*German consumer inflation increased by 0.3% monthly in July, as expected, and increased by 6.2% year-on-year. It continues to maintain its high course in inflation.

* Philly Fed President Harker stated that if there is no alarming situation in the data until mid-September, the interest rate can be kept constant and if it reaches the point of keeping the interest rates constant, it should be at this level for a while. In the continuation of his statements, he said that he did not foresee a result of lowering interest rates in the short term and that he expected that unemployment would increase slightly.

*In the trade balance data for June, the US trade balance showed a deficit of 65.5 billion dollars, the Canadian trade balance of 3.73 billion Canadian dollars and the French trade balance of 6.7 billion euros.

*FED’s Barkin said in a statement that GDP remains solid and the labor market is remarkably resilient. In the continuation of his statements, he did not give a signal about his interest rate preference.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

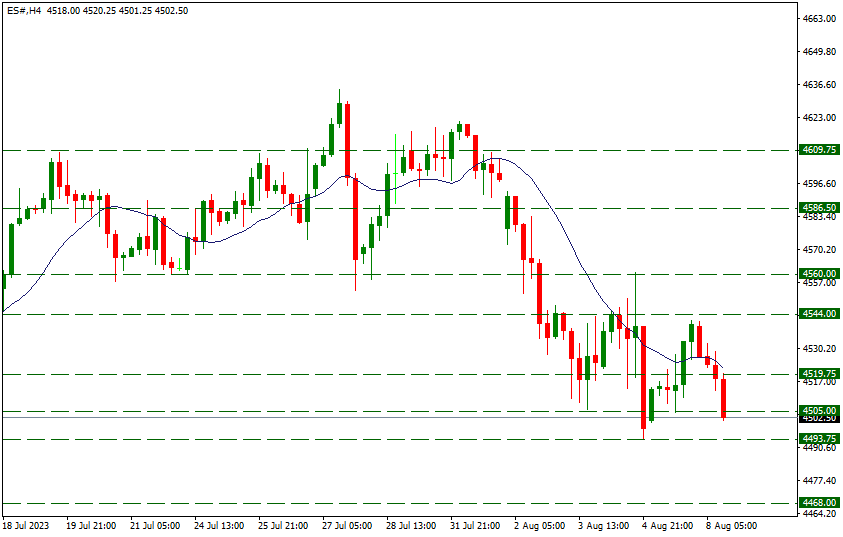

SP500 CFD

SP500 – Pulled Back Towards Week Opening…

The index, which started the new week with a rise, moved towards the 4544 level. Reactions from this level and withdrawals showed their effect again. It is momentarily below the 4505 level, with a decrease of approximately 0.8%. We will follow the critical level 4493.75 in the continuation of the pullbacks. On the ups, the 4544 level can be considered as the main resistance level in the short term.

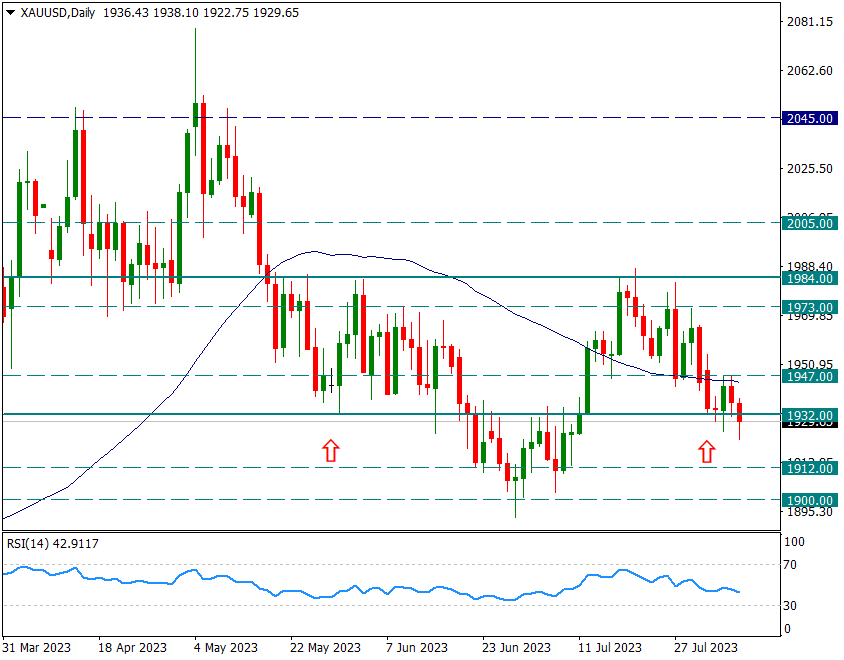

XAUUSD

Ounce Gold – 1932 Support Breaks Negative Pressure May Stay Strong…

Ounce Gold had slightly increased last Friday with the Non-Farm data that came below expectations. However, Average Hourly Earnings and Unemployment Rate, which are among the other data that the FED cares about, were quite strong, but the market did not care much about it. As of the new week, the markets are starting to price the data again. While the US Dollar index is getting stronger, there are strong decreases on the Ounce Gold side. As of today it has drooped strongly below 1932. If there is a closing below this support, we can observe a rapid withdrawal towards 1900.

While we expect possible reactions to rise above 1932 in the evening hours, the main weekly resistance is at 1947 level.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

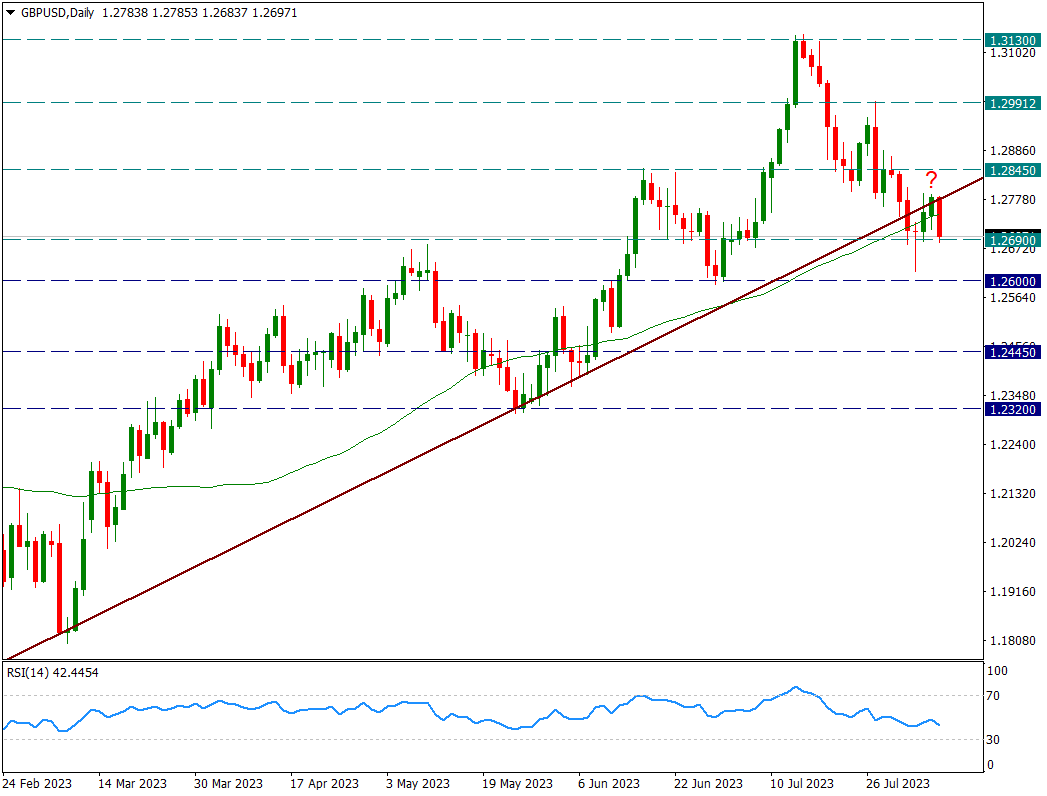

GBPUSD

GBPUSD – Upside Limited, Failed to Re-enter Trend. 1.2690 Important…

The pair broke the trend from 1.09 last week and sagged up to 1.2690. He immediately reacted and confirmed the trend he broke, and as of today, we see a strong decline again without breaking the trend. With this decline, 1.2690 support is being tested again. When it fell below 1.2690 last week, it hung up to 1.2620, but made its daily close above 1.2690. For this reason, we will follow the daily closing.

Below 1.2690, we can observe a gradual decrease to 1.2320 level.

In possible reactions, the intraday first reaction zone is seen as 1.2785.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.