*In the UK, the Consumer Price Index (CPI) for May, announced today, exceeded the expectations and increased by 0.7% monthly and 8.7% annually. Data were expected to increase 0.5% and 8.4%. Core CPI also increased above expectations, increasing 0.8% and 7.1%, respectively. With the increase in inflation rates, the Bank of England (BOE) meeting to be held tomorrow has a 45% chance of increasing the interest rate by 50 basis points.

*European Central Bank (ECB) Member Kazimir said in his speech today that core inflation will need to be brought under control in order for monetary tightening to stop and it is not certain that monetary policy will tighten further in September.

*The text of Fed Chairman Powell’s presentation to the House of Representatives today has been published. In the published text, it is stated that the road is still long in the process of reducing inflation to 2%, it will be appropriate to increase the interest rates of almost all members until the end of the year, it will take time for the effects of monetary tightening on inflation to emerge, and decisions will continue to be made at each meeting based on incoming data.

Agenda of the day;

17:00 (GMT +3) FED Chairman Powell’s Speech

18:40 (GMT +3) FED/Goolsbee speech

23:00 (GMT +3) Speech by FOMC Member Mester

23:30 (GMT +3) US OPI Weekly Crude Oil Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

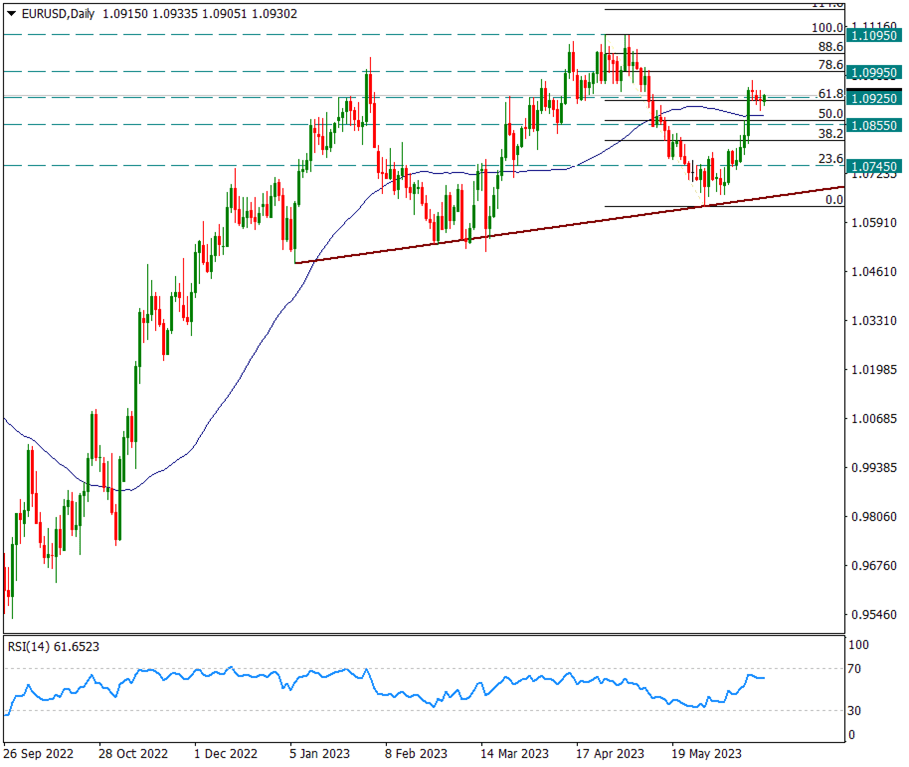

EURUSD

EURUSD – Continuing its Horizontal Course at 1.0925 Support, No Surprise From Powell…

The pair remained flat this week and remained in the 1.0925 support zone. It wasn’t much of a surprise that Fed Chairman Powell said in his presentation today, and he said the same thing he said on the night of the FOMC meeting.

While the pair continues to stay at the 1.0925 line, it also supports the 50-day average prices at the bottom. As long as this line is not broken, it may be premature to expect pricing to turn in favor of the dollar.

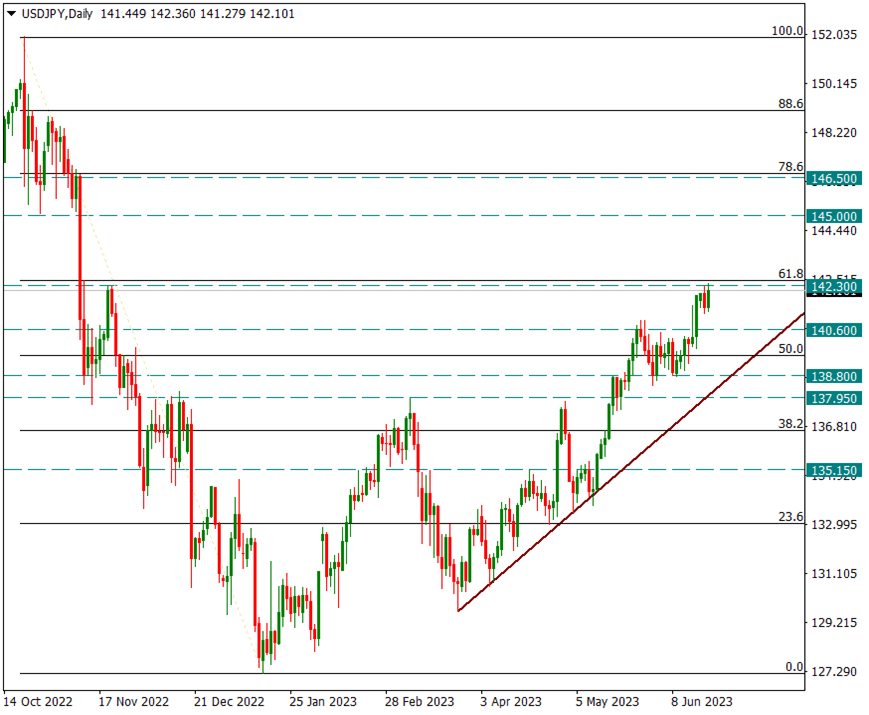

USDJPY

USDJPY – 142.30 Resistance is being tested again…

With the US 10-year bond yield starting an upward trend again today and approaching the downtrend from 4.33%, this situation causes the pressure on the Japanese Yen side to continue.

Today 142.30 resistance is being tested again. We remind you that this region coincides with the Fibonacci 61.8 correction, as we have mentioned in our previous reports and you can see in the chart. When this region is exceeded with the daily candle, the level of 146.50 will come to our agenda.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

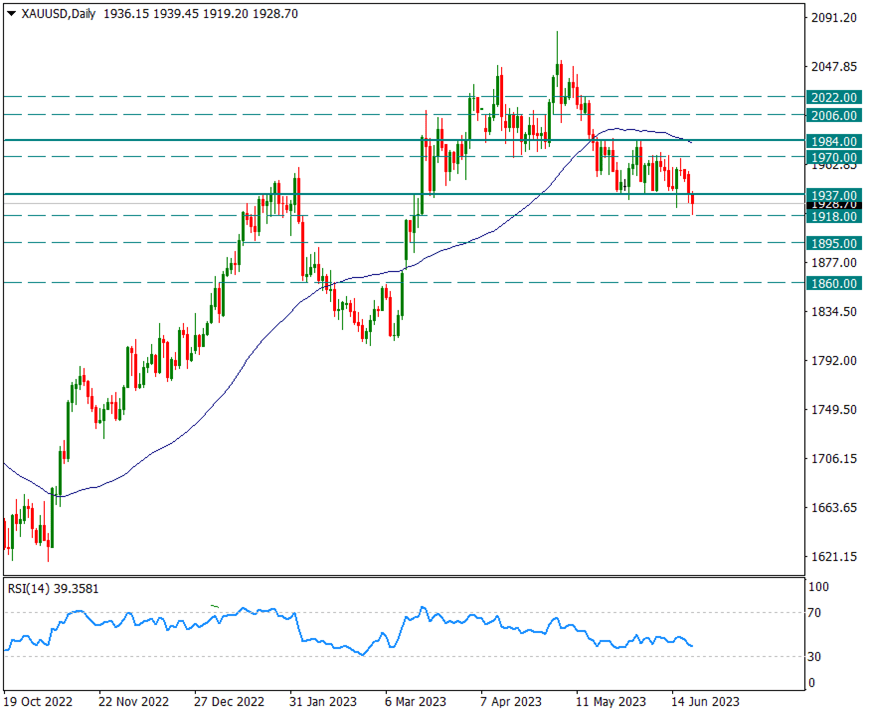

XAUUSD

Ounce Gold – 1937 Support Line Broken, Loosen Until 1918…

It sagged below the 1937 support the other day and its closure was just below this support. The negative trend continued today and after the Fed chairman Powell’s statement, there was a serious decline and sagging until 1918.

Below 1937, the yellow metal can be predicted to have a strong downtrend. We will follow this.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.