- In the Eurozone and Germany, the largest economic power in the region, the leading S&P Global Manufacturing and services PMI surveys in October indicated that the situation in both sectors worsened and the contraction deepened.

-Manufacturing Purchasing Managers Index (PMI) (Annex) Announced:46.6 Expected:47.8 Previous:48.4

-Services Purchasing Managers Index (PMI) (Annex) Announced:48.2 Expected:48.2 Previous:48.8

-Germany Manufacturing Purchasing Managers Index (PMI) (Annex) Announced:45.7 Expected:47.0 Previous:47.8

-German Service Purchasing Managers Index (PMI) (Annex) Announced:44.9 Expected:44.7 Previous:45.0

- In the comments made by S&P Global, there were statements that the Eurozone economy seems ready to contract in the fourth quarter, given the steeper production loss and worsening demand picture in October. Following the worse-than-expected numbers, the EURUSD parity fell to the level of 0.9806.

- Natural gas price is declining in Europe. The seasonal temperatures and the high stock level in many European countries, especially in Germany, are effective in the decrease in natural gas prices. Today, the gas price for November delivery in the Netherlands TTF decreased by 14.7 percent to 98 Euro/MWh. Thus, the price of natural gas in Europe fell below 100 Euros for the first time since June. In the Netherlands TTF, the gas price for December delivery decreased by 8.28 percent to 132.90 Euro/MWh.

- Manufacturing and Services PMI in the UK, where political turmoil has not subsided, came in worse than expected, pointing to a deepening contraction in both sectors. Over the weekend, the GBPUSD parity started the week with a gap up after Boris Johnson announced that he was withdrawing from the Conservative Party leadership race, but after the data, the pair dropped to the 1.1273 band. Rishi Sunak will become Britain’s new prime minister, with Johnson withdrawing from the race and Mordaunt failing to gather the 100 signatures necessary to lead the Conservative Party and run for prime minister.

- The estimated size of Japan’s intervention in the foreign exchange market by buying Yen on Friday, October 21st is estimated at 5.4-5.5 trillion Yen ($36 billion). Although the USDJPY parity decreased to the 145 band today, it recovered to the 149 region with subsequent purchases.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

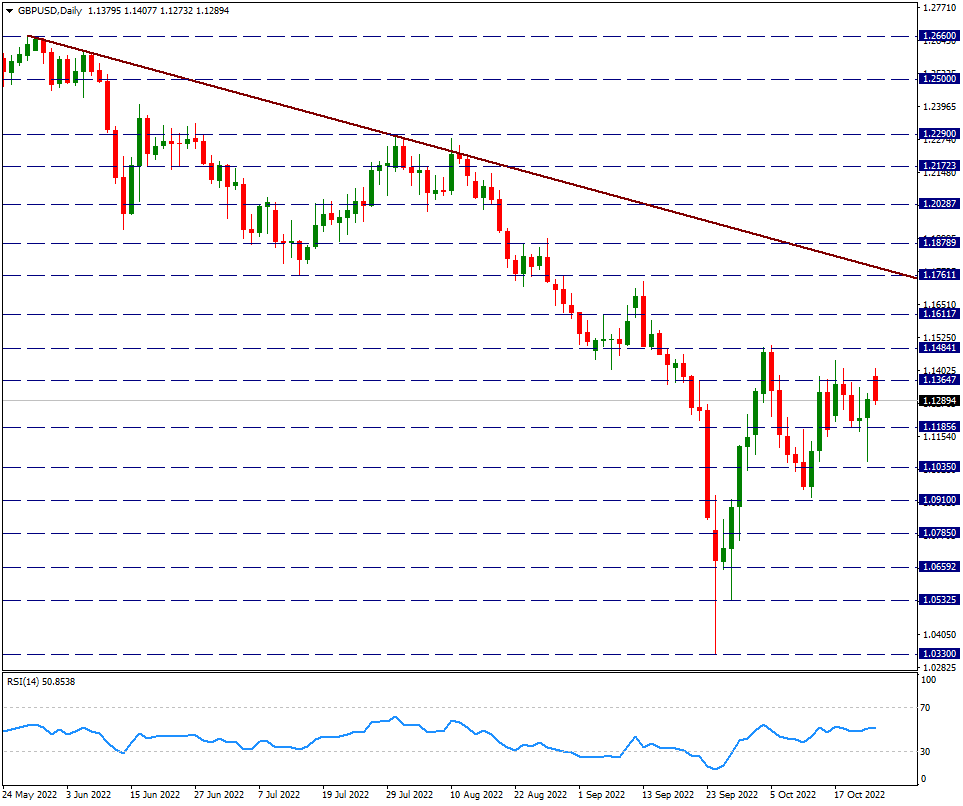

GBP/USD

GBP/USD – Gave Back Gains in Asian Session…

GBPUSD, which left behind an active Friday after the resignation of the Prime Minister, started the new week with a slight upward gap and gave back its gains during the day. Overall we will still follow the 1.1485 resistance above and this will be the first condition for a possible GBP move. Above, we will follow the downtrend line from 1.26 as the next level.

CRUDE

CRUDE – Pulling Back From 86.10 Resistance…

Crude oil prices failed to pass the 86.10 resistance and encountered some selling in the new week and approached the 81.50 support. At this point, we can see 86.10 as important for the first phase of the positive zone. Besides, the 89-day average will be even more important for a possible strong uptrend. For this reason, we will watch the 86.10 resistance in the first place during the day. In case of possible breaks, attention should be paid to the 81.50 support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

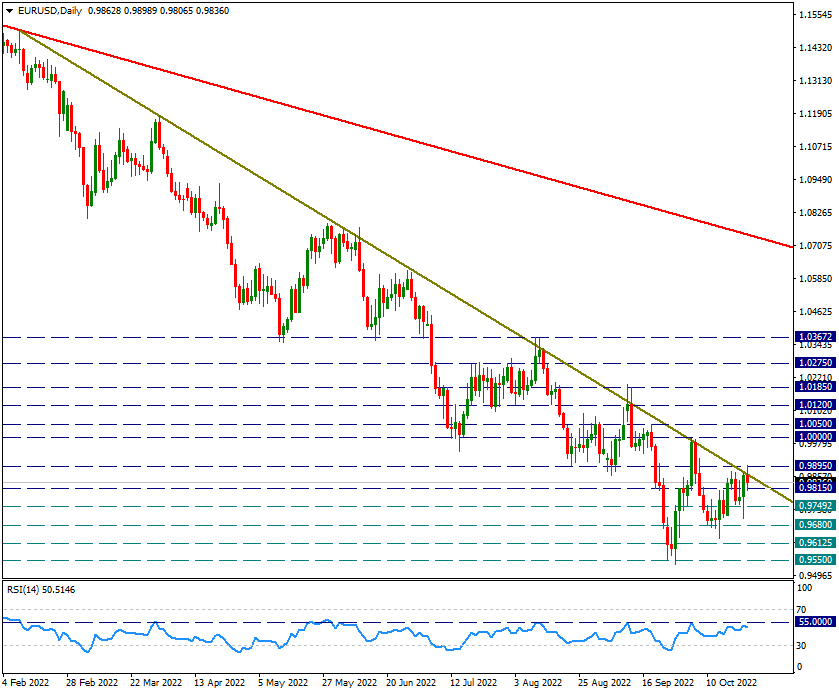

EUR/USD

EUR/USD – Should Pay Attention to 0.9895 Resistance…

After touching 0.9895 resistance today, the pair pulled back slightly and is priced above 0.9815 support. However, the downtrend line from 1.15 was also started to be tested again. Daily candle closings that may be above 0.9895 may cause the parity to move in favor of the Euro for a while.

For this reason, we will follow the movements in the 0.9895 region for the near future.

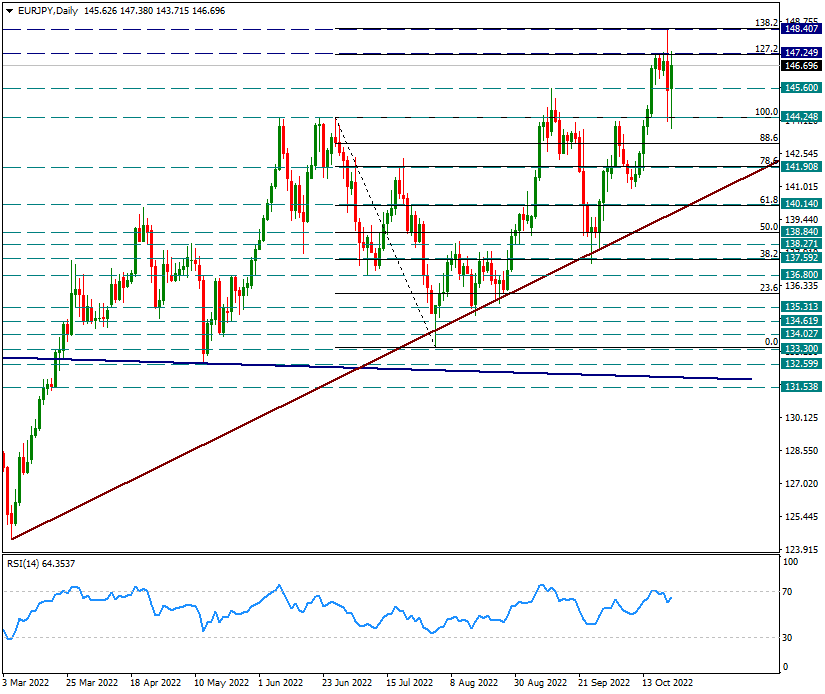

EUR/JPY

EUR/JPY – Last Friday’s Sharp Fall Is Massively Retracted…

With the intervention of Japan last Friday, the EURJPY pair fell sharply from the 148.40 resistance. However, as of today, we see that more than half of the decreases have been reversed. The 147.25 resistance, which was frequently tested last week, is now being tested again. It touched the 148.40 resistance last week, while the daily close remained below 147.25. The continuation of the possible rises can be triggered by the daily closing above 147.25 technically.

In possible decreases, we will be watching the 145.60 and 144.25 supports gradually.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.