*The balance sheet period, which started in international stocks, will continue with the announcement of Apple and Amazon’s balance sheets in the new week.

-1 August Tuesday Pfizer; Merck, AMD and Starbucks

-2 August Wednesday; Qualcomm

-3 August Thursday; We will follow Amazon and Apple.

*We followed the inflation and economic growth data from the Euro Zone during the day.

-Eurozone – CPI (monthly): -0.1% (Previous: 0.3%)

-Eurozone – CPI (annual): 5.3% (Previous: 5.5%)

-Eurozone – Core CPI (annual): 5.5% (Previous: 5.5%

-Eurozone – Economic Growth (annual) Q2: 0.6% (Previous: 1.1%)

-Eurozone – Economic Growth (quarterly) Q2: 0.3% (Previous: 0%)

*The US Dollar declined after the US inflation announcement this month but is expected to rebound following the ECB and BOJ decisions at the end of the month. The currency pair is set to close July above 1.10. Key factors to watch in August include the Non-Farm Employment Report from the USA, US July inflation, FOMC member opinions, and the Jackson Hole meetings. Major product prices are as follows, approximately one hour after the opening of the US markets;

EURUSD 1.1055 – GBPUSD 1.2850 – USDJPY 142.20 – Ounce Gold 1970 – Crude Oil 81.20 – Brent Oil 85.00

Futures SP500 4610 – Nasdaq Futures 15860 – Futures Dow Jones 35610 – US 10-year 3.95%

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

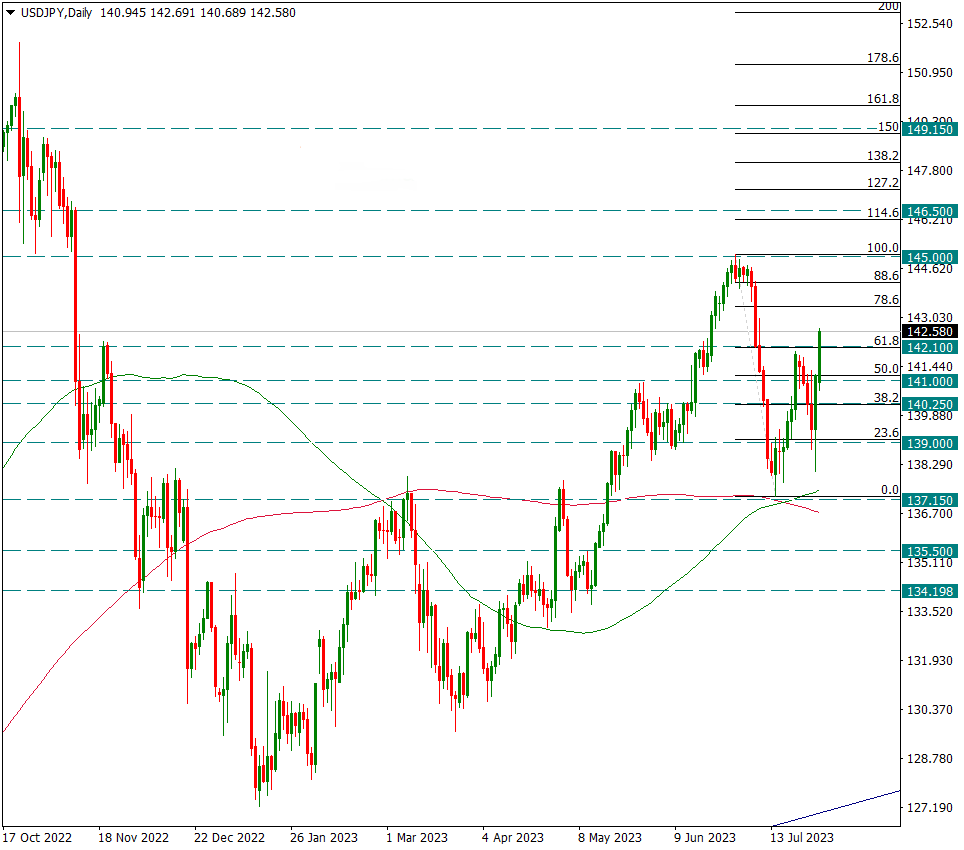

USDJPY

USDJPY – Breaks Above 142.10 and Uptrend Accelerates…

The pair had a very volatile day after the BOJ meeting last Friday, but closed the day at 141.00. On the first business day of the new week, its rise continued during the day and rose to 142.60. As such, it broke above the Fibonacci 61.8 retracement of the 145.00/137.15 decline.

Although the BOJ extended the 10-year yields up to 1%, it did not actually raise the ceiling here and stated that it would allow from 0.50% to 1%, but would bring the interest rate closer to 0.50% by buying bonds. Therefore, the absence of a strong hawkish stance depreciates the JPY side. The end of the depreciation in the Dollar Index also pushed the USDJPY up again

The main intraday support zone is now at 142.10 and as long as we stay above this level, we may see pricing towards 145.00. Above 145.00 BOJ’s chances of re-intervention or rumors may increase.

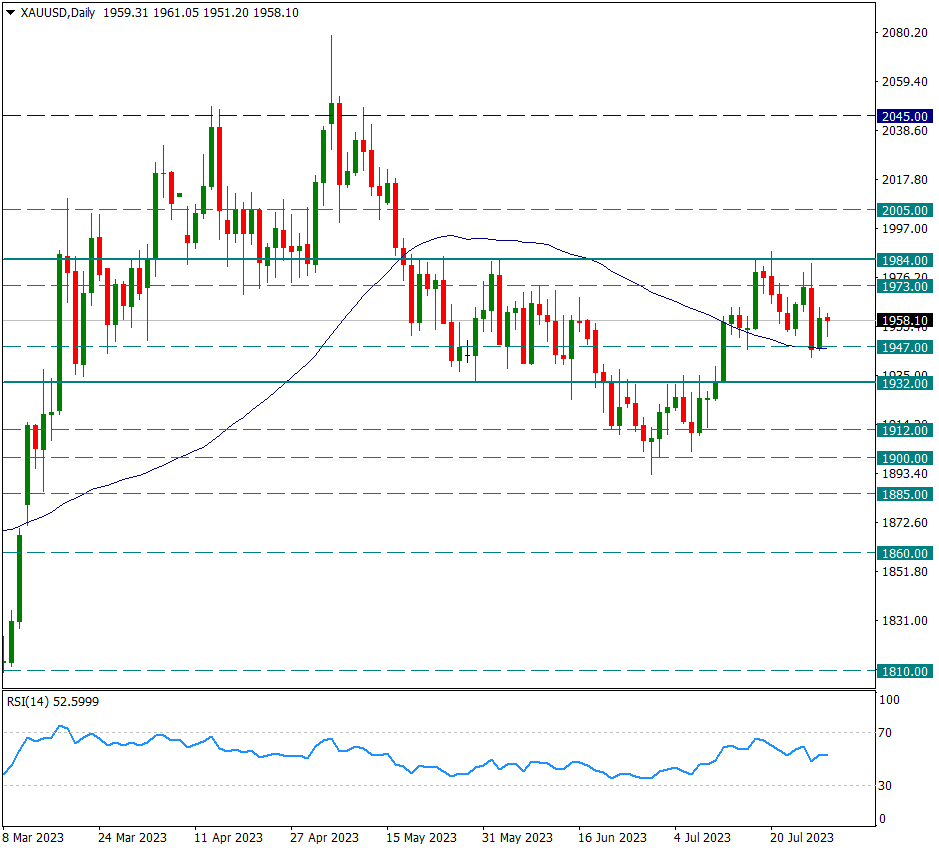

XAUUSD

Ounce Gold – Started New Week With Over 50 Days…

The yellow metal reacted from its 50-day average on the last trading day last week, climbing from 1947 to 1960. While it continues to sit on the 50-day average for the new week, the movements are more stable due to the beginning of the week. The support below holding prices is the 50-day average. If this is broken, the selling pressure will make itself felt and the 1932 level will come to the fore as the main weekly support.

On the upside, the main weekly resistance is 1984. The reverse shoulder head-shoulder structure can be triggered if 1984 is exceeded and canceled if the 1932 support is broken. We will follow the movements in this area.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

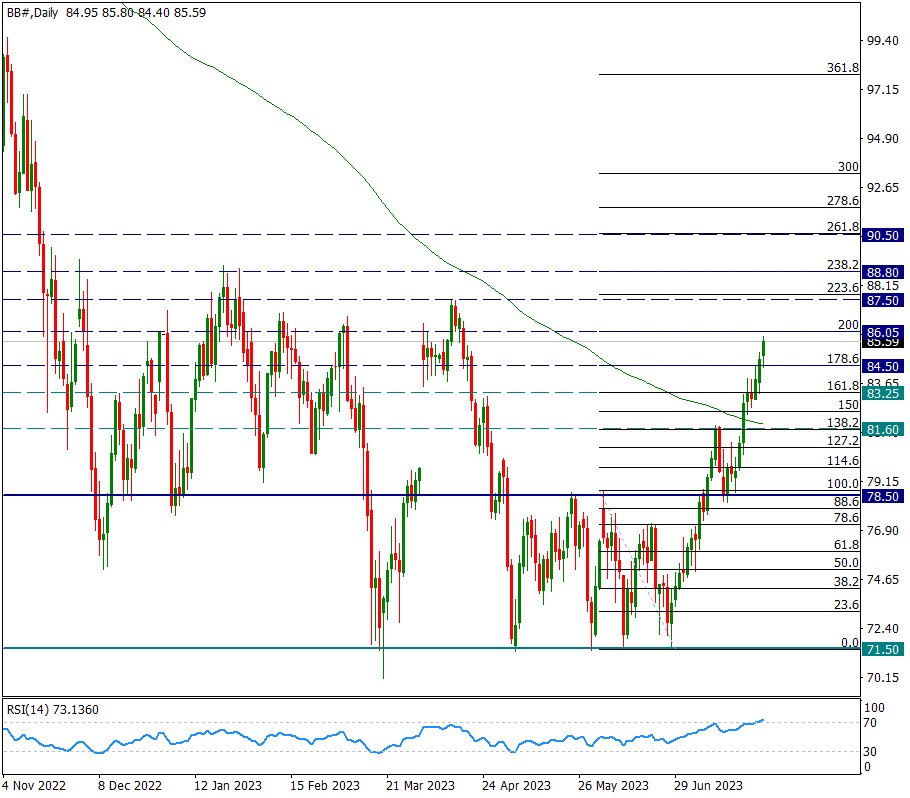

BRENT

BRENT – As The Rise Continues Where Are The Important Technical Regions?

The rise in Brent oil continues with full force. The fact that it broke the 78.50 level in the previous weeks and then exceeded the 200-day average in the ongoing positive movements pulled the prices even higher. After these positive movements, we saw a rise to the level of 86.05.

Due to the successive rise, it came to the extreme bullish zone and there may be occasional profit sales. However, unless the 81.60 support on a weekly basis is broken, a gradual trend towards 88.50 may be possible.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.