*The negative outlook in Germany’s industrial production continued in June as well. Data decreased by -1.5% on a monthly basis, against the expectation of -0.5%, and decreased by -1.83% on a yearly basis.

*Fed’s Bowman reiterated in his statement that he expects additional rate hikes. He stated that he will look for evidence that inflation is on a consistent and meaningful downward path while making a decision, and that inflation is still well above the 2% target.

* In an interview with New York Fed President John Williams, he stated that it is possible to start a decrease in interest rates next year. In his evaluation of the September meeting, he stated that the data to come until the meeting will be followed and the right decision should be made by analyzing these data. Additionally, he said he expects the unemployment rate to rise above 4 percent next year.

*This week, global markets followed the July inflation data to be announced in the USA. Following the announcement of consumer inflation on Thursday, producer inflation data will be shared on Friday.

*The series of declines in house prices in the UK reached four months. According to the Halifax housing price index, the average housing price decreased by 0.3 percent on a monthly basis in July. On an annual basis, it decreased by 2.4 percent.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

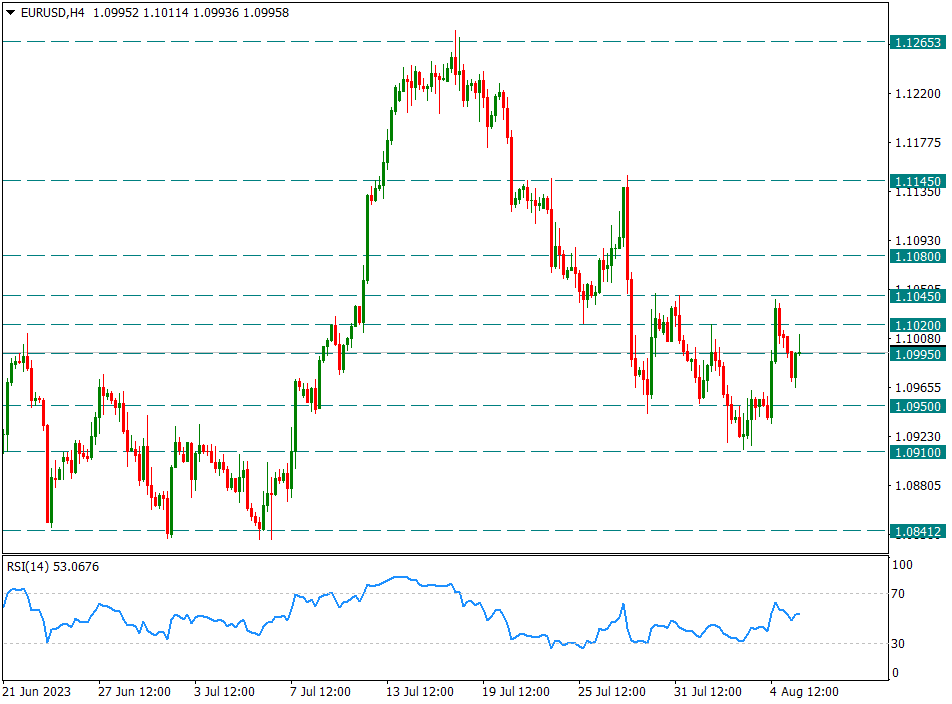

EURUSD

EURUSD – Takes Back Non-Farm Gains…

The pair retraced most of the post-US Non-Farm gain last Friday and is now generally priced in favor of the US Dollar. The first intraday support is at 1.0950. If this support is broken in the short term, we can expect the movements in favor of the dollar to continue by getting stronger.

Intraday resistance is at 1.1045.

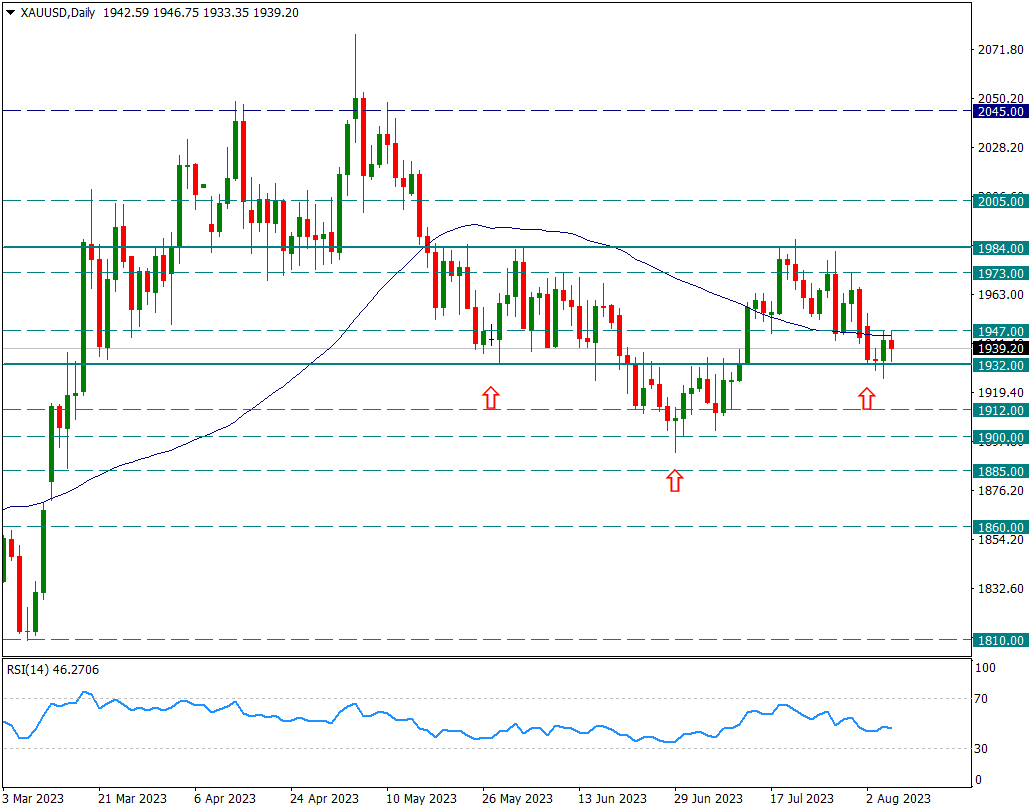

XAUUSD

Ounce Gold – Following the 1932 Support of the Inverted OBO Formation…

The yellow metal reacted from the 1932 support after the Non-Farm data last Friday, and this reaction was limited until 1947 support, where the 50-day average was above.

We’ve been talking about reverse shoulder head shoulder structuring here for a while. The shoulders of the formation coincide with the 1932 support. Therefore, daily closes below 1932 may cause the formation to be canceled and the selling wave to be strengthened.

On a daily basis, 1947 is the first resistance in the possible reactions, but the main resistance is at the 1984 level and if the mentioned formation 1984 is broken upwards, it will be triggered.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

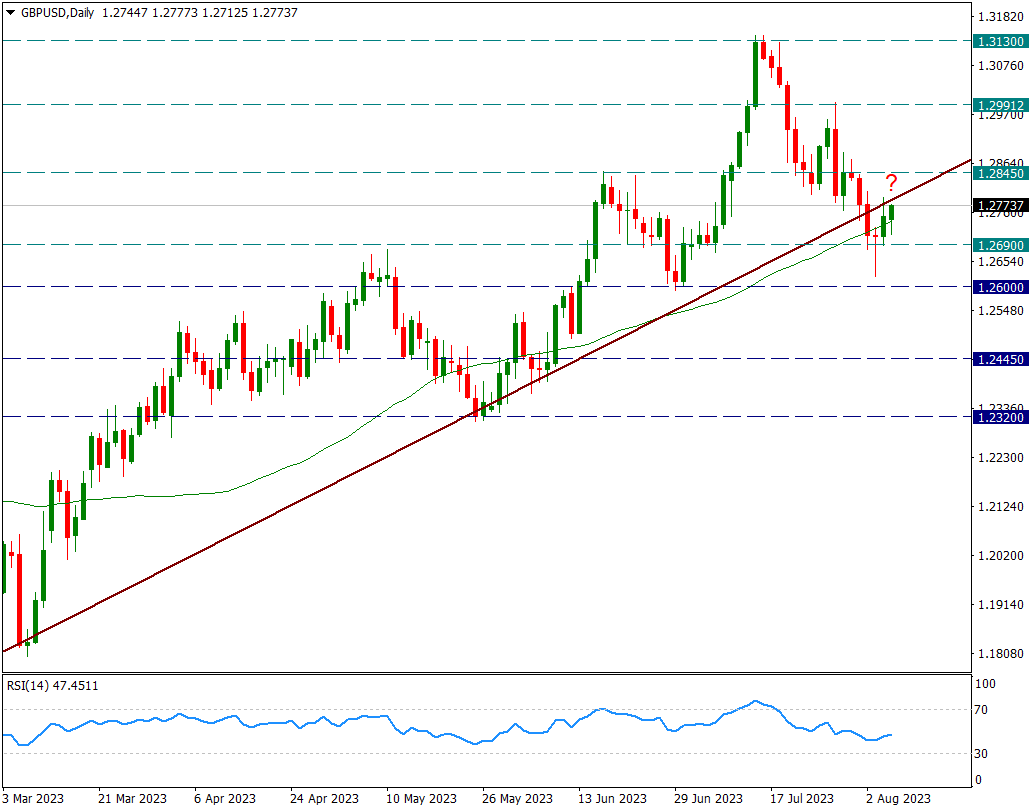

GBPUSD

GBPUSD – Pay attention to the resistance zone as it reacts to the trend it broke…

The pair hung up to 1.26 after the Bank of England decision last week. However, as can be seen from the chart, we saw reactions after the candle closed with the doji that day. Now, both last Friday and today, we see that there is a reaction again on the broken trend from 1.09. As long as this trend is not overcome, it is possible that the movements in favor of the Dollar will continue from where they left off. Technically, it is a common move to react after such important trends break, to contact and confirm the trend without exceeding it again, and to limit the movement here.

Therefore, unless there is a close above 1.2792, we can expect the movements in favor of the dollar to continue from where they left off.

In the continuation of the possible decline, the main intraday support is 1.2690.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.