*The Bank of England increased interest rates by 25 basis points in line with expectations and increased the policy rate to 5.25%. While it was stated in the statements that the tight stance would be maintained in general, it was stated that inflation was taken seriously. In September, no clear signal was given that the rate hike would continue.

*In the European session, the German Services PMI index was announced as 52.3 and the Eurozone’s Services PMI index as 50.9.

*Euro Area Producer Price Index continued to be negative in June. It was -0.4% monthly and -3.4% annually.

*In the Service PMI indices announced in the USA, S&P Global’s data was 52.3, while ISM’s data was 52.7.

S&P Global said in its PMI report that companies are more optimistic about the outlook.

* The rise in the US 10-year bond yield continues step by step. The interest rate, which had increased to 4.15% at noon, has risen to 4.18% as of the US session. The rise in US bond yields is a very important situation that puts pressure on the market, so we follow it closely.

US stock markets are struggling to react to yesterday’s sharp drop. The reactions on the ounce gold side are also weak.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

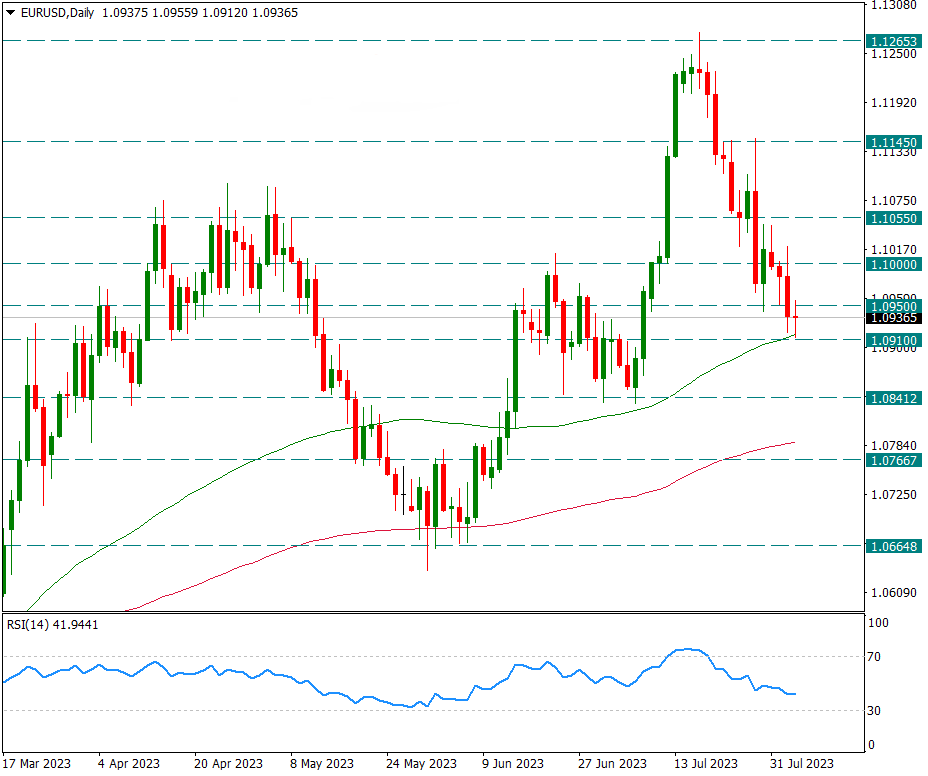

EURUSD

EURUSD – Drop Braking on 100-Day Average…

The EURUSD parity, which maintained its downward trend during the day, reacted slightly after 16.30. Still, the response is weak and the pair is struggling to hold above its 100-day average. We will look at this level, which coincides with 1.0910, in intraday movements. In possible reactions, it may be premature to expect 1.1055 main resistance and Euro rally again without breaking above this resistance.

The US 10-year bond yield increased to 4.18% during the day, showing us that the upward trend continues. This is one of the factors that put pressure on the parity.

Non-Farm Employment data from the USA tomorrow may increase the volatility in the pair.

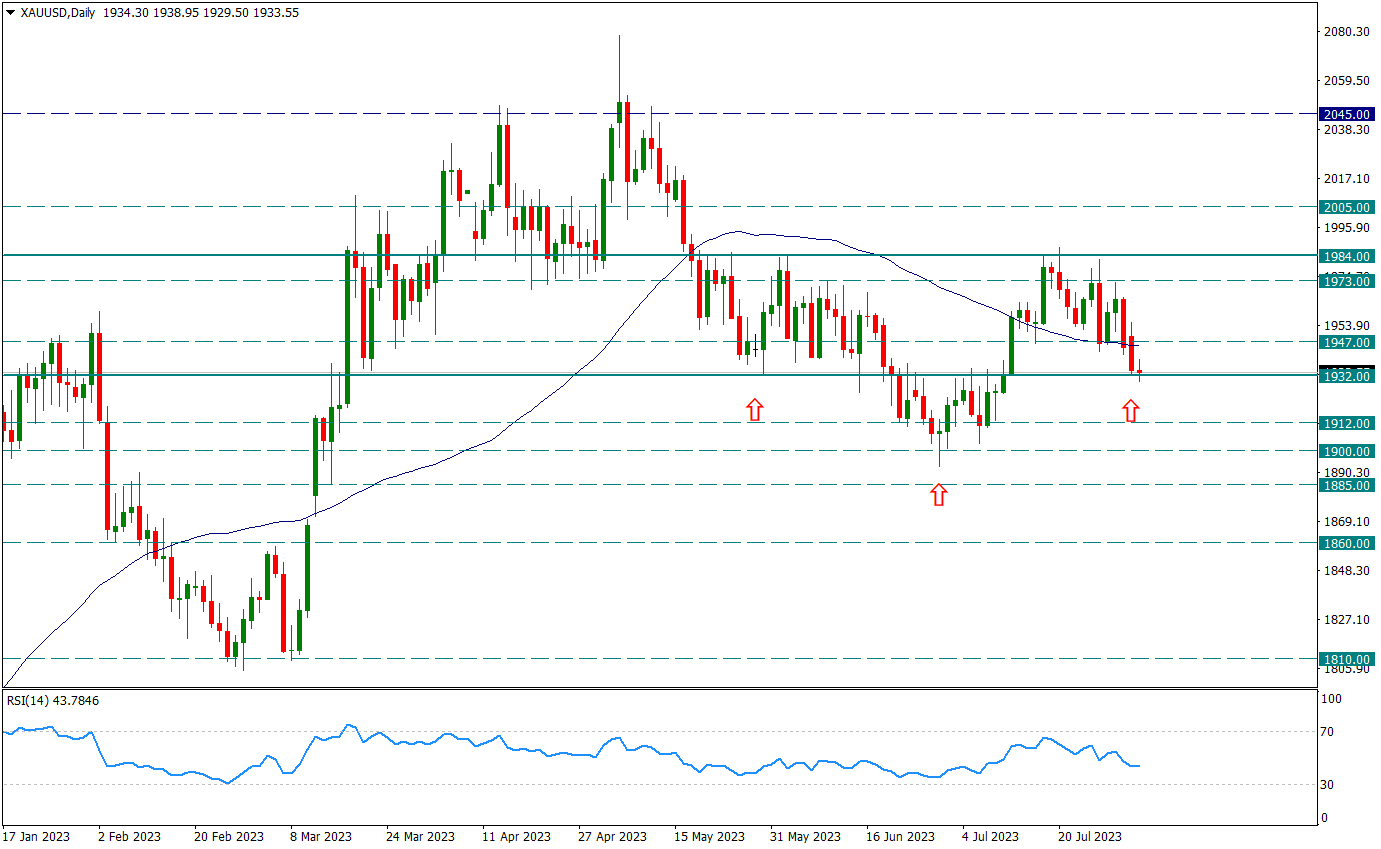

XAUUSD

Ounce Gold – Suppressed But Seeking Support From 1932 Level…

The yellow metal has been heavily suppressed in recent days, with the US 10-year bond yield rising as high as 4.15% today, in addition to the strengthening of the Dollar index. As a result of this suppression, it declined until the support of 1932. Here we observe the possibility of a reverse shoulder head shoulder formation, but if the 1932 support is broken, this possibility may be broken. Today and tomorrow we will observe the 1932 support along with the US Non-Farm data.

There are intermediate resistances in possible attacks, but we have to see that the 1984 resistance is broken with the daily candle in order to confirm the trend to 2000 and above.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

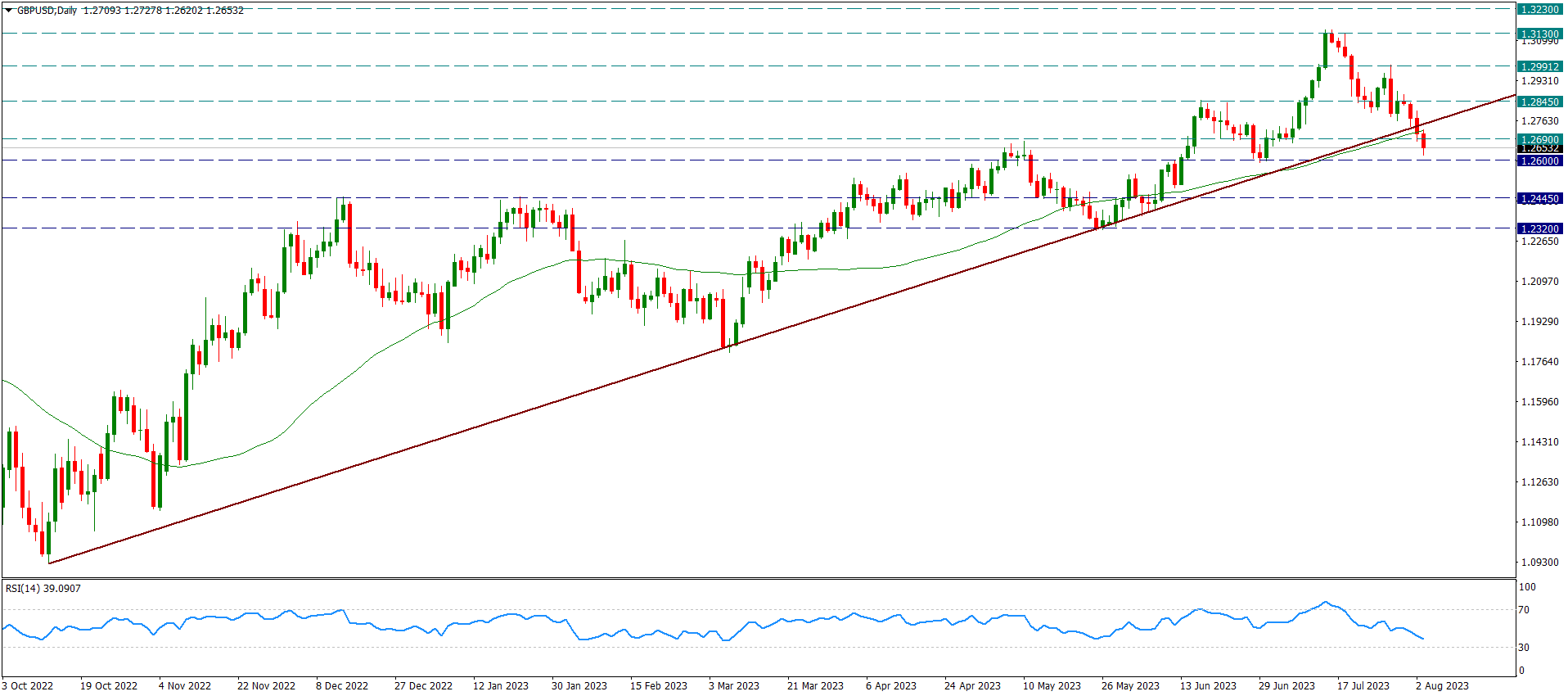

GBPUSD

GBPUSD – Continued Its Downtrend After BOE…

The pound is on the fourth trading day of its decline against the dollar. As of yesterday, it broke the 10-month uptrend coming from the 1.09 region. Today, with the technical breakout, it continued its downward trend, falling below its 50-day average and approaching the 1.26 support. It may be premature to expect a short-term recovery in Sterling as long as it does not rise above the 50-day average in intraday movements.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.