- Global markets started the new week calmly and close to last week’s closing levels, but there is a slight recovery trend on the US Dollar side as of midday. EURUSD parity declined slightly from 1.0365 resistance. Ounce Gold declined slightly from 1722 resistance and the US 10-year bond yield is at 3.90% with a slight reaction.

- When we look at the intraday data, the Producer Price Index of Switzerland for October decreased by 0% on a monthly basis and decreased by 4.9% on an annual basis.

- Industrial Production in the Euro Zone was 0.9% monthly and 4.9% on an annual basis in October.

- Morgan Stanley, in the report prepared by the Bank of England on the interest policy, predicts that the bank will reach 4% interest rate by March 2023, while it predicts a 150 basis point rate cut in 2024 as a result of the slowing inflation and rising unemployment that will occur during the tightening process.

- European Central Bank official Panetta stated that tight monetary policy is necessary to prevent inflation from becoming permanent.

- At the G20 summit in Indonesia, US President Biden and Chinese President Xi held a meeting for about 3 hours. Xi noted that climate change and food security are two common issues. In general, it was emphasized that the competition should be strong.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

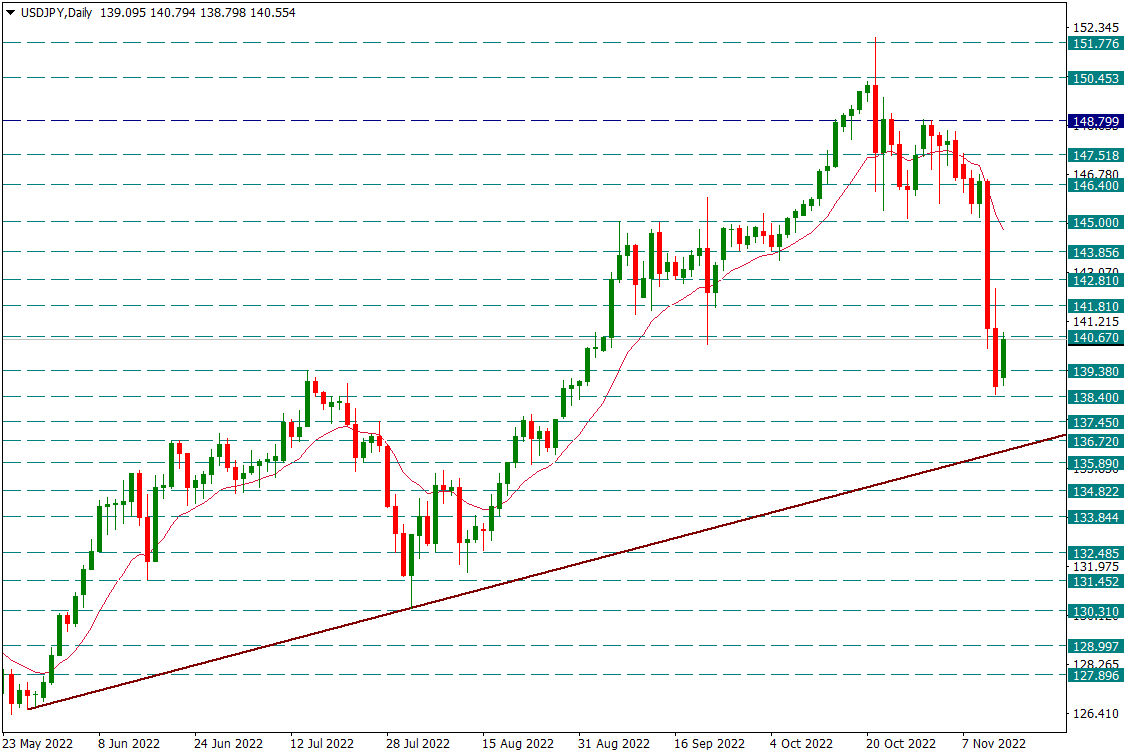

USD/JPY

USD/JPY – Slightly Recovering Last Week’s Rapid Fall…

While the USDJPY pair declined rapidly last Thursday, it continued this trend on Friday. The pair, which closed on Friday at 138.40 support, reacted slightly in the new week and reached 140.65 levels. Possible reactions after such a rapid decline are of course normal. However, as long as it stays below 141.81 resistance in general, we can see movements in favor of the Japanese Yen for a while and watch the annual rise in USDJPY, which has rallied throughout the year, digested.

If the declines continue, the 136.70 region, where the uptrend line from 126 is now, will be in our follow-up.

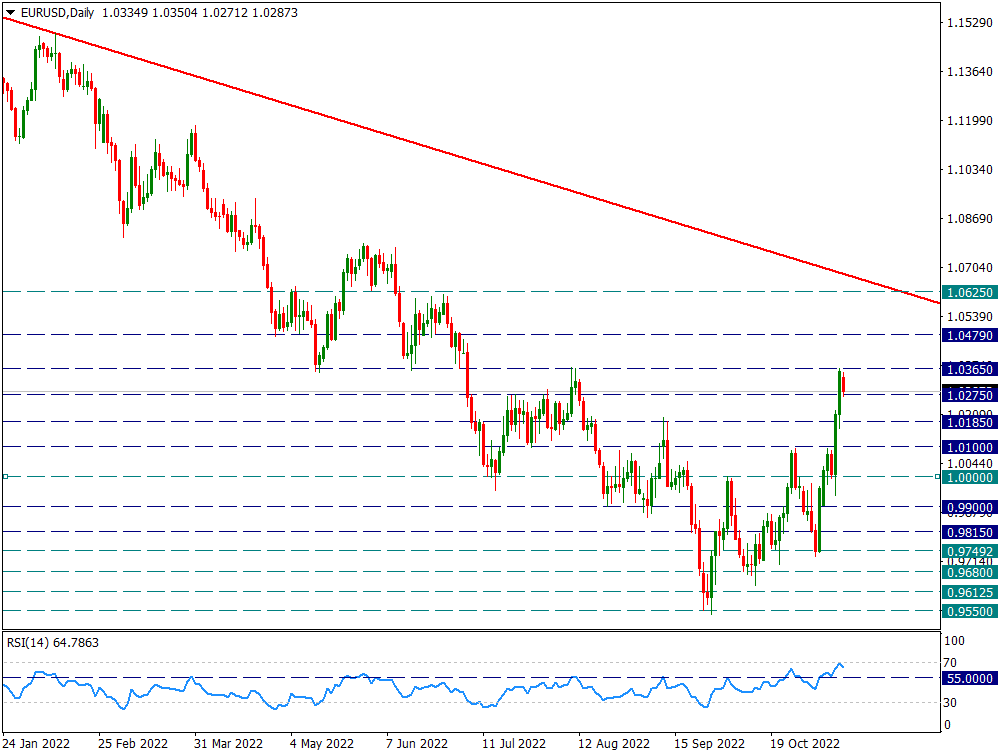

EUR/USD

EUR/USD – Slight Recovery Effort in Dollar in New Week…

The upward movement, which started from 0.9550, formed a bowl structure and rose up to 1.0365, which is the upper part of the structure. As the movements in favor of the dollar recovered slightly in the new week, the parity was withdrawn to 1.0275. In the next process, of course, we will look at the statements of the FOMC members and the data. However, technically, we will be observing 1.0365 resistance during the day. Overcoming this resistance may drive the reactions towards the 1.07 region in the short term.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

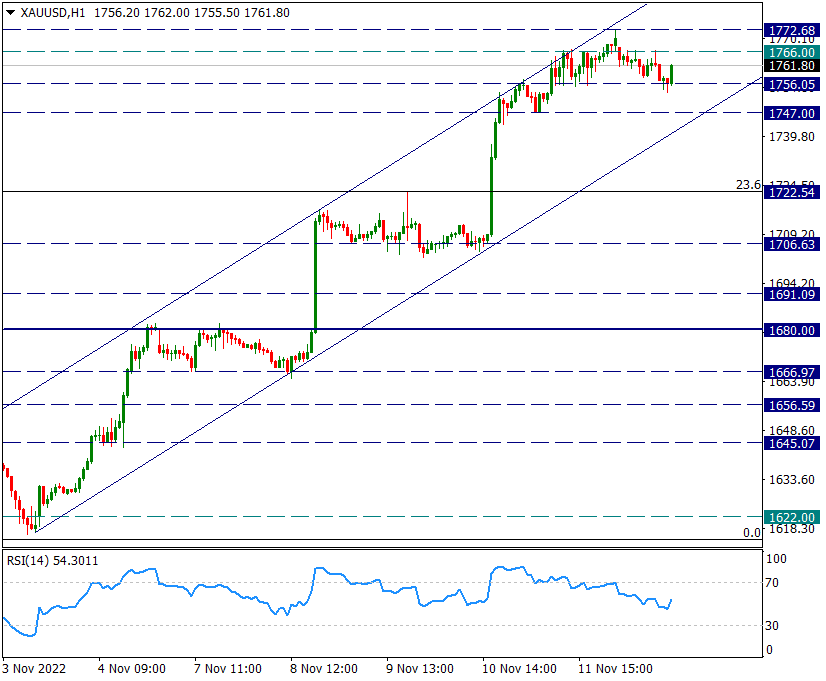

XAU/USD

XAU/USD – Intraday Movements and Hourly View…

The yellow metal, which rose step by step after the 1616 level and rose with the decline in the dollar index and the US 10-year bond interest in the last days, fell back to the 1756 support after touching the 1722 level tonight. Here we see that the rise of 1616/1722 took place within a regular channel and the level of 1722 coincided with the upper band of the channel.

Today, it took its support from 1756 in the decline in intraday movements, and there is a formation that resembles a shoulder-head-shoulder structure. If 1756 is broken, we can trace the declines to 1747 and 1722 levels.

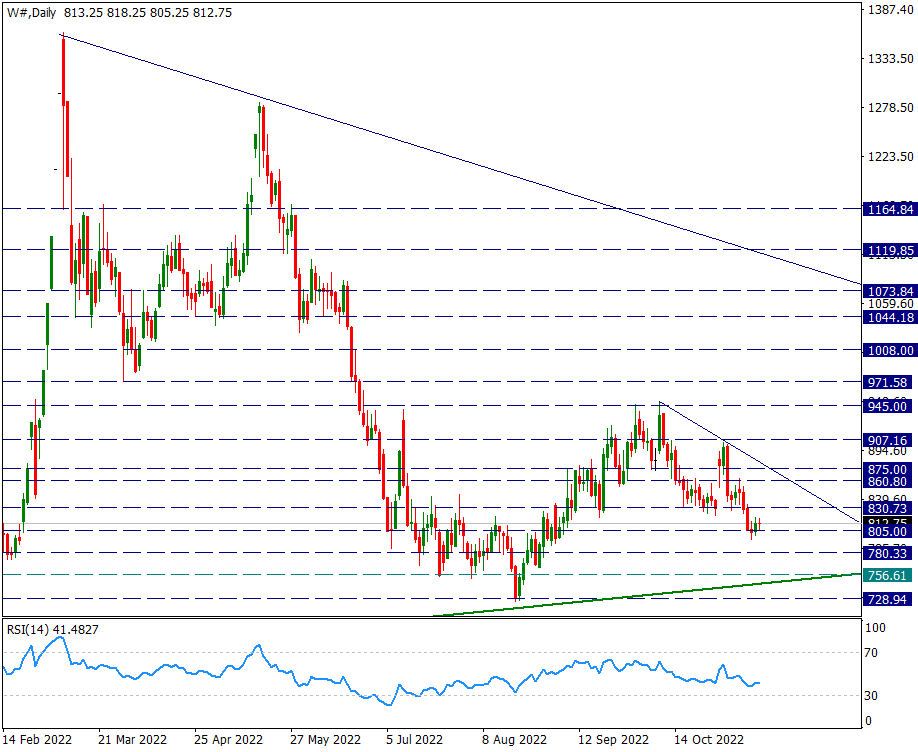

W#

W# – What Are the First Support Zones While Reactions Are Weak?

Wheat prices corrected their August/October minor rise by Fibo 61.8 percent. This support coincides with the 805 region. That’s why this area is important right now. If this is broken, prices could gradually decline towards 756 support. In the reaction that may come from here, we will be following the movements towards the minor downtrend line, which we drew from the 945 level seen in October. Therefore, 805 support may be important for the positive-negative zone in the short term.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.