*In his speech, Wunsch, Member of the European Central Bank (ECB), stated that the ECB may raise interest rates further before interrupting the rate hike process, price pressures have eased and inflation has not reached the ECB’s 2% target before 2025.

*The Yen side had a very active day on Friday, with the Non-Farm Payrolls data from the US. Having regressed to 144.80 support, the pair then rose again and approached the 146.50 resistance. As of the new week, we see the continuation of pricing in favor of USD and the test of 146.50 resistance continues by getting stronger. If we can see the daily candle close above 146.50, we could technically confirm the trigger for the move towards the 150.00 level. Otherwise, we will continue to watch the 146.50/144.50 band.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

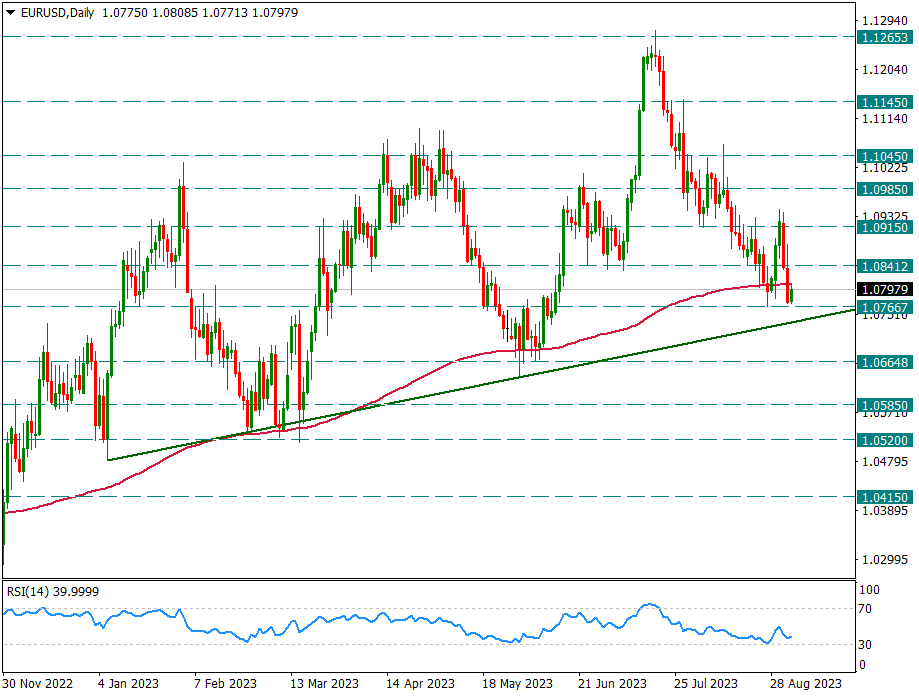

EURUSD

EURUSD – Reacts to Breaking 200-Day Average at 1.0766…

Last week, after two consecutive days of decline, the daily candle closed below the 200-day average. There is a correct reaction from 1.0766 to the 200-day average (1.0806) on the first trading day of the new week. As long as it stays below this average, dollar pressure is felt in the parity. In addition, the break of 1.0766 can continue this pressure by increasing.

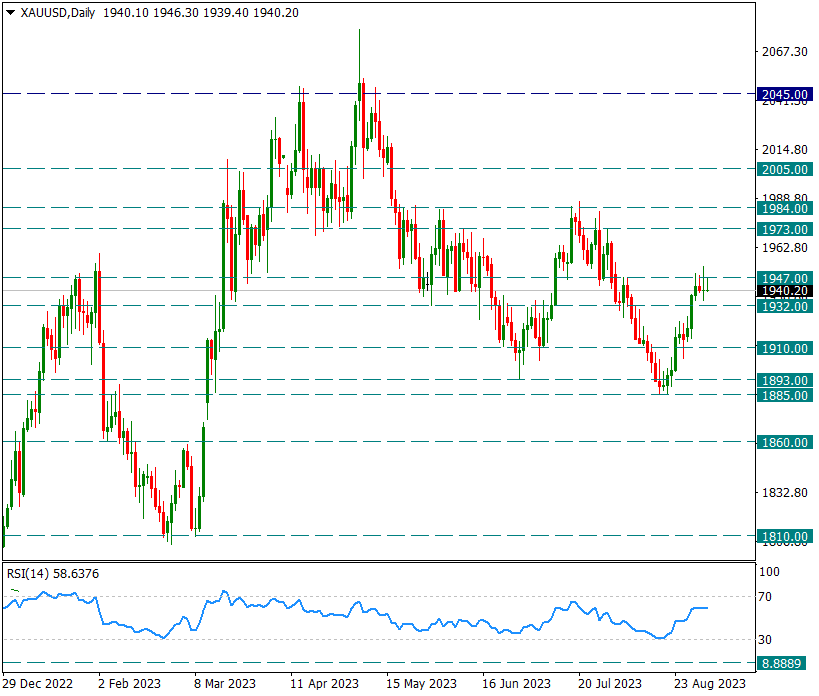

XAUUSD

Ounce Gold – Tests 1947 Resistance on Day Four…

Along with today, the yellow metal tested the 1947 resistance for the fourth consecutive day of trading. Intraday movements are calm due to USA Labor Day. In general, going above 1947 may bring 1984 to the agenda in the short term.

Otherwise, breaking the intraday support of 1932 below may bring the 1900s regions to the agenda.

For now, we are watching the 1947/1932 range.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

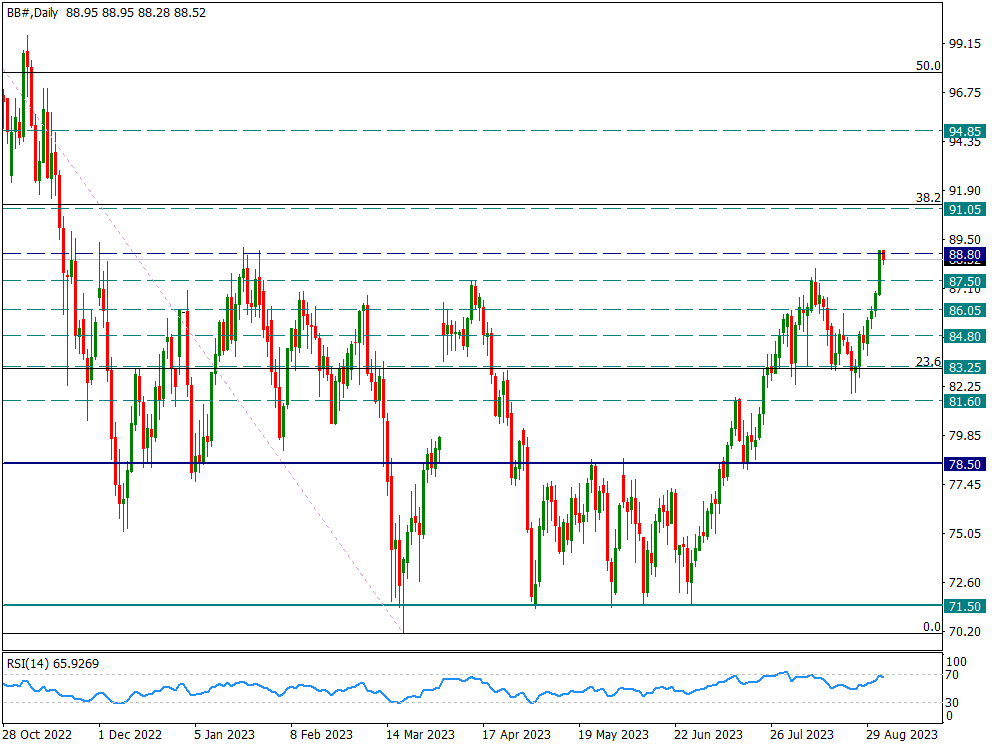

BRENT

Brent – Remains in the Highest Region Since November 2022…

Brent oil futures prices maintained their upward momentum towards the close of the market last Friday and prices rose as high as 88.80 resistance. The top of this region has not been crossed since November 2022 with daily candles before. Generally, the 88.80/89.00 region is critical resistance. Due to the US labor day holiday, there is calm in the markets, but in general, 87.50 is the main intraday support during the day. The main weekly support is at 83.25.

In the continuation of possible attacks, we can expect attacks towards 104 levels.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.