The key data from the US during the day included the Producer Price Index and Retail Sales.

- USA – PPI (monthly): -0.5% (Previous: 0.2%)

- USA – PPI (annual): 6.2% (Previous: 7.3%)

- USA – Core PPI (monthly): 0.1% (Previous: 0.2%)

- USA – Core PPI (annual): 5.5% (Previous: 6.2%)

When we look at the retail sales side, there is a rapid decrease on a monthly basis, especially on the Core side, and it decreased by -1.1%.

These data continued the weakening in the US Dollar index. While the EURUSD parity is rising to the level of 1.0880 during the day, there is an upward trend on the Ounce Gold side.

After the data, the US 10-year bond yield fell to 3.4%, hitting its lowest level in recent times.

Today we followed the policy decisions of the Bank of Japan. Contrary to the doubts, the upper limit of bond yields was kept fixed at the meeting, which started at 06.00 hours in Turkey. The 10-year Japanese Government Bond yield was kept at 0.50%. The policy rate was kept constant at -0.1%.

- 2023 Core Inflation forecast increased from 1.6% to 1.8%.

- 2024 Core Inflation forecast held at 1.6%.

- 2023 economic growth forecast decreased from 1.7% to 1.9%.

- 2024 economic growth forecast fell from 1.5% to 1.1%

Approaching 131.85 after the decision, the USDJPY parity retreated to 128.00 again during the day due to the weakening in the Dollar Index.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EUR/USD

EUR/USD – The Rise Continues After Profit Sales…

We have observed red candles with profit sales for the past 3 days in Euro Dollar parity. Today, we see that it started to recover after regressing to the level of 1.0765. It continues to trade at 1.0825 levels with the recovery movement.

As long as the uptrend continues, a close can be seen at the levels in the range of 1.0866 – 1.0873, which has been tested for several days. In case of closing at this level, the upward movement can continue. If 1.0873 resistance is broken, our new resistance levels will be 1.0935 and 1.1044.

In case of a downward movement, our new support levels will be 1.0735 and 1.0705, in case of a break at the 1.0765 support point.

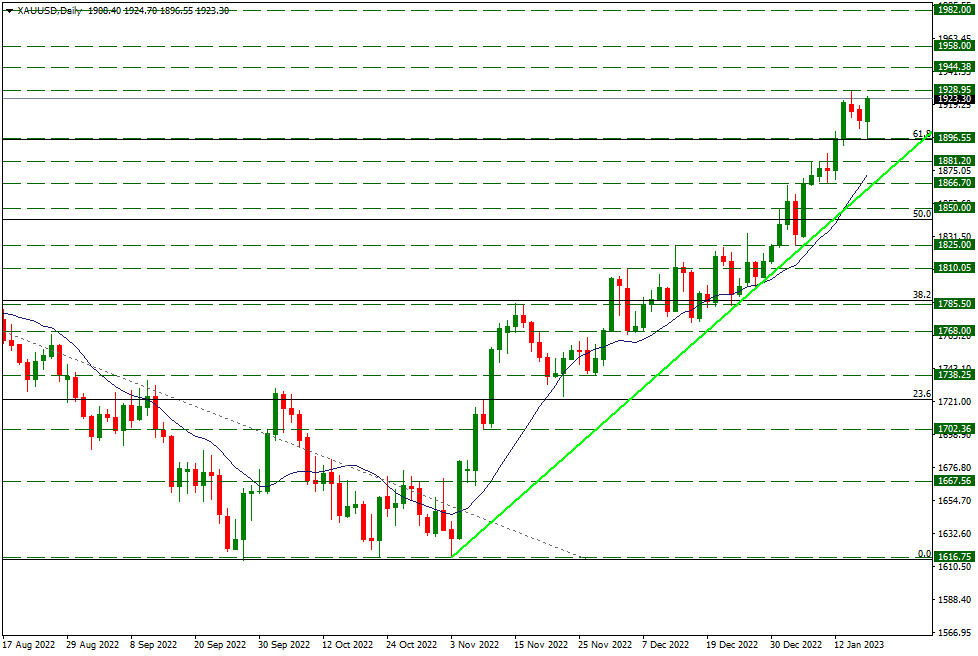

XAU/USD

XAU/USD – The Uptrend Continues From Where It Left Off…

After a minor correction with the profit sales in the last 2 days, the bullish candle showed itself again. Even though there was a regression to 1896.55 levels during the day, the purchases showed their strength from this level and the transactions continue at the 1923 level.

In case the upward movement continues, 1928.95 resistance can be tested again. In an upside break at this level, new resistance levels can be followed as 1944.38 and 1958, respectively.

In a downward movement, 1896.55 level can be followed as a support zone. In case of weakening of this region, the new support levels can be followed as 1881.2 and 1866.7, respectively.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

USD/JPY

USD/JPY – BOJ Returned Its Quick Response After Decision…

After the Bank of Japan did not make any changes in its monetary policy, the parity, which suddenly reacted, approached the 131.65 resistance. However, it gave back most of its rapid rise during the day and retreated to 128 again.

With the rapid pullback, the 126.70 support below has become important again. Breaking this support may cause a gradual acceleration of the movements in favor of the JPY and bring the 125.00 level to the agenda.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.