- In his statement after the USDJPY parity rose to the level of 150.08, Japanese Finance Minister said that they would not tolerate speculative movements, that they would continue to monitor exchange rate movements carefully, and that they would take action against speculative, extreme and sudden movements. Deputy Minister of Finance, on the other hand, stated that excessive and irregular exchange rate movements negatively affected the economy and he would not comment on when the exchange rate would be intervened. After the explanations, there was a pullback in the USDJPY parity.

- The CBRT lowered the Policy Rate more than expected after its meeting today. The Interest Rate was expected to be lowered from 12% to 11%. In the statement made, it was stated that after a similar step was taken at the next meeting, ending the interest rate cut cycle was on the agenda.

- In his statement after the USDJPY parity rose to the level of 150.08, Japanese Finance Minister said that they would not tolerate speculative movements, that they would continue to monitor exchange rate movements carefully, and that they would take action against speculative, extreme and sudden movements. Deputy Minister of Finance, on the other hand, stated that excessive and irregular exchange rate movements negatively affected the economy and he would not comment on when the exchange rate would be intervened. After the explanations, there was a pullback in the USDJPY parity.

- The CBRT lowered the Policy Rate more than expected after its meeting today. The Interest Rate was expected to be lowered from 12% to 11%. In the statement made, it was stated that after a similar step was taken at the next meeting, ending the interest rate cut cycle was on the agenda.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

USD/TRY

USD/TRY – CBRT Lowered Interest Rates Above Expected…

The Central Bank of the Republic of Turkey, at the Monetary Policy Committee meeting held today, cut the interest rate by 150 basis points beyond the expectation of a 100 basis point cut, and reduced the policy rate, the One-Week Repo Rate, from 12.00% to 10.50%. At the time of the announcement of the rate decision, the USDTRY parity dropped to its 100-unit exponential moving average. If the parity declines below this average, which also corresponds to the 18.52 band, 18.46 and 18.32 levels can be followed as the next support zones. If above, 18.60 and 18.68 levels may form resistance.

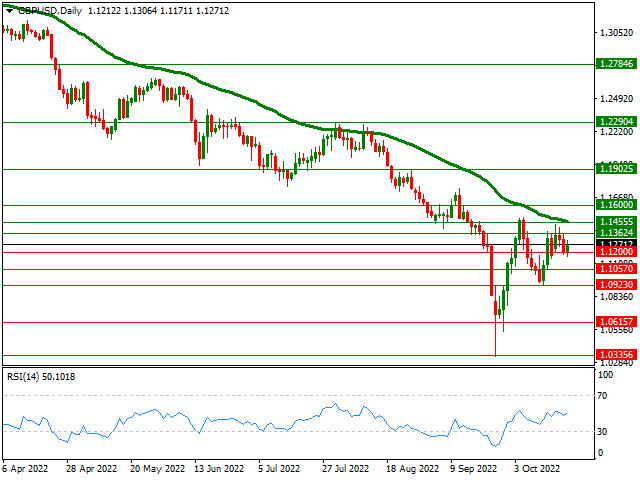

GBP/USD

GBP/USD – Political Turmoil in Britain Ends with Prime Minister’s Resignation…

The GBP/USD pair rallied to the 1.1300 region on Thursday, after falling to the weekly low of 1.1171 on Thursday. The selling pressure felt on the US Dollar paved the way for the recovery effort of the pair. On the other hand, the turmoil that started in the UK government since the mini-budget announced on September 23 resulted in the resignation of Prime Minister Liz Truss today. In GBPUSD parity, which has trended up to above the 1.1300 band after Prime Minister Truss resigned and declared a leadership election, the level of 1.1362 before the 55-day exponential moving average of the 1.1455 band can be viewed as an intermediate resistance zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

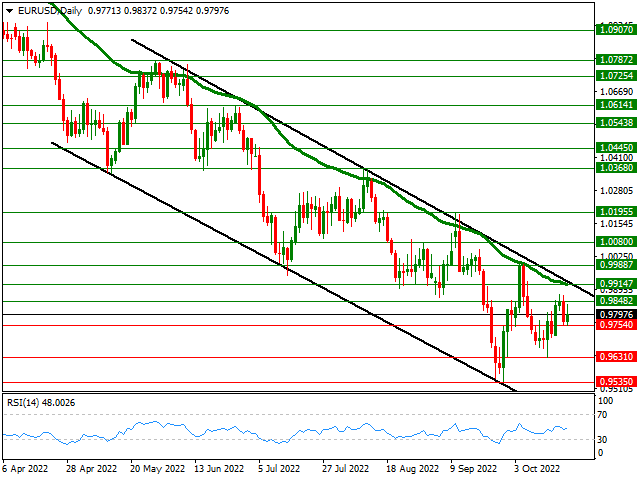

EUR/USD

EUR/USD – Trying to Rebound With Purchases From Three-Day Low…

The EUR/USD pair is drawing buys from the 0.9754 region, the three-day low touched on Thursday, and retraces some of the previous day’s heavy losses. The pair followed a positive course throughout the European session. If the recovery effort in the pair continues, 0.9850 and 55-day exponential moving average will be the first resistance zones to follow. Below, the 0.9631 band, which is the lowest level seen in October, stands out as the next support zone for possible trends below the 0.9754 band.

XAU/USD

XAU/USD – Response Buying in Three-Week Low…

Ounce of Gold followed a generally buying trend throughout the European session, with purchases developing at the lowest level in three weeks on Thursday. The losing ground of the US Dollar in the global market allowed the precious metal to recover, but with the opening of the US session, Yellow Metal gave back some of its intraday gains. The continuation of the rise in the US 10-year bond yield may trigger a headwind in favor of the Dollar.

In the Yellow Metal, the 25-unit exponential moving average and the black descending trend line, which we followed on the 4-hour chart above, can be viewed as the first resistance areas. Below, the 1614 band, which is the lowest level it has seen so far this year and tested on September 28, stands out as the next support zone in possible directions below the 1624 support band.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.