*In terms of global markets, the most important data of the day was the US Non-Farm Employment Report, which was announced at 15.30.

The employment change, which everyone paid attention to, came under expectations and was announced as 187,000. In addition, the data for the previous June was revised down from 209,000 and 185,000 was announced. On the other hand, from the side data, we can say that the unemployment rate was 3.5% and the average hourly earnings were quite good with 0.4% monthly and 4.4% annually.

However, we saw strong sales in the dollar index with the loosening in the employment change. While the EURUSD parity rose above 1.10, the US 10-year bond yield decreased from 4.2% to 4.10%.

While the data can ease the pressure on the FED, the still positive Unemployment Rate and Hourly Earnings may not keep the pricing against the dollar in the market for long. Next week, we will try to predict the Fed’s September move by watching the FOMC members’ statements and inflation data. Not to forget the Jackson Hole meeting at the end of August.

*We see that the US futures stock indexes, which have withdrawn in the last two days after the US Non-Farm data, have recovered and reacted with support.

*Amazon.com shares approached the highest level of the last year with the opening at 16.30.

*Booking Holdings Inc. shares rose close to 10% at the opening of the USA and broke the record.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

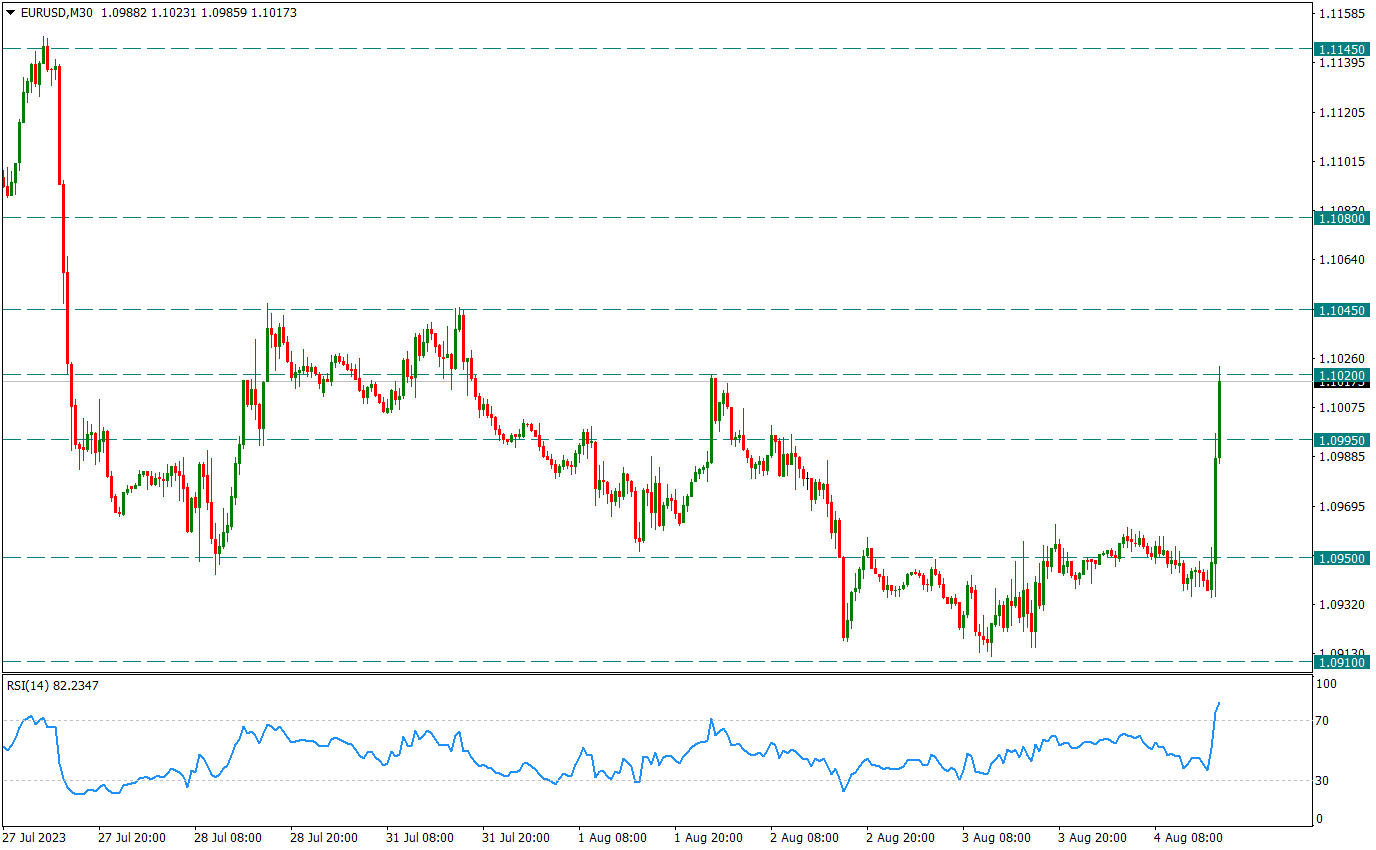

EURUSD

EURUSD – Breaks Above 1.10 After Under-Expectation Non-Farm

US July Non-Farm Payrolls came in at 187,000, below expectations, and the previous data was also revised down. Unemployment Rate and Average Hourly Earnings maintain their trends, but softening in the headline data caused profit sales on the Dollar side and EURUSD parity to rise above 1.10. If there is a possible hold above 1.1045 in intraday movements, it is possible to see the continuation of the weakening on the Dollar side.

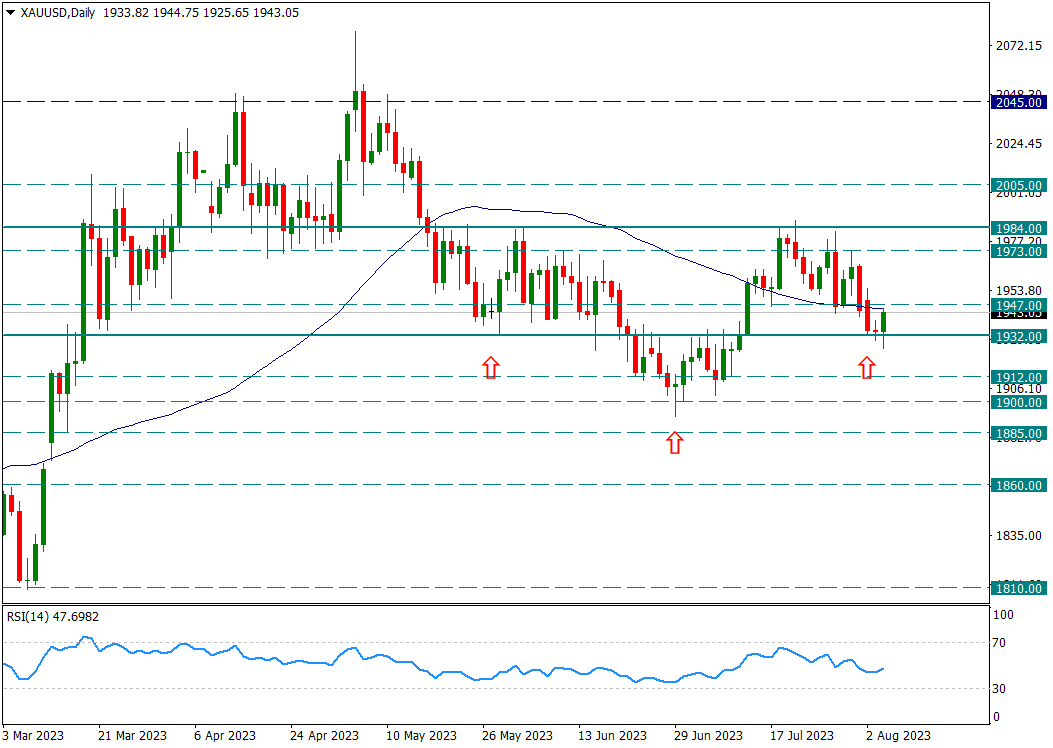

XAUUSD

Ounce Gold – Reacted from 1932 with US Non-Farm…

During the week, it gradually regressed to the 1932 support. Today, however, we are seeing a reaction with the US Non-Farm’s coming in at 187,000, below expectations. While the US 10-year bond yield fell from 4.20% to 4.13%, there is also a rise on the yellow metal side.

When we looked at the technique of yellow metal, we were talking about the possibility of reverse shoulder head shoulder formation. Here the right shoulder coincides with the 1932 support. With this reaction after the decline experienced during the week, the support of 1932 worked. The first intraday resistance in the movements that can be step by step is the 1947 level.

In general, in the short term, as long as 1932 is not broken, the reverse shoulder head and shoulder formation will remain on the agenda. However, the fact that this formation works and the pricing of 2000 and above depends on the breaking of the 1984 resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

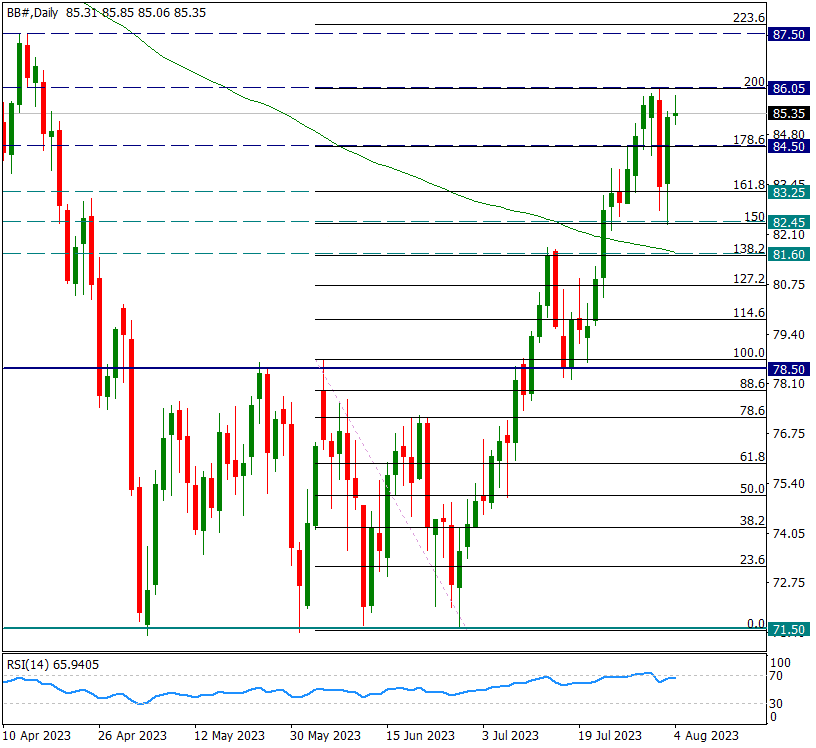

BRENT

BRENT – Near 86.05 Resistance After Weekday Fluctuation…

On the Brent side, it has followed a very volatile course in recent days. We followed a band movement from 86.05 to 82.45. Today, we are watching a pricing close to the 86.05 resistance towards the close of the week. In general, pricing above the 200-day average continued despite this fluctuation, and as long as it continues, positive movements may follow one after another. We will definitely pay attention to support and resistance as we rise again towards 86.05 resistance after a correction during the week.

In the possible continuation of the attacks, the rises above 86.05 may continue by gaining strength and may go towards the 90 levels. We think 86.05 should be broken to the upside with four-hour or daily closes for the attacks to gain strength.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.