- Producer Price Index (PPI) data in the USA came in above expectations. PPI increased by 0.7% in January, above the expectations of 0.4%. Compared to the same period of the previous year, it increased by 6.0%, above the 5.4% expectation. Core PPI, on the other hand, increased by 0.5% in January, while it was expected to increase by 0.3%. For the same period of the previous year, an increase of 5.4% was realized, above the expectation of an increase of 4.9%.

- Looking at the data, annual data continues to decline due to the base effect. But don’t let this mislead you. Because the price increase momentum on a monthly basis is quite strong. This was also seen by the market and the Dollar Index continues to strengthen. The US stock markets are under pressure these days, with the US 10-year bond yield gradually rising above 3.85%.

- In the face of these data, the explanations of FOMC members will be important. In addition, the PCE Price Index data, which will be announced on Friday next week, will be one of the important data we will monitor.

- After the higher-than-expected PPI data announced in the USA, Mester from the FED stated that the interest rate would have to rise above 5% and stay there for a while. The European Bank for Reconstruction and Development (EBRD) updated its 3.5 percent growth forecast for Turkey to 3 percent after the earthquakes in 10 provinces. They predicted that the Gross Domestic Product could decrease by 1 percent after the disasters.

- World Bank President David Malpass announced in his speech that he will resign from his post by the end of June. Panetta, Member of the Board of Directors of the European Central Bank (ECB), stated that since interest rates have reached the restrictive zone, there should be no prior commitments for future policy moves, that policy can be adjusted better with lower rate hikes and that tightening risks should be taken into account. He said it could drop below 3%.

- After the abolition of the upper limit of interest in the Currency Protected Deposit (KKM) system, the increase in the amount in deposit and participation accounts continues. According to the weekly bulletin published by the Banking Regulation and Supervision Agency (BDDK), the total amount in KKM accounts increased from TL 1.455 trillion to TL 1.483 trillion last week.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EUR/USD

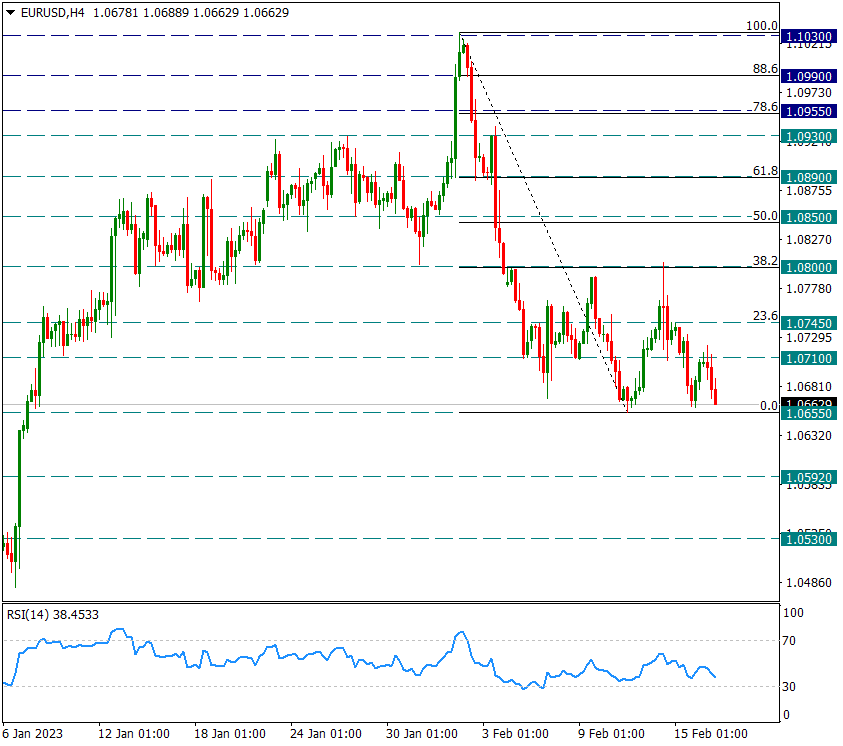

EURUSD – Response Limited, Attention to 1.0655 Support!

The EURUSD pair gained slight support from the 1.0655 level it tested yesterday evening and rose to the 1.0710 region, where it stumbled upon the resistance we set earlier. There was an image in favor of the dollar during the day and it approached 1.0655 again. The US producer price index announced today was above expectations. On an annual basis, there is a slight decrease compared to the previous month due to the base effect. However, monthly gains are quite high and inflation is still a big problem in the US.

The pair is priced at 1.0675 after the data. If the decline continues, we will look again at 1.0655 below. 1.0655 is the main intraday support.

Intermediate resistances that we will mention below are important in possible reactions, but the 1.08 level is the main intraday resistance.

XAU/USD

XAUUSD – 1830 Support Being Strongly Tested Again…

The bearish trend in the yellow metal continues. While the employment market and inflation data continue to be quite strong on the US side, US bond yields continue to rise step by step. With the effect of this, the pressure on the yellow metal continues. Support for 1830, which was tested yesterday, is being tested again today after the US PPI data.

A possible four-hour candle close below this support could trigger a drop to the Fibonacci 50 and 61.8 retracement zones of the 1616/1959 rise.

1830 support will therefore be important. Any resistance up to 1888 in possible responses can be defined as an intermediate resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBP/USD

GBP/USD – As Dollar Strengthens, Pressure on Parity Increases…

The sterling side weakens as the Dollar Index remains strong and the GBPUSD pair slumps towards the 1.1965 support. This level was also tested last week and there was a reaction. If this level is broken, the drop could harden towards 1.1830.

In previous reports, we mentioned the possibility of a double top formation at 1.2455 level. The 1.1830 level is also very important in terms of being the neck region of this formation.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

USD/JPY

USD/JPY – Japanese Yen Begins To Be Defeated Against The Dollar…

The US dollar and US 10-year bond yields started to recover with the good US data, and the expectation that the FED will remain hawkish is also getting stronger. On the Japanese front, there is no sign of a return from the extremely loose monetary policy yet. For this reason, the Japanese Yen started to weaken again against the Dollar. Rising step by step, the pair rose to 134.50 resistance. We can follow this rise with correction levels. The Fibo 23.6 of the 151.95/127.50 drop is corrected.

136.60 resistance, which coincides with the Fibo 38.2 correction, will come to the fore in the rises that can be step by step.

Contact Us

Please, fill the form to get an assistance.