- Turkish Statistical Institute (TURKSTAT) announced inflation data for January. According to TURKSTAT data, consumer prices increased by 6.65% and producer prices increased by 4.15% in January. On a monthly basis, CPI reached its highest level in the last 9 months. Compared to January of the previous year, consumer prices increased by 57.68% and producer prices increased by 86.46%.

- Simkus, Wunsch and Kazimir from the European Central Bank (ECB) made statements in parallel. They signaled that a clear victory has not yet been achieved in the fight against inflation and that the rate hike will continue in this direction.

- The Eurozone Producer Price Index (PPI) was above expectations for December. On a monthly basis, producer prices were expected to decrease by -0.4%, while an increase of 1.1% came. Compared to December of the previous year, it was announced as 24.6%, above the expectation of 22.5% increase. With a monthly increase of 2.5%, energy costs played a leading role in the increase in PPI.

- Today, we had a busy day in terms of January PMI data. Germany Service PMI increased from 49.2 to 50.7, Euro Area Service PMI increased from 49.8 to 50.8, 50 threshold value was passed and the green light was turned on for the service sector. The UK Services PMI fell to 48.7 from 49.9.

- US Non-Farm Employment increased by 517,000 in January, surpassing the expectation of an increase of 185,000 positively. The Unemployment Rate fell from 3.5% to 3.4%, despite the expectation that it will increase slightly. Additionally, Average Hourly Earnings increased 0.3% in January as expected.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

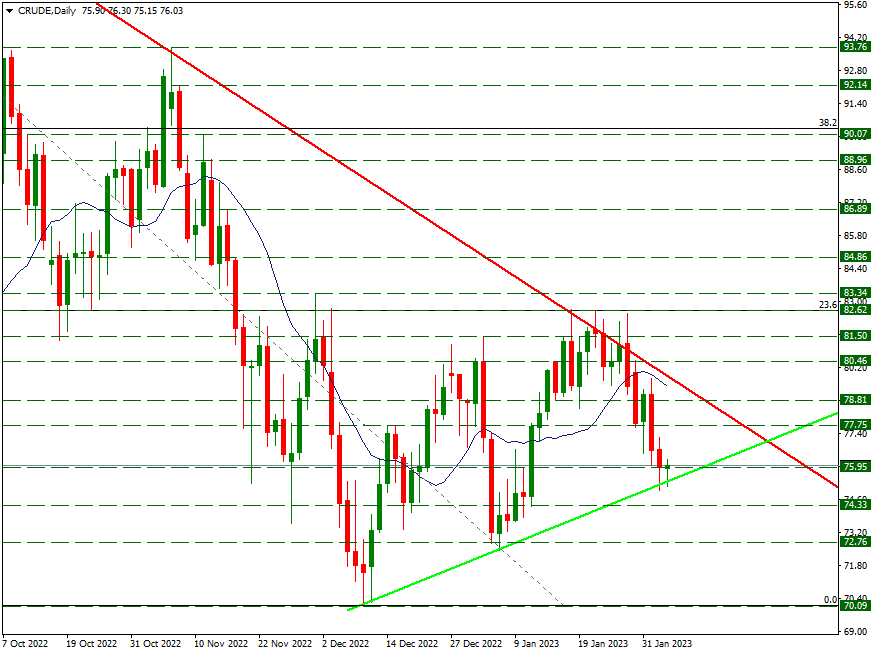

CRUDE

CRUDE – Around 76 on the Last Trading Day of the Week…

On the last trading day of the week, Crude Oil continues to price in this area by testing the lower band of the symmetrical triangle formation. If the lower band of the formation is broken, the downside trades can gain momentum. In this case, 74.33 can create support. If we stay in the formation, we can see recovery. In this case, it can form resistance at 77.75 and 78.81, respectively.

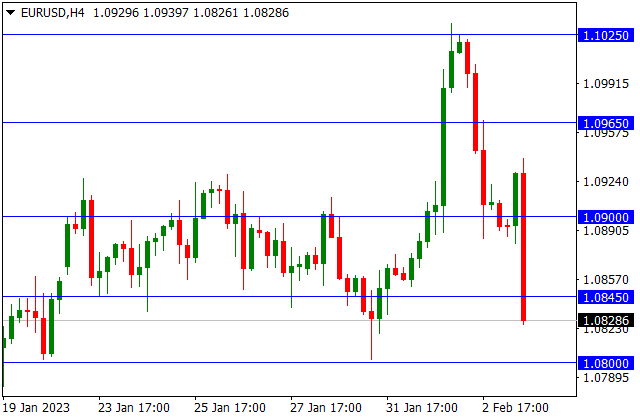

EUR/USD

EUR/USD – Non-Farm Employment Decreases After…

Non-Farm Employment for the month of January, which we followed in the USA, came in at 517 thousand, well above the expectation of 185 thousand. The Unemployment Rate fell from 3.5% to 3.4%, while Average Hourly Earnings increased 0.3% monthly. Due to the positive data, the EURUSD parity is decreasing. In the continuation of the decline, 1.0800 and 1.0765 can be viewed as support. In transactions in favor of the Euro, 1.0845 and 1.0900 may form resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

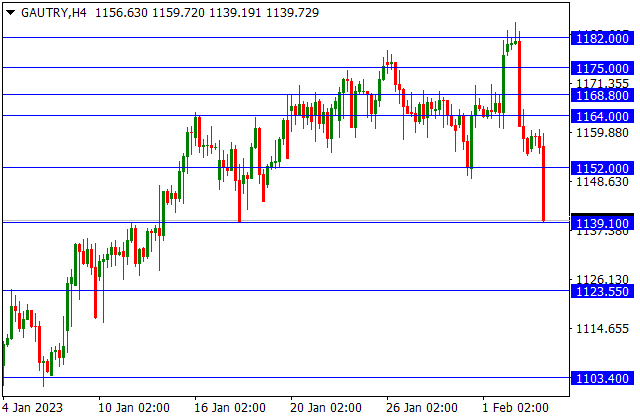

GAU/TRY

GAU/TRY – Non-Farm Tested to Post 1139.10 Support…

Non-Farm Employment in the USA came in at 517 thousand, well above the expectation of 185 thousand. After this data, 1139.10 support was tested in Gr Gold TL with the effect of the decreases in Ounce Gold. In case of holding on this support, 1152 and 1164 can be viewed as resistance. Breaking the 1139.10 level and below it can create support at 1123.55 and 1103.40.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.