- Gross Domestic Product (GDP) growth data in the Euro Area were announced as expected. In the 4th quarter of 2022, 0.1% growth was recorded. On an annual basis, there was a growth of 1.9% in the 4th quarter. Although the growth in the Euro Zone has decreased to a large extent, a more successful picture has been displayed compared to the 4th quarter of last year.

- The Unemployment Rate in the UK remained the same at 3.7%, while the Employment Change rose 74,000 in December. Average Income Index + Bonuses came in at 5.9%, below expectations of 6.2%. Unemployment Rights Applications, on the other hand, decreased by 12,900 in January.

- ECB members Centeno and Mahful made statements in parallel. The green light was given for a 50 basis point increase in March. However, it was stated that the next steps will be clarified in the next 2 months. In addition, Mahful stated that the rate hike will be increased up to a point and then it will remain flat. He said that inflation is moving down, but steps will be continued for the 2 percent target.

- In January, annual inflation in the USA fell to the lowest level of the last 15 months. Consumer prices in the USA increased by 6.4% in January compared to the same period of the previous year. In January, there was an increase of 0.5%. Core inflation increased by 0.4% monthly and 5.6% compared to the same period of the previous year.

- There is a year-on-year decline in the data due to the base effect. However, monthly increases continue. Therefore, although the market seemed to react with the annual data at first, the Dollar Index and US bond yields started to react when the fact that the price increases continued right after. On the yellow metal Ounce Gold side, the pressure has started.

- According to Reuters’ survey, the FED is expected to raise interest rates by 25 points twice more in March and May. In addition, the conclusion that there will be no interest rate cuts this year draws attention.

- In the evening, FOMC members will make statements from Harker at 19.30 and Williams at 22.05. We will follow up on possible messages about monetary policy.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

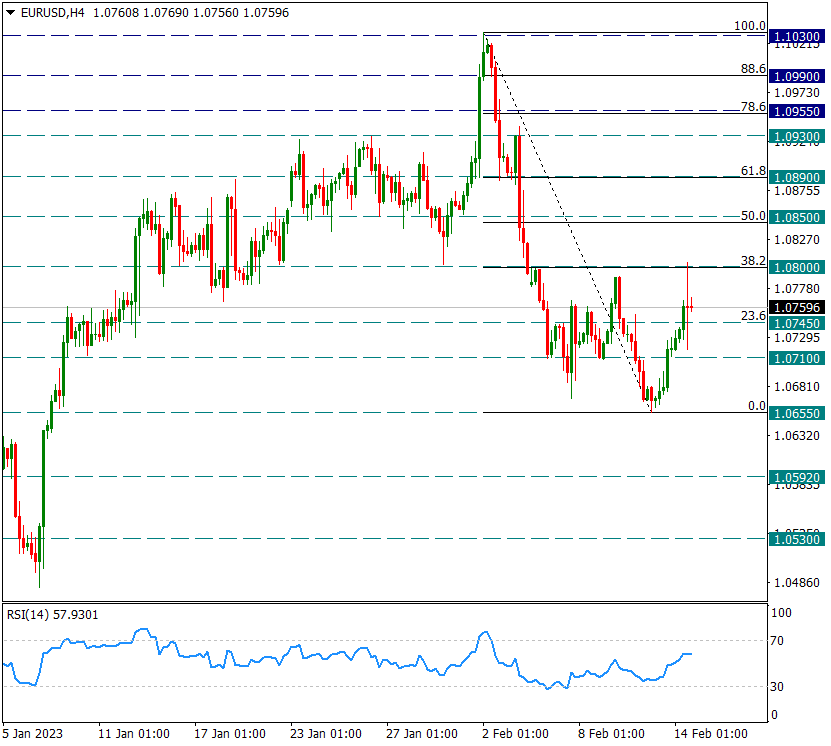

EUR/USD

EUR/USD – Level 1.08 will be important in the short term for the continuation of the attacks…

The pair followed a fluctuating course after the US inflation data at 16.30 today and corrected the Fibonacci 38.2 of the recent short-term 1.1030/1.0655 decline in that fluctuation. It hit 1.08. In intraday movements, we will now watch possible four-hour candle closures above 1.08. If this happens, however, 1.0890, which coincides with the Fibonacci 61.8 retracement, will be on our agenda. If 1.08 is not exceeded, possible upsides may remain in reaction.

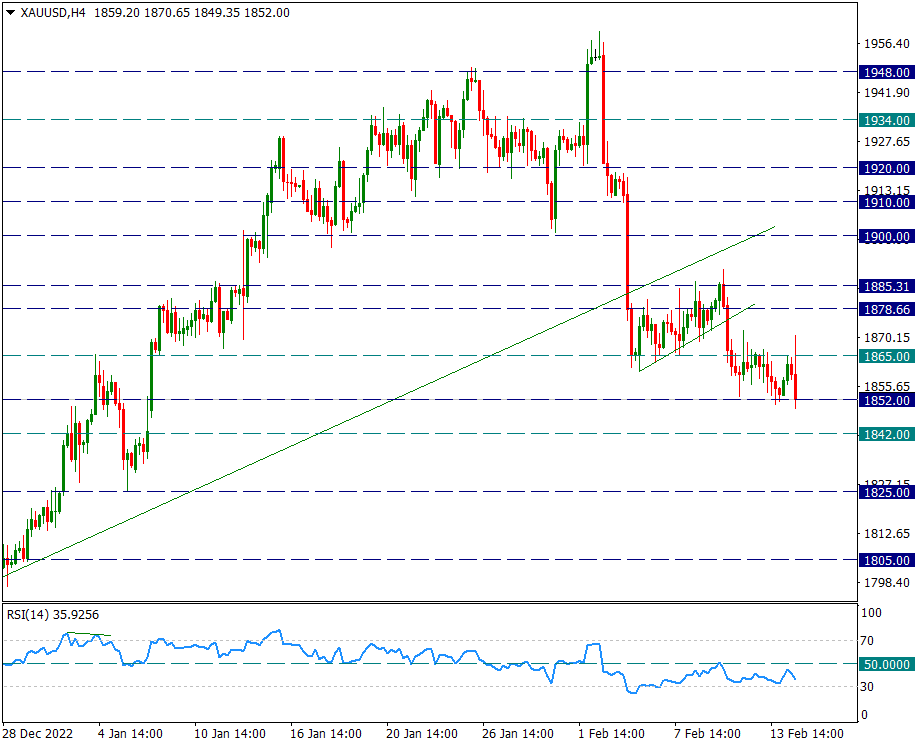

XAU/USD

XAU/USD – Downtrend Continues, 1852 Support Being Tested…

On the ounce side, the negative trend continues. Although the decline in US inflation continued compared to the previous month, its upward trend continues at full speed on a monthly basis. For this reason, although the market was relieved at first, a tightening concern in the market arose again immediately after the data.

While the ounce of Gold rose above 1865 in the early moments of the data, it retraced immediately afterwards and began retesting the 1852 support that was tested this week.

If 1852 is broken by four hour candles, the downtrend could be triggered strongly and continue. At the point where the support is not exceeded, we will be watching 1865 again for possible reactions.

In the evening, the FOMC may continue to test its support for 1852 with the statements of its members. It will be necessary to carefully monitor the interval between 1852 and 1865 this evening and tomorrow.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

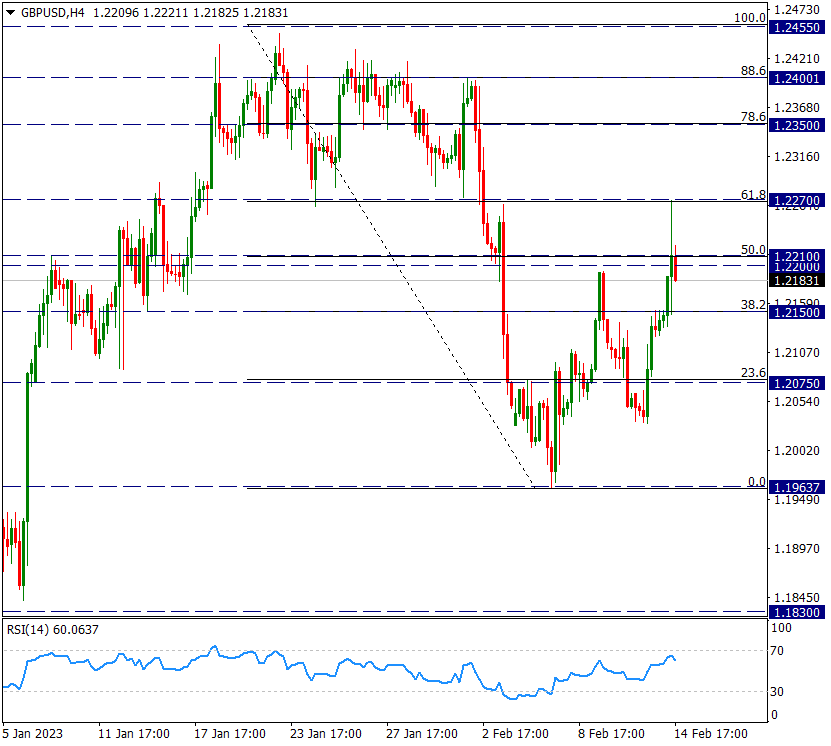

GBP/USD

GBP/USD – Stumbled to Critical Level with Volatility in Dollar Index…

When viewed on a daily basis, the sterling side formed a double top image and retraced from 1.2455 to 1.1960. In a possible double top pattern image, we see the neck region as 1.1830.

With the US inflation data released today, there was a noticeable volatility in the pair, and during this volatility, 1.2270 resistance, which corresponds to the Fibonacci 61.8 correction of the 1.2455/1.1960 decline, was tested. We see immediate withdrawal after the needle thrown here.

1.2270 and Fibonacci 61.8 is an important correction zone. If this place can no longer be exceeded, 1.1960 will be on the agenda again in the parity. We continue to see the main support as 1.1830.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

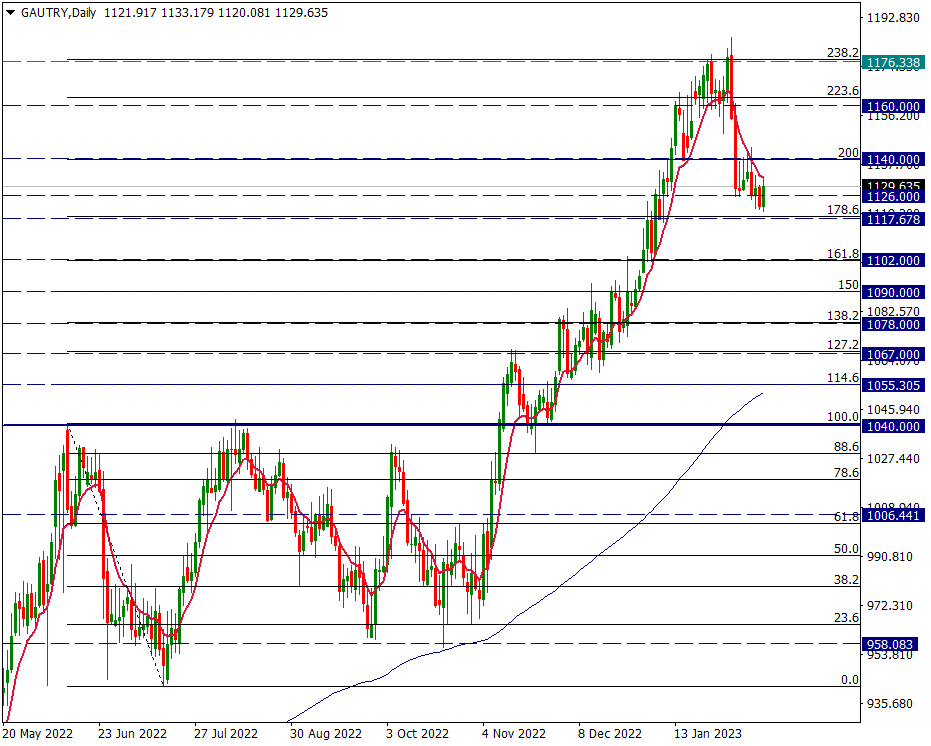

GAU/TRY

GAU/TRY – We Continue to Watch the 8-Day Average for the Intraday Trend…

Gram Gold side slowed down this trend after the sharp decline in the past weeks. However, the attacks are very limited and stick to the 8-day average. It continues to use this average for short-term trend tracking. While getting support at 1117 level recently, the reactions have not been able to close the daily candle above the 8-day average for a long time.

Contact Us

Please, fill the form to get an assistance.