The May PCE price index, a key inflation indicator in the USA, was announced at 15:30 CET. Following the data release, the US Dollar index and US 10-year bond yield slightly declined, while Ounce Gold and US stock market indices showed an increase.

USA – Core PCE Price Index (yoy): 4.6% (Previous: 4.7%)

USA – PCE Price Index (yoy): 3.8% (Previous: 4.4%)

It is very likely that this data will not cause any relaxation in the Fed’s policy of raising interest rates twice this year. However, expectations for the FED to act more aggressively can be eroded for now.

June’s Euro Zone inflation data declined compared to expectations and the previous month, May.

Despite core inflation surpassing expectations, the decline in annual inflation, given Germany’s higher base effects, made headlines. However, core inflation remains high, prompting the European Central Bank to tighten its stance.

The Japan Ministry of Cost reported no intervention for the depreciation of the Japanese Yen from 30 May to 28 June. The upcoming report will be significant as USDJPY reached the 145.00 level.

Expectations for the Reserve Bank of Australia are mixed, with a potential 25 basis point rate increase next week. Among Australia’s “big four” banks, CBA expects no changes, while ANZ, NAB, and Westpac anticipate a rate hike. The July decision is uncertain, but a rate hike in August is likely unless rates are increased in July.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

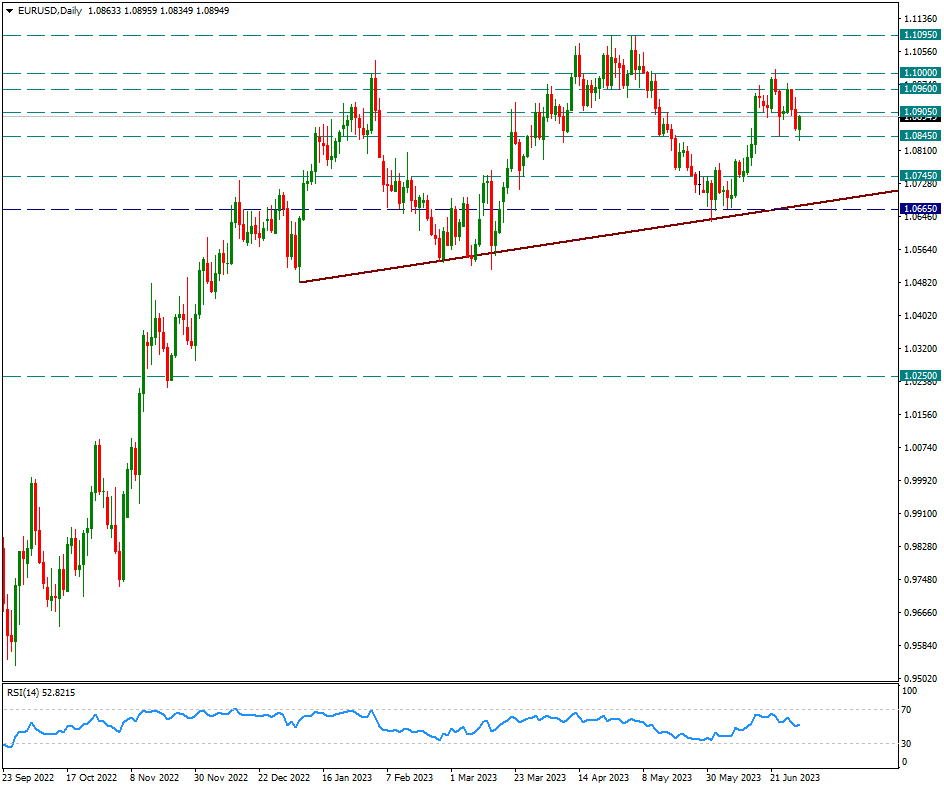

EURUSD

EURUSD – US Approaches 1.09 with PCE Price Index…

While the headline data in the PCE price policy data announced today in the US somewhat receded, the weakening in the Core PCE price group was not that strong. Still, this data may erode the FED’s further aggressiveness for now, but it probably won’t weaken the thoughts of a further two-year rate hike.

The EURUSD pair has already held the 1.0845 support during the day and experienced a mild reaction there. With the data, these reactions continued until 1.0895. Reactions are still weak. It should rise above 1.0905 as soon as possible during the day so that the Euro gains strength in direct movements.

Below we will watch the 1.0845 support as the main daily support it reacted to today. Leaking this support could pave the way for 1.0745.

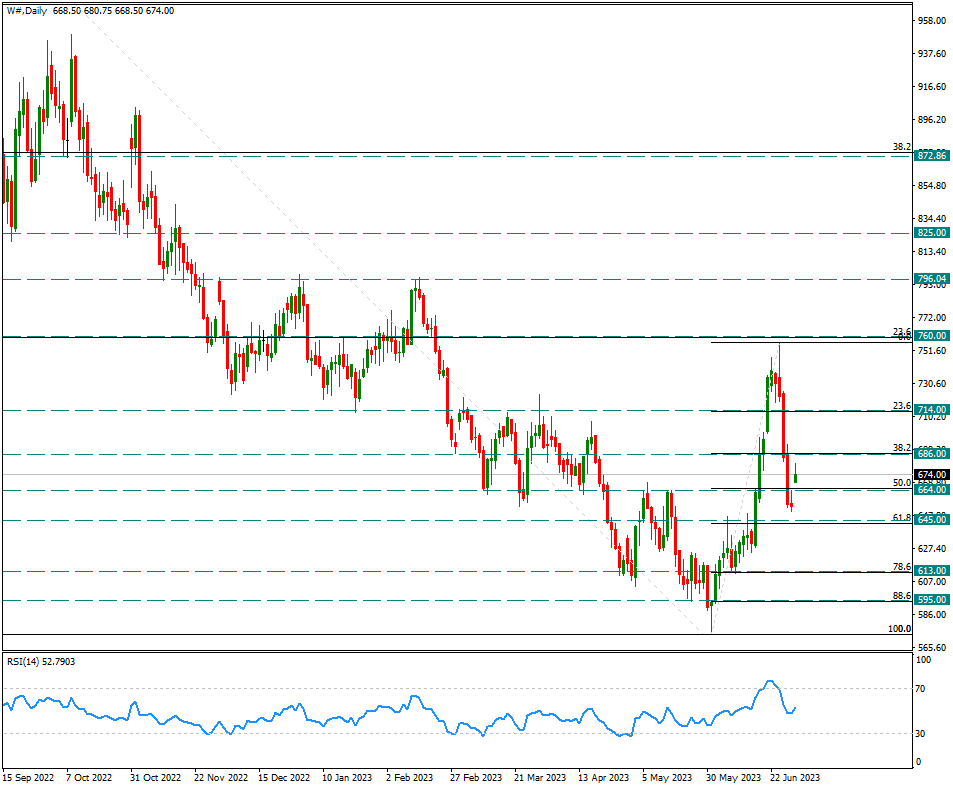

W#

Wheat – Fix Up To 645 Breathing In Here…

Wheat price reacted mildly to 760 resistance on Monday, with the unrest caused by the attempted rebellion in Russia over the previous weekend. But the suppression of the rebellion gave back that risk premium, and we’ve seen pullbacks throughout the week.

This pullback corrected the Fibonacci 61.8 of the most recent 573/760 rally. In other words, there was a pullback up to roughly 645 support zone. There is a slight reaction as of the last trading day of the week. We will continue to watch the 645 level as intraday critical support. The first damp resistance 714 above, and then the 760 tested this week will be important.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

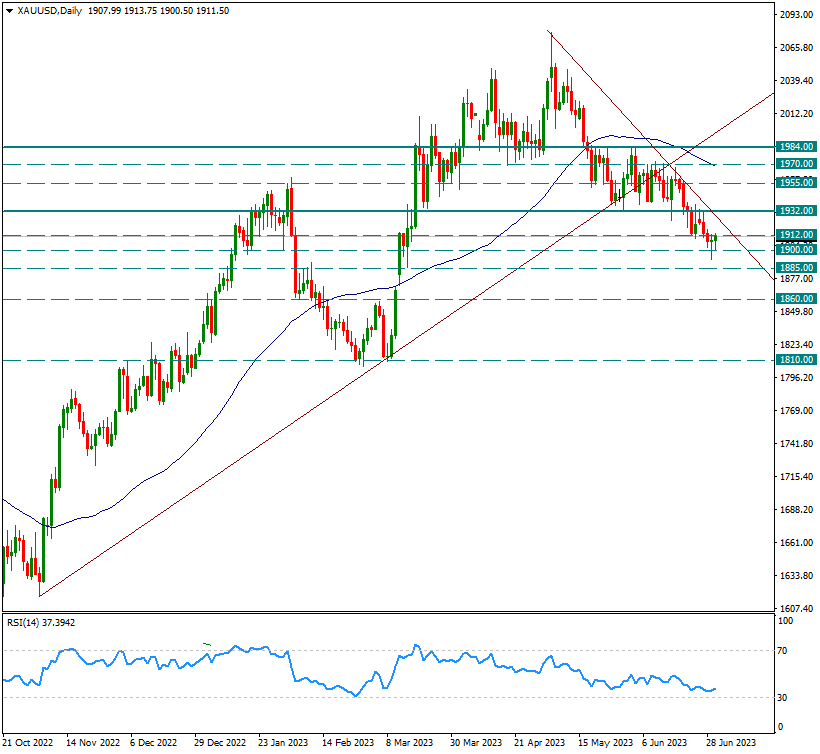

XAUUSD

Ounce Gold – Rise to 1912 by Continuing the Habit of Reaction from Supports…

While the yellow metal generally breaks the supports one by one, it is reacting lightly but weakly from the next support where it regresses. This is the attitude of movement these days. Within a week, it broke the support of 1912 and withdrew until 1900. From 1900 to 1912 there is a reaction today. We see this reaction with the effect of the PCE Price Index data, which was announced in the USA and showed a slowdown compared to both the expectation and the previous month.

If the daily candle closes above the resistance it broke, the technical picture may change a little. However, we think that we should see a daily candle close above 1932 in the short term for it to gain an upward trend again.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.