*Global markets generally moved in favor of the US Dollar during the day. In addition to the US Dollar index rising above 102.20 during the day, the US 10-year bond yield also rose to 4.04%.

While the US futures stock indexes were generally selling on the day, the US gave back some of its losses in the spot stock market opening.

*One of the most important data coming in today was the ISM Manufacturing PMI index from the USA at 17:00. While the previous data was 46, the data for July was announced as 46.4. While there is a decline on the employment side, there is a recovery in new orders, but all data except the data set are below the neutral 50 level, which means recession. Although the new orders are in the recession zone, some collections may give hope for the future.

*Another data released during the day was JOLT’s Job Opportunities data from the USA at 17.00. The data was announced as 9,582M, falling below the previous May figure and remained in the recent low region.

*While we watch the ADP Non-Farm Employment data from the USA tomorrow, we will also focus on the companies whose balance sheet will be announced in the USA tonight.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

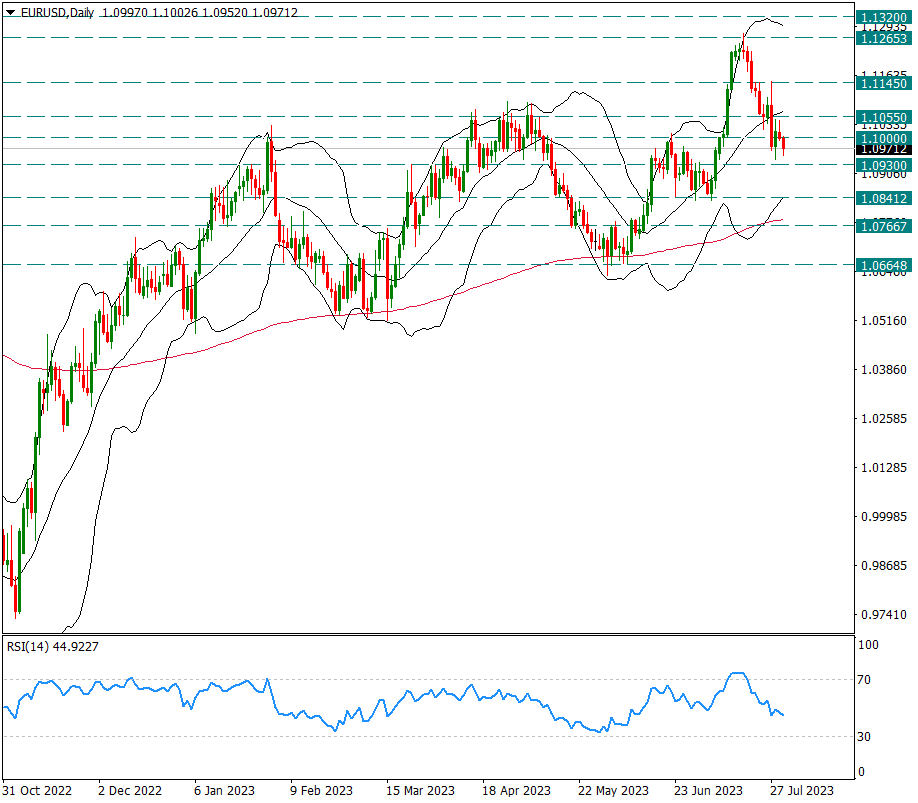

EURUSD

EURUSD – Approaching 1.0930 as Dollar Moves in Favor…

The pair is going to correct its extreme rise in the month with movements in favor of the dollar. Technically, it is recovering some of the excessive opening in the daily bollinger band. As of today, it has dropped to the 1.0960 level seen last week. Here, if it does not rise above 1.1055 in a short time, it is possible that the movements in favor of the dollar will continue and there will be a relaxation up to the 1.0840 level. This week, we will follow the ADP Non-Farm Employment Report from the USA on Wednesday and the Non-Farm Employment Report from the USA on Friday. Especially the data coming on Friday may increase the volatility in the parity.

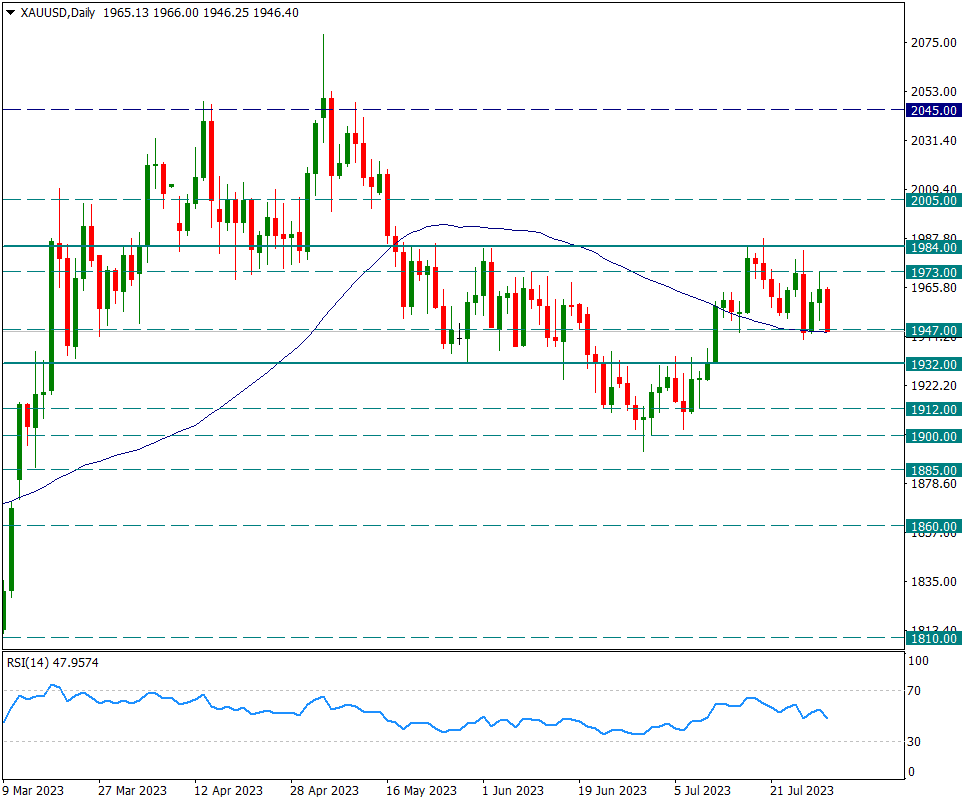

XAUUSD

Ounce Gold – Presses 50-Day Average Again…

The yellow metal has been suppressed by the resistance of 1984 and then 1973 in each attack recently and turned its direction down again. However, there is a 50-day average that keeps the prices above, which corresponds to the 1947 level. Today, with the US Dollar index and the US 10-year Treasury yield rising, the yellow metal is suppressing and also suppressing its 50-day average. 1947 is important in this sense. If it breaks, we will carefully monitor the 1932 level. Again, the first resistance will be 1973 in possible reactions.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

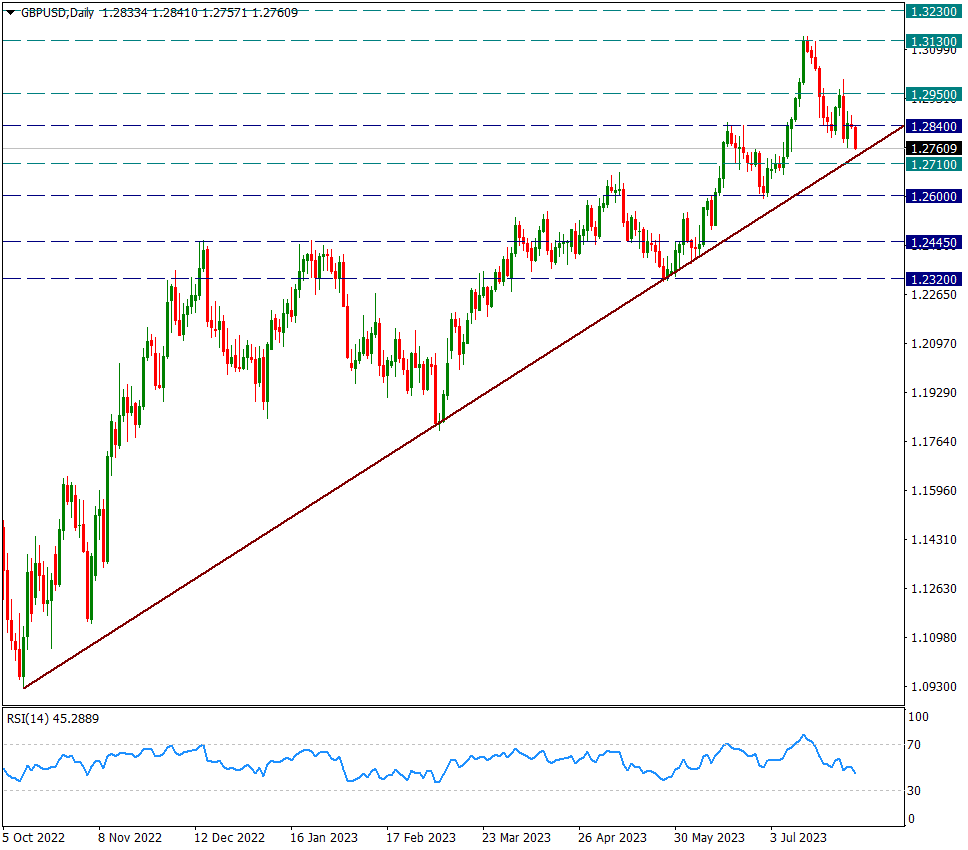

GBPUSD

GBPUSD – Closer to Ten Month Uptrede With Today’s Drop…

With the gains in the dollar index, the GBPUSD parity came down step by step and came very close in the uptrend that followed the rise since 1.0955. Approaching the beginning of the US session, the pair declined as low as 1.2760. Here our main intraday support will be 1.2710. If the dips break this level and/or trend, we are more likely to see a trend up to 1.2320.

Initial resistance in intraday possible reactions is 1.2840.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.