On the last trading day of the week, an image is drawn in favor of the mild Dollar Index, and it is a day full of statements and economic data by the ECB.

Final inflation in the Eurozone for November was announced as 10.1% annually. Core annual inflation stood at 5%. Core inflation remained unchanged and remains at a record level. This justifies the hawkish tendency of the European Central Bank at the meeting yesterday.

Another ECB Member, Holzmann, stated that they made a decision between increasing the interest rate by 50 basis points and giving a hawkish message, or increasing the interest rate by 75 basis points and softening the rhetoric a little more, and they chose a 50 basis-hawk stance. It has not made a statement on the targeted interest rates, prompting the market to make its own forecast.

Rehn, one of the ECB members, stated that there is still a long way to go with interest rate hikes and gave guidance on 50 basis points each at the February-March meetings. After the hawkish statements made yesterday, two increases of 50 basis points each in the first quarter of the year and an increase of 25 basis points in the second quarter are currently on the agenda.

ECB’s Centeno made a statement supporting Lagarde’s rhetoric, stating that it is difficult to return to the 75 basis point rate hikes.

10-year Italian bond yields have increased since yesterday to 4.28%, and the bond yield spread between Germany and Germany rose to 212 basis points. The increase in this spread is a sign that should be paid attention to in terms of economic risks in the region.

Leading December Service PMI indices from across Europe were announced during the day.

- UK – Services PMI (leading – Dec): 50 (Exp. 49.2 ; Prev: 48.8)

- Eurozone – Services PMI (leading – Dec): 49.1 (Exp. 48.5 ; Prev: 48.5)

- Germany – Services PMI (leading – Dec): 49 (Exp. 46.3 ; Prev: 46.1)

Manufacturing PMI data is as follows;

- UK – Manufacturing PMI (leading – Dec): 44.7 (Exp. 46.5 ; Prev: 46.5)

- Eurozone – Manufacturing PMI (leading – Dec): 47.8 (Exp. 47.1 ; Prev: 47.1)

- Germany – Manufacturing PMI (leading – Dec): 47.4 (Exp. 46.3 ; Prev: 46.2)

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

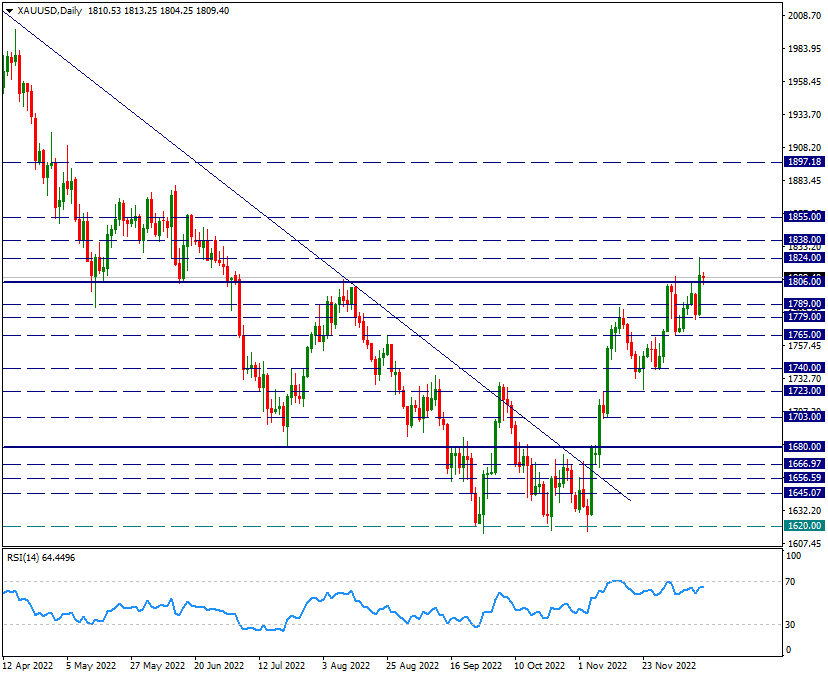

XAU/USD

XAU/USD – Priced In The 1782/1773 Range After The Fall…

After starting to withdraw from 1824 level at the beginning of the week, Ounce Gold deepened this movement with the FED and ECB meetings and regressed to 1773 support as of today. Here he found support for now. But the reactions hang on the 1782 resistance. In intraday movements, we will watch the 1773/1782 range and follow the breakout directions from this region. If it rises above the 1782 level, it may want to retest the lower band of the rising wedge that it broke with the ECB.

Below 1773, we will check the 1740 and 1723 supports.

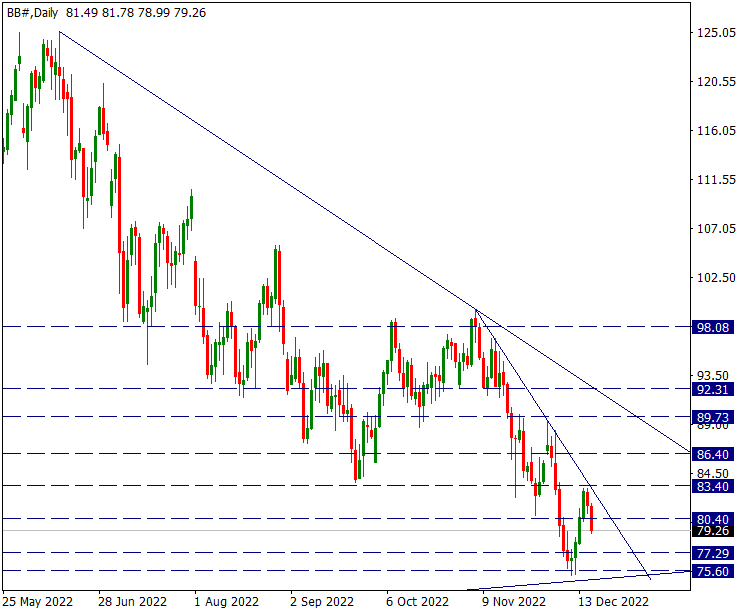

BRENT

BRENT – Reactions remained limited and were replaced by profit sales…

Brent oil has been on the upswing since last week, albeit slightly. However, we see sales yesterday with the hawkish rhetoric from the ECB and the expectations that the economies will slow down.

When we look technically, we see that the recovery trend has ended at the point that coincides with the short-term downtrend line from 99.56 and profit sales are coming. As long as we cannot see a pricing above 83.40 in the short term, we can think that the reactions on the Brent oil side may bring profit sales.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

USD/JPY

USD/JPY – 138.05 Resistance Could Not Be Crossed Once Again…

While the USDJPY parity continues to be priced between 144 and 233-day averages, it continues to be priced within this region. Yesterday, 138.05 resistance was tested, which corresponds to the 144-day average. Today, we see that this line is not broken and profit sales are formed in the pair again. Unless this line is broken, the short-term trend situation for USDJPY is now neutral and movements between the upper and lower band of this region can be observed.

138.05 above and 133.60 below are important in this sense.

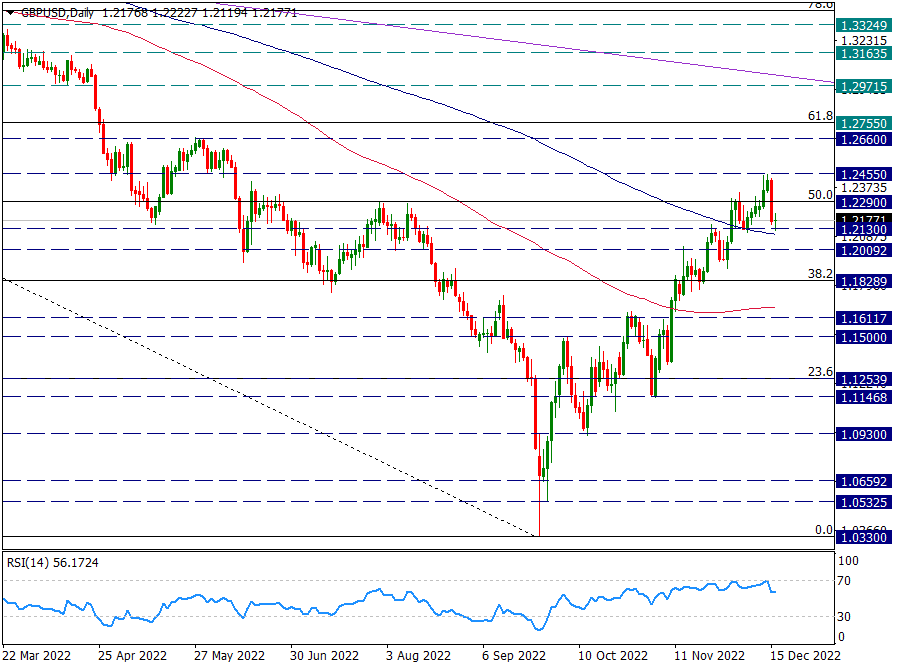

GBP/USD

GBP/USD – Holding Above 200 Days Despite Yesterday’s Rapid Drop…

After reacting as high as 1.2455 during the week, a strong profit selling came from this region yesterday and the continued rise since December 7 almost took it back in one day. However, it did not break the 200-day average and remains above this average (1.2130) as of the last day of the week. The 200-day average is important and as long as it holds above this average, the positive image in GBPUSD can be processed step by step. However, at a critical point and if it falls below 200 days, the 1.18 and 1.16 regions may come up again.

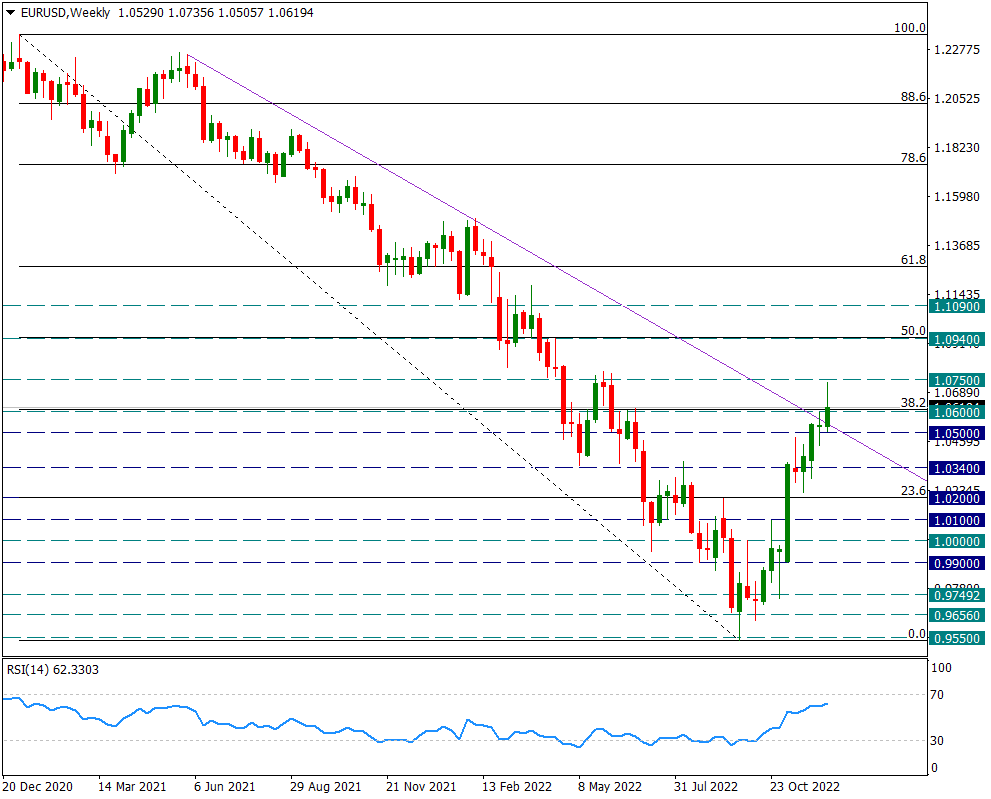

EUR/USD

EUR/USD – Long-Term Downtrend May Be Noticed in Weekly Closing…

The parity, which continued its upward trend with the weak US inflation data on Tuesday during the week, continued to move in favor of the Euro yesterday as the European Central Bank was more hawkish than the FED. However, there is some pullback today and it is down from 1.0720 to 1.0630.

Here, the region to be watched at the weekly close is the downtrend line coming from the 1.22 region, as seen in the chart, and it is necessary to watch the weekly closes around this downtrend line. A close below may raise doubts about movements in favor of the Euro again. In general, a close above 1.06 can give a technical idea about the continuation of the rise experienced in recent weeks. This zone will also be important as the 1.23/0.95 drop coincides with the Fibonacci 38.2 retracement. A close below the 1.06 zone could lead to a loss of momentum for buyers showing the 1.0720s during the week.

We will continue to monitor movements around 1.06.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.