- According to the Central Bank of the Republic of Turkey (CBRT) Market Participants Survey, the year-end inflation expectation rose to 35.76% in February. The expectation in January was 32.46%. According to the data of the Turkish Statistical Institute (TUIK), house sales in January increased by 10.6% compared to the same period of the previous year and amounted to 97,708. Compared to December 2022, a 53% decrease was recorded. According to the announced data, the Current Balance in the Euro Area posted a surplus of 15.9 billion Euros in December 2022.

- The Producer Price Index (PPI) in Germany was announced as -1.0% in January with the decrease in energy prices. However, it was shared as 17.8%, exceeding the expectations of 16.4% compared to January of the previous year. Retail Sales data released today in the UK were slightly better than expected. Retail Sales increased by 0.5% in January and decreased by -5.1% compared to the same period of the previous year. Additionally, Core Retail Sales rose 0.4% in January, down -5.3% year-on-year.

- Goldman Sachs predicted in his previous posts that the FED would increase interest rates twice. However, since the expected results could not be obtained in the inflation data, it increased its rate hike forecast from 2 to 3 in the form of 25 basis points increase each in March, May and June.

- ECB’s Villeroy said in a statement that no interest rate cuts will be made this year. He added that inflation continues to pose a threat. In addition, ECB President Schnabel said that there is a great need for a 50 basis point increase in interest rates in March.

- No response from hawk messages from ECB. However, the dollar market is starting to tighten again. The fact that the inflation and employment data from the USA remain quite strong creates an expectation that the FED will not immediately end the rate hike. The US 10-year Treasury yield rose above 3.9% again.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

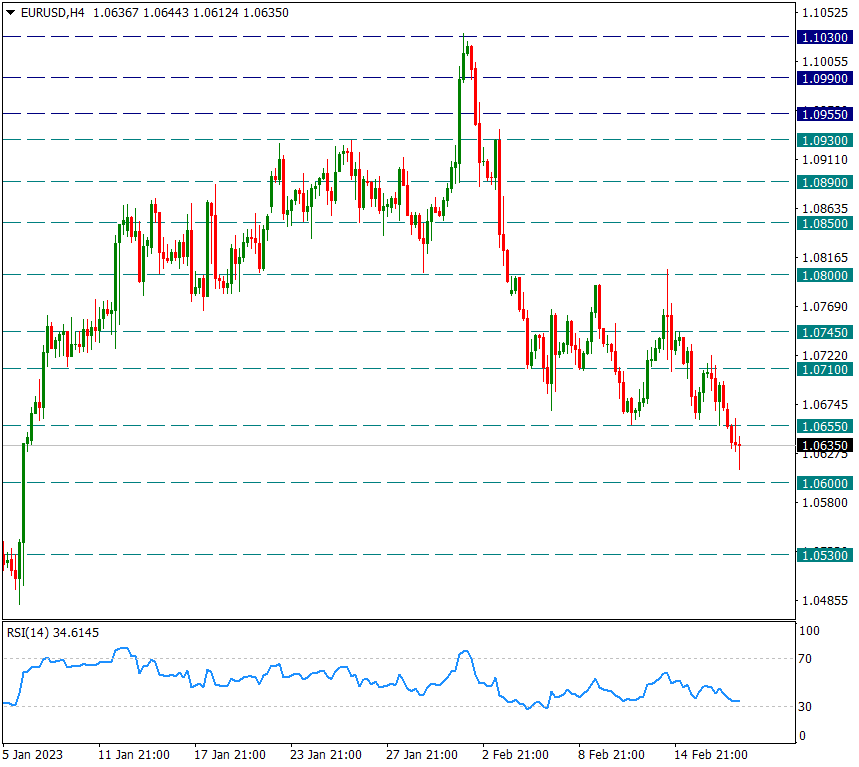

EUR/USD

EURUSD – Dollar Market Tends to Tighten Again…

After the recent strong US data, the market started to warm up again step by step. The US 10-year Treasury yield also rose to 3.9%. Therefore, the dollar market began to tighten again. The downward trend in the EURUSD parity continues accordingly. In the recent decline, 1.0655 worked as support and received a reaction from this region. The movement in favor of the dollar continued and as of today, four-hour candles were closed below 1.0655. During the day, the sagging was up to 1.0610.

Our first intraday resistance is now 1.0655. As long as the four-hour candles do not hold onto this region again, it can be predicted that the downward trend in the parity will continue.

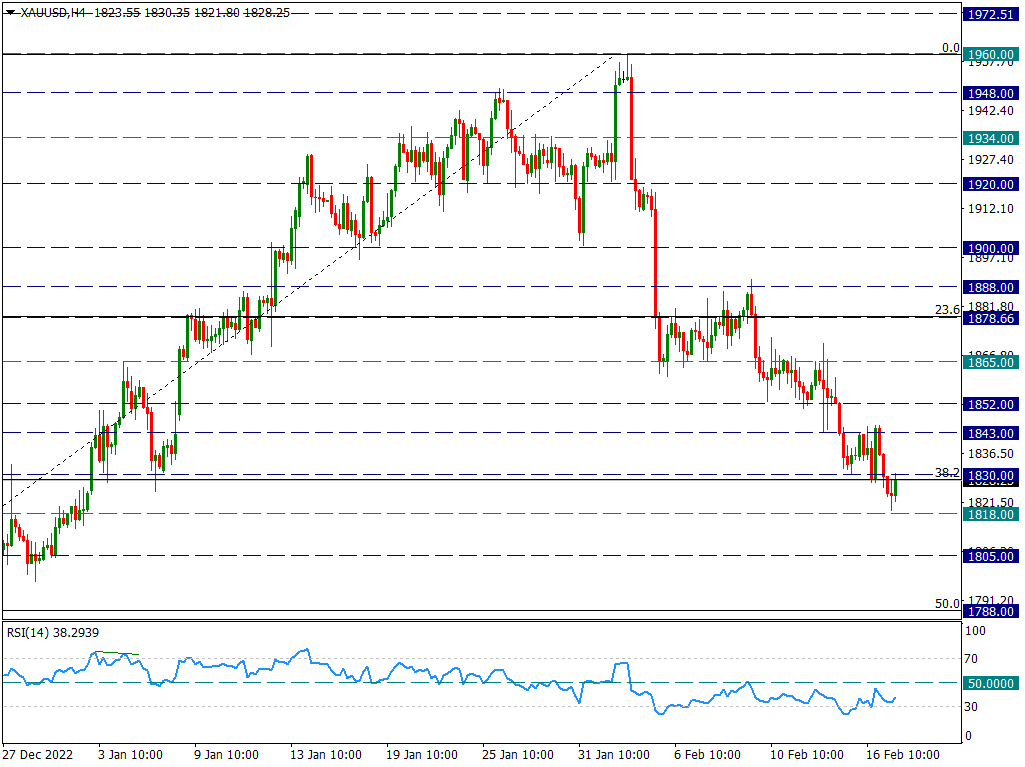

XAU/USD

XAUUSD – Attempting to Confirm the Broken 1830 Support…

The bearish trend in the yellow metal continues. While the employment market and inflation data continue to be quite strong on the US side, US bond yields continue to rise step by step. With the effect of this, the pressure on the yellow metal continues. Support for 1830, which was tested yesterday, is being tested again today after the US PPI data.

A possible four-hour candle close below this support could trigger a drop to the Fibonacci 50 and 61.8 retracement zones of the 1616/1959 rise.

1830 support will therefore be important. Any resistance up to 1888 in possible responses can be defined as an intermediate resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

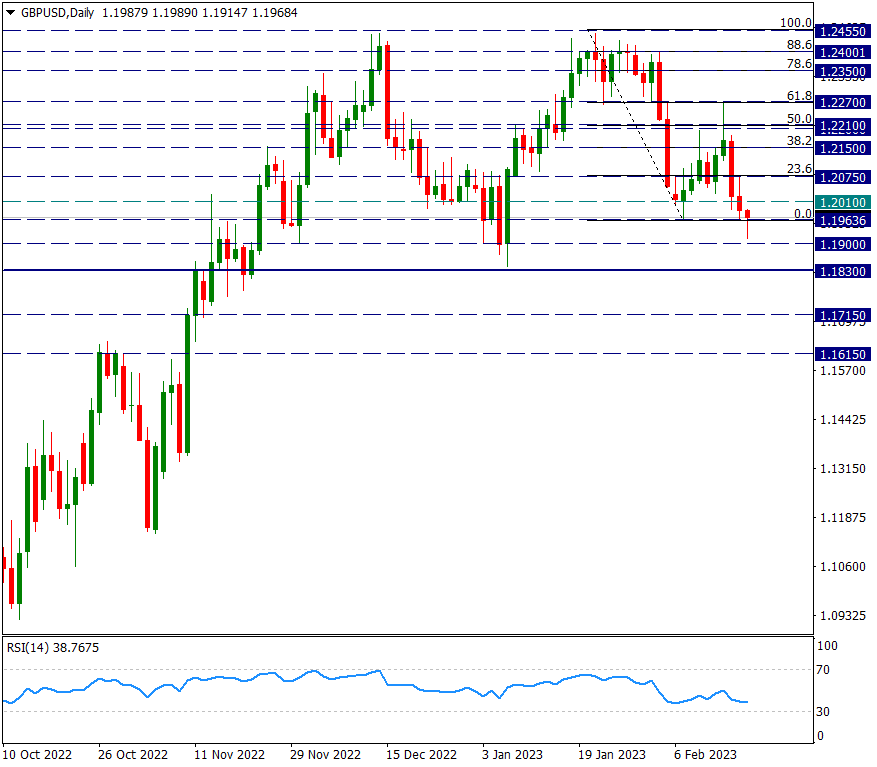

GBP/USD

GBP/USD – Intraday Decrease Sagged Until 1.19…

With the continuation of the movements in favor of the dollar in the parity, the double top formation structure continues from where it left off. As of today, there has been a sag until 1.19. However, as of now, it is trying to stay in this region by reacting on the 1.1965 support that was tested last week. If it is successful in holding above 1.1965, we can watch the continuation of possible reactions.

However, if this situation fails, the 1.19/1.1830 line, which is the neck region of the double top formation, will be on the agenda again. A break of 1.1830 may bring strong selling as it will trigger the formation to work.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

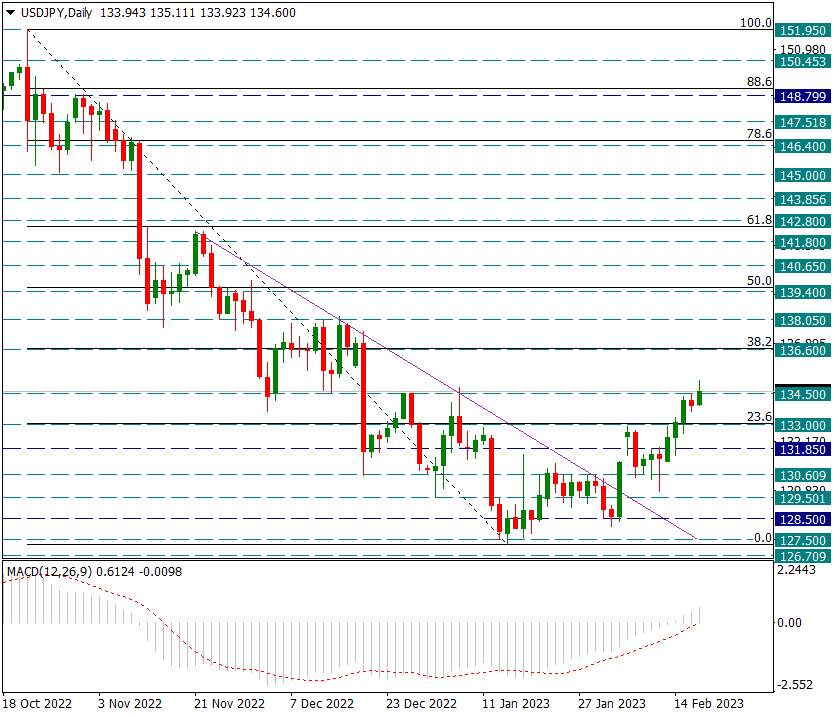

USD/JPY

USD/JPY – As Rising Continues, Tests 134.50 Resistance…

The pair is preparing to make a weekly close by continuing its uptrend after breaking above the Fibonacci 23.6 retracement of the 151.95/127.50 decline. As of today, it is testing 134.50 resistance. In general, we can think that the rise in the parity can be carried up to 136.60 as long as it remains above the 133.00 support, which corresponds to the 23.6 correction we mentioned in the first sentence.

Contact Us

Please, fill the form to get an assistance.