*Swiss Central Bank (SNB) raised the interest rate by 25 basis points to 1.75%, as expected, at its meeting today. In the statement, it was stated that they did not ignore the possibility of additional interest rate hikes to ensure price stability, that the SNB was willing to be active in the foreign exchange market when necessary, and that its inflation forecast was revised from 2.6% to 2.2% this year. SNB Chairman Jordan, in his speech after the decision, said that the gradual approach to rate hikes is appropriate, they will look again in September, interest rates are their main instrument and foreign exchange market interventions complete this.

*Following the SNB, the Bank of England (BOE) also increased the interest rate at its meeting today. BOE raised the 4.50% interest rate by 50 basis points to 5.0%. The rate was expected to increase by 25 basis points. In his speech after the decision, BOE Chairman Bailey said that inflation is still very high and that if interest rates are not increased now, it could get worse later.

Agenda of the day;

17:00 (GMT +3) US Home Sales

17:00 (GMT +3) FED Chairman Powell’s Speech

18:00 (GMT +3) US Crude Oil Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

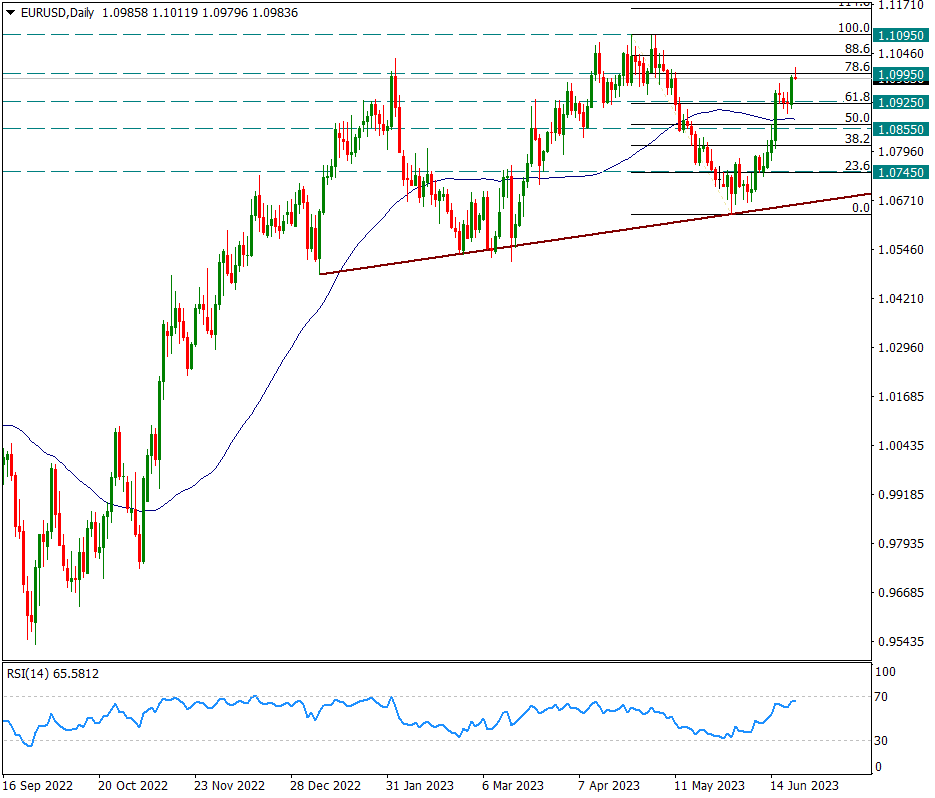

EURUSD

EURUSD – Challenges Above 1.0995…

While the pair strongly pushed the 1.0995 resistance yesterday, today it continues this trend, albeit slightly. Although there is an increase up to 1.1011 during the day, it continues to be priced just below the 1.0995 resistance with immediate profit sales. In general, our main intraday support is 1.0925, and as long as we stay above this level, we expect movements in favor of the Euro to sit above 1.10 step by step in the short term.

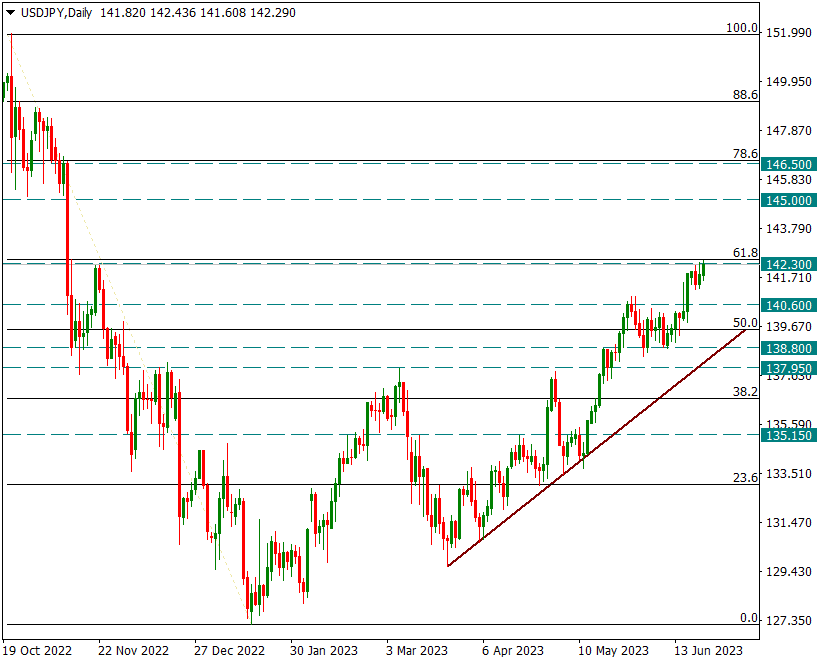

USDJPY

USDJPY – Struggles To Break 142.30 Resistance…

The Japanese yen is losing against the US dollar as the US 10-year bond yield maintains its upward trend. The critical resistance of 142.30, which was tested several times earlier in the week, is being tested again today. A possible daily candle close above this resistance may carry the move in favor of the current dollar to 146.50. Technically, we will follow this process.

In possible declines, intraday interim support is 141.20 and main support is 140.60.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

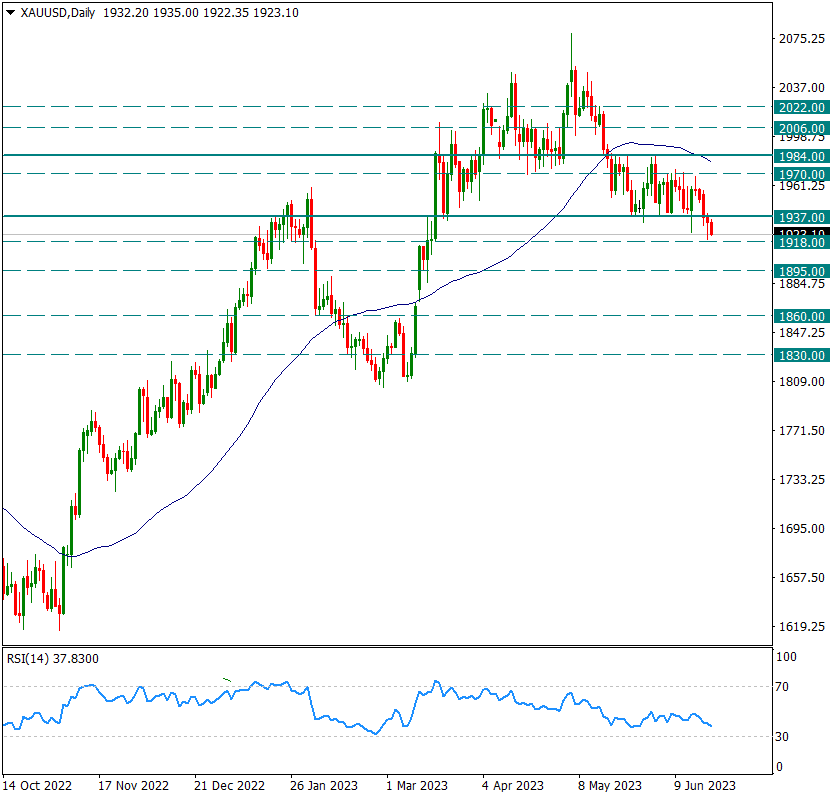

XAUUSD

Ounce Gold – Under 1937, Poor Image May Continue in the Short Term…

While the dollar index remains in a weak zone and attacks remain limited, the yellow metal side has been in a weakening trend since the day it broke its main weekly support in 1937.

It received a reaction from the support of 1918 yesterday, but today it is turning towards the support of 1918 again. The fact that the US 10-year bond yields are close to the 3.90% trend zone and there is no easing here seems to be suppressing the yellow metal. In addition, technically, as long as it stays below 1937, it can enter the 1800 region in the short term.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.