- Today is once again a brutal day for the US Dollar, which is down over 1% against currencies such as the Euro, Sterling, Aussie (Australian Dollar) and Kiwi (New Zealand Dollar). The post-CPI rally continues in global stock markets, and this situation puts pressure on the Dollar.

- US 10-year bond yields fell to the lowest level of the last month as the risk appetite in the market remained positive. After last week’s US CPI data showed signs of weakening, excessively rising bond yields are falling.

- After the US October CPI data last week, Producer Price Index data for October were announced this week. The data came in below expectations on both the headline and core side, causing the continuation of the market movement that has been going on since last week.

US – Producer Price Index (monthly): 0.2% (Previous: 0.2%)

US – Producer Price Index (yoy): 8.0% (Previous: 8.4%)

US – Core Producer Price Index (monthly): 0.0% (Previous: 0.2%)

US – Core Producer Price Index (yoy): 6.7% (Previous: 7.1%)

- While the EURUSD parity, which tried above 1.04 during the day, reacted up to the 1.0480 region after the data, it was observed to approach the 1790 region on the Ounce Gold side. In general, it was recorded as a data that increased the risk appetite in the market.

- This week’s movements may vary depending on the continuation of the relief movement triggered by the US CPI data last week and how fast inflation expectations will fall in the future.

It is rare for the PPI report to move the markets, especially when it comes after the CPI report. This shows how focused the market is on economic data. That focus will not change as both the market and the Fed try to understand where growth and inflation are headed.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

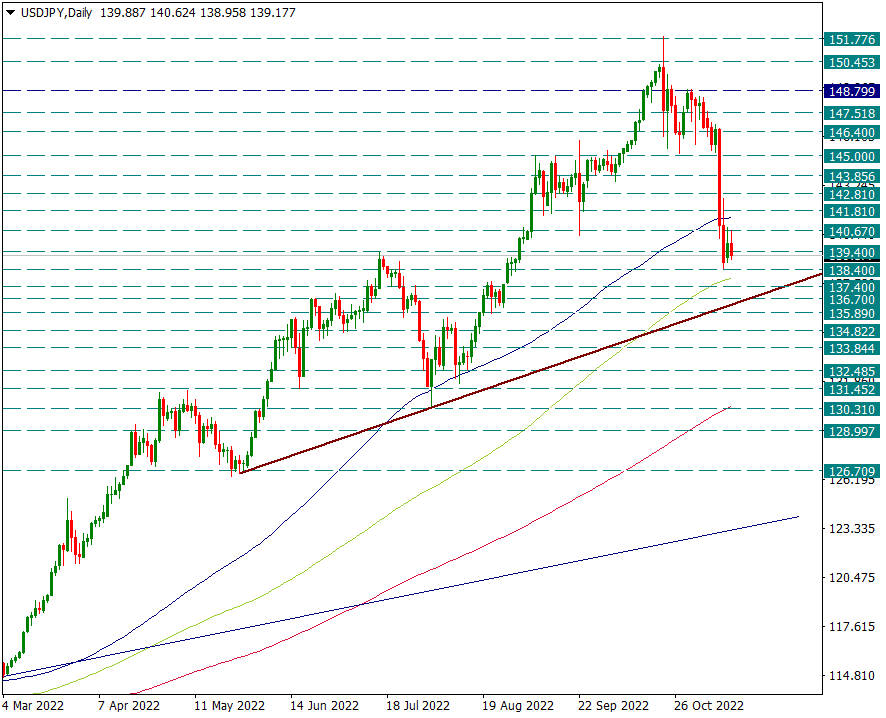

USD/JPY

USD/JPY – 144-Day Avg. Looking for Support…

The sharp decline in the dollar index and the US 10-year bond yields has brought demand for the recently oversold Japanese Yen, and the USDJPY pair is very close to the 138.40 support. It came to this level from 151.75. Although there was a slight reaction at the beginning of the week, the reactions were taken back again today. Above, we will take the 89-day average as resistance and the 144-day average as support. It may decline towards the 233-day average below the 144-day average. We expect the movement in favor of the Yen in the parity to continue step by step, unless it can rise above 140.70, which corresponds to the 89-day average, in a short time.

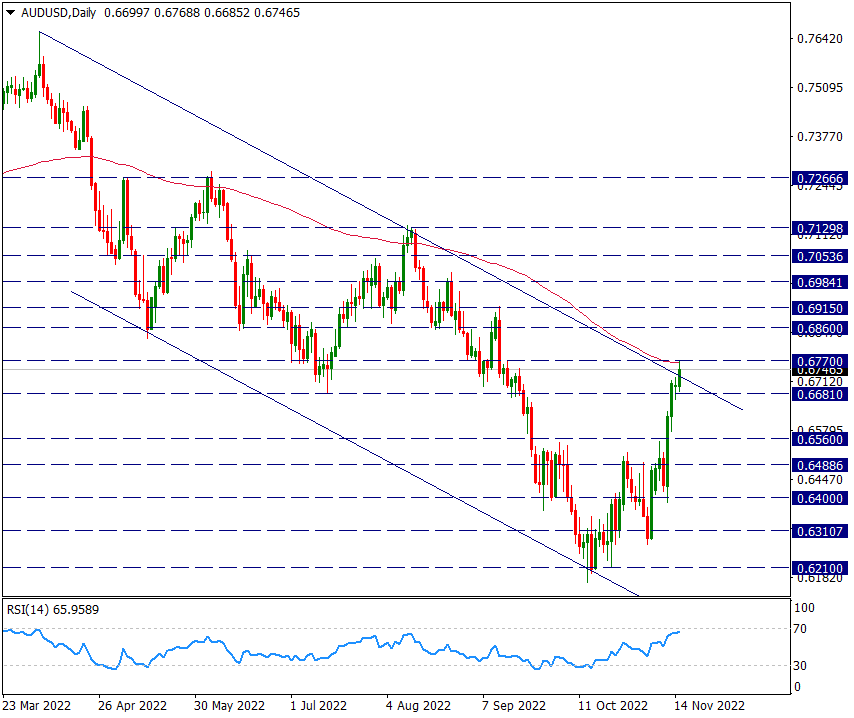

AUD/USD

AUD/USD – Aussie Stuck in a Critical Zone While Recovering…

The Australian Dollar, which was subject to deep selling when the risk appetite disappeared, was in a slight recovery trend from the 0.6220 level. The recovery from this region was triggered by the slight easing of the Dollar Index and technically coinciding with the lower band of the bearish channel. The weakening of the rising trend in the US inflation data last week brought some relief to the global markets, and the Australian Dollar also found the opportunity to recover, testing the upper band of the current falling price channel.

This region also coincides with the 144-day average. In the daily candle closings above 0.6770, the recovery may continue step by step and the 0.7130 level may come to the fore. For this reason, we will follow 0.6770 in the near future. Due to the recent rapid rise, this critical resistance may be difficult to pass in the first place. If it is not passed, we will monitor the possible weakening again.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

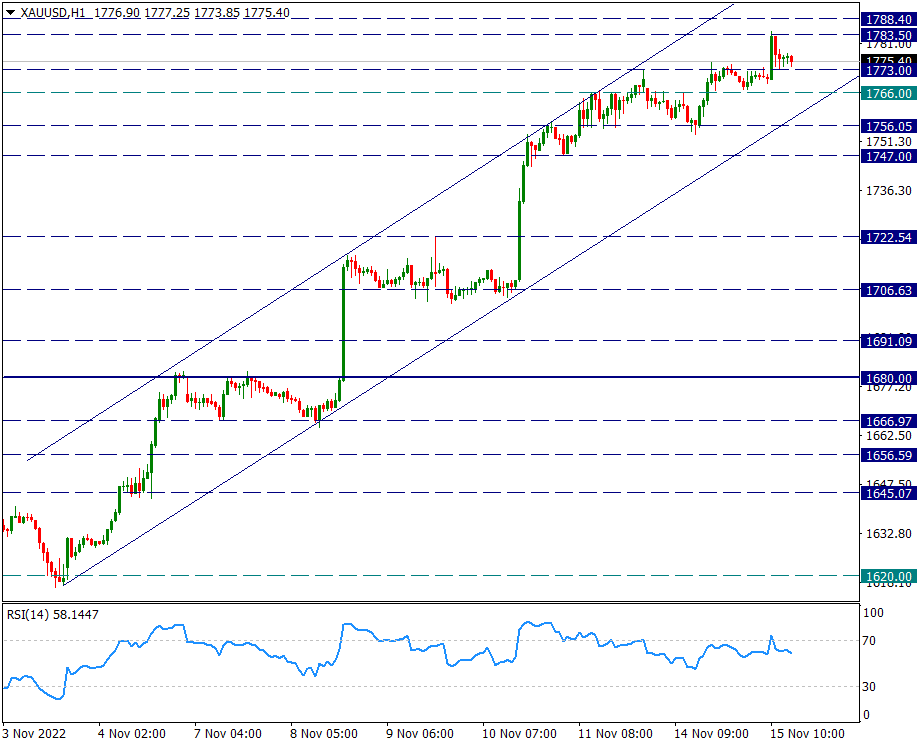

XAU/USD

XAU/USD – The Rise in the Short Term Should Be Watched Well…

The yellow metal, which has been rising step by step within the rising price channel since the 1620 region, had slightly flattened its rise yesterday after touching the upper band of the channel. It started again in the European session today when the prices came to the middle of the channel on an hourly basis and reacted up to 1783.5. After pinning here, we see profit selling again and a slight weakening is observed in the right-angle trend. We will look at the supports inside the channel step by step, but if the 1756 support is broken, we can exit the channel and see a gradual correction of the 1622/1783 rise. While following the movements within the channel, we would like to remind you that this channel is hourly and should be watched frequently.

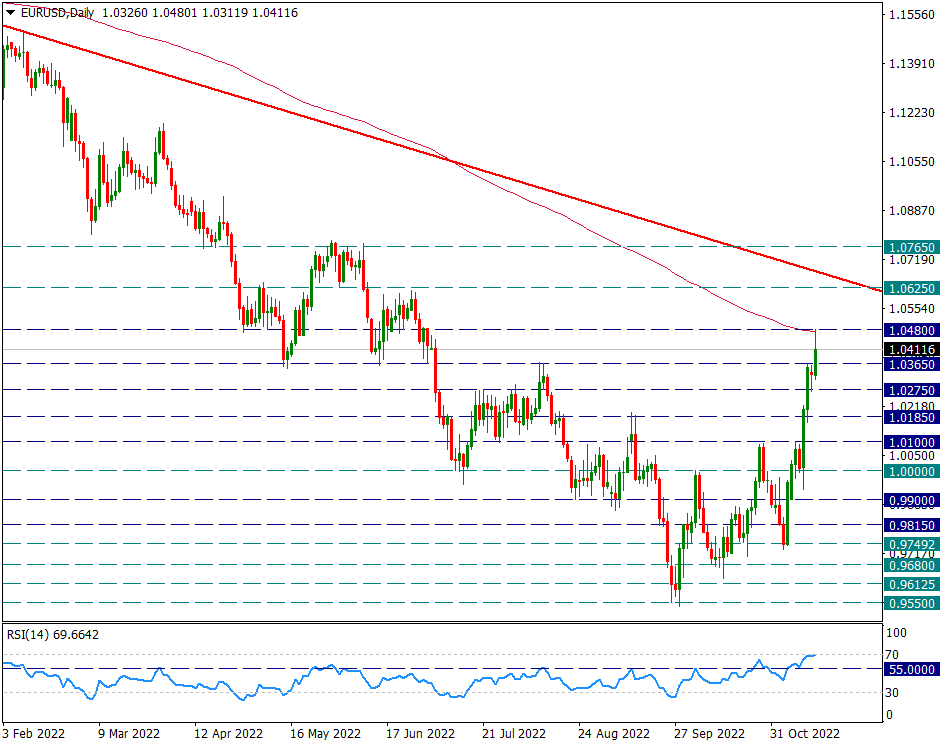

EUR/USD

EUR/USD – The 233-Day Average with the US PPI Pinched…

After the US CPI data last week, the EURUSD parity continues to rise from the 1.00 region at full speed and has touched its 233-day average as of today. The slowdown in the producer price index of the USA today further increased the sales in the Dollar, and the EURUSD parity reacted up to 1.0480, which corresponds to the 233-day average.

The 233-day average is a very important and trend-influencing average. It may technically be premature and excessive to expect the current movement to carry itself higher without seeing a hold on this average. It is necessary to pay attention to the possible profit sales below the 233-day average in the parity, which has been rising rapidly since almost 0.9750.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.