- Inflation rates in the UK, which we follow today, increased above expectations. Consumer Price Index (CPI) came in at 0.5% monthly and 10.1% annually. After this increase, the Consumer Price Index reached its highest level in the last 40 years on an annual basis. Inflation in the UK was 10.1% in July. Core CPI, on the other hand, increased 0.6% monthly and 6.5% year-on-year.

- The Consumer Price Index (CPI) for September, announced today in the Euro Zone, came close to the expectations and increased by 1.2% monthly and 9.9% annually. Data were expected to increase by 1.2% and 10.0%, respectively. Core CPI, on the other hand, increased by 0.9% monthly and 6.0% annually.

- After inflation rates, European Central Bank (ECB) Member Vasle said that the ECB should increase interest rates by 75 basis points in the next 2 meetings.

- Housing Starts announced in the US for September decreased 8.1%, while Building Permits increased 1.4%. On the basis of units, Housing Starts were 1.439 million, while Construction Licenses were 1.564 million.

- Canada’s Consumer Price Index (CPI) fell to 6.9% in September from 7.0% in August, according to data released Wednesday by Statistics Canada. However, this reading was slightly above the market expectation of 6.8%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

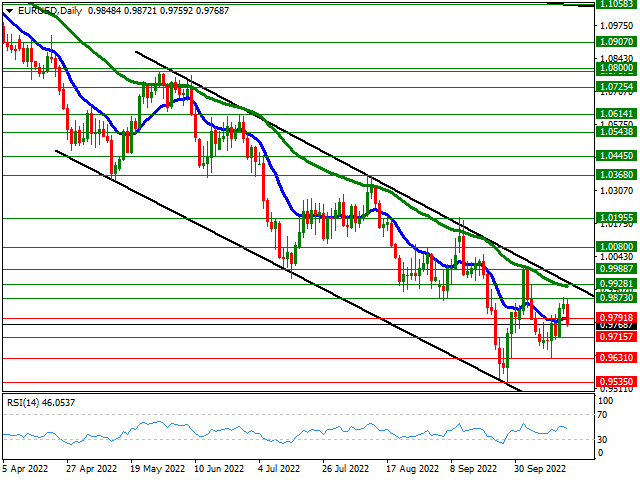

EUR/USD

EUR/USD – Euro Zone Deepens Intraday Losses After Inflation Figures…

The EURUSD pair fell in the first half of Wednesday as it struggled to capitalize on the gains recorded in the last two trading days. Expectation of a faster rate hike cycle by the Fed continues to support US Treasury bond yields and helps the dollar gain some positive momentum. Current market prices show another 75 basis points increase of almost 100% for the fourth consecutive meeting in November. This was reaffirmed by hawkish comments from several Fed officials reiterating their commitment to contain inflation. Minneapolis Fed Chairman Neel Kashkari said on Tuesday that the Fed may need to raise its benchmark policy rate above 4.75% if inflation does not stop rising.

On the other hand, the September inflation figures announced today on the Euro front increased by 9.9% on an annual basis, above the previous period, but were slightly below the expectations. Core inflation, on the other hand, increased in line with expectations. From a technical point of view, the pair, which deepened its intraday losses after inflation figures, has declined below the 15-day exponential moving average support, which it broke on the first trading day of the week. If the pair continues to decline, 0.9715 and 0.9631, the lowest level since October, can be viewed as the next support zones. In possible upward trends, the 0.9873 band will continue to be followed as the first resistance zone.

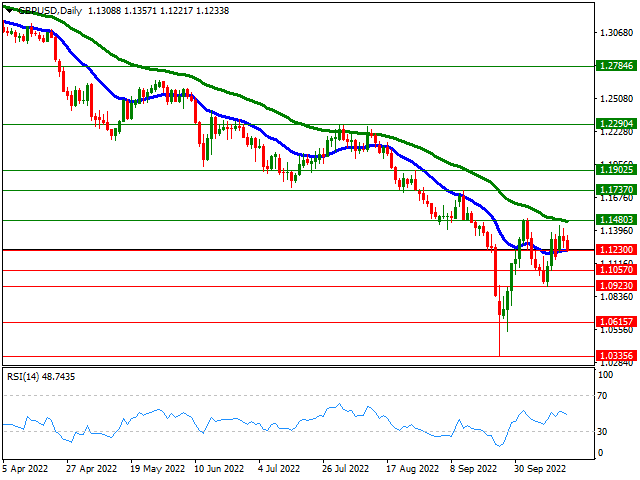

GBP/USD

GBP/USD – Hot Inflation Figures and Global Recovery of the US Dollar Pressured the Parity…

The selling pressure felt yesterday in GBPUSD increased its effect today. Britain’s inflation figures announced today increased above expectations. A hot UK inflation data is likely to put the Bank of England in a difficult position after the government’s financial and political debacle. A mixed market mood and the global recovery of the US dollar are also putting pressure on the pair. Falling below the 1.1300 level, the pair is testing its 20-day exponential average. 1.1057 under possible tensions below this region and 1.0923 band, which is the lowest level seen since October, can be viewed as the next resistance zone. In possible recovery, the 55-day exponential moving average will remain in our follow-up as the first resistance zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

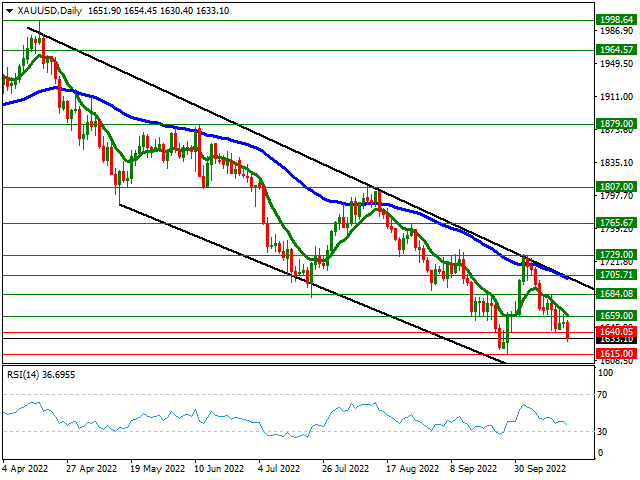

XAU/USD

XAU/USD – Dropped To Three-Week Lowest…

The recovery effort, which was followed in the first two trading days in the last two trading days, gave way to a decline today and fell to the lowest level in three weeks in the European session. The recovery of the US dollar in the global market and the rise in US bond rates stand out as the factors that put pressure on the precious metal. From a technical point of view, 1615 level, which is the lowest region of the last two years, can be followed as the next support band in Precious Metals, which fell below the 1640 support band. On the other hand, the 1659 band, which corresponds to the 10-day exponential moving average, will be followed as the first resistance zone in possible upward trends.

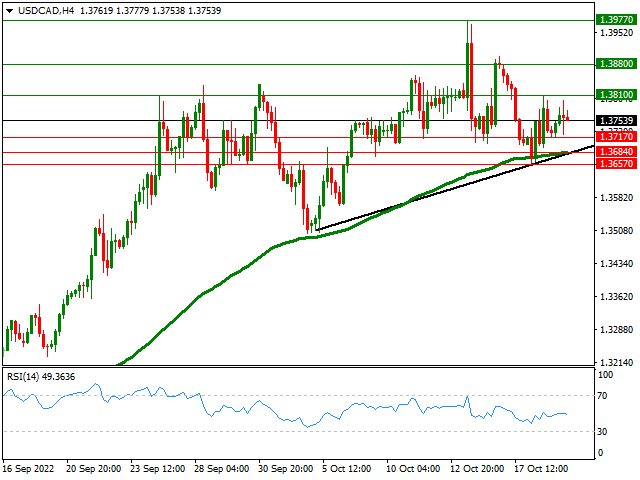

USD/CAD

USD/CAD – Inflation Rises In Canada More Than Expected…

Canada’s Consumer Price Index (CPI) fell to 6.9% in September from 7.0% in August, according to data released Wednesday by Statistics Canada. However, this reading is slightly above the market expectation of 6.8%. While the effect of inflation figures on the parity is limited for now, the support of the US dollar in the global market kept the parity up throughout the European session. From a technical point of view, 1.3810 and 1.3880 levels above the pair can be followed as the first support zones. Below, the 100-unit exponential moving average, which we follow on the 4-hour chart, stands out as the next support area for possible tendencies below the 1.3717 level, which functions as support today.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.