*European Central Bank (ECB) Member Panetta said in his speech today that they have to act very quickly in raising interest rates and curb spending without adversely affecting their economic efficiency. Another ECB Member, Vasle, said the population remains high and persistent and further rate hikes are needed to reach the 2% residence target.

*Swiss Central Bank (SNB) Vice-President said in his speech today that they are seeing signs that the boom is expanding in other areas beyond the energy and supply bottleneck, they cannot ignore further quantitative easing to ensure pricing while continuing to actively prepare favorable monetary environments to propagate.

*In the USA, 339 thousand people were shown, which is far above the expectations in the Non-Farm Employment 180 thousand region for the month of May that we are watching today. Unemployment Rate, which was 3.4%, also rose to 3.7%. Apart from this rate, Average Hourly Earnings showed 0.3% monthly and 4.4% annually.

Agenda of the day;

20:00 USA Weekly Number of Oil Drilling Rigs

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Stable Despite US Non-Farm…

The US Agriculture Foreign Employment Report came in somewhat mixed. The employment change came in at over 300,000 and well above expectations, with the Unemployment Rate rising to 3.7% and a decline on the Hourly Earnings side. Therefore, despite mixed data and a 300,000+ employment change in the market, the EURUSD parity did not move in favor of the dollar. There was an indecision on that side as well.

The parity, which came to the 1.0775 resistance as of yesterday, is priced right near the same resistance today. In general, movements above 1.0715 in hourly movements during the day are positive for the pair, while movements in favor of the Euro can gain some more space if a daily candle closes above 1.0775. We will follow the movements in the 1.0775 – 1.0715 region in daily movements.

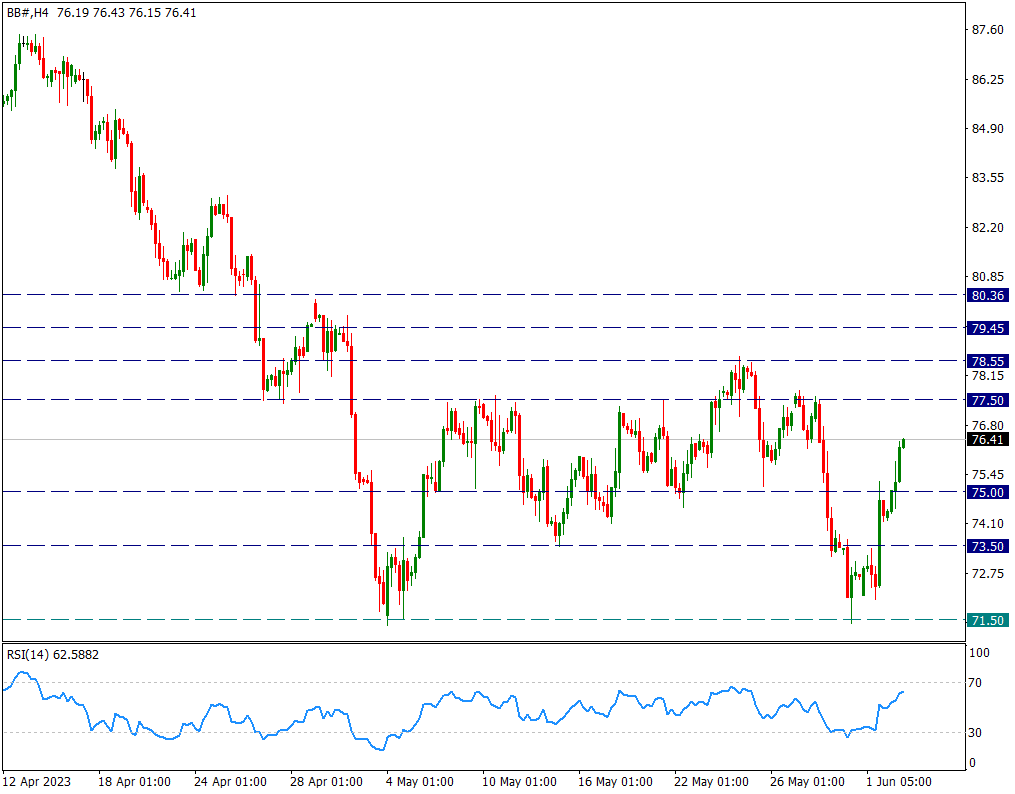

BRENT

BRENT – Attacks Triggered from the Bottom of 71.50 Continue…

Attacks from the bottom of 71.50 soon pushed the price above the 75.70 resistance and today the 76.30 level is seen. In the continuation of the attacks, the 78.55 resistance seen in May will be followed as the main resistance in the short term.

Below is 71.50 main support. Therefore, together with the intermediate zones, we can watch the 78.55 to 71.50 range as a horizontal zone for the short term.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

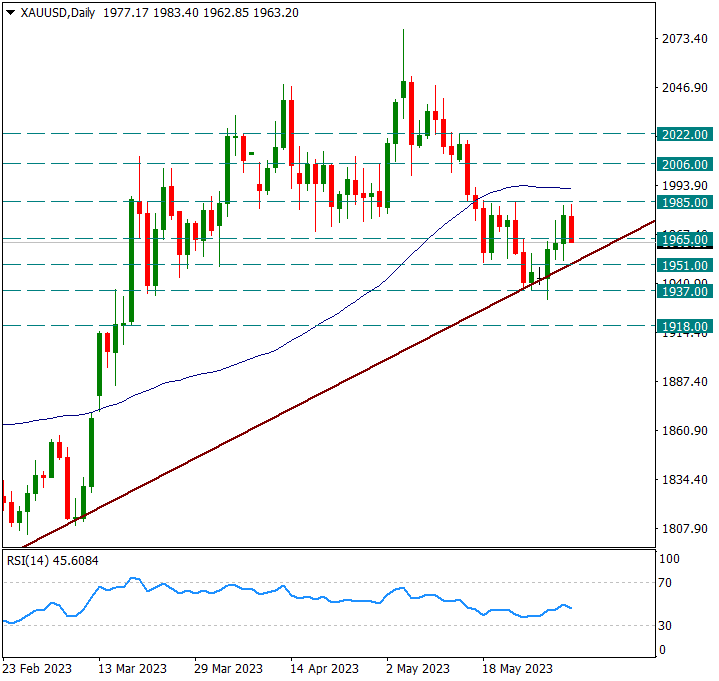

XAUUSD

Ounce Gold – Profit Sale from 1985 and Important Short Term Technical Details…

The yellow metal paused the recent positive movements on the last trading day of the week and regressed back to 1965 support with profit selling in the 1988 (or 50-day average) region.

Just near this zone, the uptrend line from 1616 is at the main support position. Therefore, if the declines continue, this region is very important for the uptrend. This trend currently coincides with the 1951 support.

At the same time, there is a reverse shoulder head shoulder formation structure with shoulders in 1951 and head area in 1937. For this reason, we can understand the importance of 1951, which coincides with the trend line, from here. If it is broken, the pattern may be canceled and the uptrend may come to an end.

In possible reactions, we will check the 1985 resistance, which is the neck region. Exceeding 1985 may bring over 2000 to the agenda again.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.