- According to the data announced by the Turkish Statistical Institute (TURKSTAT), consumer inflation (CPI) was 84.39 percent on an annual basis in November. CPI increased by 2.88 percent on a monthly basis. Annual inflation was recorded as 85.51 percent in October. In the same period, a slowdown was observed in core inflation. Annual core inflation was recorded as 68.91 percent in November. Annual core inflation was 70.45 percent in October. Treasury and Finance Minister Nureddin Nebati said, “Unless there is an unexpected global development, we have entered a downward trend in inflation, leaving the peak behind.” He commented.

- S&P Global Eurozone final composite PMI rose to 47.8 in November from 47.3 in October. Services PMI, on the other hand, dropped to 48.5, the lowest level since early 2021. According to the report shared by Sentix, investor confidence index, which was at the level of -30.9 points in the previous month, increased to -21.0 points in December. The market expectation was for the index to rise to the level of -27.6 points. Gabriel Makhlouf, a member of the European Central Bank and Governor of the Central Bank of Ireland, said he believes the ECB should raise the interest rate by a minimum of 50 basis points at its policy meeting on 15 December.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

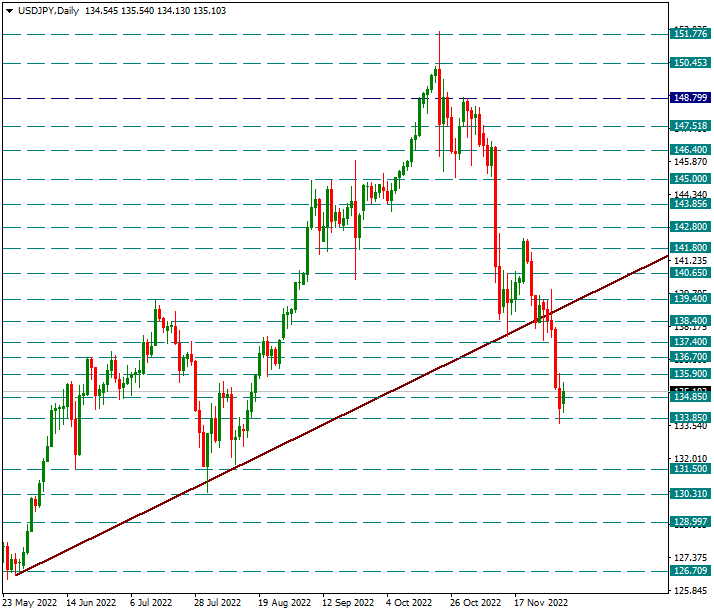

USD/JPY

USD/JPY – Mild Reaction From 133.85 In The New Week…

The pair, which declined rapidly after breaking the uptrend from 126.70, continues to trade above the 133.85 support it held on Friday. The reaction from this level is weak and limited at 135.90 for now. This level will be monitored in possible reactions. However, if the current move in favor of the JPY continues, we will continue to watch the 133.85 level, which worked as a support last week.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

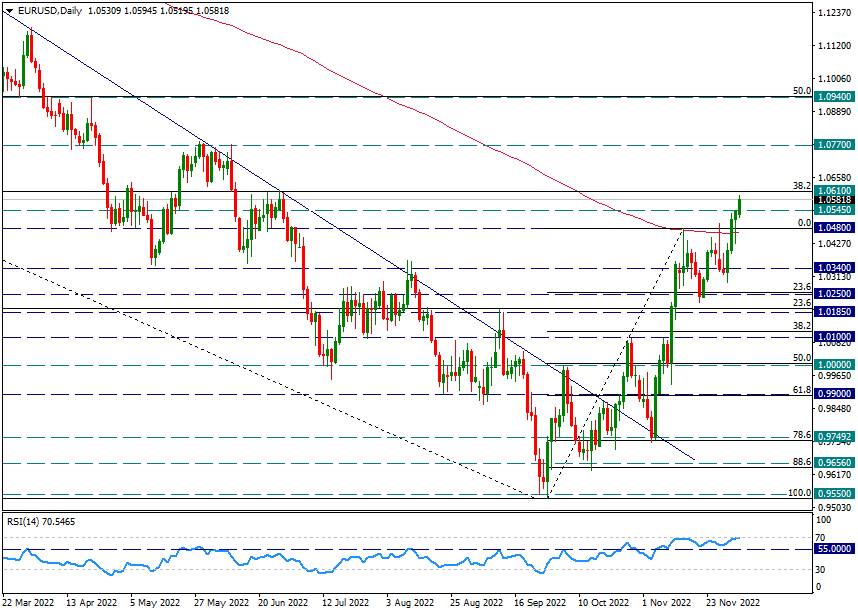

EUR/USD

EUR/USD – Above the 233-Day Average, the Outlook Continues in favor of the Euro…

The EURUSD parity, which has been resisting on the 233-day average in the past weeks, has not been able to break this region upwards for a while, and after it went above this average, it expanded its movements in favor of the Euro. In the new week, there was a rise to the level of 1.0595. In the next period, we will take the 233-day average, which corresponds to 1.0480, as weekly support.

We will look at the Fibonacci retracement zones of the 1.2349/0.9535 decline as resistance zones for possible upsides. In this case, we will first pay attention to the Fibo 38.2 retracement approaching today and the corresponding 1.0610 level.

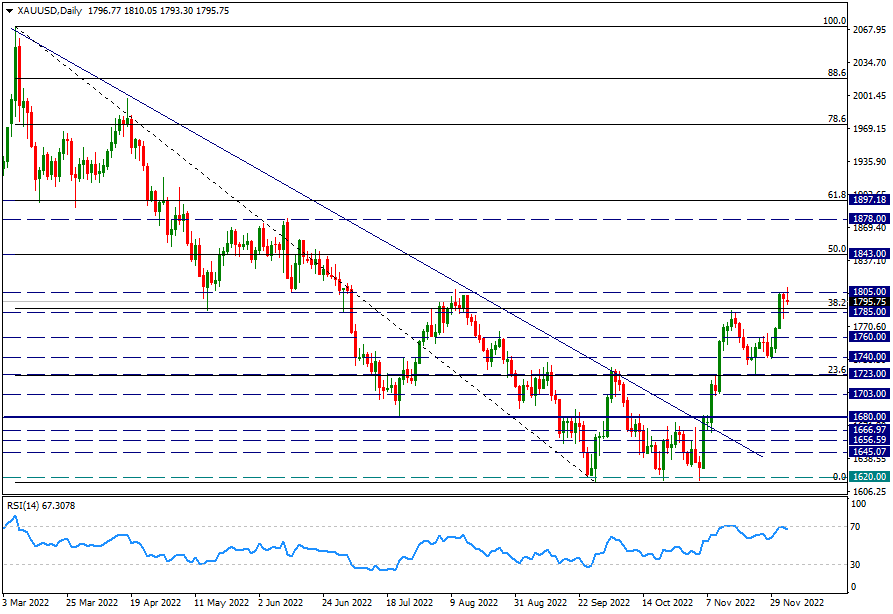

XAU/USD

XAU/USD – A Positive Image May Continue On 1785…

The yellow metal, which rose above the 1785 level with a strong rise last week, continues its pricing above this level in the new week. The 1785 level was significant as it coincided with the Fibo 38.2 retracement of the 2070/1620 drop and this zone was broken. In the next period, as long as there is no daily candle close below the 1785 level, the positive trend may continue and a step-by-step exit may come to the Fibonacci 50 correction, which is also seen on the chart.

If it breaks below 1785, the positive image may deteriorate for now.

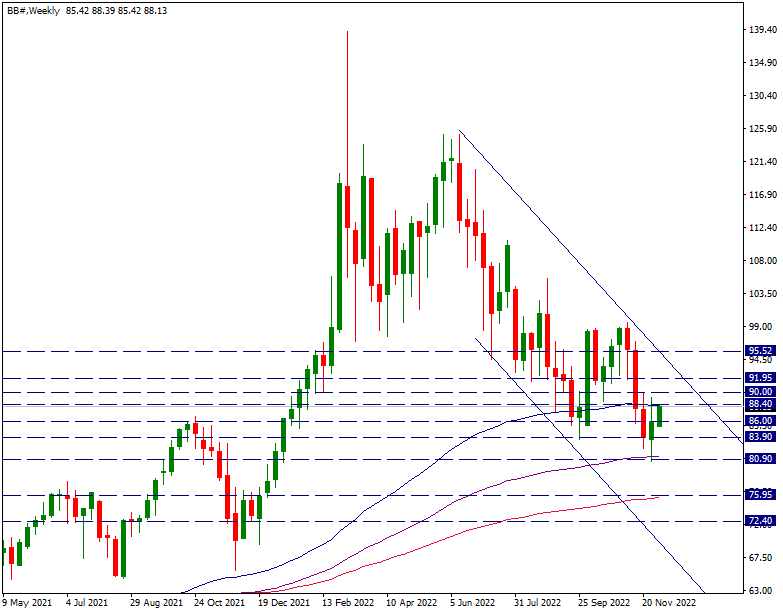

BB#

BB# – Last Week’s Resistances Are Being Tested Again In The New Week…

The Brent side continues its strong reaction this week, which was triggered by the 144-week average last week, and the 89-week average is being tested again. This average, which coincides with the 88.40 resistance, will be followed during the day. Breaking this zone with daily candles can carry the rise towards the upper band of the descending price channel seen on the chart.

If 88.40 is not exceeded, we can follow the downward trend within the descending channel in possible power losses.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.