As expected, the Swiss National Bank (SNB) increased the policy rate by 50 basis points from 0.50% to 1.00%. Thus, the Bank increased interest rates for the third time in a row, achieving a total increase of 175 basis points this year. In the statement, it was stated that if additional increases in policy rates are required to ensure price stability in the medium term, they cannot be ignored and that they are willing to be in the foreign exchange market when necessary to ensure favorable monetary conditions.

After the December policy meeting, the Bank of England (BoE) increased the policy rate by 50 basis points (bps) to 3.5%, as expected. The vote in favor of the rate decision was 6-3. Two members, Tenreyro and Dhingra, voted to keep the rates at 3%, while Mann voted to raise the rate to 3.75%. Thus, the Bank increased interest rates by a total of 325 basis points in 8 meetings this year, raising the interest rate to the highest level in 14 years. After the decision, the 10-year UK bond yield decreased by 9 basis points to 3.23 percent.

The European Central Bank (ECB) increased the policy rate by 50 basis points from 2.00% to 2.50% as expected at its December meeting. “The Governing Council has determined that interest rates still need to be raised substantially to reach sufficiently restrictive levels at a steady pace to allow inflation to return to its 2 percent medium-term target,” the statement said. Statements included.

European Central Bank President Lagarde, in his statement, emphasized that interest rates should be increased more than the market priced them, while he also emphasized that tightening on the financial side is a must, and this statement gave a very hawkish message. With this statement, the pair exceeded 1.0680 and rose to 1.0735 during the day.

Data from the US front came in worse than expected, excluding applications for unemployment benefits.

- Applications for Unemployment Benefits Announced:211K Expected:230K Previous:230K

- Retail Sales (MoM) (November) Announced:-0.6% Expected:-0.1% Previous:1.3%

- Philadelphia Fed Manufacturing Index (Dec) Announced: -13.8 Expected:-10.0 Previous:-19.4

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

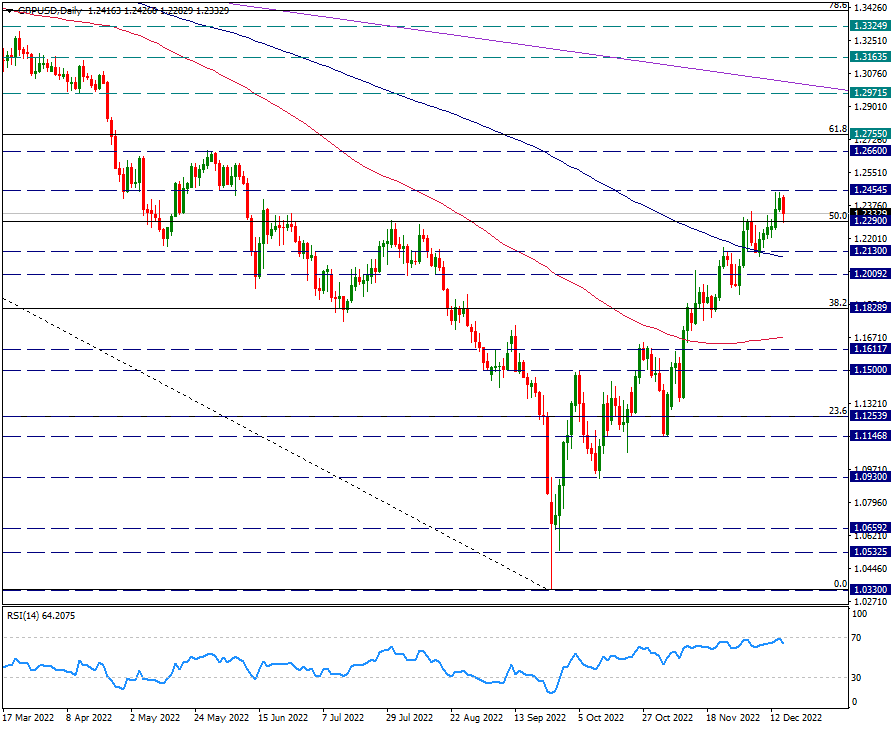

GBP/USD

GBP/USD – Looking for Support at 1.2290 After the Interest Rate Decision in England…

During the day, the decisions of the Bank of England had a small impact on the pair. BOE, as expected, increased interest rates by 50 basis points and increased the policy rate to 3.5%. The resolution was unanimous, and some members voted that interest should remain constant. For this reason, there was a slight decrease on the Sterling side for fundamental reasons. The statement also drew attention to the impression that there might be a decrease in the rate of increase even though the rate hikes continued.

Technically speaking, it has remained above the 200-day average since last week. However, we see a decrease from 1.2455 level during the day.

This decline finds support from the Fibo 50 correction for now. If it continues to hold above this zone or the 200-day average, 1.2660, the region of the Fibo 61.8 retracement, may be possible.

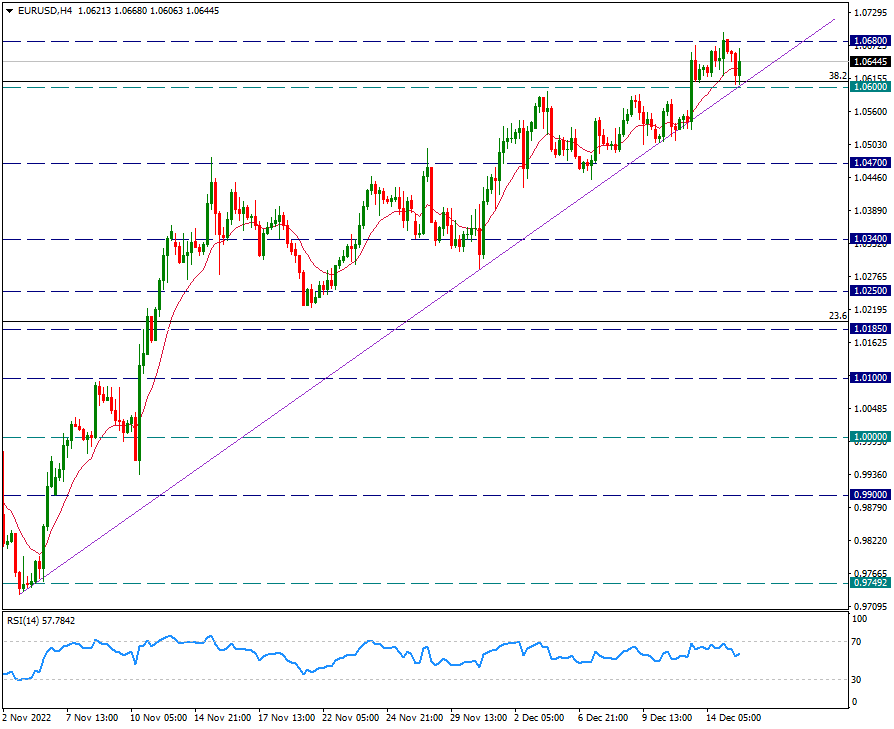

EUR/USD

EUR/USD – Stuck in 1.06/1.0680 Range for Two Days with Central Banks…

The EURUSD parity kept its movement area limited after the FED decisions yesterday and moved between 1.06 and 1.0680. It remained above 1.06, although slightly in favor of the dollar in the Asian session tonight. Today, during the day, first the ECB interest rate decision came, and then the retail sales and manufacturing indices from the USA. The negative retail sales in these data caused sales in the Dollar index and the parity started to react to the 1.0680 level again.

Now as the moves start to get stuck at 1.0680, the short term uptrend line from 0.9750 is starting to be tested. According to the message from the intraday ECB statements, if there is a sagging below 1.06 and candle closings are experienced, the parity may move in favor of the dollar again and the correction of the rise starting from 0.9750 can be seen.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

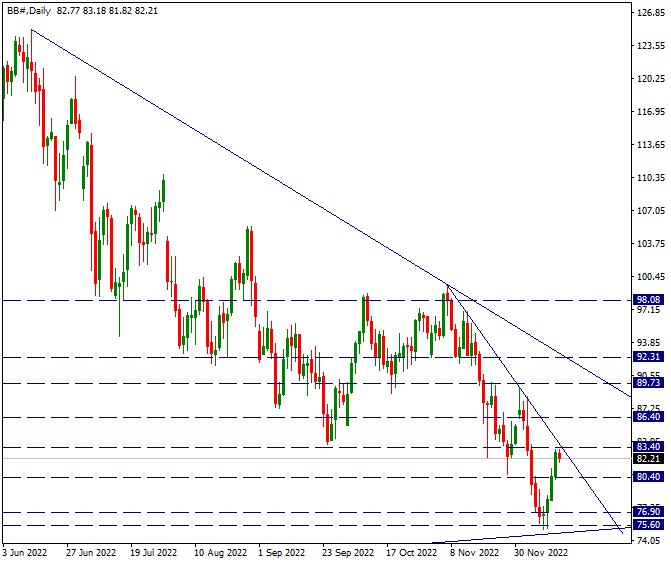

BRENT

BRENT – Rising Brakes In The Intermediate Resistance Zone Today…

Brent oil reacted from the uptrend line this week and rose from 75.60 support. This movement has been braked at the intermediate downtrend line at 83.40 for now. 83.40 level works as resistance. In intraday movements, we will pay attention to this resistance on the up side. If it is exceeded, the 92 region may come to the fore. In case the 83.40 resistance is not exceeded, it is possible to observe profit sales in intraday short-term movements.

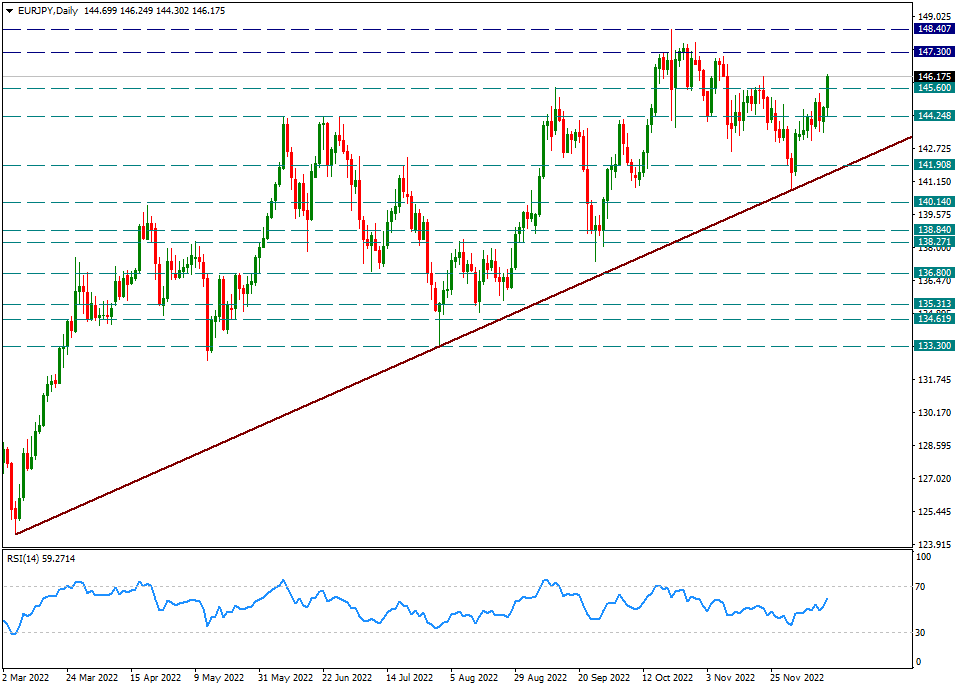

EUR/JPY

EUR/JPY – Rising with ECB and Lagarde’s Hawk Tone…

The hawkish statements of President Lagarde on the interest rate decision of the European Central Bank caused the Euro to attract buyers. Lagarde stated that the 50 basis point increases will continue and that a higher interest rate should be reached than the market has priced. In addition, he increased the hawk tone by emphasizing that it would tighten financially. The EURJPY parity, which has been rising with a reaction from the almost 1-year trend line since last week, has increased even more with these explanations and reached the level of 146.25. 145.60 will now be intraday support and we will follow the 148.40 region above.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.