- Retail Sales in Germany for October decreased more than expected. Retail Sales decreased by 2.8% month on month and 5.0% year on year. Data were expected to decrease by 0.6% and 5.0%, respectively.

- In Europe, we followed the Manufacturing PMI data for November today. Manufacturing PMI shrank in Germany, the Eurozone and the UK at 46.2, 47.1 and 46.5, respectively. Data were at 46.7, 47.3 and 46.2 in October.

- Unemployment Rate for October, another important data announced in the Euro Zone, decreased from 6.6% to 6.5%. The European Central Bank (ECB) may consider a more moderate interest rate hike at its meeting on December 15, after the latest data in Germany and the Euro Zone are negative. For now, the ECB is expected to raise the interest rate by 50 or 75 basis points.

- According to the weekly monetary reports released by the CBRT, non-residents bought $24.2 million worth of stocks and $2.9 million of Government Domestic Debt Securities last week. Foreign currency deposits of domestic residents also decreased by $5.53 billion. Apart from these data, CBRT’s Foreign Exchange Reserves decreased by $264 million to $79.766 billion, while Gold Reserves decreased by $20 million to $42,835 billion.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

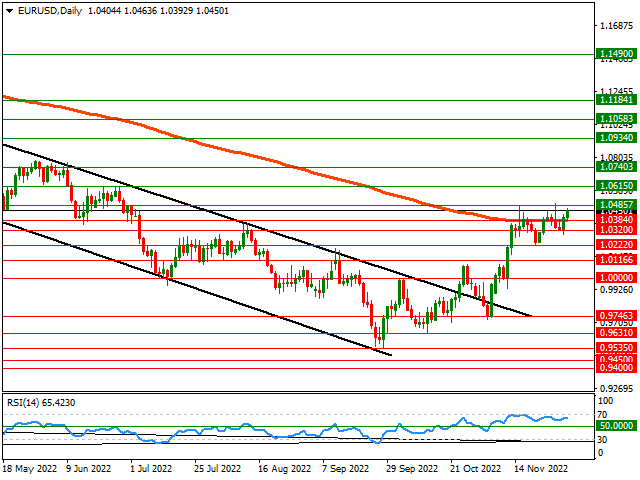

EUR/USD

EUR/USD – Post-Powell Uptrend Brings The Pair To 1.0485 Resistance Zone…

The EUR/USD pair maintained its upward trend, which started yesterday after Fed Chairman Powell’s dovish statements, throughout the European trading session. 1.0485 and 1.0615 levels can be followed as the first resistance zones in the pair, which is traded above its 200-day exponential moving average. On the other hand, 1.0320 and 1.0222 levels can form support if the pair turns down with the start of the US trading session and if it is below the 200 average, it is possible.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

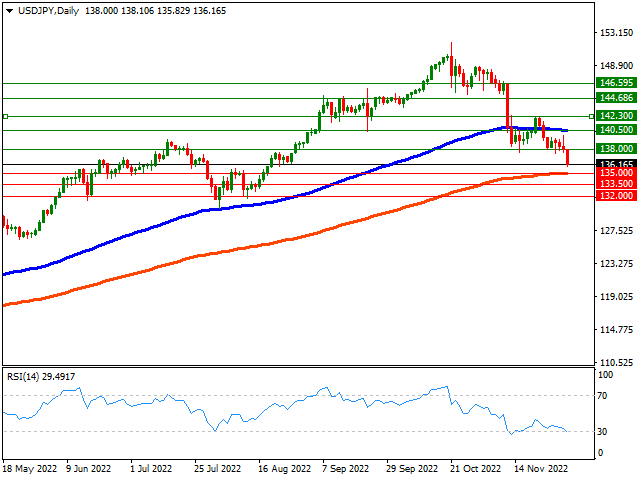

USD/JPY

USD/JPY – Pricing in the Lowest Region of the Last 3 Months…

The USD/JPY parity fell to the lowest region of the last 3 months at 135.82 in the European session on Thursday as the statements of Fed Chairman Powell put pressure on the US Dollar. If the parity, which is approaching its 200-day average, turns below this region, 133.00 and 131.00 levels can be followed as the next support zones. On the other hand, 138.00 and 100-day exponential moving average can be followed as the first resistance zones if the parity encounters reaction buying in the 200 average region and gives its direction upwards.

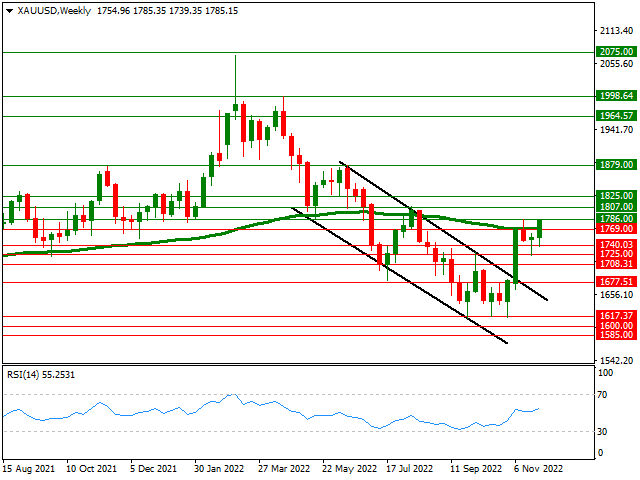

XAU/USD

XAU/USD – He Moves Post-Powell Earnings to the 1786 Resistance Zone Boundary…

After Fed Chairman Powell’s statements yesterday, Ounce Gold, which rose above the 100-week exponential moving average and maintains its upward trend today, approached the 1786 resistance zone, the highest level of 14 weeks. If Yellow Metal breaks above this resistance zone, 1807 and 1825 levels can be followed as the next resistance zones. On the other hand, 1769 band, which is the 100-week exponential moving average, can be followed as the first support zone in case Precious Metals encounter sales.

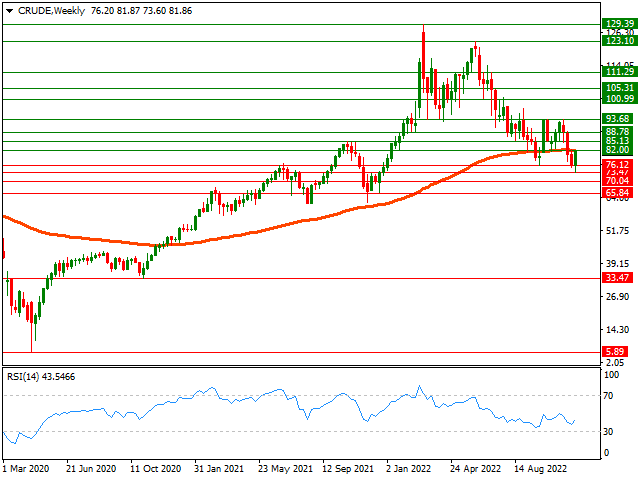

CRUDE

CRUDE – At the Boundary 100-Week Average…

After the bounce in the $73 region in Crude Oil, the upward rally that has continued since the beginning of the week is based on the $82 resistance zone, which is the 100-week average. Crude Oil, which is approaching the border of this resistance zone during the day, if it succeeds in splashing above this zone, the $85 and $88 levels will come to the fore as the next resistance zones. On the other hand, if Crude Oil price turns down, the $76 level can be followed as the first support zone.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.