- The European Central Bank (ECB) will announce its interest rate decision at 16:15(GMT+3) tomorrow. After the decision, ECB President Lagarde will make a statement at 16:45(GMT+3). The ECB is expected to raise interest rates by 50 basis points.

- Industrial production data in the euro area was more positive than expected. While an increase of 0.2% was expected in January, an increase of 0.9% was recorded. Compared to the same period of the previous year, an increase of 0.7% was recorded, above the expectation of 0.4% increase.

- After the banking crisis that started in the USA, alarm bells came from Credit Suisse in Europe. With the Saudi National Bank, the biggest partner of Credit Suisse, giving the red light to the capital increase, the stock price of the bank reached 25 percent, while a general selling pressure prevailed in the market. In the EURUSD parity, there were decreases from 1.0759 to 1.0561.

- US retail sales were down -0.4% in February, up 5.39% year-on-year.

- Producer inflation in the US came in better than expected. Producer prices were expected to increase by 0.3% in February, but decreased by -0.1%. On the other hand, an increase of 4.6% was realized against the expectations of 5.4%. Core PPI, on the other hand, was shared as 0.0%, while it was expected to increase by 0.4% in February. Annual data came in at 4.4%, below the expectation of 5.2%. Although annual producer inflation remains high in the data, monthly-based developments draw attention.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

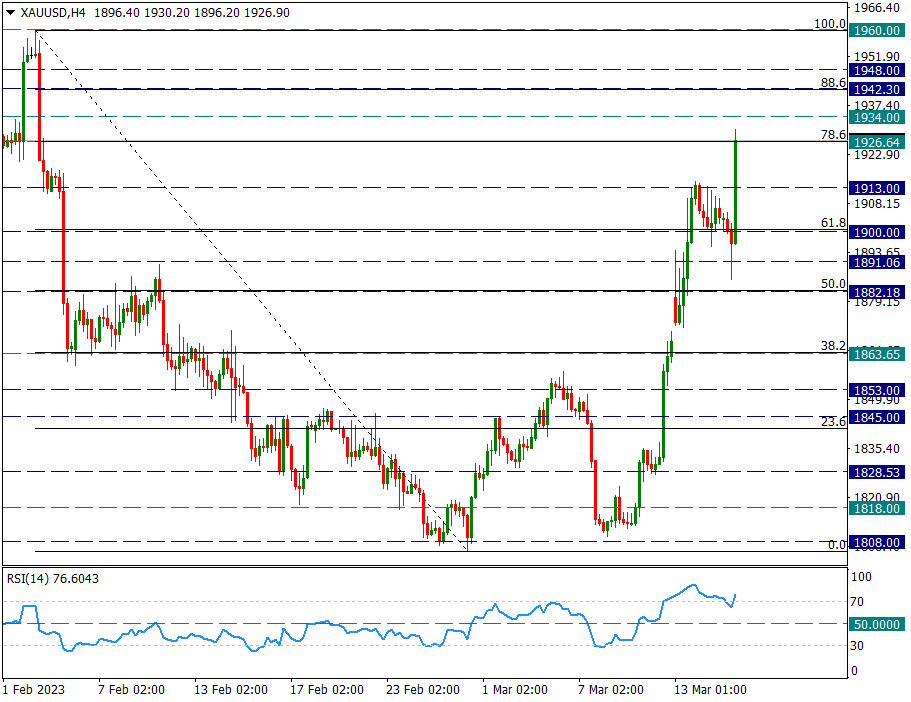

XAU/USD

XAU/USD – Yellow Metal Sees Demand As Banking Crisis Spreads…

The yellow metal, which had been in demand as a safe haven with the bankruptcy of the SVB bank in the USA at the beginning of the week, triggered the worries again, after taking a break from this situation for a day, this time the Credit Suisse bank faced the risk of default. The bank’s CDS premium rose above 800. The danger of the problems in the banking system and the possibility of spreading the risk cause demand on the safe harbor Ounce Gold side.

The yellow metal reacted up to 1930 levels. In this state, the Fibo 78.6 correction of the 1960/1808 decline was made. It is technically possible to maintain the positive image over 1900, which has become rapidly evident in the last 1 week.

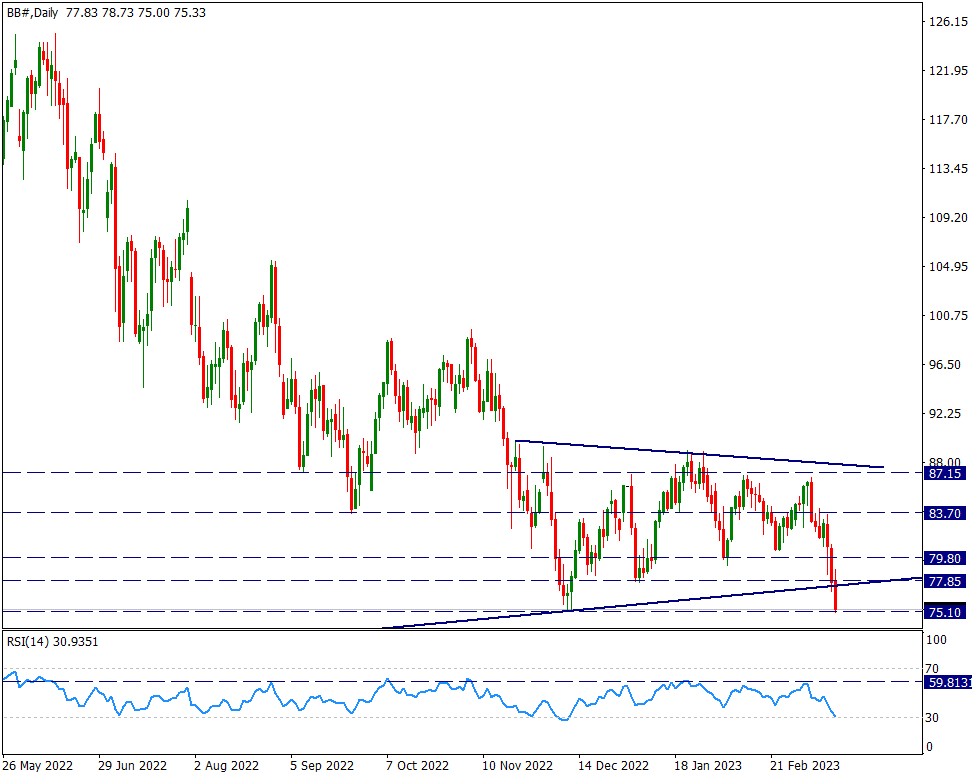

BRENT

BRENT – Broke Stuck, Below 77.85 Negative Pressure Strong…

After retracing from 125 levels, Brent, which has been moving within a horizontal area that has been stuck since November 2022, broke down the area it was stuck in and retreated again until the 75.10 level seen on December 9, 2022. In terms of not being the bottom region of the recent time, this region is important and there may be a reaction. However, these days, technically negative movements can be expected to gain weight on the side of Brent, unless the daily candle closes above the 77.85 resistance, which also coincides with the lower band of the broken triangle.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

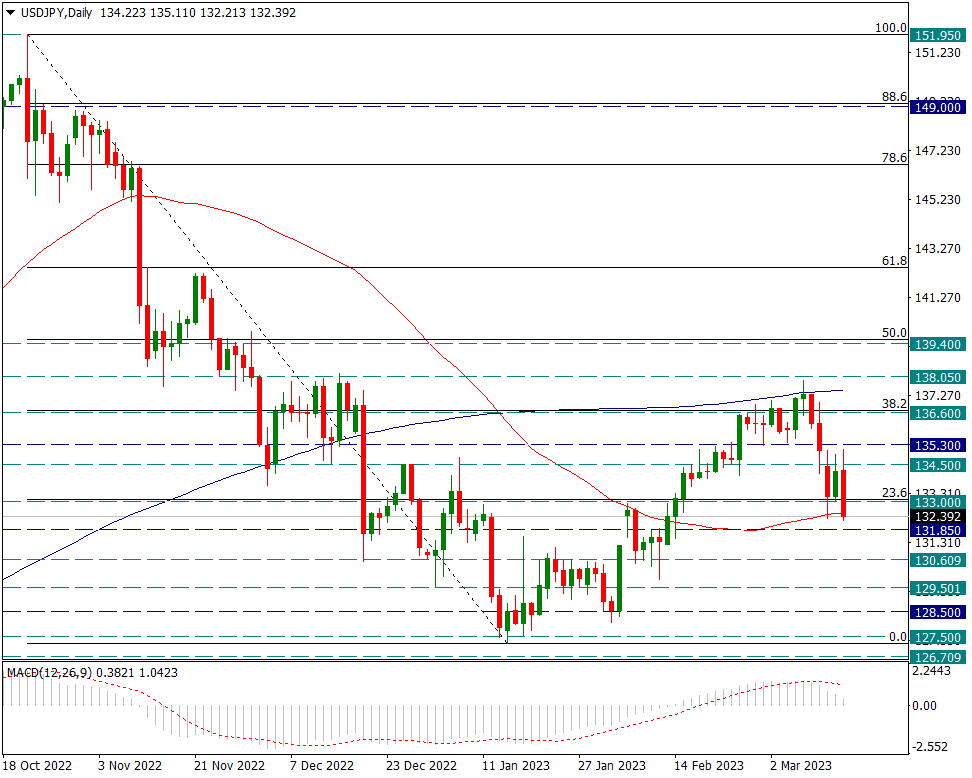

USD/JPY

USD/JPY – Japanese Yen Continues as a Safe Haven…

The Japanese Yen, which gained value as a safe haven with the bankruptcy of the bank called SVB in the USA on Monday, was exposed to some sales yesterday. Today, with the emergence of the default risk of Credit Suisse in Europe, it is valued as a safe haven again, and as a result, the USDJPY parity is priced at 132.50.

It strongly tests the 50-day average again, both Monday and today. Daily candle closes below this zone may trigger the Japanese Yen rally again.

Possible repercussions are possible if the 50-day average or stays above 131.85. For this reason, the region corresponding to the significant average should be closely monitored.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

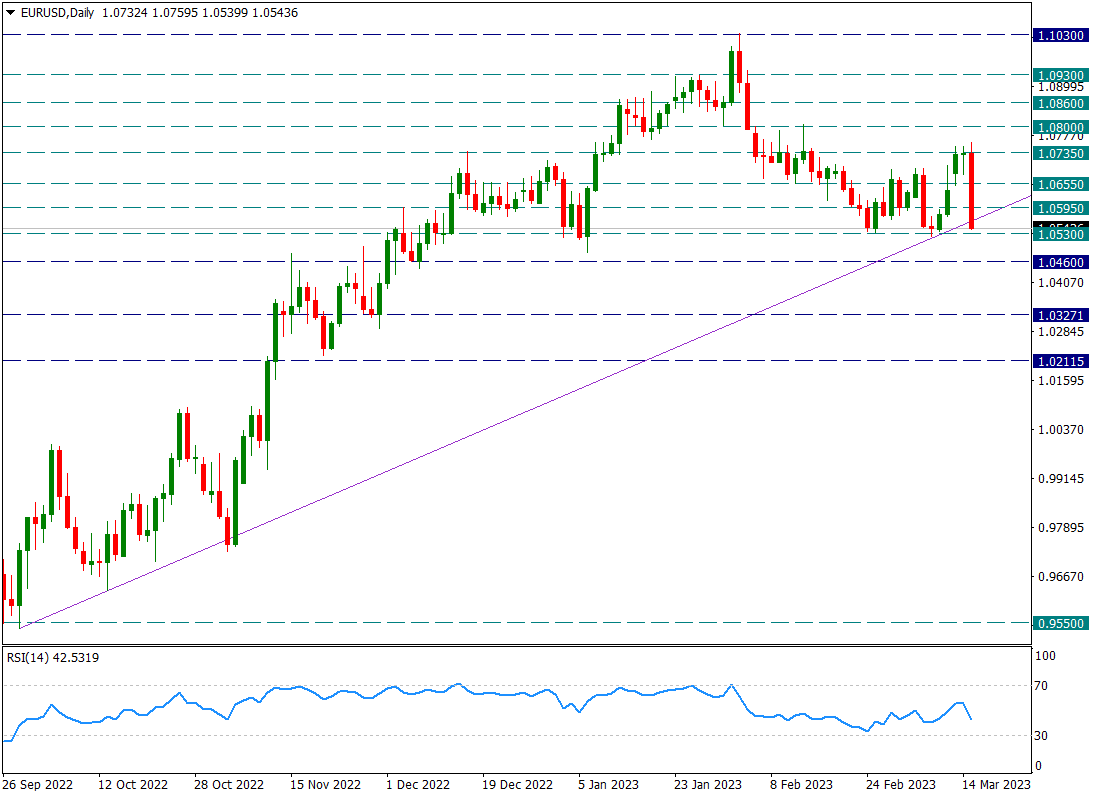

EUR/USD

EUR/USD – Credit Suisse Incident Created Great Panic in Euro…

We mentioned the importance of 1.0735 for the EURUSD parity at the beginning of the week. The closing of the daily candle above this resistance was important for the continuation of the possible rises, but this did not happen. Today, in the news feed, the CDS premium of Credit Suisse bank exceeded 800, creating a great panic on the Euro side. Although ECB members remained determined to increase interest rates by 50 basis points at the meeting to be held tomorrow, they did not support the Euro and the pair retreated to 1.0530. 200 pips retracement in one day.

As such, the uptrend line from 0.9550 is now being strongly tested with support intent. If the trend and/or 1.0530 support is broken, a strong drop in the pair is possible. Possible reactions are important, but it is difficult to be permanent in this environment in the short term. We will carefully monitor the 1.0530 line.

Contact Us

Please, fill the form to get an assistance.