- The share value of Credit Suisse bank, which created a big agenda during the week, lost value by more than 11% in the European session today after its reaction yesterday and fell below 2 francs.

- With no change in the probability of Credit Suisse’s bankruptcy and its shares falling sharply again, there has been a re-entry into safe havens. While the US 10-year bond yield decreased from 3.56% to 3.46% today, the 2-year bond yield also decreased. Germany’s 10-year bond also declined rapidly, approaching 2.15% today.

- When we look at the Industrial Production data for February, which was announced at 16.15 from the USA, no change was observed on a monthly basis. However, the data for the previous month, January, was revised positive to 0.2%.

- Consumer inflation data for February were released today at 13:00 (GMT+3) from the Euro Zone. When we look at the data, the headline annual inflation seems to have decreased from 8.6% to 8.5%, but the monthly inflation increase still continues strongly.

- However, there is no slackening on the core inflation side. It increased by 0.3 points annually to 5.3% and monthly inflation was announced as 0.8%. While inflation continues to rise in both items on the monthly side, we can clearly see the rigidity in core inflation.

- The data, which is in line with the statements made by the ECB members today, shows that the inflation trend remains strong and these data show that the European Central Bank may continue to increase interest rates.

- Kazimir, one of the ECB members, said in a statement this morning that core inflation has not regressed and that interest rate hikes should be continued. Another member Simkus made similar statements and stated that interest rate hikes may continue.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

S#

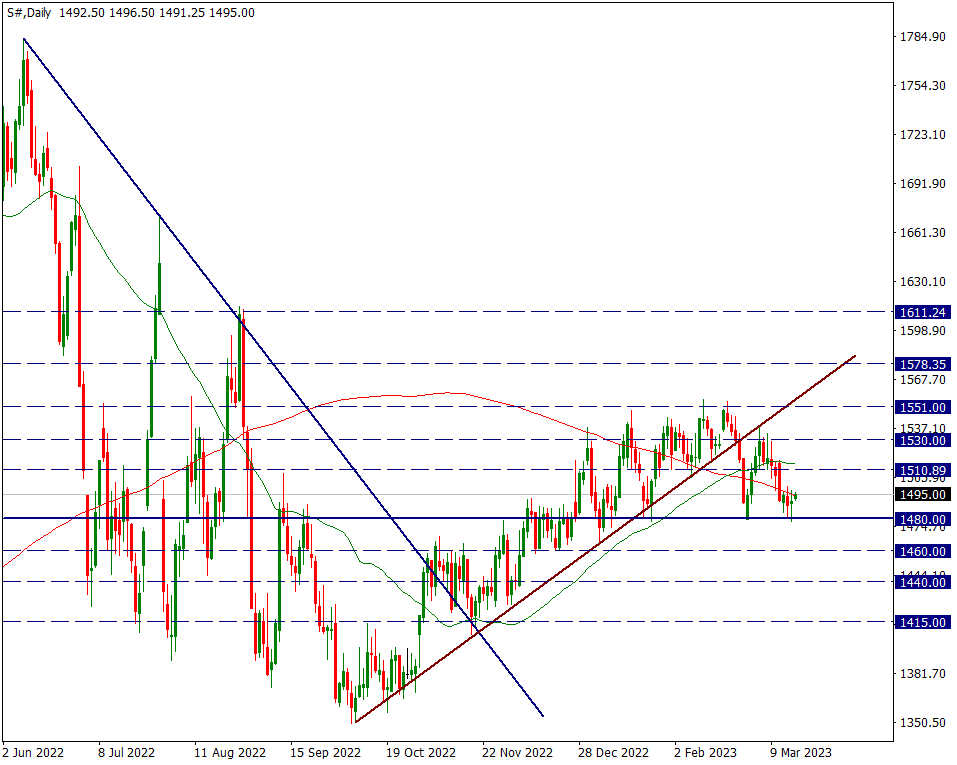

S# – Drought News and Importance of 1480 Support…

On the soybean side, there has been recent news of drought and production shortages. In Argentina, one of the largest soybean producers, 2022-2023 soybean production was affected by the lack of rain and frosts in February. After 43.3 tons of production in the 2021-2022 period, the production forecast for the 2022-2023 period decreased to 25 million tons. Bad weather conditions affect production.

Technically speaking, soybean active futures price once again clings to the 1480 support. 1480 has worked as an important support-resistance line in the last 3-4 months period. If the holding at 1480 is successful in the current situation, there may be a double bottom formation effect and we can observe the 1551 top seen in February again.

If 1480 is broken with daily candle closings, 1460 and 1415 levels may come to the fore.

BRENT

BRENT – Continuing to Stay Below Level 75…

With the dangers in the US and European banking sector affecting oil prices, Brent Petrol saw the level of 71.68 after 15 months. It continues to be priced around 74.25 with the reactions following the declines. Possible decreases can be viewed as 72.29 support. On the rise, 75.23 may show resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAU/USD

XAU/USD – After a 45-day break, it rose to 1940 level…

While Yellow Metal continued to rise rapidly, 1940 levels were seen again after 45 days. Demand for Yellow Metal increased due to the bankruptcy of 2 banks in the USA and the insecurity caused by the Swiss-based Credit Suisse. If the 1944.38 resistance is broken upwards, the 1958 level may come to the fore. In possible retracements, 1928.95 can be followed as support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

EUR/USD

EUR/USD – Withdrawals After Euro Zone Inflation Data…

After the consumer inflation data from the Euro Zone at 13:00 (GMT+3), there was a pullback in the parity to 1.0611 levels. It continues to price around 1.0630 with the backlash. The 1.0635 level can be followed as resistance on the ups. On the downside pricing, 1.0574 level can be followed as support.

Contact Us

Please, fill the form to get an assistance.