- US stock indices started the session slightly positive on the calm day on the global side. US futures were positive throughout the day. US 10-year bond yield is 3.70% and 2-year yield is 4.55%.

- FED member Bowman, in his statement during the day, stated that the labor market is still very strong and they do not see inflation as moderate as they would like. Stating that he expects the rate hikes to continue, he explained that there is more data between today and the next FOMC meeting and that they will continue to stick to the data.

- On the occasion of these statements, we would like to remind you that the US consumer inflation rates will be announced tomorrow at 16.30 (GMT+3).

- According to TURKSTAT data, retail sales increased by 4.8% in December. There was a 1.2% monthly increase in the previous data. The data for the same period of the previous year, on the other hand, increased by 21.8%. The annual change had increased by 11.8% in the previous month.

- According to the data announced by the CBRT today, the current account balance had a deficit of 5.91 billion dollars in December 2022. It reached the highest level of the last 9 years with a current account deficit of 48.76 billion dollars in 2022 on an annual basis.

- The EU Commission revised down its inflation expectations for the Euro Area. It lowered its expectations for 2023 from 6.1 percent to 5.6 percent, and from 2.6 percent to 2.5 percent for 2024.

- CPI data in Switzerland came in above expectations. It rose 0.6% for January versus expectations of 0.4%. Compared to the same period of the previous year, it increased by 3.3%. The annual expectation was for an increase of 2.9%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

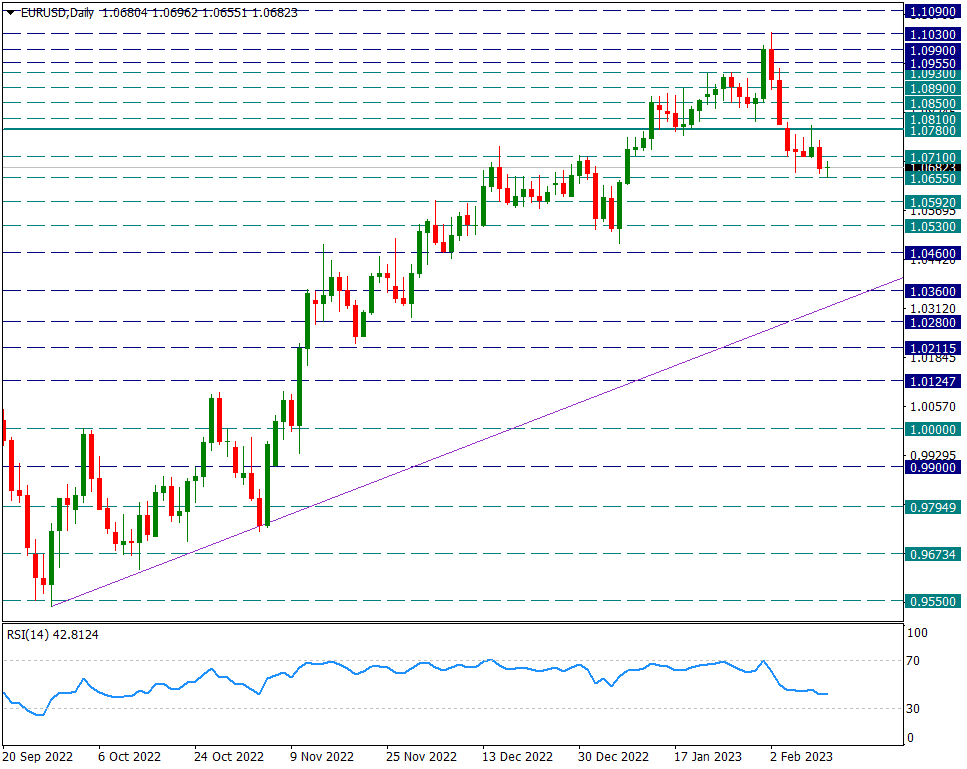

EUR/USD

EUR/USD – Below 1.0710 and Narrowband Image Dominates…

The pair started the new week below the 1.0710 level. The parity, which moves in a very narrow band during the day, is trying to find support at the 1.0655 level. In general, as long as it stays below 1.0780 in the short term, it is possible to feel the movements in favor of the dollar. We will watch 1.0710 as resistance in the short time interval during the day in possible attacks. A move above 1.0710 could make 1.0780 a target.

However, 1.0780 is an important resistance within a few days of movement.

XAU/USD

XAU/USD – Negative Trend Continues, But Beware of Possibility of Positive Dissonance…

The yellow metal extended its decline to 1852 support after running the inverted flag image it created last week. Just above here, the 1865 resistance was tested but not surpassed and the overall downtrend continues. Due to the reverse flag formation length, if the resistance of 1865 is not exceeded, it is possible for the declines to deepen. There is a point here that should not be overlooked. It is the positive divergence in the RSI indicator on the four-hour chart. However, we can wait for the RSI to surpass its 50 level for this dissonance to be triggered strongly.

So, for possible strong reactions, we need to confirm 1865 and RSI to exceed their 50 level.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

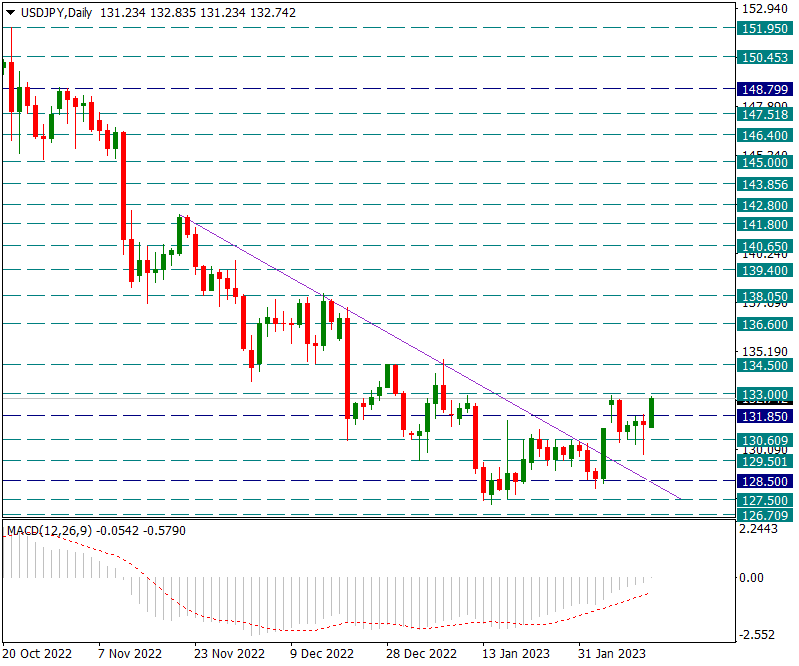

USD/JPY

USD/JPY – Where It Tested Last Monday…

The gradual rise in US 2-year and 10-year bond yields continues to put pressure on the Japanese Yen. The pair came back to the level of 133.00, where it made contact with the gap last week, with a slight attack today. Exceeding 133.00 can show us the rises. For this, 134.50 and 138.05 levels may come to the fore.

133.00 is important because it worked as a resistance last week, and we will follow the 130.60 level as support in new sales that may come from here.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

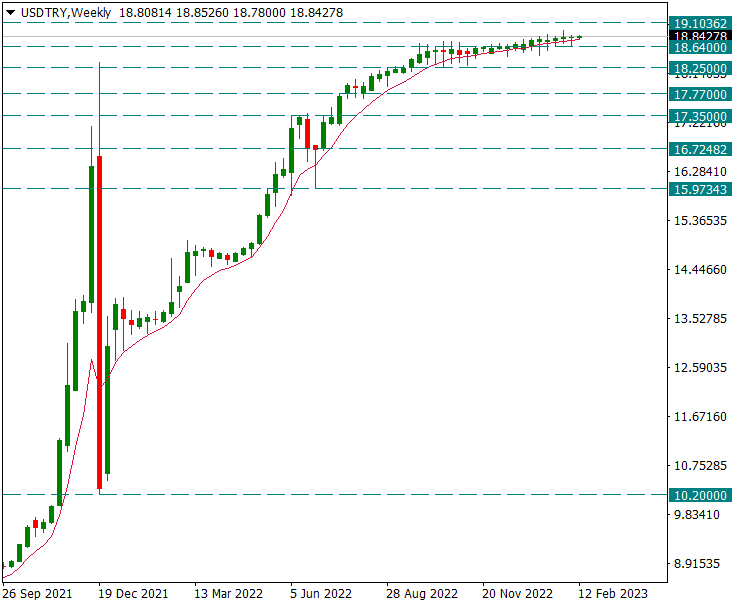

USD/TRY

USD/TRY – No Change in Weekly Image…

Let’s take a look at the USD/TRY side with the weekly chart. We continue to follow the current trend here with the 8-week average. There was no weekly candle closing below this average, and until this happens, we maintain our expectation that the current trend technically will continue in the pair.

Contact Us

Please, fill the form to get an assistance.