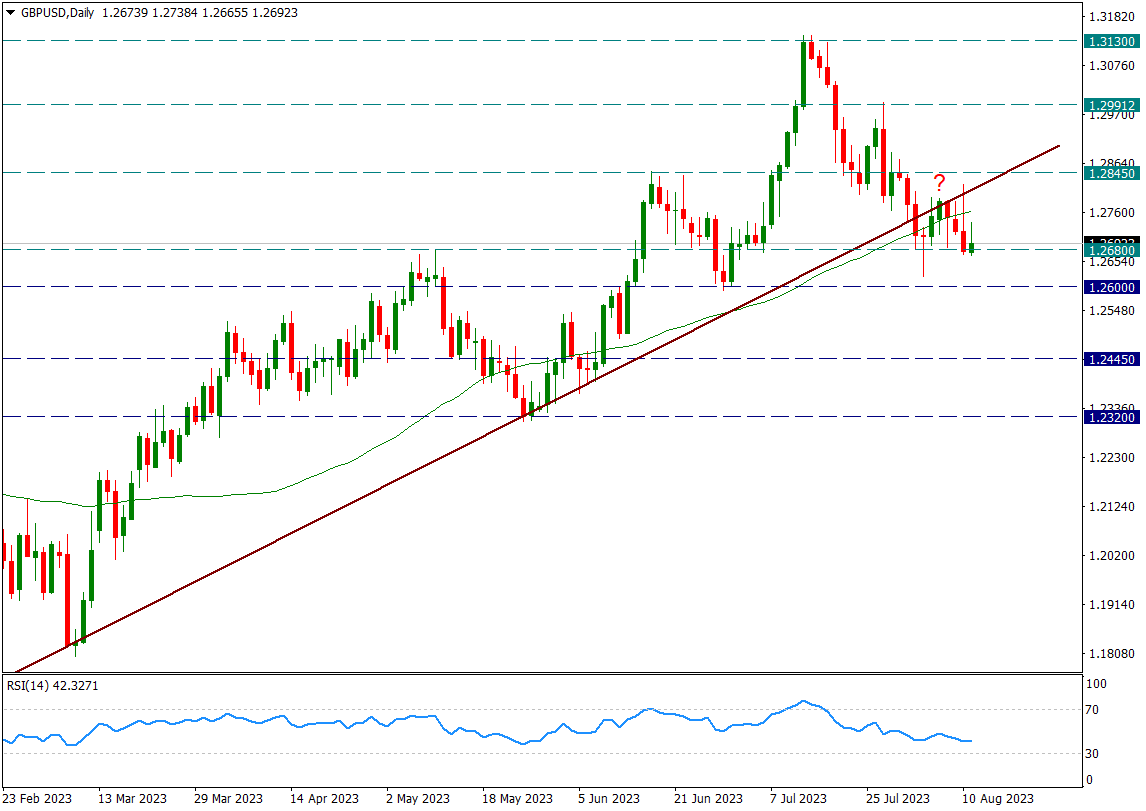

*The UK saw better-than-expected economic indicators today. Q2 GDP surpassed predictions, growing by 0.2% quarterly and 0.4% annually (expected: 0.2%). June alone showed 0.5% growth. Industrial and manufacturing production for June exceeded projections: industrial production rose 1.8% monthly (expected: 0.1%) and 0.7% annually (expected: -1.1%), while manufacturing increased by 2.4% monthly (expected: 0.2%) and 3.1% annually (expected: 0.3%). UK trade data also beat forecasts, with a deficit of £15.46 billion compared to the expected £16.40 billion in June. GBPUSD rose past 1.2696 resistance.

*Global oil demand hit a record 103 million barrels per day in June, per the IEA. Expectations point to another record in August. The 2024 global oil demand forecast was revised to 1 million barrels per day from 1.15 million.

*In the US, July producer inflation surpassed expectations by 0.1 points: headline and core producer inflation were announced at 0.3% monthly, 0.8% annually, and 0.3% monthly, 2.4% annually, respectively. Initial reactions led to a 4 bps rise in the US 10-year bond yield to 4.13%, USDJPY at 145, EURUSD at 1.0973, and Gold Ounce at $1915. GBPUSD initially climbed to 1.2699 due to positive UK data, but pulled back below 1.2696 after the US PPI data.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

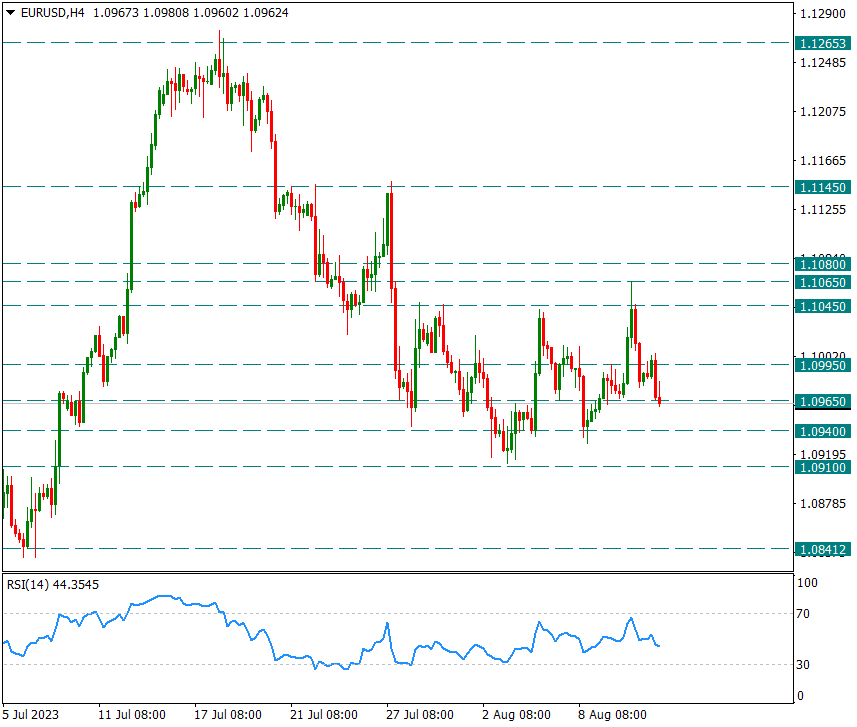

EURUSD

EURUSD – Parity Heads Down With US Inflation…

After the US CPI data announced yesterday, we followed the PPI data today. Although the CPI data was generally below the expectations in the annual based data yesterday, the headline CPI was above the previous month. Core CPI, on the other hand, weakened slightly. Our rating in the CPI was that the rising energy prices as of the beginning of August could have an impact in the next month.

On the PPI side, we do not see a suppression as in the CPI, but we see results above the previous month’s expectations in monthly and annual data. This shows that the weakening trend of the inflation trend in the USA is over and it is likely to be reflected in the CPI in the next month.

With this data, the EURUSD parity moved in favor of the dollar index and forced the 1.0965 support. From a technical point of view, we can expect the movements in favor of the dollar to continue gradually as long as it remains below 1.1045 in general and to strengthen below 1.0910.

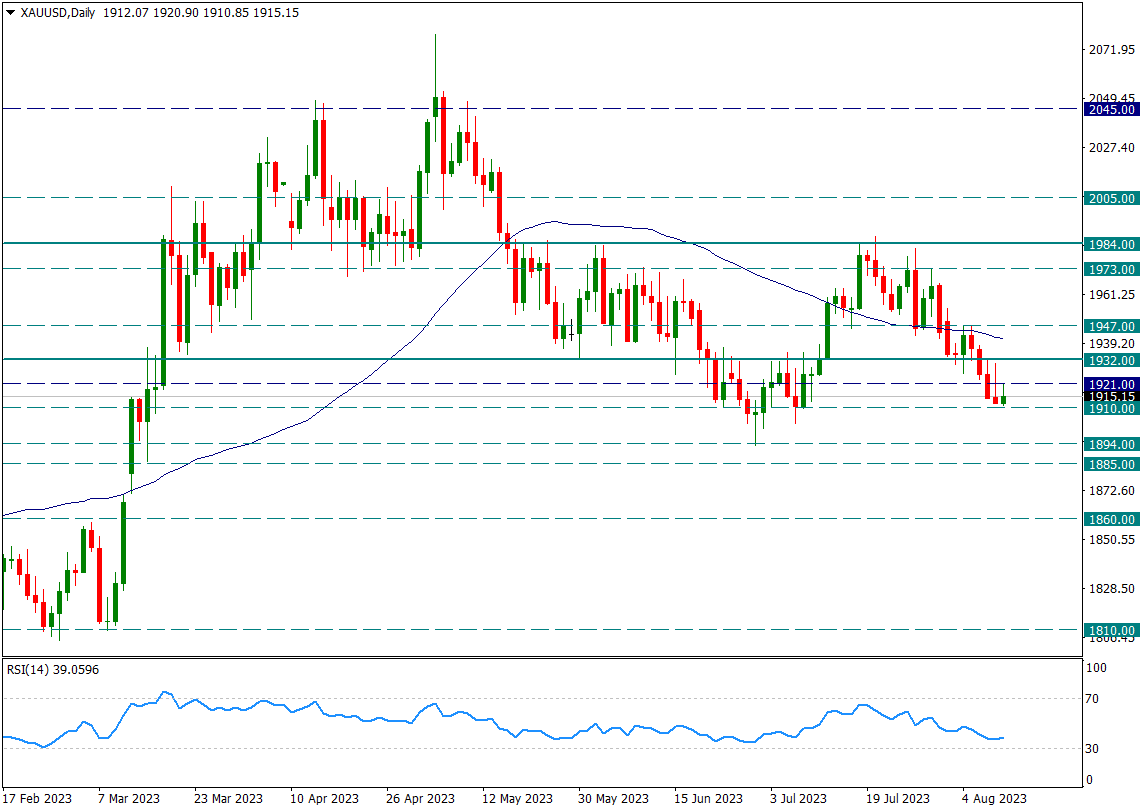

XAUUSD

Ounce Gold – US PPI Caused a Decline from 1921…

After the yellow metal reacted to the level of 1921 during the day, it retreated to 1910 after today’s US PPI data. Even though it reacted to 1916 again, it could not rise above the level of 1921, which we watched during the day. At the levels followed during the day, 1921 is the intermediate resistance and 1932 is the main resistance.

Below, 1910 is the intermediate support, and 1894 is the main support.

Movements have been stuck between 1932/1910 for the last three days and we think it’s important to stick to technical levels in these regions.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBPUSD

GBPUSD – We Carefully Follow GBPUSD – 1.2680 Support…

It retraced to 1.2680 after breaking the 10-month uptrend last week. Afterwards, the reactions from this support reacted again in the broken uptrend, but this uptrend could not pass upwards and we see movements in favor of the dollar gradually. Now 1.2680 support is trying to break down again. If the 1.2680 daily candle is broken, we can expect the declines to continue by getting stronger. For this reason, we will continue to monitor the daily closings carefully.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.