- We will follow Powell’s statements in the Senate presentation after 18.00 CEST. While the market is pricing the probability of the Fed’s interest rate hike by 25 basis points on March 22 as 75%, the probability of 22% is 50 basis points.

- We will carefully monitor how Powell responds to these market expectations and his messages for the future. You can follow the developments on IKON News.

- Mann from the Bank of England emphasized that more moves should be made regarding interest rates and expressed his concerns despite the continuing upward trend in core inflation. His hawk-toned remarks match his previous thoughts, and in that respect it’s no surprise.

- Despite the hawkish tone, the GBPUSD parity fell from 1.2070 to below 1.20 again during the day.

- ECB member de Cos, on the other hand, became one of the market politicians who emphasized core inflation and stated that it will remain high in the short term. He said that while he might see a gradual decline afterward, time will tell if this is a “mistake”.

- The Central Bank of Australia met this morning and increased the interest rate by 25 basis points, raising the policy rate to 3.6%. The decision came in line with expectations.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

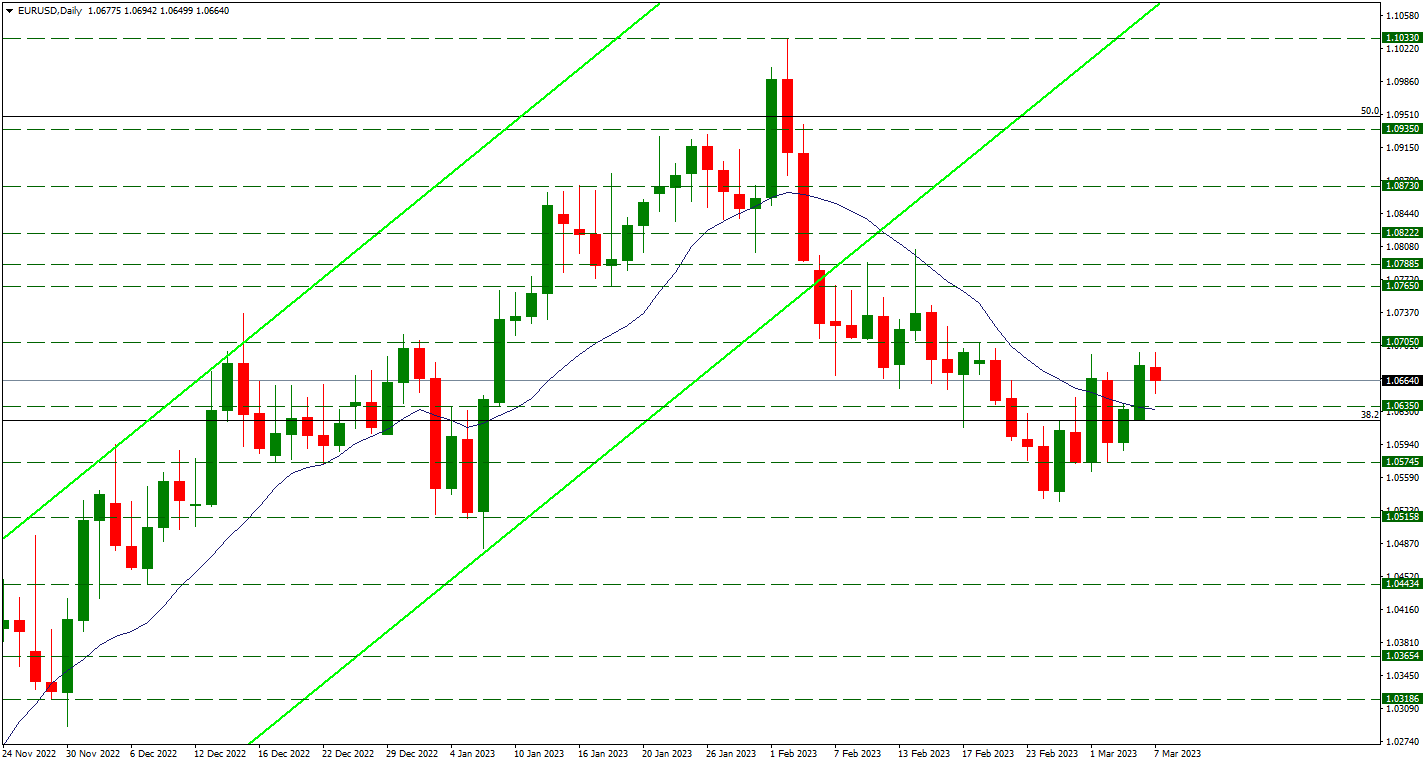

EUR/USD

EUR/USD – Pricing Around 1.0664 Continues…

In the Euro-Dollar parity, the level of 1.0635 was exceeded the previous day and there were increases. After the rises, it continues to be priced around 1.0664 with slight pullbacks today. 1.0705 level may come to the fore in case the upward mobility gets stronger again. In downside pricing, the pullback to 1.0635 may continue and this level can be followed as support.

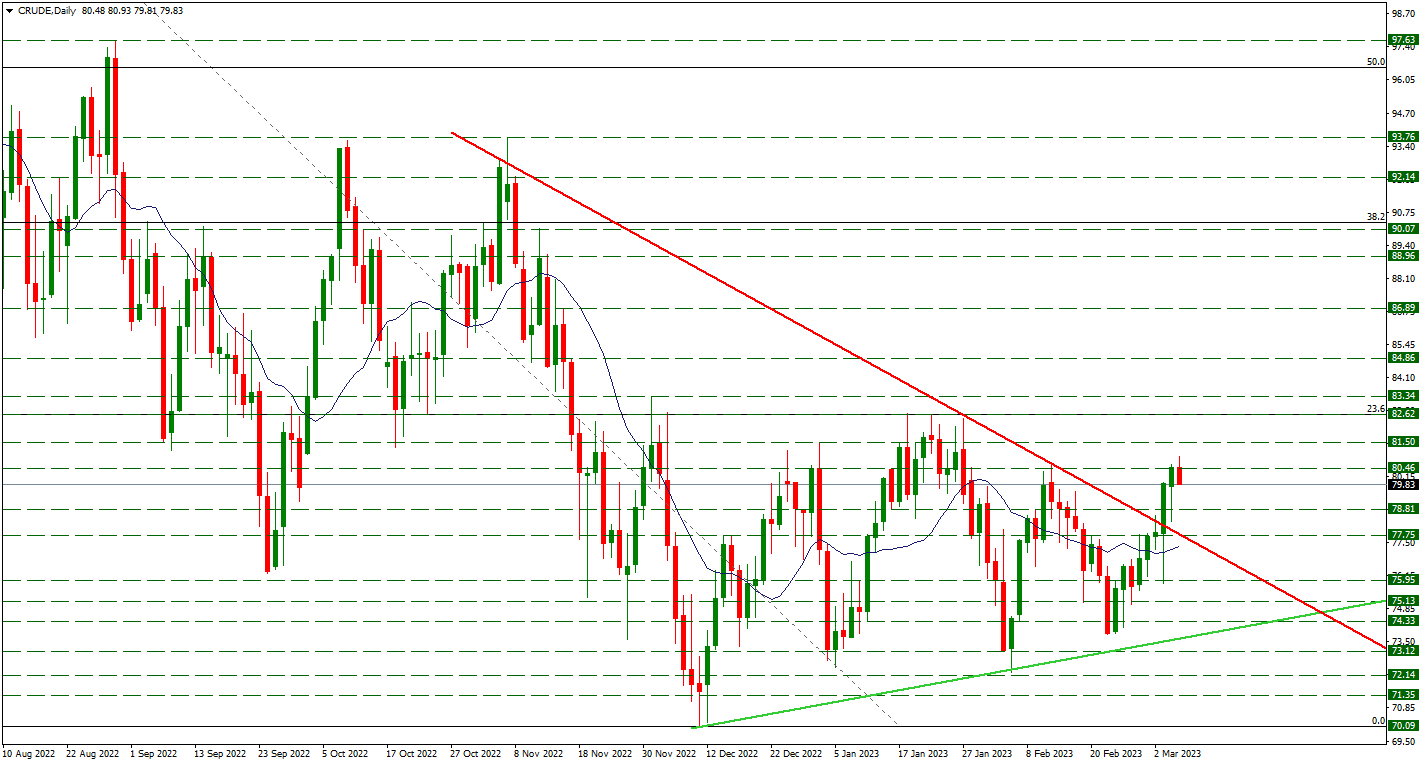

CRUDE

CRUDE – There Have Been Withdrawals In Reaction From The 80.46 Resistance…

Crude Oil fell below the 80 level with the reaction it received from the 80.46 resistance after the rapid rises. In the continuation of the pullbacks, 78.81 support may come to the agenda. In case the upward pricing shows the effect and 80.46 resistance is broken upwards, the 81.50 level can be followed as resistance.

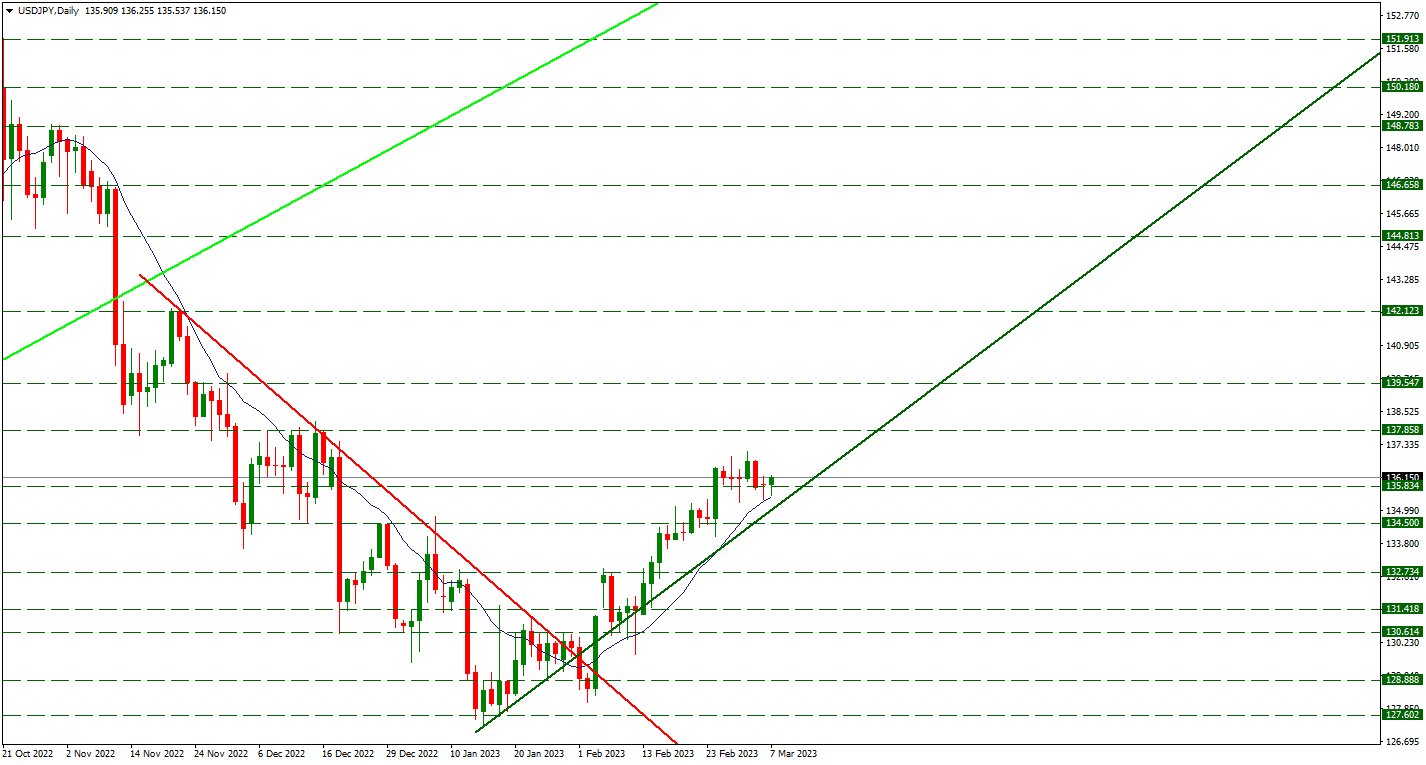

USD/JPY

USDJPY – Horizontal at 136 Level…

While the Japanese Yen continues its horizontal course after rapid rises, it continues to test the 135.83 support with slight pullbacks. If this support maintains its strength, the rises may continue and the level of 137.54 may come to the fore. In case of downward pricing, 135 levels, which coincide with the upward trend line, may come to the fore. On the downside break of this trend, 134.50 can form support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.