*After consecutive bank failures in the USA, there was a rapid retraction in the treasury bond yields. While 2-years decreased to 3.99%, 10-years decreased to 3.41%.

*The Bank of England announced that the UK units of Silicon Valley Bank, which was declared bankrupt in the USA, were purchased by HSBC Bank.

*Silicon Valley Bank’s German operations, with the decision of BaFin, the regulatory agency in Germany, decided to freeze the transactions. He forbade the bank from selling its assets or making payments because of the risk of failing to honor its commitments.

*In his statement, US President Biden stated that they will do their best to prevent the banking crisis from turning into a 2008 crisis, that the measures and banking regulations will be tightened, that the loss will not be burdened on the US taxpayers and that the necessary liquidity will be provided from insurance funds.

*While FED’s 50 basis point rate hike was on the agenda last week, the 50 basis point increase agenda was replaced by a 25 basis point increase after the problems in the banking system and the weakening in the dollar index. The probability of a 25 basis point increase in the survey results is now expected to be 50 percent. The other 50 percent is that the interest rate will be kept constant.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

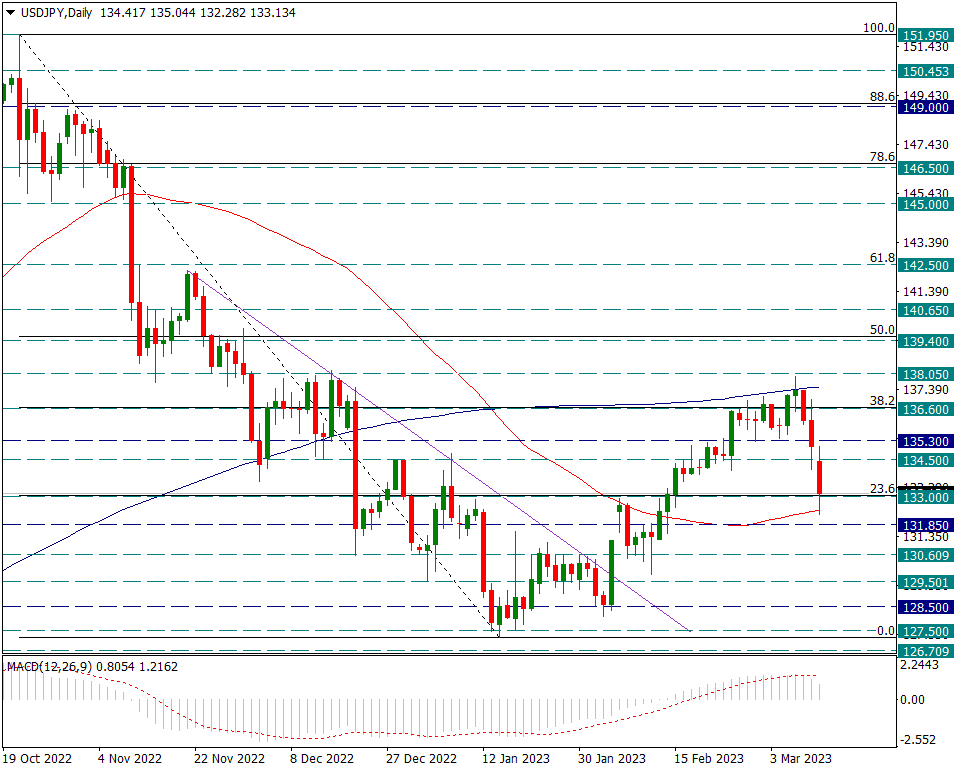

USDJPY

USDJPY – Japanese Yen as Safe Haven…

The Japanese Yen, which was seen as a safe haven in times of crisis, is back on the scene. The Japanese Yen, which gained value today with an ounce of Gold, caused the USDJPY parity to sag to the level of 132.30. We will watch 133.00 as support for the daily candle close. Possible profit selling below 133.00 may make the movements in favor of Yen strongly felt in the pair.

Last week, there was a rise up to 138.05 and then we saw rapid declines. This region is technically an important region in terms of coinciding with the 200-day average.

The decline experienced today continued until the 50-day average and gave a slight reaction to this average by throwing a needle. Therefore, 200 and 50-day averages are our main resistance and support points in this process.

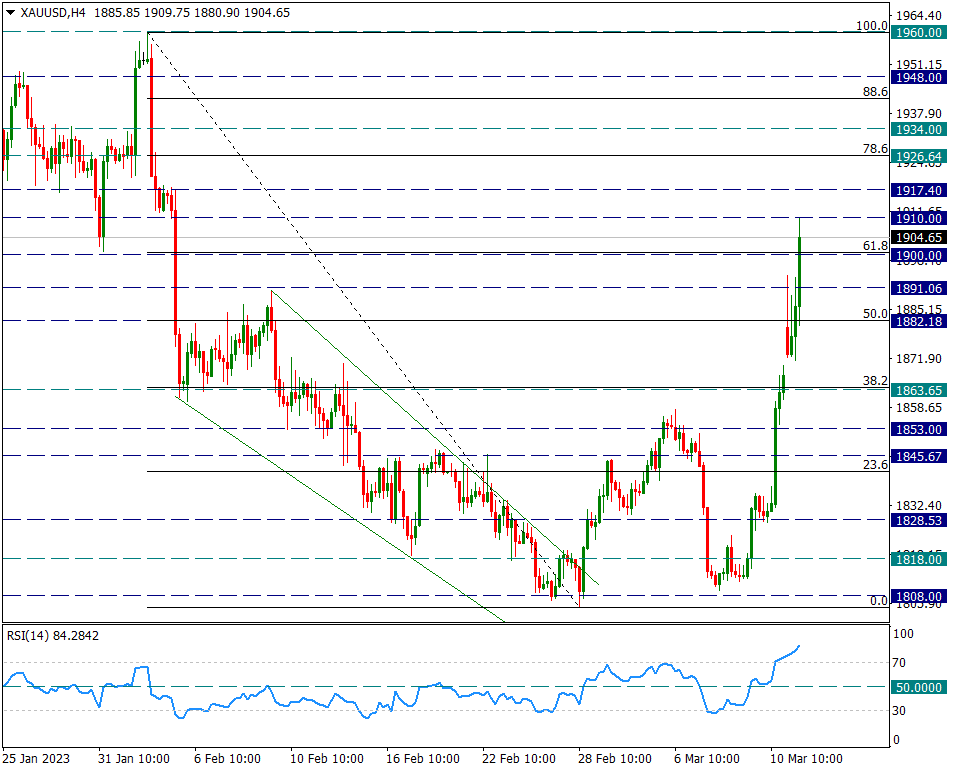

XAU/USD

XAUUSD – Intraday Extreme and Pinched 1910…

Ounce Gold gained a very strong appreciation with its remembrance as a safe haven and the rapid depreciation in the dollar index.

With the recent rises, the 1960/1808 decline was corrected by Fibonacci 61.8 and pinned to the 1910 resistance. The four-hour candle is now above 1900, which coincides with the 61.8 correction, but we will pay attention to the persistence of the four-hour candle closes. In the four-hour period, the RSI indicator rose to the tops of the overbought zone due to the strong bullish effect. For this reason, it is useful to be cautious against the continuation of possible rises. We will pay attention to 1891 support in intraday movements in possible profit sales. As long as it stays above this zone, the uptrends can resume and the Fibonacci 78.6 retracement (1926) of the 1960/1808 decline may be the target.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

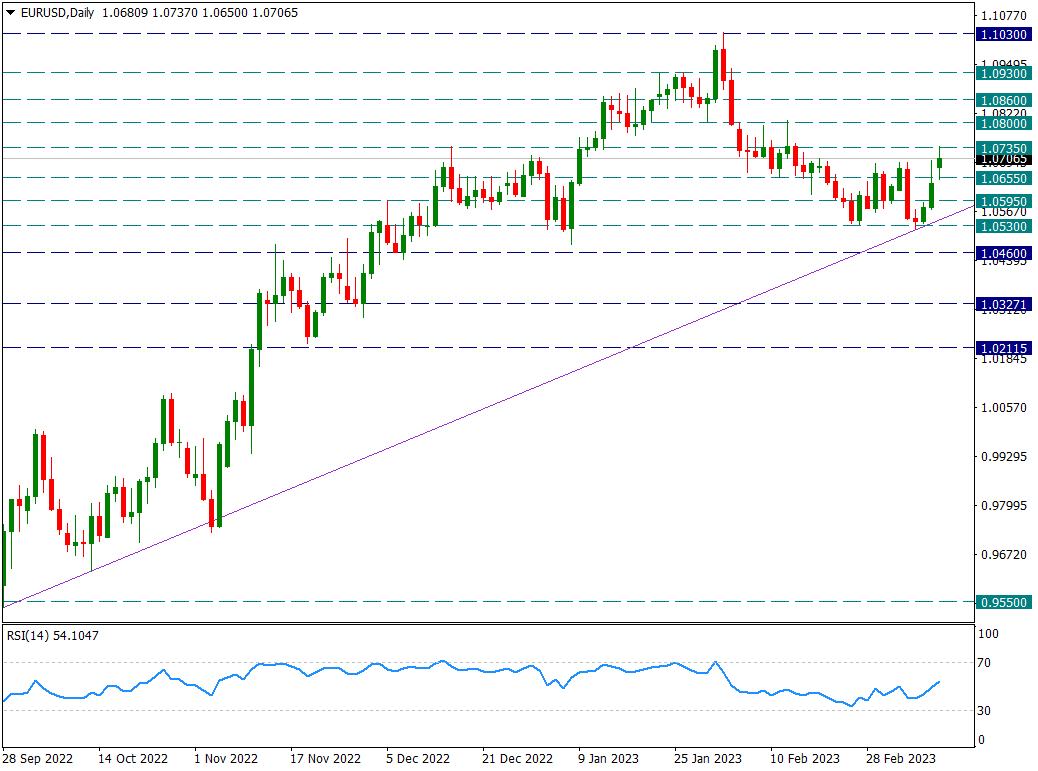

EUR/USD

EURUSD – Today’s Response Limited at 1.0735 Resistance for Now…

The United States is experiencing a minor banking crisis. The bankruptcy of Silicon Valley Bank triggered a mini panic in the USA. The President of the United States stated that the depositors will not be harmed, but the bank will not be saved either. This situation brought up the risks on the US banking sector. The Fed’s interest rate hike is a challenge for banks. For this reason, at the FED meeting in the following days, there were expectations that the FOMC could take a breather in the interest rate hike and hold a meeting without raising interest rates.

This situation brought a jump in the EURUSD parity. Having already reacted at 1.0530 last week, the pair opened a gap this week and touched 1.0735 resistance. We will now take a closer look at the 1.0735 resistance. A possible hold above this level could continue the move towards the Fibonacci 61.8 retracement of the recent 1.1030/1.0530 drop.

If it is below 1.0735, we will follow the uptrend line from 0.9550 again as the main support line.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.