*In the Euro Area, CPI for August, announced today, increased by 0.6% month on month and 5.3% year on year. The previous data came at the level of -0.1% and 5.3%, respectively. In the minutes of the meeting of the European Central Bank (ECB) in July, it was stated that a new interest rate hike in September may be necessary if there is no evidence that monetary tightening is strong enough to reduce headline inflation to the 2% target.

*In the US, Core PCE for July, which we follow today, came in as expected, increasing 0.2% month on month and 4.2% year on year. The previous data showed an increase of 0.2% monthly and 4.1% annually. Headline PCE also came in as expected, rising 0.2% and 3.3%, respectively.

This data points out that the inflation trends in the USA are still on an upward trend and strengthens the possibility of the FED’s interest rate hike and keeping the interest rates high for a long time.

The US Non-Farm data, which will be released tomorrow, will be quite significant given the recent low of JOLT’s Jobs data released on Tuesday.

Agenda of the day;

19:00 Speech by ECB Member de Guindos

23:30 FED Balance Sheet

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

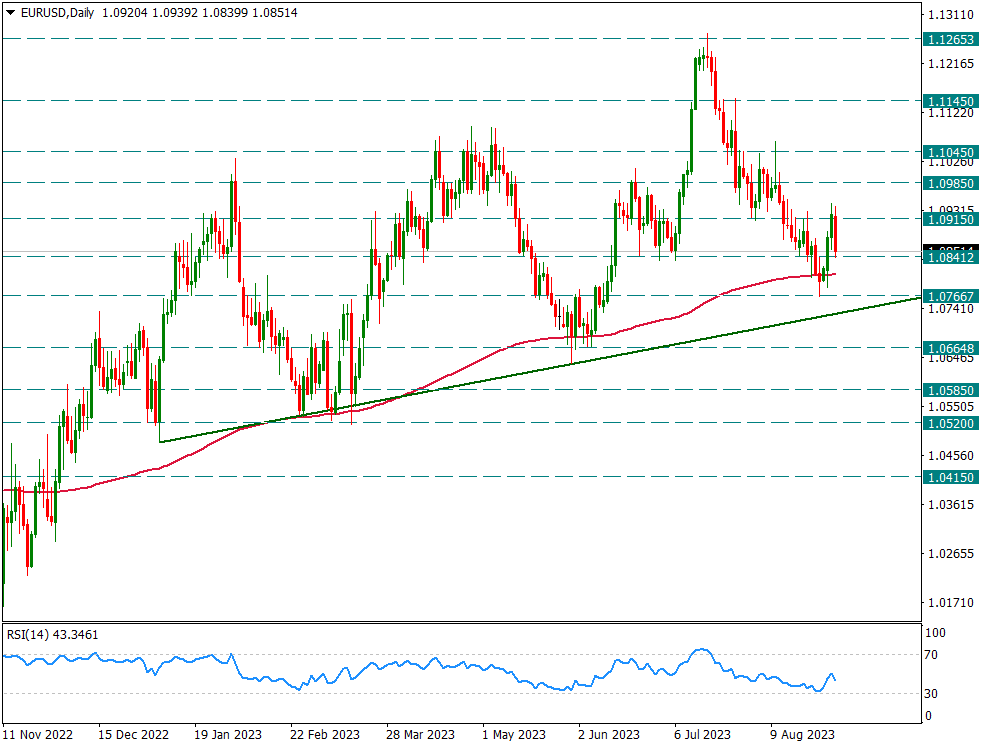

EURUSD

EURUSD – US Inflation Still Strong And Pair Heads Back To The 200-Day…

Last Tuesday, the US JOLT’s job opportunities data came in at the lowest level of the last period, bringing a rapid depreciation in the dollar index. With this depreciation, the pair received a reaction from the 200-day average and rose to the 1.0915 region. Today, at 15.30, PCE Price Index data came from the USA. Core data was 0.2% monthly and 4.2% annually. The increase in the core PCE price index on an annual basis after a long period caused a reversal in the dollar index. Although the mixed data may also confuse the market, the reality is that inflation pressures continue in the US and the Fed’s interest rate hike in September is likely to occur.

The pair is again priced to the downside in favor of the dollar, and it is pulling back towards the 200-day average. A break of this average on the downside may strongly increase the outlook in favor of the dollar in the parity, and 1.0665 and then 1.0520 levels may come to the fore.

In possible reactions, 1.0915 level will be followed again in the short term.

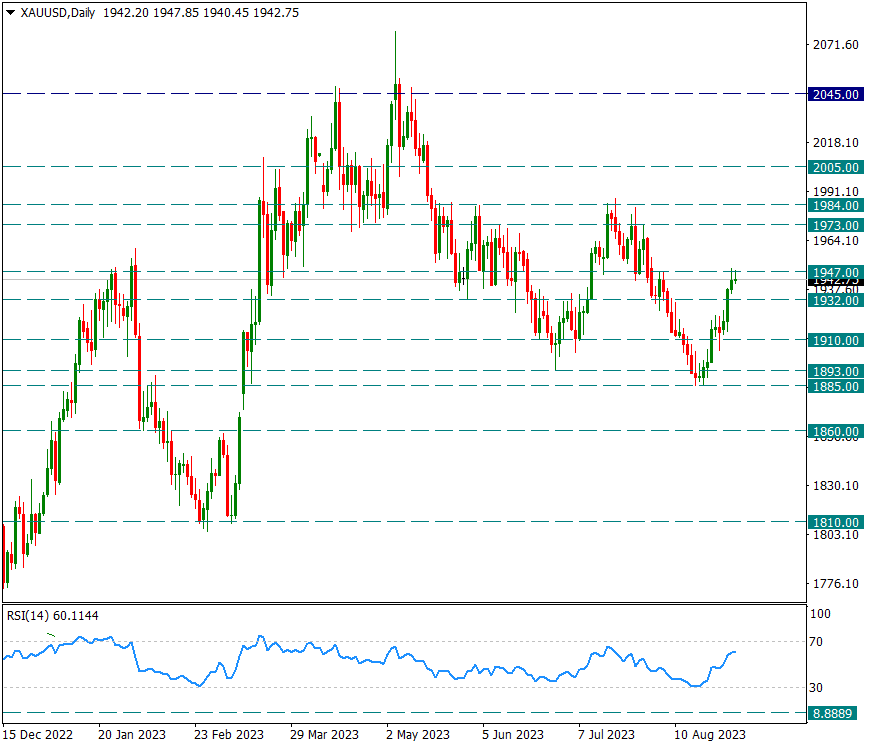

XAUUSD

Ounce Gold – Yellow Metal May Keep Up Unless US Responds to 10 Years…

Although the dollar index gained strength during the day, this situation did not bring sales to the Ounce Gold side because the US 10-year bond interest remained low/horizontal. The US is priced at the 10-year level of 4.10%. Ounce Gold also maintains the attacks it has experienced in the last two days and is watching close to the 1947 resistance. While the intraday interim support is 1932 and the main support is 1910, the weekly main support is in the 1885 region.

There are intermediate resistances above but 1984 is the main weekly support.

In the US, the core PCE price index increased year-on-year after a long time. If there is a concern that inflation pressures continue in the market, the US 10-year bond rate may rise again and this may be reflected as a strong pressure on Ounce Gold.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

BRENT

BRENT – Reaching 87.50 Tested Early August…

Brent oil continues its reaction from the 83.25 support, which we saw as critical in our previous reports, and is priced at 86.75 as of today. In this pricing, we will carefully follow the 87.50 resistance as the main support. A profit sale came from this resistance, which was previously tested on August 9th. Now it can enter the testing phase again and if it breaks, a powerful attack can come.

We will continue to watch 83.25 as the main support for possible declines. In the intraday support zone, 84.80 could be significant.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.