the statements of the new Minister of Finance…

On the first trading day of the week, the British pound is watching the buyer with the statements of the new finance minister, Hunt. Hunt announced that it has rolled back almost all tax measures announced on September 23. On the other hand, the loss of ground in the US Dollar index also supports the rise in the parity. If the rise continues in the pair, 1.1380 and 55-day exponential moving average, which created resistance last week, can be followed as the first resistance zones. On the other hand, if the pair gives intraday gains and turns down, the 20-day exponential moving average and 1.1057 level can form support.

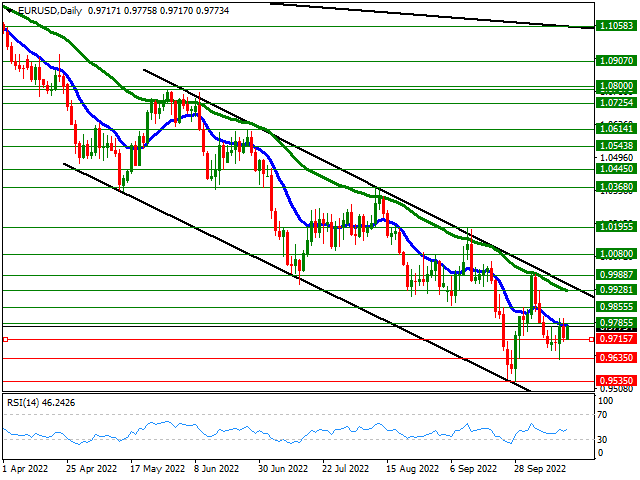

EUR/USD

EUR/USD – The 15-Day Average Builds Resistance…

The EURUSD parity remains positive above the 0.9715 band on the first trading day of the new week, after two weeks of decline. However, the upward movement is limited to its 15-day average for now. If the pair turns above this average, 0.9855 and 50-day exponential moving average stand out as the next resistance zones. On the other hand, in case of re-experiencing the selling pressure in the parity, the 0.9635 level below the 0.9715 support band can be followed as the next support zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

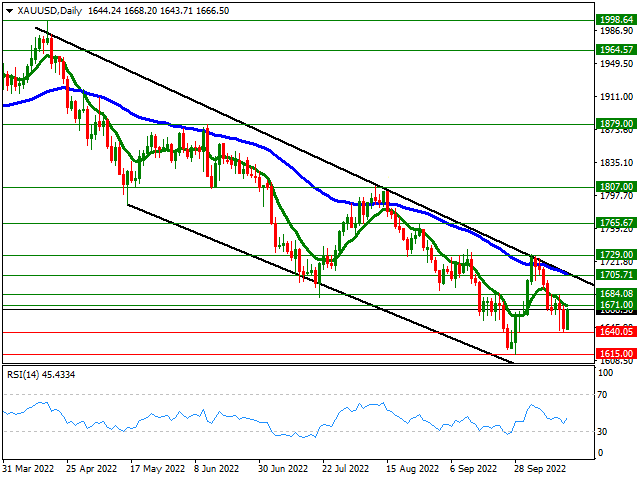

XAU/USD

XAU/USD – Recovered Friday’s Losses…

Ounce Gold took back most of Friday’s decline with purchases on the first day of the new week. Preserving its intraday gains throughout the European session, Ounce Gold technically approached the 1671 resistance zone limit, which is the 10-day exponential moving average. If it moves above this resistance zone, 1685 and the black descending trend line in precious metal stand out as the next resistance zones. On the other hand, if Yellow Metal is suppressed from its 10-day average, the 1640 level will be the first support zone in our follow-up.

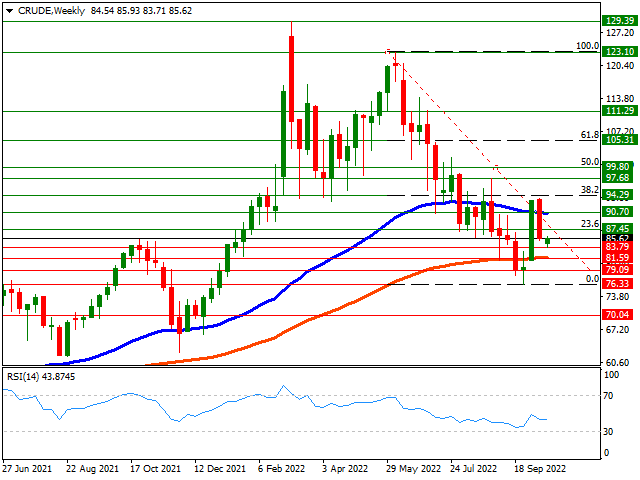

CRUDE

CRUDE – Trying to Consolidate After Biggest Weekly Loss in Last 2.5 Months…

Crude Oil, which experienced the biggest weekly loss of the last 2.5 months with a loss of around 8.5% last week, is trying to consolidate above the $83 band on the first trading day of the new week. In case of accelerated rise in crude oil, which is followed by a mild buyer, $87 and $90, which is the 50-week exponential moving average, can be followed as the next resistance zones. On the other hand, if the selling pressure comes to the fore again in Crude Oil, the $81 level can be followed as the next support zone under the $83 support. This level is also important in that it coincides with the 100-week exponential moving average.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.