*Durable Goods Orders in the US came in at 0.3% in March versus negative expectations of -0.2%. The data was announced as -0.3% last month. Core Durable Goods Orders came in at 3.2%, above the 0.7% expectation. The data was announced as -1.2% last month.

* In the USA, the Merchandise Trade Balance posted a deficit of -84.6 billion dollars in March, against the expectations of -89 billion dollars. Last month, the Goods Trade Balance had a deficit of -91.99 billion dollars.

*The fact that deposit outflows approached $100 billion in the first quarter balance sheet published yesterday by First Republic Bank, one of the leading concerns in the banking sector, brought along concerns. The bank’s shares fell nearly 50 percent.

* The Central Bank of Sweden increased the interest rates to 3.50 percent with an increase of 50 basis points.

*European Central Bank member Boris Vujcic stated that interest rate hikes should be continued due to the continuing inflationary pressure and core inflation remaining stubbornly high.

*Germany GFK Consumer Confidence Index decreased from -29.3 to -25.7 and was more positive than the expectation of -27.9.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

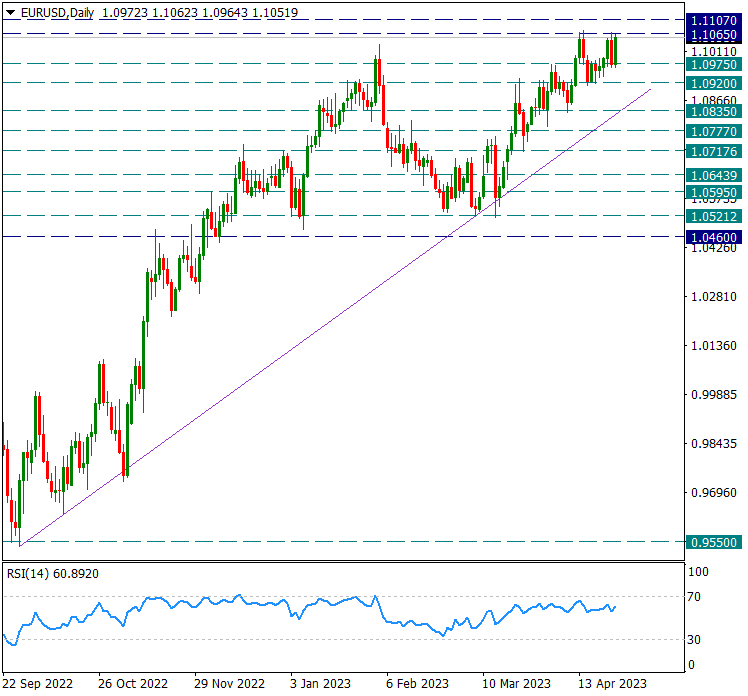

EUR/USD

EURUSD – 1.1065 Resistance Continues to be Tested Frequently…

The pair remains priced at the 1.1065 resistance line. Tested 1.1065 resistance again today. However, it is not yet passed. Therefore, 1.1065 is very important as intraday resistance above. Since this resistance has been tested many times, we can get a technical confirmation that the movements in favor of the Euro may continue, only if there is a daily candle close on it. We will follow this carefully.

In case of possible declines, intraday support is 1.0975.

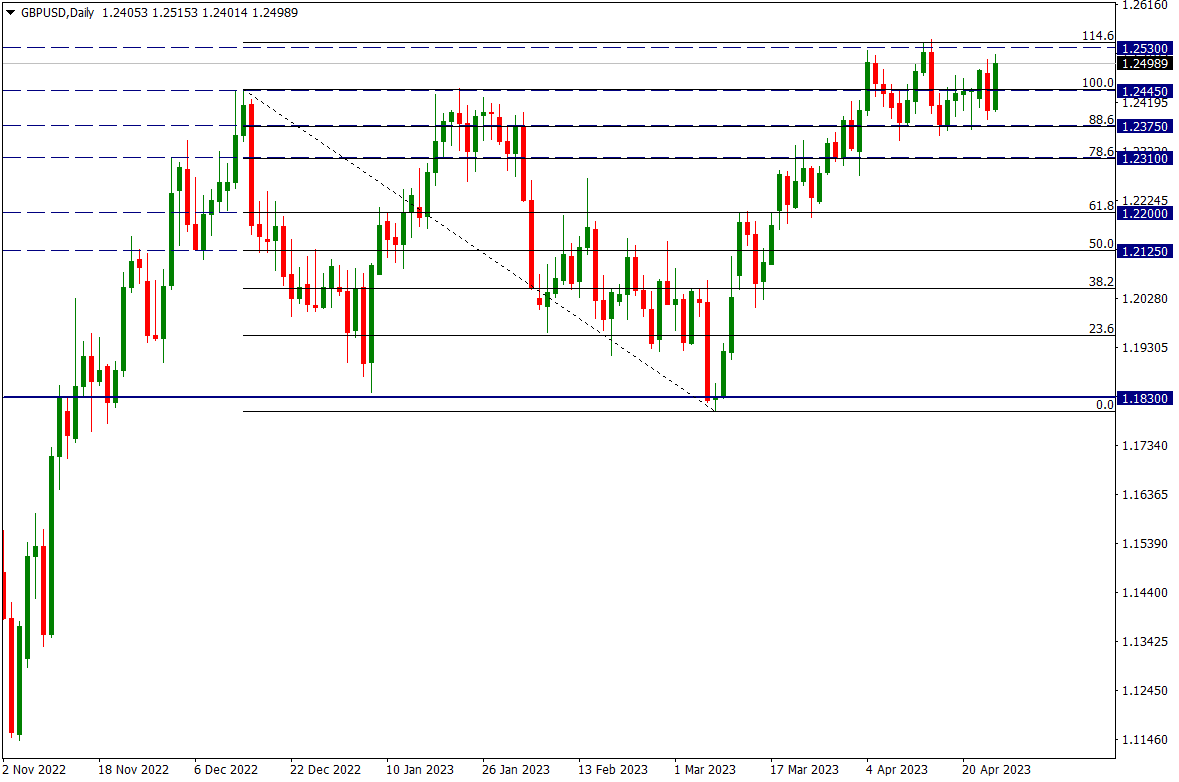

GBPUSD

GBPUSD – Reacts to 1.2530…

The Sterling/Dollar parity once again approached its recent peak of 1.2530 and rose as high as 1.2515 during the day. It was between 1.2530/1.1375 in the jam that has been experienced for about 3 weeks. In the attacks that occur, if the 1.2530 daily candle is broken upwards, it may be possible to continue the movements in favor of sterling by gaining strength.

In possible declines, 1.2445 is the intermediate support and 1.2375 is the main support.

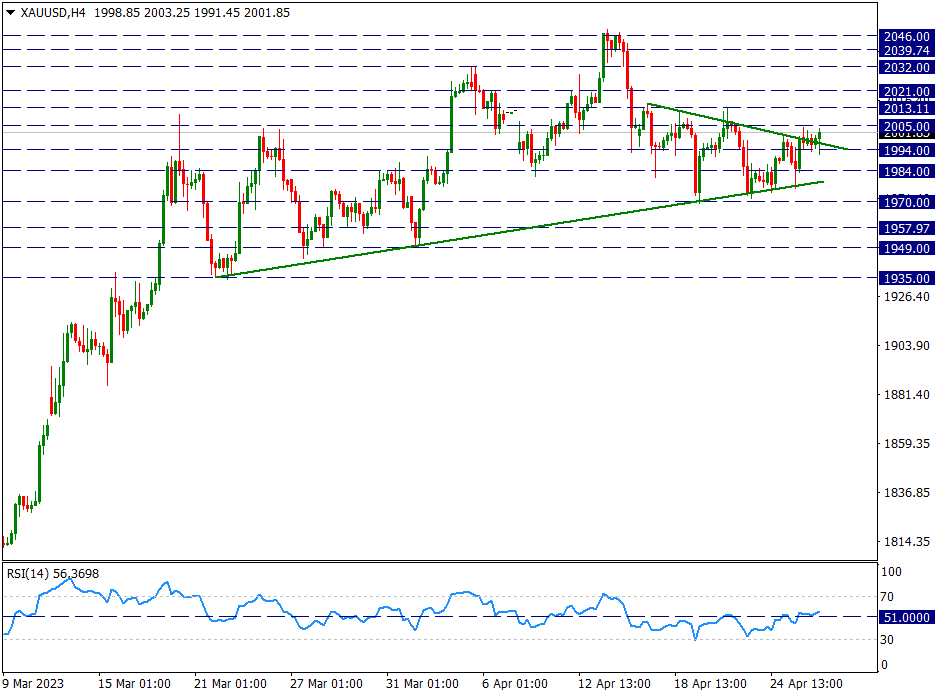

XAU/USD

Ounce Gold – Strives to Pricing in the 2000 Region…

Since the movements on the ounce gold side are limited at this time, we control the four-hour chart. The yellow metal, which has reduced its negative trends recently due to the depreciation of the dollar index, is close to the 2005 level as the intermediate resistance we attach importance to during the day. Below, the 1994 level also stops the negative trends as an intermediate support. Intraday breakout zones are 2005 resistance and 1994 support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.