- Although the economic data for the 4th quarter from China in the Asian session last night was above the expectations, it clearly showed the slowdown trend. This slowdown of China, which repeated the Covid closures in the last quarter of 2022, is extremely normal. While China closed 2022 with a growth of 2.9%, annual industrial production was 1.3%. Unemployment rate, on the other hand, decreased by 0.2 points to 5.5% according to the latest data.

- We will follow the decision of the Bank of Japan at 06:00(GMT+3) in the morning of the next day. At the last meeting, the 10-year Japanese government bond yield ceiling was raised from 0.25% to 0.5%, and the USDJPY side quickly pulled back. At this meeting, the possibility of raising the bond ceiling by 50 basis points to 1% is discussed. If this happens, strong volatility may occur in pairs with JPY legs.

- Inflation data came from Germany during the day and inflation for 2022 ended with 8.6%. December inflation decreased by -0.8%. The ZEW Economy Confidence Index, which also came from Germany, started the new year positively and turned positive to 16.9.

- Canadian inflation closed the year 2022 with 6.3% inflation, 0.1 percentage point lower than expected. Thus, the decline that started from 8% continued.

- The Empire State manufacturing index from the USA came in at -32.9, worse than the expectation and the previous month.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

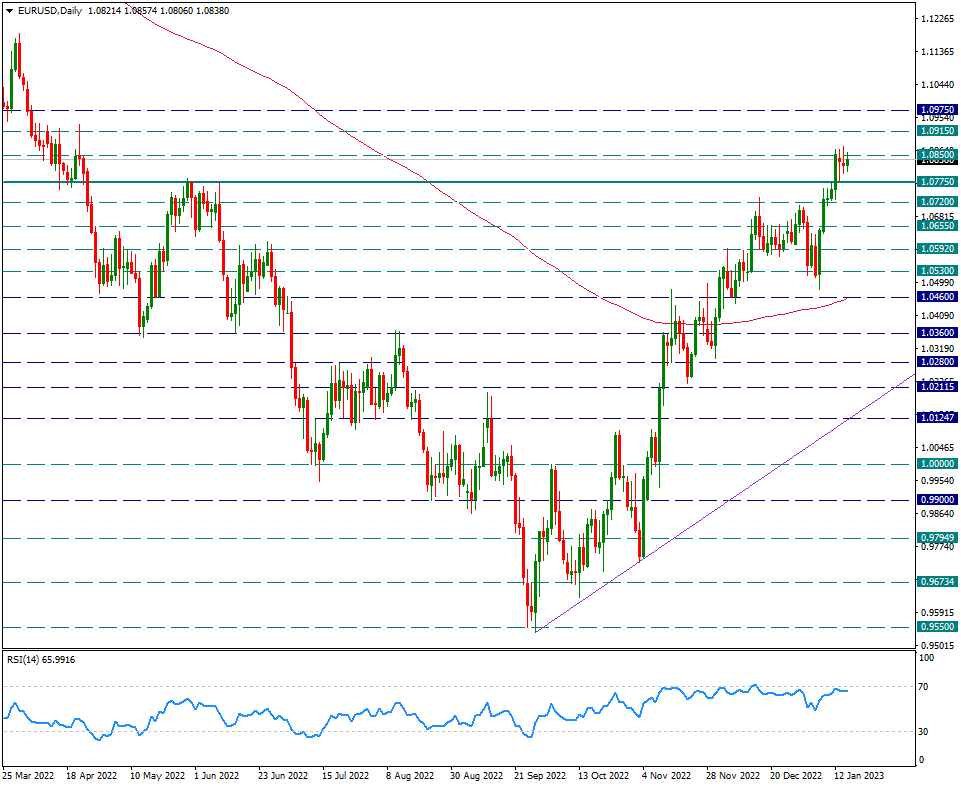

EUR/USD

EUR/USD – Trying 1.0850 Again During the Day…

While the pair continues in the range of 1.0850/1.0775, today it forces the upper part of this band again. A daily candle close above 1.0850 may further strengthen the uptrend in the pair and the upward trend towards the 1.10 region may continue step by step.

Otherwise, we will be following the 1.0775 support as the first intraday support.

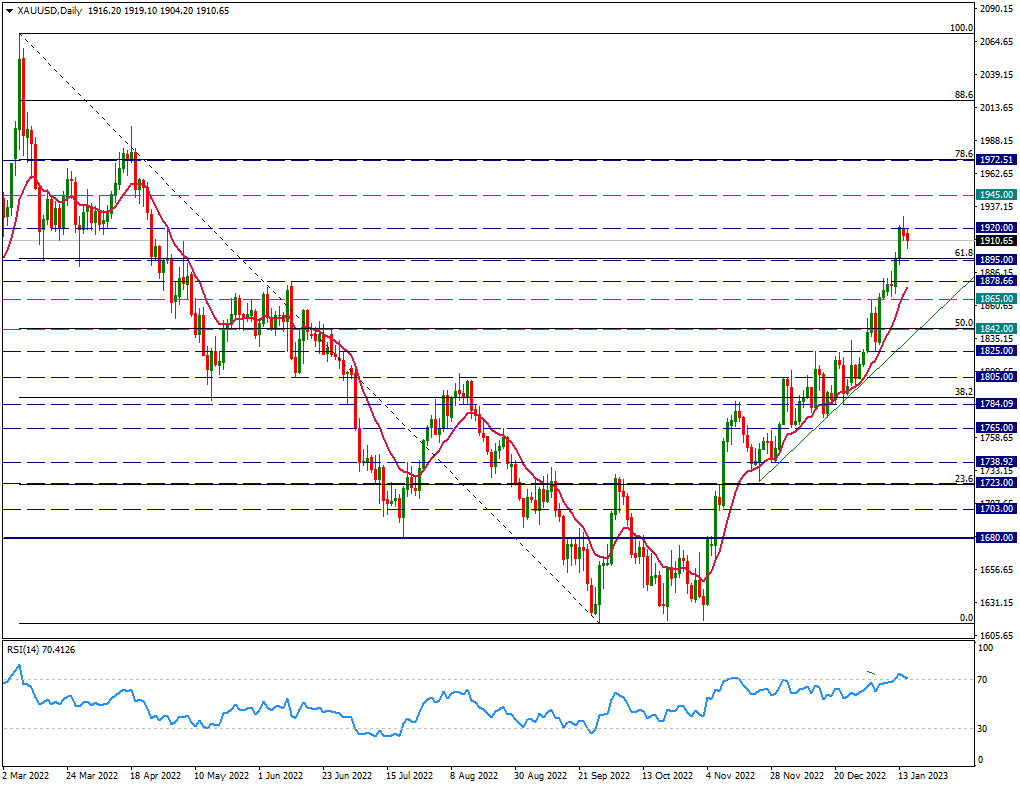

XAU/USD

XAU/USD – On the Second Day of the Profit Sale from 1920…

At the beginning of the week, it had risen above the 1920 resistance and strongly tested this region. However, the 1920 resistance is significant and profit selling is coming from this region. The 13-day average, which is one of the averages we use for trend tracking, will be the main support line. This average corresponds to 1878 support and we will follow it carefully.

Despite possible profit selling, it may technically be premature to expect strong declines in the yellow metal unless a close below the 13-day average is achieved. Above the 13-day average, we can expect the current trend to be maintained in the short term.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

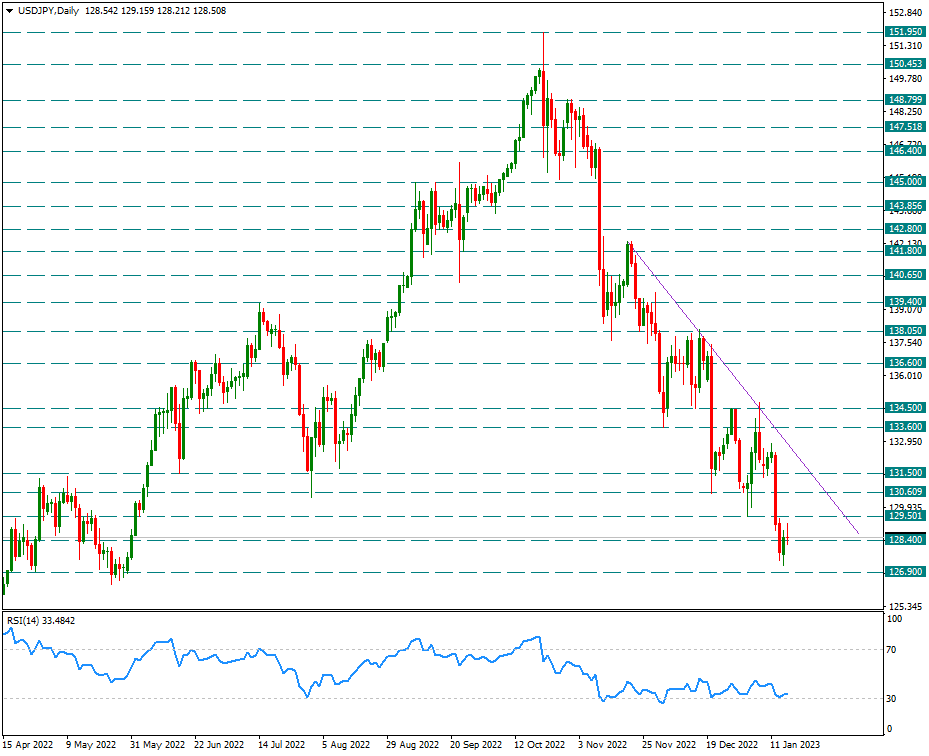

USD/JPY

USD/JPY – Reactions Limited Ahead of BOJ Meeting, Decision Might Be Important…

Tonight, we will follow the decision of the Bank of Japan’s monetary policy meeting in the morning. In the previous meeting, it was decided to increase the 10-year bond interest band from 0.25% to 0.5%, and the USDJPY parity declined rapidly on this decision.

At this meeting, it is among the expectations that the BOJ will stop controlling the yield curve and stop controlling the 10-year bond interest band. However, there is no clear direction for this yet by the BOJ. The meeting decision gives room for surprise in this regard.

The 126.90 support below is one of the important support areas. The pair, which is close to this level, could strengthen its moves in favor of the JPY if it breaks 126.90. It is useful to pay attention to pairs with JPY legs during and after the meeting.

While looking at the intermediate resistances line by line in possible reactions, the main intraday resistance will be checked as 131.50.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

GAU/TRY

GAU/TRY – Its Orientation Towards 1165 Resistance Continues…

The Gram Gold side rose step by step, touching the 1165 level earlier this week. However, slight profits were lowered by the sale. Today, there is a trend towards 1165 resistance again. In general, we continue to monitor the movement with the 13-day average for trend continuation in the short term.

Contact Us

Please, fill the form to get an assistance.