*Consumer inflation in Germany increased by 0.3% in September, as expected. Consumer inflation, which increased by 6.1% on an annual basis in the previous data, increased by 4.5% in September, in line with expectations. Although the 1.6 point decline in annual data draws attention, monthly increases continue to be effective.

*US Treasury Secretary Yellen said in her statement: “The global economy is in better shape than expected, we are monitoring downside risks. We want a healthy economic relationship with China, debt restructuring and cooperation on global issues. “The United States is monitoring the possible economic effects of the crisis in Israel and Gaza.” He made his statements.

*FED’s Bowman said in his statement: “The US policy rate may need to rise further. “We monitor financial stability risks arising from non-bank firms.” He made his statements.

*ECB’s Knot said in his statement: “The effects of inflation shocks are decreasing. Upward inflationary pressures now arise from domestic factors. “Restrictive policies will be needed for a while longer.” He made his statements.

*Producer inflation in the USA for September increased above expectations. While PPI increased by 0.5% on a monthly basis, it increased by 2.2% on an annual basis. Expectations were for an increase of 0.3% and 1.6%, respectively. Core PPI increased by 0.3% on a monthly basis and 2.7% on an annual basis. Expectations were for an increase of 0.2% and 2.3%, respectively.

*Construction permits in Canada increased by 3.4% in August, above the 0.5% increase expected. In the previous data, there was a -3.8% decrease.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Touched in Downtrend from 1.1265, 1.0690 Resistance to Watch…

Although it retreated slightly during the day with the arrival of PPI data from the USA, it has continued its gradual upward trend since the beginning of the week. With this rise, it touched the downtrend line at 1.1265. Now we will check if it can break this place. If it breaks and daily candle closes occur, the upward trend may continue for a while.

Intraday support for possible declines is 1.0575.

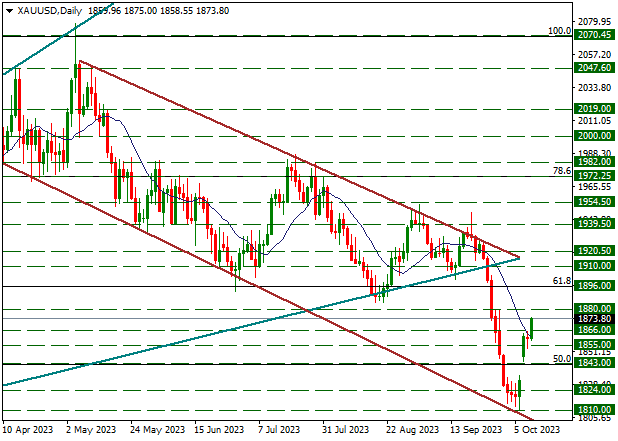

XAUUSD

Ounce of Gold – 1866 Resistance Passed. The Next Resistance Zone was 1880…

The rises that have been active in the yellow metal since the beginning of the week continued today, exceeding the 1866 resistance and reaching the 1875 level. In the continuation of the increases, the 1880 level may constitute resistance. In case of downward pricing, the 1866 level, which we have been following as resistance in the past days, may this time constitute support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

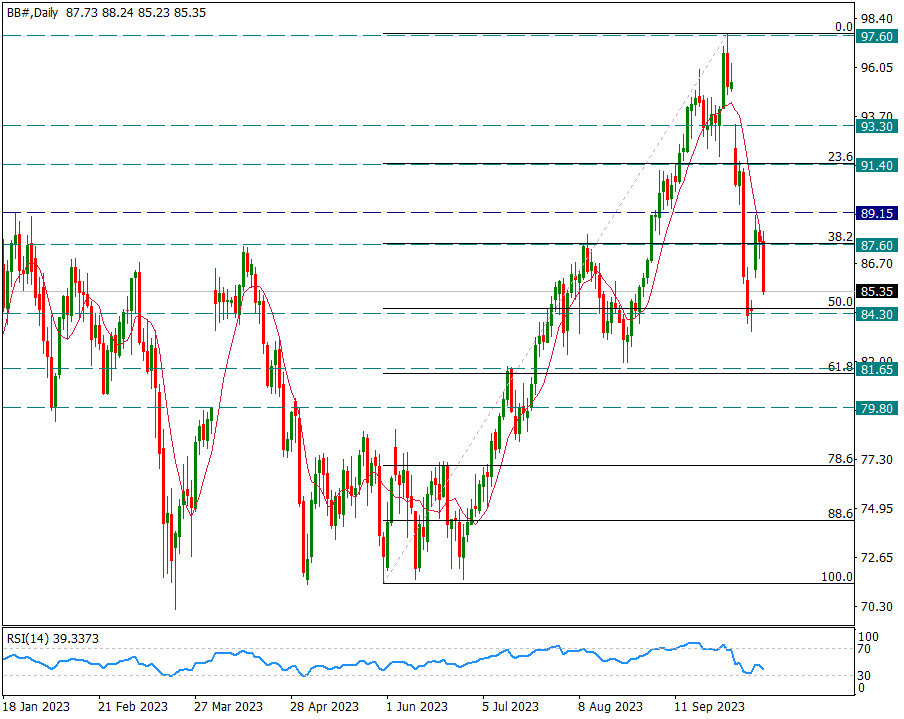

BRENT

BRENT – Continued Its Downtrend Under 89.15 Resistance Today…

In the oil market, repeated declines continue after Monday’s upward gap opening. With the decline experienced today, it started to get closer to the 84.30 support. For a recovery trend again, we need to see a daily close above 89.15. Otherwise, selling pressure may be noticeable and the 81.65 level may come to the fore.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.