*Villeroy from the European Central Bank said in his statement: “Despite the situation in Israel, we see a clear downward trend in inflation. Interest rates are currently at a good level. “At this point, further interest rate increases are not right,” he said.

*While industrial production in Turkey decreased by -0.8% in August, it increased by 3.1% on an annual basis. Another data announced today was the unemployment rate. The unemployment rate decreased by 0.2 points compared to the previous month, falling to 9.2%.

*IMF economist Gourinchas said: “Inflation is disturbingly high and it is very important to lower near-term expectations.” He made a statement.

*IMF lowered its 2024 global GDP growth outlook from 3% to 2.9%. The expectation for 2023 is 3% growth.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Testing the Upper Band of the Bearish Channel…

Attempts to increase parity continue to be effective due to the decline in the dollar index. During the intraday rises, the resistance at 1.0605, which intersected at the upper band of the downward channel coming from the level of 1.1270, was tested. Instant prices are priced around 1.0590 with the resistance reactions coming from this region.

If upward pressures increase and there is an upward break from the downward channel, daily closings will be important for the upward trend.

In case of increases, 1.0605 and 1.0670 levels, respectively, may constitute resistance. In case of short-term withdrawals, the 1.0540 level can be followed as support.

XAUUSD

Ounce Gold – Profit Sales from 1866 Resistance Was Effective…

The yellow metal, which is seen as a safe haven due to the tension between Israel and Hamas, opened the week with an upward gap due to the increasing demand. The previous day, the upward momentum that started from the 1843 region exceeded the 1855 resistance and moved step by step towards the 1866 resistance. Today, profit selling from the 1866 resistance was effective during the day and pricing is being tested as support by retreating to the 1855 area.

In case the buying demands continue to be dominant, the increases may break the 1866 resistance and move towards the 1880 resistance. In case of withdrawals, the 1843 level, which corresponds to the Fibonacci level 50, may provide support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

BRENT

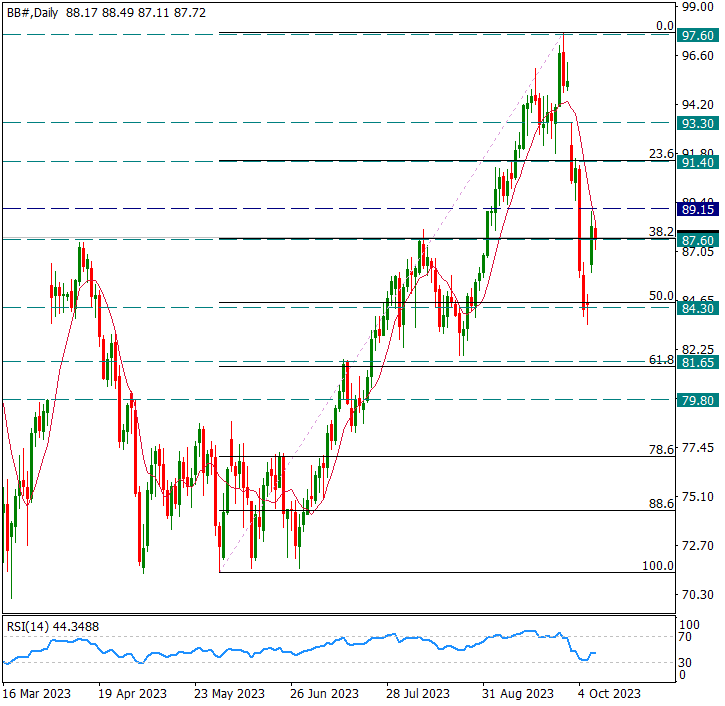

BRENT – 89.15 Level Becomes Critical Intraday Resistance…

On the Brent side, yesterday’s rise remains limited for now, with the 8-day average acting as resistance. This region, which corresponds to the 89.15 resistance, is our first intraday resistance and if it is confirmed that this resistance is broken, 90 levels may come to the agenda again.

The 84.30 support seen last week will be important in the additional pressures that may come from 89.15.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.