*US ISM Services PMI index decreased compared to the previous month, but still remained in the positive zone and was announced as 50.3.

While EURUSD parity remained in the region of 1.0725 in the new week, Ounce Gold recovered to 1955 levels by recovering the decline of the last week. The US 10-year Treasury yield fell to 3.67%.

*In April, the trade balance in Germany was expected to give a surplus of 16 billion euros, while it gave a surplus of 18.4 billion euros, above the expectations. The trade balance had a surplus of 16.7 billion euros in March.

*Today, in the service PMI data for May from various regions;

-Germany services PMI rose to 57.2 from 56, although it fell short of the expectation of 57.8.

-Eurozone services PMI was expected to decline to 55.9, but fell to 55.1 from 56.2.

– UK services PMI was expected to decline to 55.1, but fell to 55.2 from 55.9.

* ECB President Lagarde said: “There is no clear evidence that inflation has peaked, price and wage pressures remain strong. Decisions will continue to be made based on incoming data. The effects of our policy can be expected to strengthen in the coming years.” He made his statements.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Pricing in the 1.0725 Region Continues…

While the pair continues to be stuck in the 1.0775/1.0635 range recently, it started below 1.0725 on the first trading day of the week. As of 17.00, the US ISM Service PMI data, which was below expectations, gave a mild reaction, but is still in the 1.0725 region. In general, we are watching the 1.775/1.035 range in the short term in the pair.

BRENT

Brent – Fills Gap Overnight, May Stay Positive Above 77.50 Resistance…

Oil prices opened with an upward gap tonight as Saudi Arabia announced that it would voluntarily cut an additional 1 million barrels of oil production in July.

Brent futures price momentarily rallied to 78.55 resistance during the night, but failed to break through here and gave back gains again. During the day, the gap was almost closed.

If it can hold above the 77.50 resistance during the day, possible attacks may gain strength, but in general, the rises are not permanent despite the news effect. In possible decreases, selling pressure may increase below 75.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAUUSD

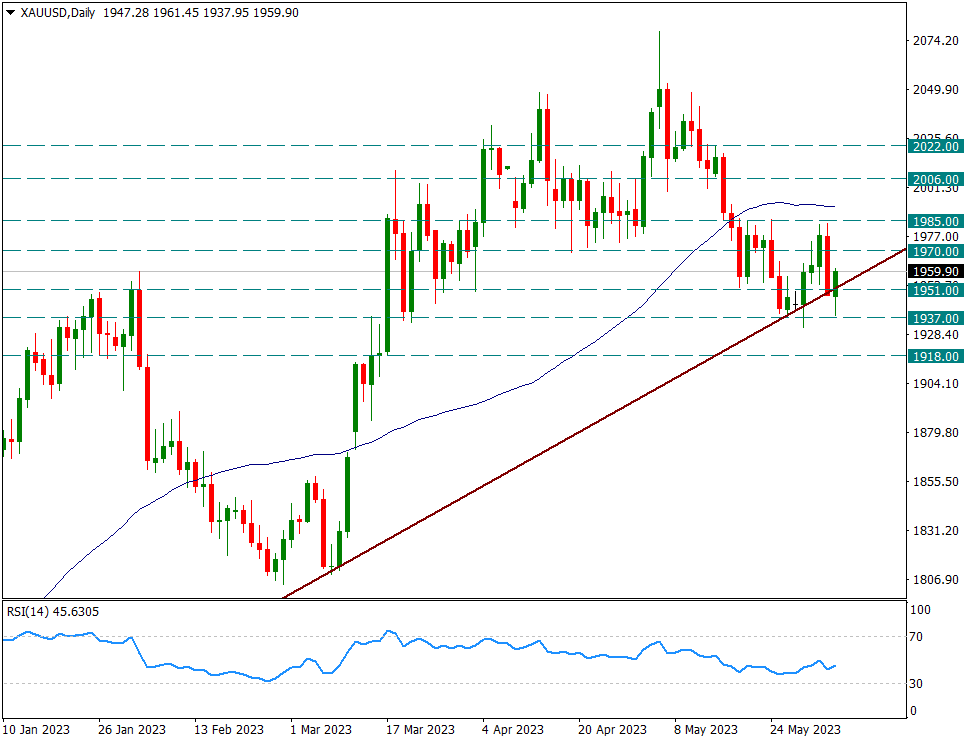

Ounce Gold – Trying to Take Back Losses During the Day…

The yellow metal quickly retreated after testing the 1985 resistance last week and closed in 1951. Although there were sagging in the new week until 1937, it was collected during the day and is at the level of 1960. The 1937 site was also tested last week and worked again. When we look at it above, 1985 will be the main resistance and 1937 will be the main resistance. In addition, the uptrend line from 1616 was very difficult last Friday but could not be broken. However, there is a possibility of breaking the uptrend in the retracements that can be experienced below 1951. Therefore, it will be necessary to look at this trend as well.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.