*In the USA, non-farm employment was expected to increase by 239,000 in March, while an increase of 236,000 was recorded. An increase of 311,000 was announced last month. The unemployment rate fell from 3.6% to 3.5%. Average hourly earnings, on the other hand, met expectations with a monthly increase of 0.3%, but fell short of expectations with an annual increase of 4.2%. After the release of the data, there was a pullback in the EURUSD parity to the level of 1.0876.

* Bank of Japan (BOJ) Governor Kuroda will hand over his 10-year mandate to Ueda as of April 9.

*Tesla announced a $5,000 discount on Model S and Model X prices in the US. Tesla made a discount for the third time this year.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

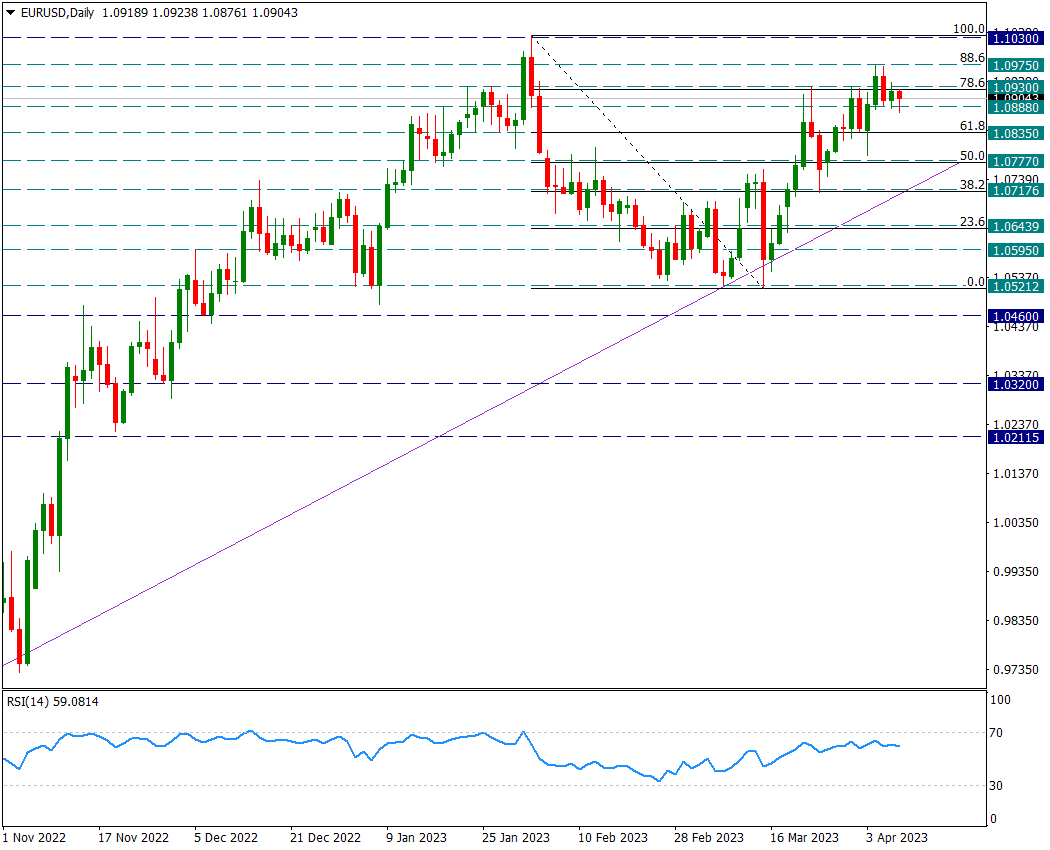

EUR/USD

EURUSD – Limited Price Movement Due to Easter…

Due to the Good Friday holiday in the USA and Europe, price movements are limited despite the Non-US Farm data. Although the US Non-Farm Employment Change was below expectations, it did not deviate from the general trend zone and came in at 236,000. The unemployment rate is one of the lowest at 3.5%, and the Average Hourly Earnings data is also not negative for the employment market as it hovers at 0.3% per month.

The pair followed a slight trend in favor of the dollar after the data. The pair declined to 1.0880 support, but these movements are not very strong for now. However, on this day where price movements may be limited, we will follow between 1.0930/1.0880.

GBP/USD

GBPUSD – Importance of 8-Day Average in Profit Sales…

On the sterling side, we see a 3-day candle retracement after the 1.2520 level and this pullback reacted from the 8-day average. In the period when the daily candle closes above this average, the movements in favor of Sterling may continue from where they left off.

However, if this average is broken by the daily candle, the strength of the pullbacks can be triggered even more. In this case, 1.2310 and 1.2200 levels will be on the agenda.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

USD/JPY

USDJPY – Response Coming 50-Day Average Gains Importance…

The dollar index, which has lost a lot of value in the last two days, continues to recover, albeit slightly. This is also reflected in the USDJPY pair and is trading at 132.20.

Along with these reactions, new reactions may come towards the 50-day average above. The 132.90 resistance will now be important to coincide with this average. There has been no daily candle close since 17 March 2023 above the 50-day average. Recent attacks have also caught up with this average.

If new attacks can stay above the 50-day average, the 137.00 region will be on the agenda.

Otherwise, the main intraday support is 130.55.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.