- According to the results of the survey announced by the European Central Bank (ECB), consumer inflation expectations for the next 12 months increased from 5.0% to 5.1%, economic growth expectations decreased from -1.7% to -2.4% and Unemployment Rate expectation % It went from 11.9 to 12.2%.

- According to the unofficial results of the midterm elections held in the USA yesterday, the Republicans seem to be leading in the House of Representatives. According to these results, the Republicans have won 193 seats and the Democrats 166 seats in the House of Representatives. There are a total of 435 seats in the House of Representatives. In the Senate, Democrats have won 12 seats and Republicans have won 19 seats. There are 105 seats in total in the Senate, and 35 of these seats are elected. Before this election, Republicans had 50 seats and Democrats 48 seats in the Senate. 2 chairs were independent. To get a majority in the Senate, 51 seats must be won. The current President of the USA, Biden, was elected from the Democratic Party in 2020 and won the Presidency. If the Democrats lose the House of Representatives in this election, volatility in the market may increase with expectations that Biden may not be able to implement his political and economic policies.

Data to be Disclosed;

18:30 (GMT+3) US Crude Oil Stocks

19:00 (GMt+3) FOMC Member Barkin’s Speech

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

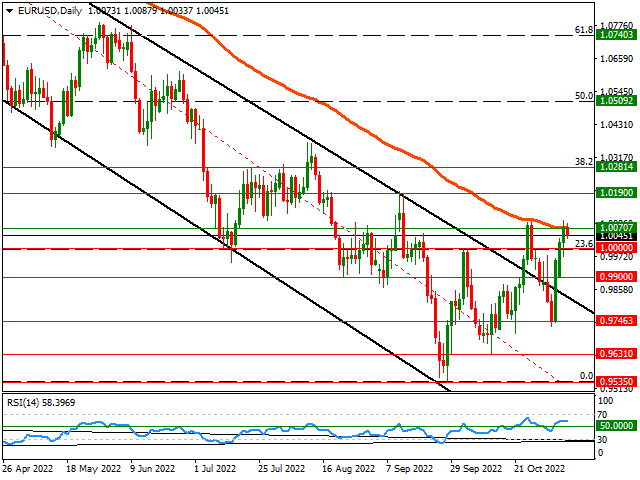

EUR/USD

EUR/USD – Faced Resistance at 100-Day Average…

The US Dollar is trying to stabilize as we await the clarity of the US midterm election results. The results from the midterm elections so far have revealed a result where the Democrats won the Senate and the Republicans won the majority in the House of Representatives. After a three-day bullish rally, the EURUSD pair faced selling off from its 100-day exponential moving average, but for now, we can say that this relaxation is limited. 1.000 and 0.9900 levels can be followed below as the first support zones in the pair. If the 1.0070 band, which corresponds to the 100-day exponential average, is exceeded and managed to hold above, 1.0190 and 1.0281 technical levels may come to the fore.

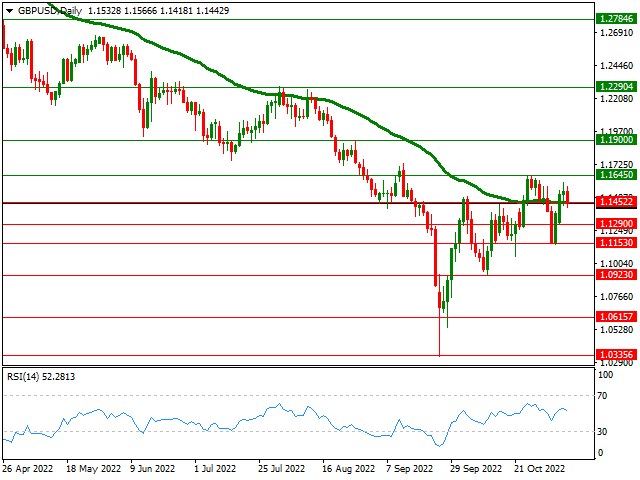

GBP/USD

GBP/USD – The Pair Retraces Yesterday’s Gains, Withdrawn To Its 55-Day Average…

The GBPUSD pair declined below 1.1500 in the European session, extending its daily decline below 1.1450. Before the critical US inflation data to be announced tomorrow, global markets are waiting for the US Midterm Election results to become clear, while the US Dollar is trying to recover its strength. 1.1290 and 1.1153 levels can be followed as the next support zones if GBPUSD parity, which regresses to its 55-day average limit and gives back yesterday’s gains, breaks below the average. In possible upward trends, the 1.1645 level will continue to be followed as the first resistance zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

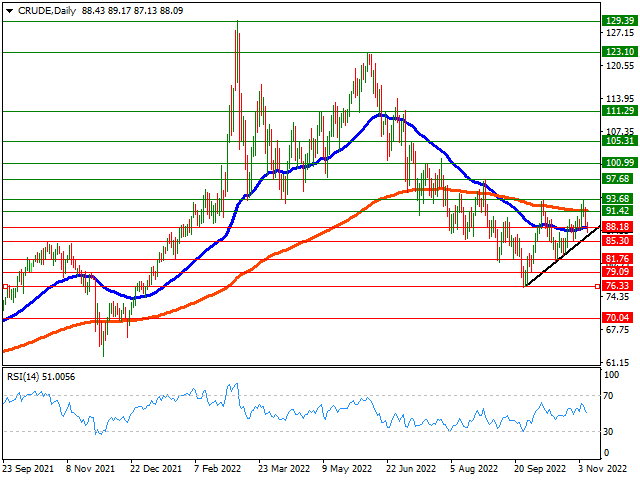

CRUDE

CRUDE – Trying to Find Balance in the 50-Day Average Region…

Crude Oil, which showed a trend towards the $93 region above its 200-day exponential moving average at the beginning of the week, but failed to break through, fell back below its 200-day average on Tuesday as sales gained momentum. While global markets are waiting for the US by-election results to be clarified, eyes on crude oil will be on US crude oil stocks, which will be announced in the evening. Crude Oil, which has a selling trend and regressed below the 50-day average of $88, stands out as the next support zones at $85 and $81.

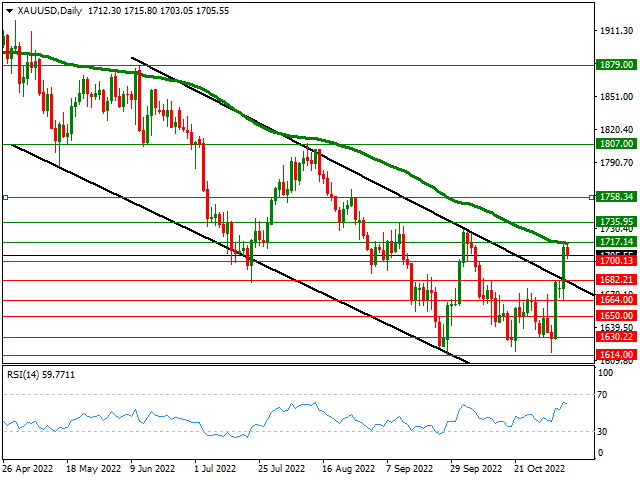

XAU/USD

XAU/USD – Uptrend Rally Loses Momentum as US 10-Year Bond Yield Rebounds…

Ounce Gold, after 2% upward rally on Tuesday, lost its upward momentum today and regressed to the 1.700 band on Wednesday. The 10-year US bond interest finding support in the 4.10% band and recovering to 4.16% seems to have caused the Ounce Gold to lose its upward momentum. From a technical point of view, the Precious metal testing its 100-day exponential moving average has seen sales from this region. Developing sales are limited to the 1700 band for now, but if the yellow metal falls below this region, 1680 and 1664 levels can be followed as the next support zones.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.