- On the first trading day of the new year, almost all commodities, metals and stock markets were closed and we had a day when only parities were open.

- The European market was open and the Manufacturing PMI from Germany fell from the previous one to 47.1. In the Euro Area, the Manufacturing PMI Index remained the same as the previous month and was realized as 47.8. Both data remain below 50, indicating negative status.

- The US market will be closed in the evening.

- The only instrument that attracted attention was the USDJPY parity. The pair hit the bottom zone of 2022 today and is pushing 130.55 down. BOJ policies may attract more attention during the year than last year.

- In the last trading hours of the last trading day of 2022, there was a sudden increase in oil prices. The status of this pricing will be followed tonight at the Crude Oil and Brent oil openings.

- As of tomorrow, we will be entering a more normal and open market.

- At 04:45 (GMT+3) tomorrow night, the Caixin Manufacturing PMI Index will come from China.

- During the day, primarily on the domestic side, inflation data for December and 2022 will be announced by TURKSTAT.

- At 16.00 (GMT+3) in the afternoon, this time we will be getting Germany’s December and 2022 lead inflation data.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

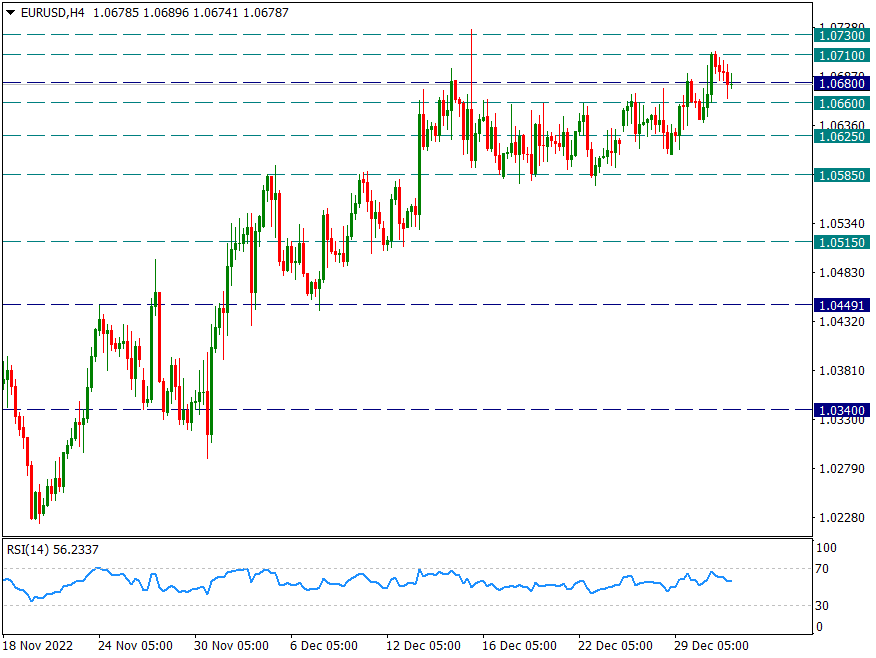

EUR/USD

EUR/USD – We Are Observing 1.0680 During the Day While We Are In A Slight Declining…

The pair is trending slightly down with limited moves below 1.0710 in the new year. We carefully monitor the short-term supports for the parity, which is trying to hold on to the intermediate support of 1.0680. In case of sagging below 1.0680 and closing of four-hour candles, it can be predicted that the movements in favor of the dollar will be a little more weighty and 1.0585 will come to the fore.

We will continue to monitor 1.0710 for possible reactions.

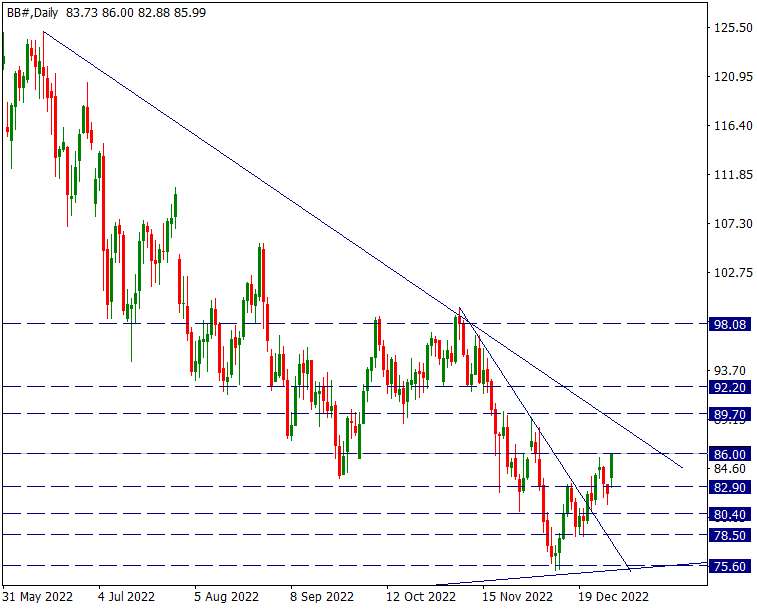

BRENT

BRENT – He Closed the Last Hours of the Year with Rising…

Oil prices had risen by around $2.5 towards the close on the last trading day of 2022. Here, aside from the year-end volatility, it seems like a continuation of the pre-pricing that China will give up its zero COVID policy this year (2023). If China truly abandons its zero-COVID policy, its economic activity will increase further, which could push up oil demand.

Technically speaking, Brent, which has increased step by step since the 75.60 level, rose to $86 in 2022. While we have resistance in this region, the downtrend line from the 125 region will be the main resistance. When we look at it in this way, it is possible to see a pricing that can continue by getting stronger above the 89.70 resistance. But for now, we’ll be watching the 86 and 89.7 regions.

Brent market was closed today. We would like to remind you that it will reopen after 04:00 (GMT+3) tomorrow night. Along with the Chinese news, we will also follow the OPEC developments.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

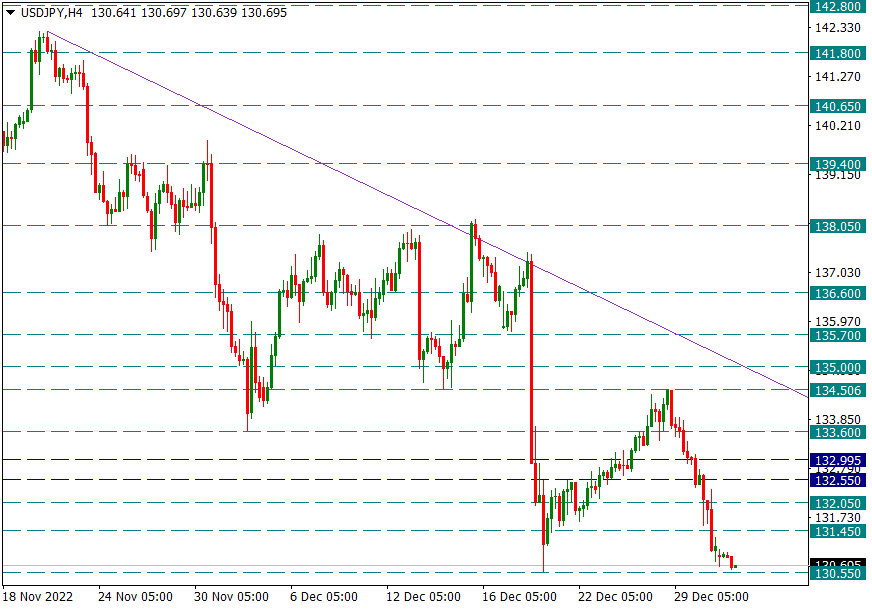

USD/JPY

USD/JPY – Again at an All-Time Low…

On the last trading day of the year, it continued to move in favor of the JPY. This situation continues on the first trading day of the new year, and the USDJPY pair has dropped back to 130.55, the low of 2022. When we look below 130.55 with the short-term Fibonacci length, we will first be watching 129.50 and then 128.20 levels.

As long as it does not go above the 133.00 level in possible reactions, we can think that the attacks in the parity may return to the movement in favor of JPY.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

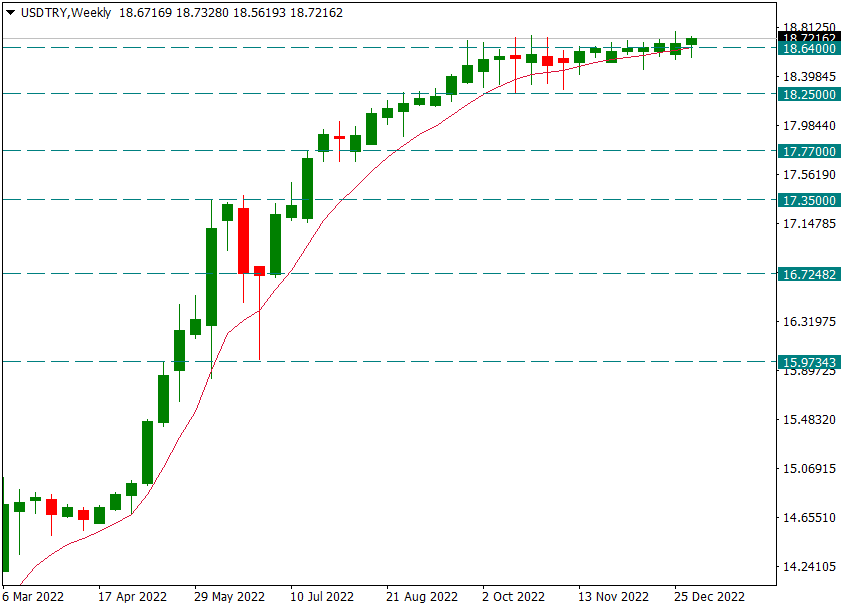

USD/TRY

USD/TRY – Continuing to Stay Above the 8-Week Average…

The dollar rate started the new year generally at 18.72 levels. We look at USDTRY on a weekly basis with an 8-week average. With the close of last week, the candles continue to stay above the 8-week average. As long as this average is maintained, we can expect the general trend to continue.

Contact Us

Please, fill the form to get an assistance.