* The European Central Bank (ECB) raised the policy rate by 25 basis points to 4.00% at its meeting today. In the statement made, it was stated that inflation is expected to be 5.4% and core inflation is 5.1% in 2023, core inflation indicators continue to be strong and a data-based approach will continue to be followed to determine the appropriate monetary tightening level and duration. ECB Chairman Lagarde also said that it is very likely that they will continue to increase interest rates in July and that they do not plan to stop the rate hikes.

*Retail Sales for May, which we tracked in the US, increased by 0.3% month on month and 1.6% year on year. Data was expected to decrease 0.1% monthly and increase 2.2% annually. Weekly Unemployment Claims, which are among other important data announced in the USA, came in at 262 thousand, above the expectation of 250 thousand, while the Philadelphia Business Activity Index decreased from -10.4 to -13.7.

Agenda of the day;

17:30 USA (GMT +3) Natural Gas Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

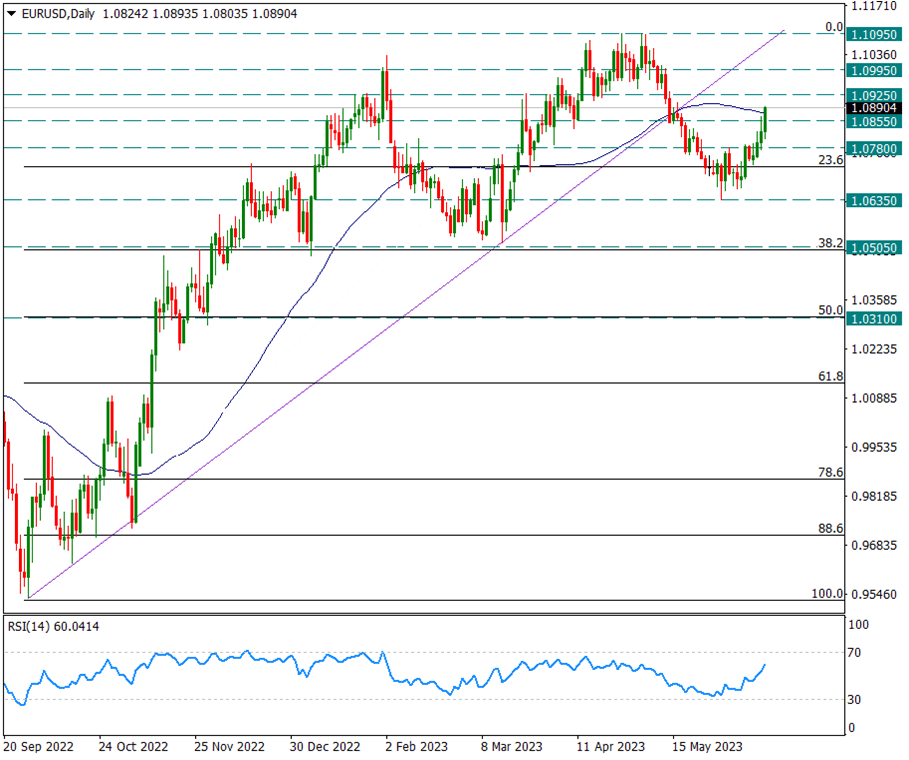

EURUSD

EURUSD – A Distinctive Falcon Breaks Over 50-Days With The ECB…

Yesterday we left the Fed meeting behind. The FED kept interest rates unchanged, but reduced the probability of interest rate cuts for the prospective 2023 to almost zero, and according to the dot plot, two more rate hikes were expected in the markets in 2023. Although the FED was cautious and gave a message that they would talk about everything from scratch at the July meeting, he was a hawk despite the passing of the FED yesterday.

Today, we watched the European Central Bank meeting. The ECB increased the interest rate by 25 basis points in line with expectations and increased the policy rate to 4%. Both the ECB’s and Lagarde’s messages were hawkish. With the Falcon statements, the Euro rose and the pair visibly broke the 50-day average and approached 1.09.

Now the 1.0855 level will be followed as the first support during the day. The formation of candle closes above 1.0855 or 50-day average may reinforce the movements in favor of the Euro. We will watch this.

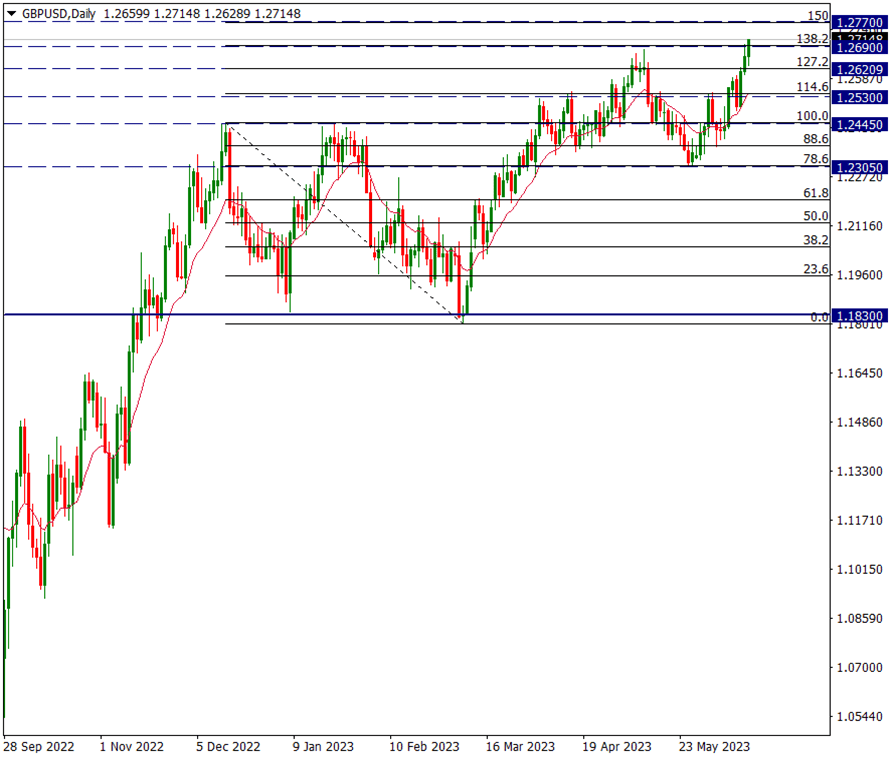

GBPUSD

GBPUSD – 1.2690 Exceeded, We Watch The Rise With The 13-Day Average…

The Sterling continues to appreciate against the Dollar and the GBPUSD pair climbed above the 1.2690 resistance as of today and hit the 1.2715 region. We are watching this rise with a 13-day average and this trend was triggered from 1.2445. This average now equates to the 1.2530 level. As long as it stays above 1.2690, the uptrend will remain quite strong. However, in case of possible sagging below this level, our main support is the 13-day average region. We will carefully monitor the 13-day average for the trend to continue.

If the rise continues, the 1.2840 level will be on the agenda.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

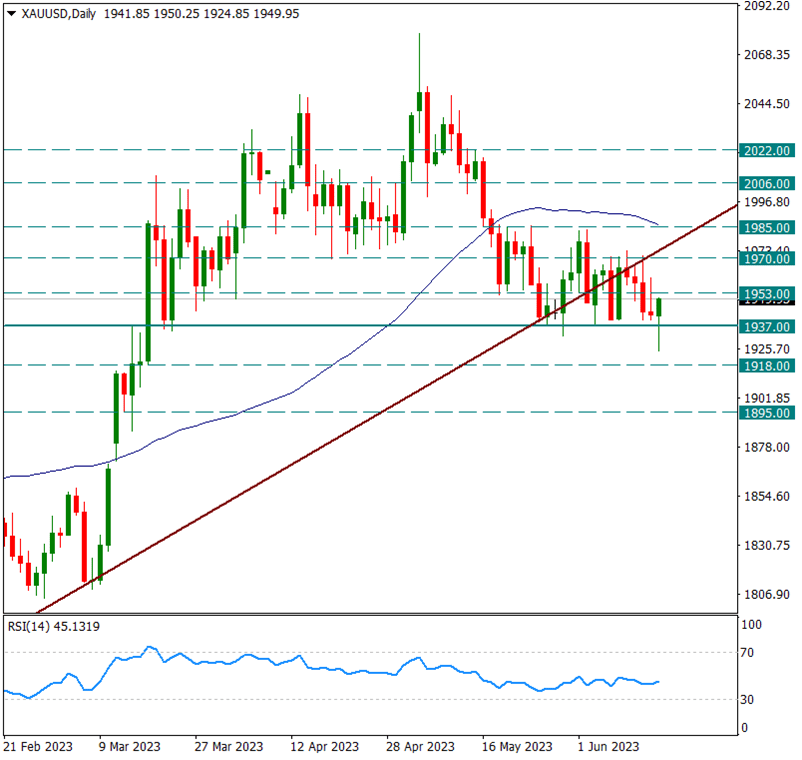

XAUUSD

Ounce Gold – 1937 Support Still Working…

The European Central Bank’s continued hawkish stance, the European continent’s determination in the fight against inflation, caused the yellow metal to sag below the 1937 support in dollar terms at the first moments of the decision. However, the strong depreciation of the Dollar index caused a reaction in the yellow metal again, and the reaction came soon after it slid below 1937. The 1937 level had been working as a short-term support for some time. Therefore, to confirm that this support is broken, either a very strong move is required or a daily candle close below the support is required.

For now, it’s trying to hold on to 1937. However, due to the uptrend line from 1616 and below the 50-day average, the attacks may not be permanent. In the short term, 1937 will be the main support and 1985 will be the main resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.