*In the PMI data we tracked for the month of June, Germany’s services PMI declined from 57.2 to 54.1, the Eurozone services PMI dropped from 55.1 to 52.0, and the UK services PMI decreased from 55.2 to 53.7.

*In the Eurozone, the producer price index for May was reported at -1.9% compared to the expected -1.8%, and it was -1.5% compared to the same month of the previous year, slightly lower than the anticipated -1.3%.

*Nagel from the ECB stated, ‘Interest rates should be raised further as price stability is not achieved spontaneously.’

*Visco from the ECB commented, ‘I do not agree with the idea of excessive tightening instead of very little tightening. Controlling inflation does not solely rely on more interest rate hikes. The rate decision is made on a meeting-by-meeting basis depending on the incoming data.’

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

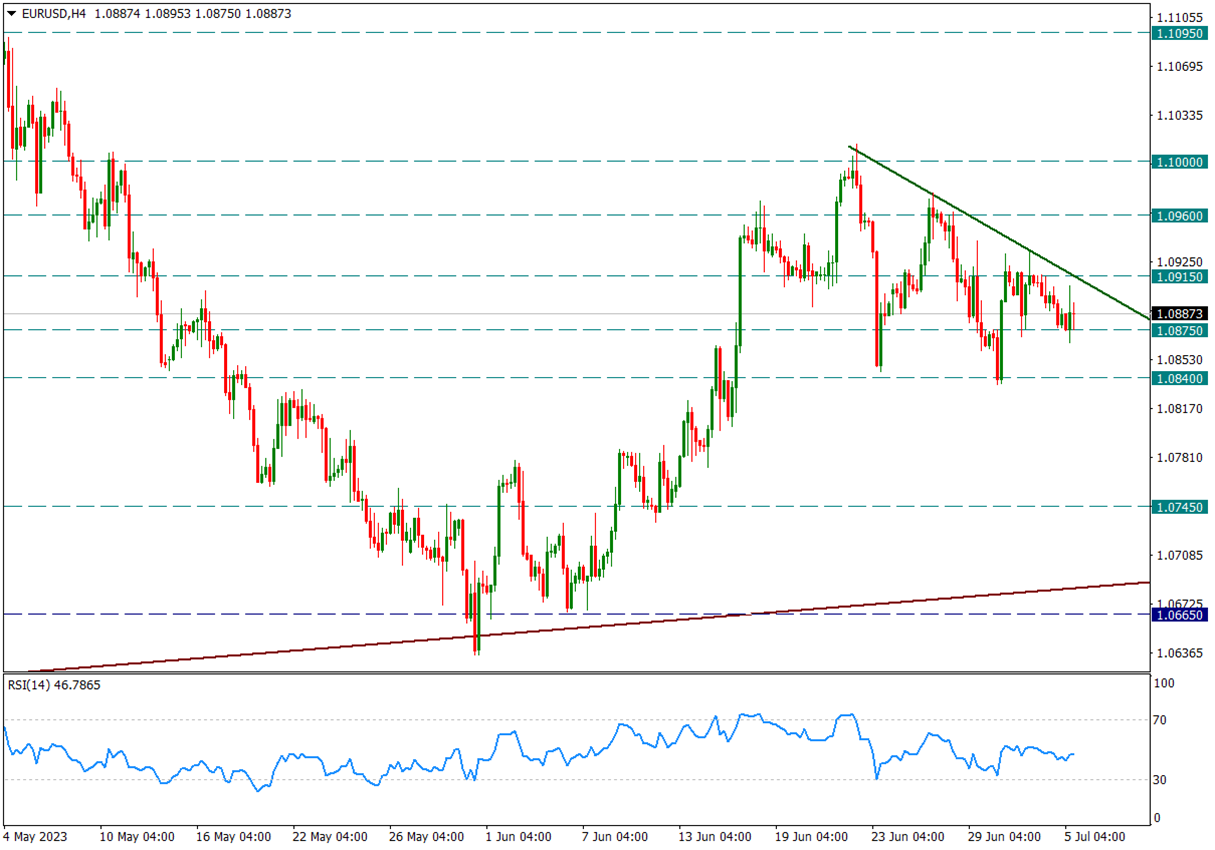

EURUSD

EURUSD – Trading Ranges are Narrowing in the Short Term…

With tightening price movements as the days go by, the currency pair is trading below the resistance level of 1.0915. Although 1.0875 level is considered as a support in intraday pullbacks, it serves as a temporary support. Our main support level in the short term is at 1.0840.

In case of possible upward reactions, we are observing the upper band of a narrowing triangle structure, which corresponds to the resistance level of 1.0915. This level is important in this regard. If it is breached, there is a possibility of a rebound towards 1.10.

Although we do not expect the June FOMC meeting minutes, which will be announced tonight, to create excessive volatility in the currency pair, we will still be monitoring it.

GBPUSD

GBPUSD – Continues to Cling at 1.2690 Interim Support…

Today, price movements have been stagnant, but the currency pair continues to sustain the rebound it initiated from the 1.26 support level and remains above the level of 1.2690. This level is significant as it aligns with the 13-day moving average. If sustainability is achieved above this level, it could lead us back to 1.2840.

If 1.2690 is breached, the first key support in potential profit-taking could be at 1.26. There is an uptrend line that has been in place for approximately 10 months, and a break of this trend line could strengthen the movements in favor of the dollar. In that case, we might see a decline towards 1.2320.

For now, in the short term, we will be monitoring the intermediate levels mentioned above.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

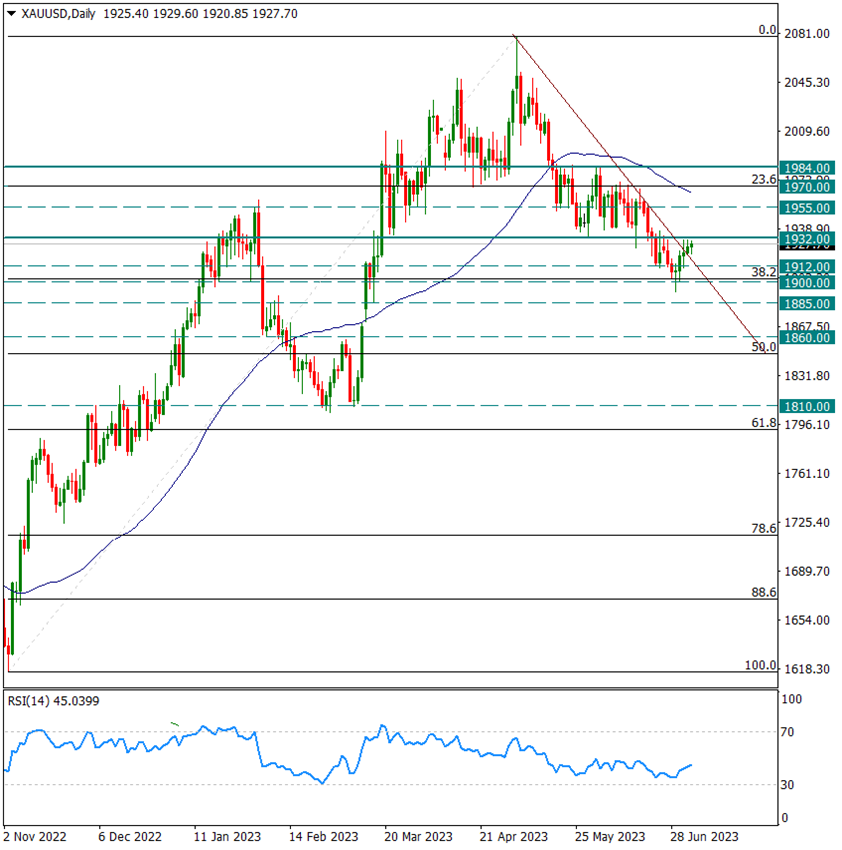

XAUUSD

Ounce Gold – Critical 1932 Level is Now a Resistance…

The currency pair is currently testing the previously mentioned and significant level of 1.932 through a reaction, and this level is acting as resistance. Despite being tested earlier this week, the level has not been breached as of the third trading day of the week, but it is still being tested. If this level is broken, we may see a movement towards the 50-day moving average. We will be monitoring this.

Below 1.932, although there have been intermittent attempts at a rebound during the day, a negative sentiment is still prevalent. A break below the support level of 1.900 can further strengthen this negative sentiment and sustain it.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.