- While recovery efforts were seen in the Dollar Index in intraday pricing, the rise in Ounce Gold and bonds also drew attention with this pricing. While the US 10-year bond was purchased, its yield decreased to 3.75% inversely.

- US 2 and 10-year bond interest spreads increased to 60 basis points again. Before the end of the year, this spread had decreased to 47 basis points. We will continue to monitor the difference here. If the gap continues to widen, the fear anxiety may start again in the market.

- In Turkey, inflation in 2022 was 64.27% according to the data announced by TURKSTAT. Monthly inflation for December was announced as 1.18%.

- Core inflation was 1.86% on a monthly basis and 51.93% on an annual basis.

- On the Turkish Producer Price Index side, there was a negative result on a monthly basis, while the PPI rate for 2022 was 97.72%.

- Unemployment Rate in Germany was 0.1 points better than the previous month and realized as 5.5%.

- Germany’s leading inflation data for 2022 was 8.6%, while monthly inflation was -0.8%.

- Looking at the PMI data, the Caixin Manufacturing PMI index came from China in the Asian session. To remind this data again, December was 49, that is, in the contraction zone.

- In other Manufacturing PMI data released during the day, the UK came in negative territory with 45.3, while Switzerland came in positive territory with 54.1.

- The last PMI data of the day came from the USA. Manufacturing PMI data announced by S&P Global came below the previous month with 46.2 and remained in negative territory.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

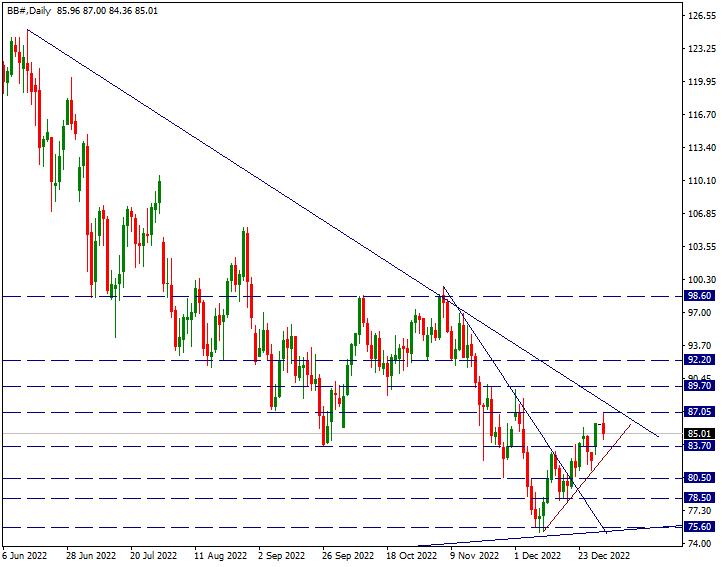

BRENT

BRENT – Giving Back Some of Its Year-End Rise…

Brent, which started the day with a rise and touched the 87.05 resistance, gave back some of its rise at the end of the year in intraday movements. Here we will pay attention to the 83.70 support. A break of 83.70 on possible declines may continue the selling trend by further strengthening. In this sense, we will follow 83.70 in the short term.

For movements above 87.05, we will be watching the downtrend line coming from the 125 region. Overcoming this resistance line may bring the 100 levels to the agenda in the future.

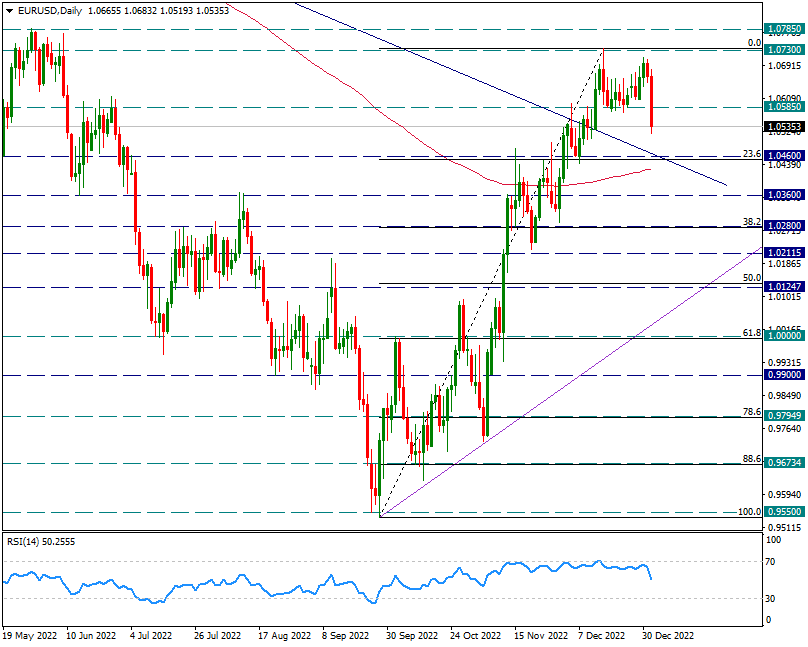

EUR/USD

EUR/USD – Declining Towards 1.0460 With a Strong Decline…

On the first volume trading day of the new year, the pair regressed with a strong move in favor of the Dollar and reached 1.0520. At the beginning of the day, it was priced at 1.0665.

In general, the dollar mood prevails in the market and the dollar index rose from 103.45 to 104.75.

With the decline experienced today, it started to approach its 200-day average. In addition, if the double top of 1.0730 on December 15 and December 30, 2022 works as a formation, it will not be surprising that the correction here will last until the level of 1.0460. As the intraday movement is now below 1.0585, there may be a technical opportunity for it to reach the 1.0460 level. On the other hand, 1.0460 became the main support in intraday movements.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

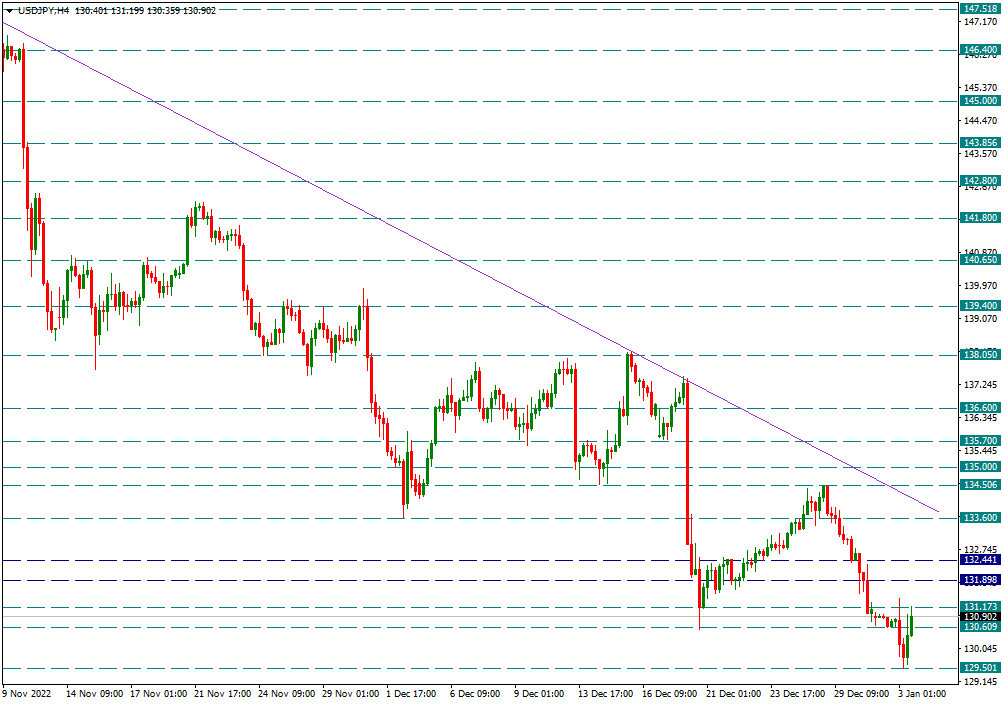

USD/JPY

USD/JPY – Reacts From Bottom With The Dollar Index…

USDJPY parity has broken below 130.60, which is the low of 2022, in the Asian session tonight and declined to 129.50. Subsequently, the sharp rise in the Dollar Index during the day caused the pair to react and touch the 131.17 resistance.

In the possible candle closes above 131.17, it is possible that the movement in favor of the dollar will continue for a while and the reaction may be extended to the regions of 132.45 and 133.60.

Possible reactions will be normal with the addition of the increase in the dollar index to the oversold of the pair. However, unless 133.60 is crossed upwards, these reactions may not lead to a change in the downtrend that started at 152.00.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

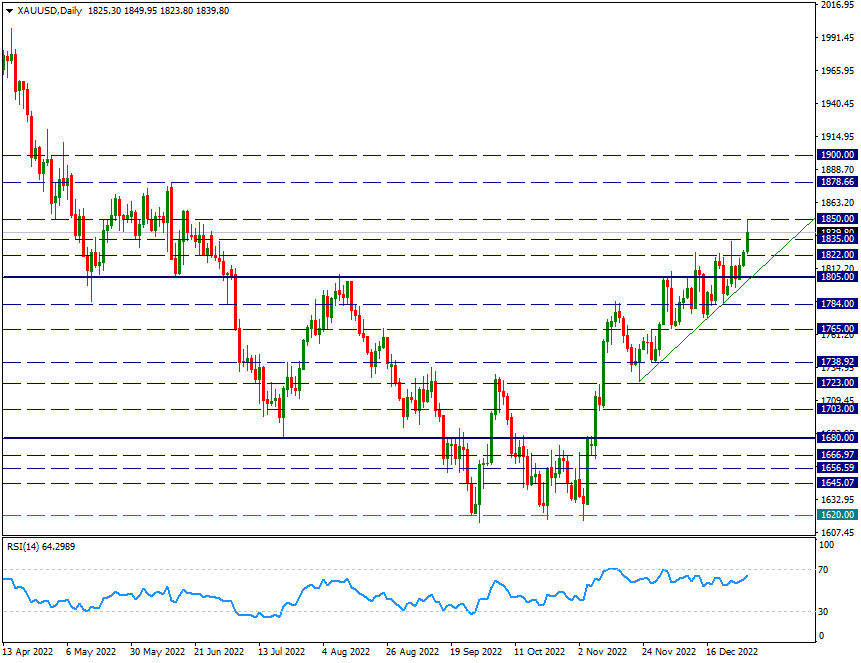

XAU/USD

XAU/USD – The New Year Started With Ascension…

Ounce Gold started the new year with a rise. Despite the strengthening of the Dollar Index, the easing in the US 10-year bond yield seems to have triggered upward movements in the yellow metal. For a while, it was in a zigzag movement very often, although it was forming new hills. The first trading day of the new year was realized as a strong upward trend for ounce. Testing the 1850 resistance, the yellow metal extended its rise to this region, correcting the Fibo 50 of the 2070/1615 decline. If the 1850 region is passed in the next period, the 1878 level will be on the agenda first.

If it is not passed in the first place due to coinciding with the Fibonacci correction, the 1805 level will appear as an important support zone in possible profit sales.

Contact Us

Please, fill the form to get an assistance.