*Last night, international credit rating agency Fitch Ratings downgraded the United States’ long-term credit rating from AAA to AA+ and changed its outlook from negative to stable. With this decision, Moody’s remains the only major credit rating agency to give the US the highest credit rating.

*Today, at 15:15, the ADP Non-Farm Employment Change data for the US was released, and it came in much stronger than expected. The July data showed an increase of 324,000 jobs, while the June data was revised from 497,000 to 455,000 jobs. This data indicates that the employment situation in the US is still robust and suggests that the Non-Farm Payrolls report on Friday may also be strong. Following the data release, the US Dollar Index showed a slight positive trend.

*Tomorrow, the Bank of England’s policy meeting will take place, and a 25 basis point interest rate hike, bringing the rate to 5.25%, is anticipated. However, an important question remains about whether the central bank will need further interest rate hikes and tightening measures to control inflation pressures. There is a general expectation in the market that the BOE will continue its policy trend and leave the door open for further tightening based on incoming data.

*According to a survey by YouGov, inflation expectations for the UK have declined. The one-year inflation expectation has dropped from 5% to 4.3%, and the inflation expectations for 5-10 years ahead have decreased from 3.3% to 3.2%. Market pricing currently indicates a 62% probability of a 25 basis point interest rate hike and a 38% probability of a 50 basis point hike. The terminal peak rate expectation has also decreased to 5.76%, indicating reduced concerns about inflation and contributing to the strength of the British Pound.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

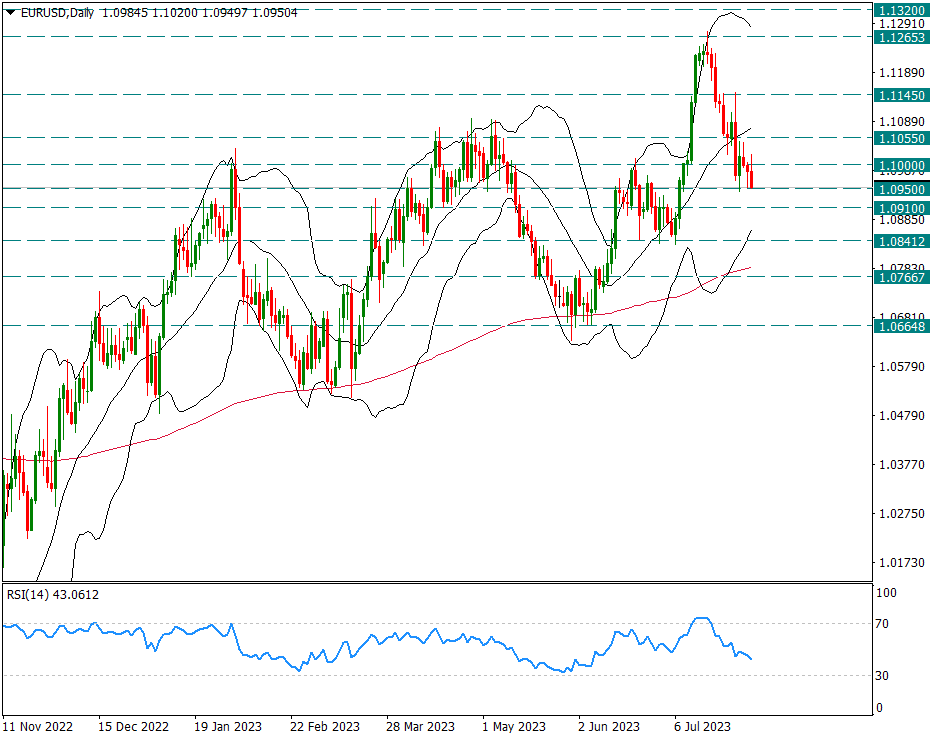

EURUSD

EURUSD – Returns Gains from Fitch’s Downgrade of the US…

With the international credit rating agency Fitch downgrading the credit rating of the USA, there was a depreciation in the US Dollar index during the night. However, the Dollar still gained strength as the safe haven and ADP Non-Farm in the US came in above expectations. For this reason, the EURUSD parity, which had risen slightly at night, declined rapidly during the rest of the day and fell to 1.0950.

It is now approaching the lower band of the bollinger band, which we have shown on the daily chart step by step. So 1.0910 and below will be quite important.

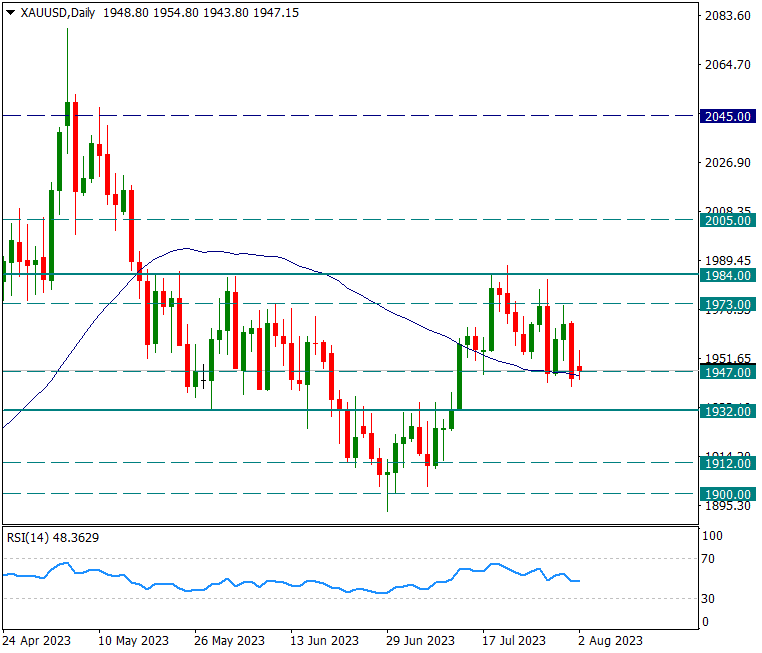

XAUUSD

Ounce Gold – Forces To Break The 50-Day Average Downward…

The yellow metal remains under pressure as the dollar index recovers and the US rises above 4% on the 10-year mark. It sagged slightly below the 50-day average yesterday. Today it is 1947 and it is just over 50 days old, but the reactions are very weak. If 1947 breaks on a daily basis, we could see a rapid sag into 1932.

In possible reactions, the first resistance during the day is 1973 and the main resistance is 1984.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

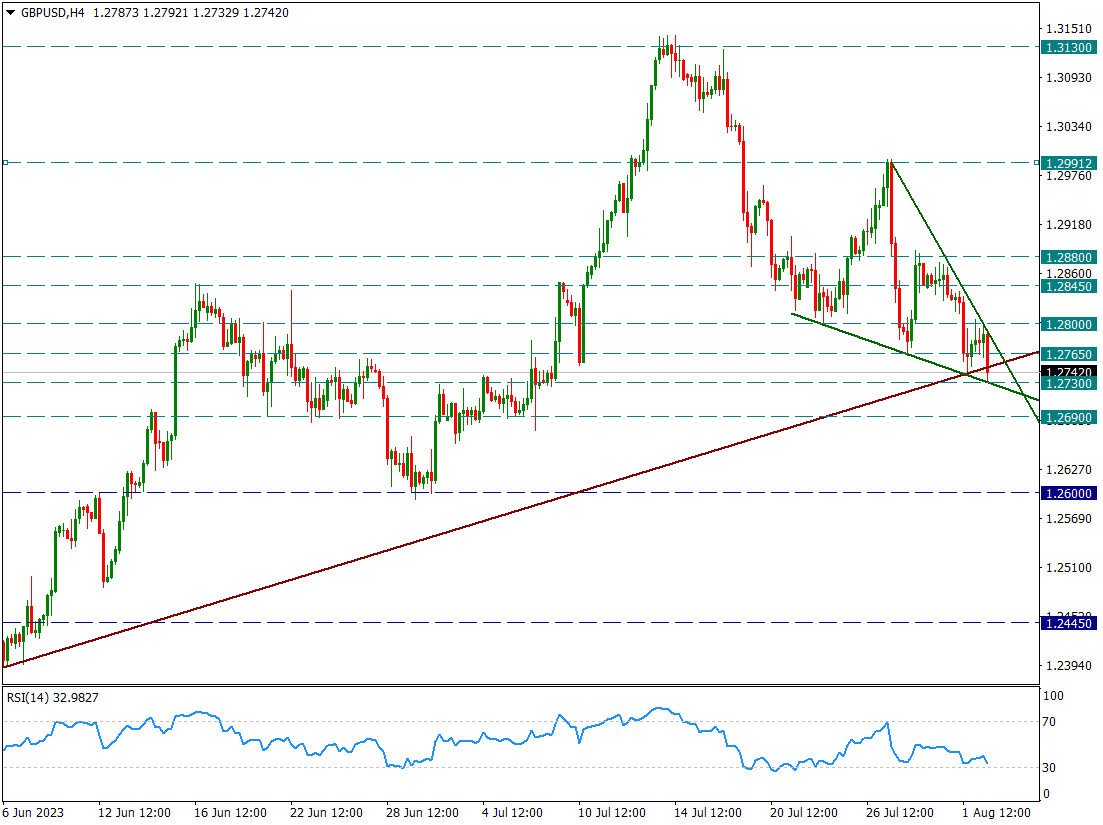

GBPUSD

GBPUSD – The Drop In The Pair Is Now To The Point Of Testing The Critical Trends…

Sterlinn continues its decline from where it left off, forcing very important supports. On the four-hour display, there was both a squeeze and a bearish bias towards the mid-term trend from 1.0995.

The declines triggered by 1.2800 today continue with the strong return of private sector employment data from the USA. GBPUSD parity declined as low as 1.2730.

A few four-hour candle closes below 1.2730 could break the medium-term uptrend and further strengthen the downtrend. We expect the pair to move in favor of the dollar unless it rises above 1.2800 in the short term.

Tomorrow we will pay attention to possible policy direction from the Bank of England for the future.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.