- The job market in the US remains strong. ADP Non-Farm Employment, which came in today at 16.15, was announced quite high compared to both expectations and the previous month.

- US ADP Non-Farm Employment Change: 235,000 (Exp. 150,000 ; Previous: 127,000)

ADP chief economist Nela Richardson said: “The job market is strong, but it also varies by industry and company size.” used the phrase. Also, “Business segments that recruited aggressively in the first half of 2022 slowed hiring and in some cases laid off in the last month of the year.” he added.

- The FOMC minutes released yesterday were disappointing for those who expected the FED to sway a little to the dove side. In the minutes, nothing different from the statements made at the meeting came and the message was given that easing in 2023 is not on the agenda for the time being. Although it was expressed that he was pleased with the decrease in inflation in October and November, there are still concerns about the existence of trends that increase inflation.

- US Weekly Unemployment Benefit Claims were announced this week as 204,000, well above expectations. Employment data in the US continues to be strong.

Tomorrow, we will follow the Non-Farm Employment Report for December with interest.

- Services PMI Index from the USA for December decreased compared to the previous month and became 44.7 and remained in the negative territory.

- France and Germany are expressing their concerns about the new variant Covid situation in China. The new XBB 1.5 variant of Covid has started to appear in Europe as well. According to official data, it is stated that this variant accounts for more than 40% of cases in the USA. There is a meeting in the EU for testing passengers coming from China to Europe.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

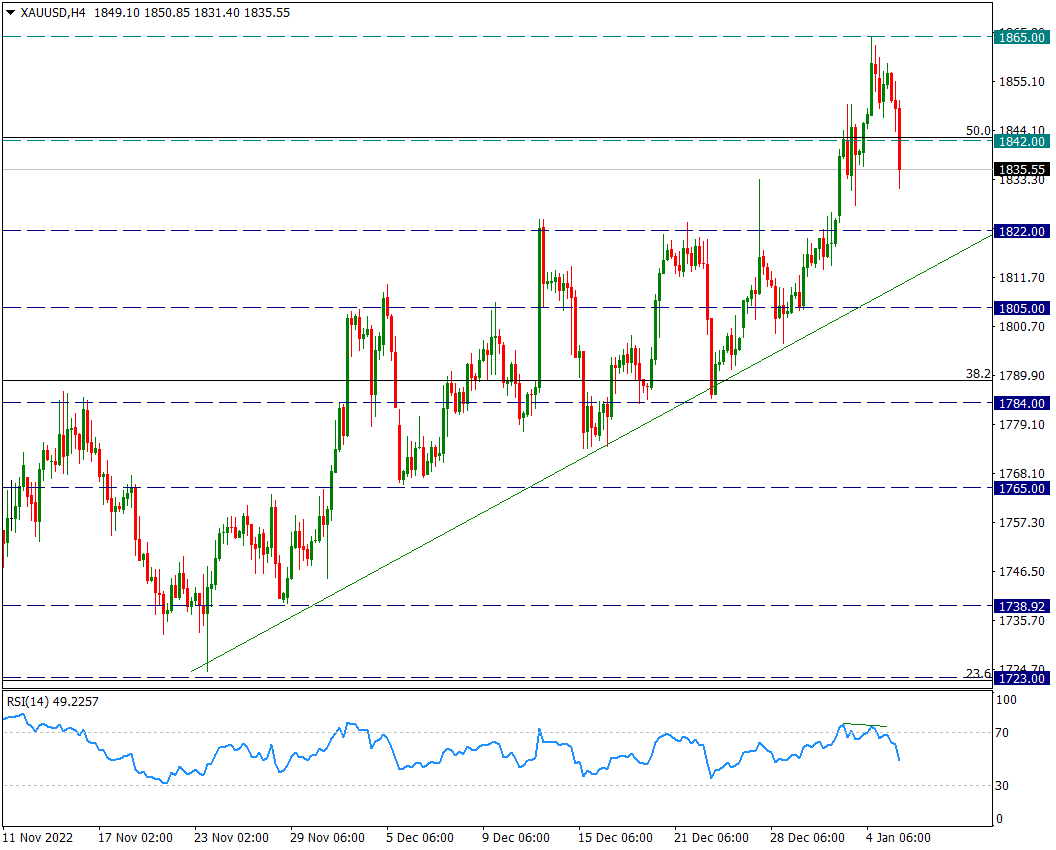

XAU/USD

XAU/USD – It Can Be Seen As A Profit Sale Up To 1822…

While ounce gold has been rising rapidly since the first trading day of the year, it stopped this rise at the 1865 resistance yesterday and was replaced by profit sales. When we look at the four-hour chart, we see that the RSI indicator has started a negative dissonance, especially between the two peaks of 1848 and 1865. These dips can be seen as selling profits up to 1822 support. But price movements below 1822 could bring back the 1780 region for the yellow metal and boost sales.

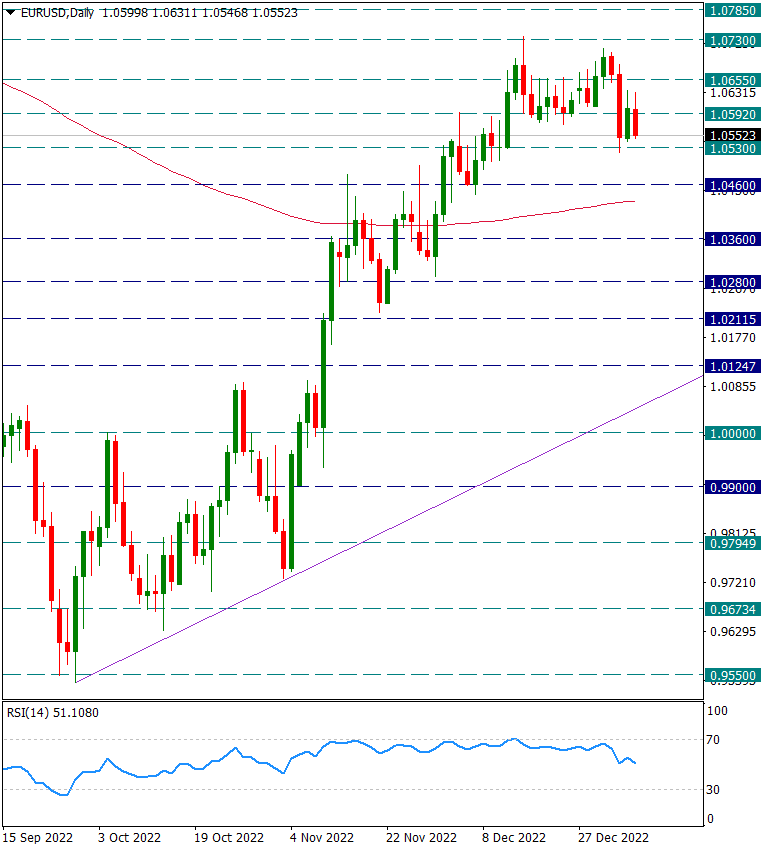

EUR/USD

EUR/USD – The Continuation of the Decline that Started at the Beginning of the Year…

The move in favor of the Dollar Index at the beginning of the year continues after a one-day break. The fact that the ADP Non-Farm Employment data from the USA today is much better than the expectations and last month has been a key factor feeding the Dollar Index throughout the day.

From a technical point of view, 1.0730 double top formation in EURUSD parity still continues. 1.0530 can be noted here. A break of 1.0530 might make the moves in favor of the dollar come out a little earlier. We would like to point out that while looking at 1.0530, we should also pay attention to the 200-day average in the 1.0450 region.

The region where the 200-day average is located is weekly-based support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

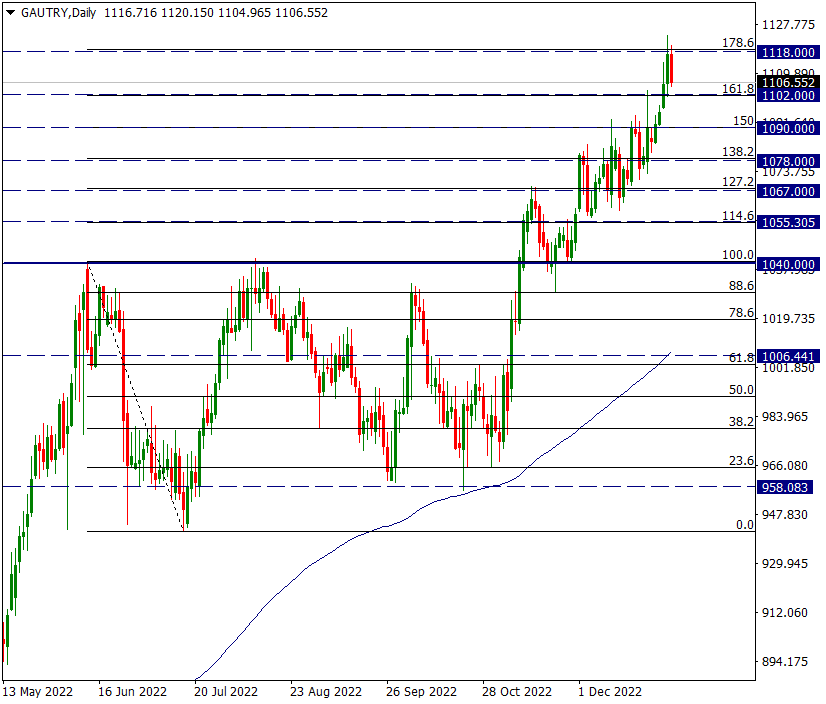

GAU/TRY

GAU/TRY – From Which Region Did the Profit Sale Come From?

When we look at the Gram Gold side, we see that there is a slight profit sale from 1118 resistance today. The decrease in ounce gold brought the price down mathematically. However, when we look at the technique of the product itself, we see that there is a sale from a resistance line corresponding to 178.6 in the Fibonacci extension of the 1040/942 movement. It is also an important detail that this type of profit sales came from a natural and technical resistance for a commodity that has been rising rapidly recently. In the continuation of possible profit sales, we will gradually follow the support areas.

However, we will continue to monitor the 200-day average as the main medium-term support line. We would like to state that the 200-day average has now reached 1006 levels.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.