*The GDP for the second quarter announced today in the Euro Zone was below expectations, showing quarterly growth of 0.1% and annual growth of 0.5%. The economy was expected to grow 0.3% and 0.6% respectively.

*The weekly unemployment benefit applications announced in the USA during the day were announced as 216,000, coming to the lowest level in recent times. With this data, we see that the employment market in the USA continues to remain strong. Following the data, the dollar index continued to gain value and fell below 1.07.

Agenda of the day;

20:00 US Oil Drilling Rig Count

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

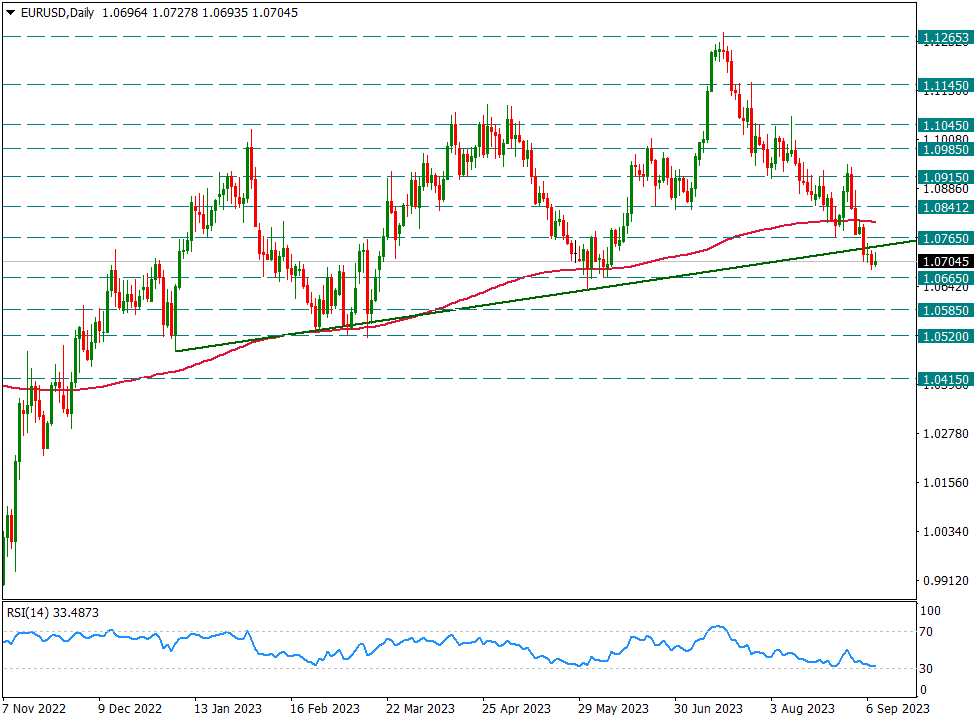

EURUSD

EURUSD – Dollar Pressure Can Be Felt Below 200-Day Average…

The parity has focused on its movements in favor of the dollar this week and upward reactions remain weak. In the short term, as long as it remains below the 200-day average, further movements in favor of the dollar can be predicted. In possible reactions, the level of 1.0765 will be followed first.

At the point where it cannot rise above these areas, we can watch possible declines towards the 1.0520 level, step by step.

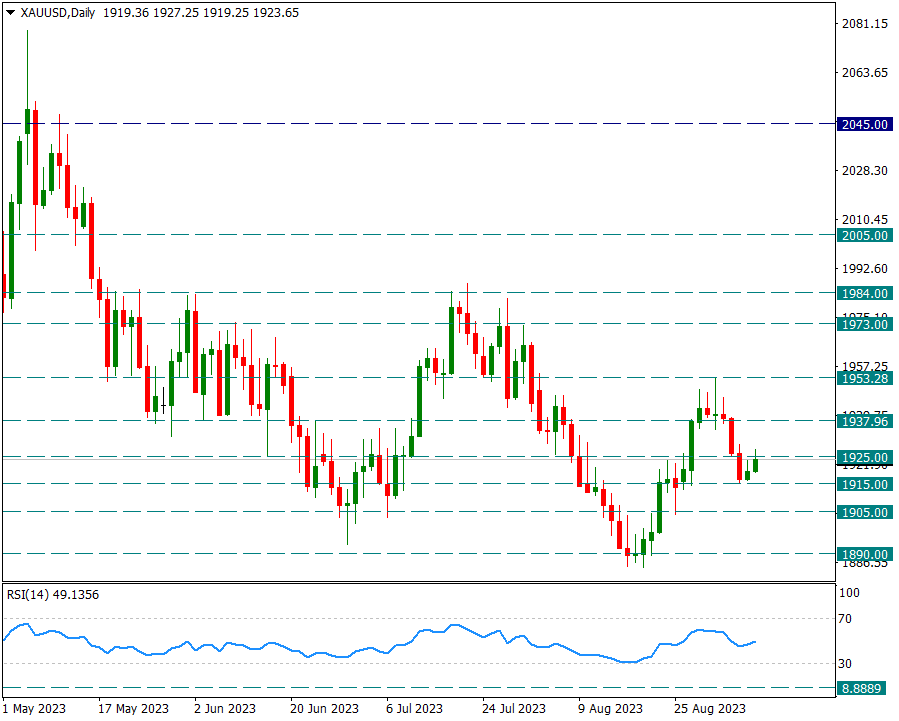

XAUUSD

Ounce Gold – We Follow the Persistence of Reactions on a Level Basis…

The yellow metal continues to react as of yesterday and today after falling to the 1915 support. With today’s reaction, it reacted to the 1925 resistance.

We see that the US 10-year bond interest rate has decreased slightly from 4.30% in the last two days. For this reason, we see a reaction in Ounce Gold. However, price movements continue to remain compressed. In general, it may be technically premature to talk about 1984 and 2000 as long as the 1953 resistance is not passed.

Even though there was a reaction in the future, the first resistance was 1953. If it cannot rise above this zone, reactions may give way to profit taking. If the 1915 support is broken, we can start talking about the 1890 support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

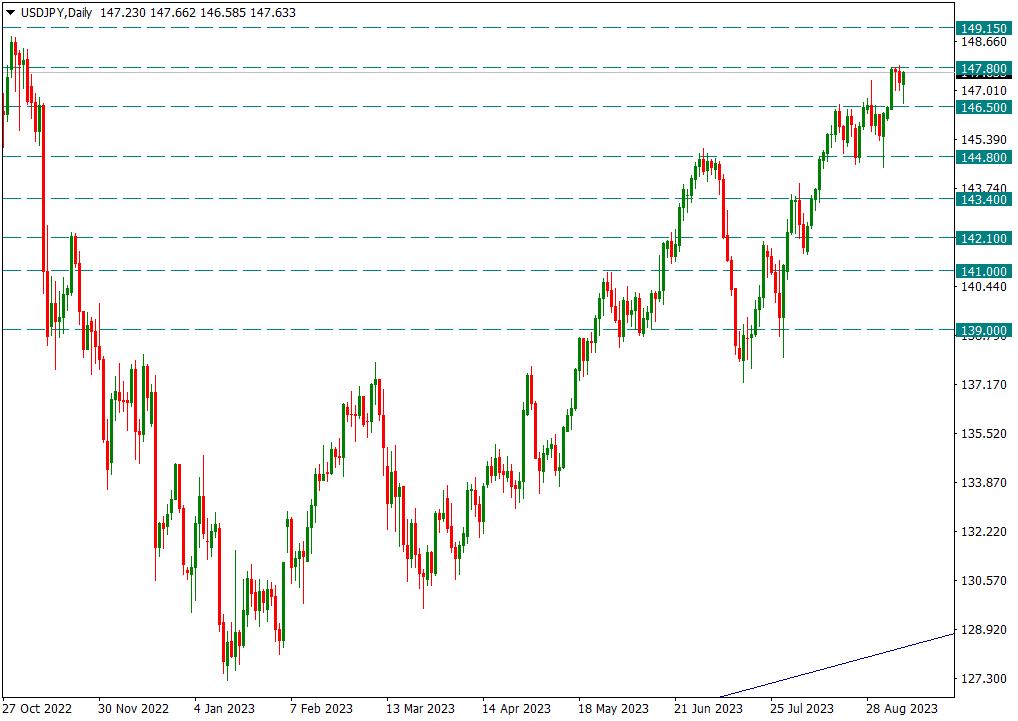

USDJPY

USDJPY – Pushing the 147.80 Resistance Again…

The 147.80 resistance seen this week was important for the USDJPY parity. However, during the week and especially today, we saw a slight sag towards the 146.50 support. However, it moved towards 147.80 again without breaking this region. We follow price movements in the 147.80/146.50 range. In the continuation of upward movements, the 150.00 region will be followed step by step.

However, it should not be forgotten that as the rise continues, it may be necessary to pay attention to possible verbal guidance from the Bank of Japan.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.