* It has been announced that First Republic, one of the 3 important banks that went bankrupt in recent months, will be acquired by JP Morgan.

*Expectations for the Fed’s interest rate decisions on Wednesday, May 3 and the ECB on Thursday, May 4, are for an increase of 25 basis points from both sides.

*April Manufacturing PMI data in Canada reached 50.2 with an increase of 1.6 points compared to the previous month. Thus, it exceeded the threshold value of 50, which is considered positive.

*In the USA, April’s S&P Global Manufacturing PMI data reached 50.2 with an increase of 1 point compared to the previous month. Thus, it exceeded the threshold value of 50, which is considered positive.

When we look at the S&P Global data, for the first time since October 2022, a data in the positive region welcomes us. Despite the mixed data, the striking thing is that employment has increased considerably, prices continue to rise, and cost burdens increase. Therefore, it is also a data that informs that the inflation trend is not extinguished.

At 17.00 TSI, ISM Manufacturing PMI data came in again in the USA. The data was announced as 47.1, outperforming the previous month, but still below the neutral level of 50, which indicates that the contraction continues.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

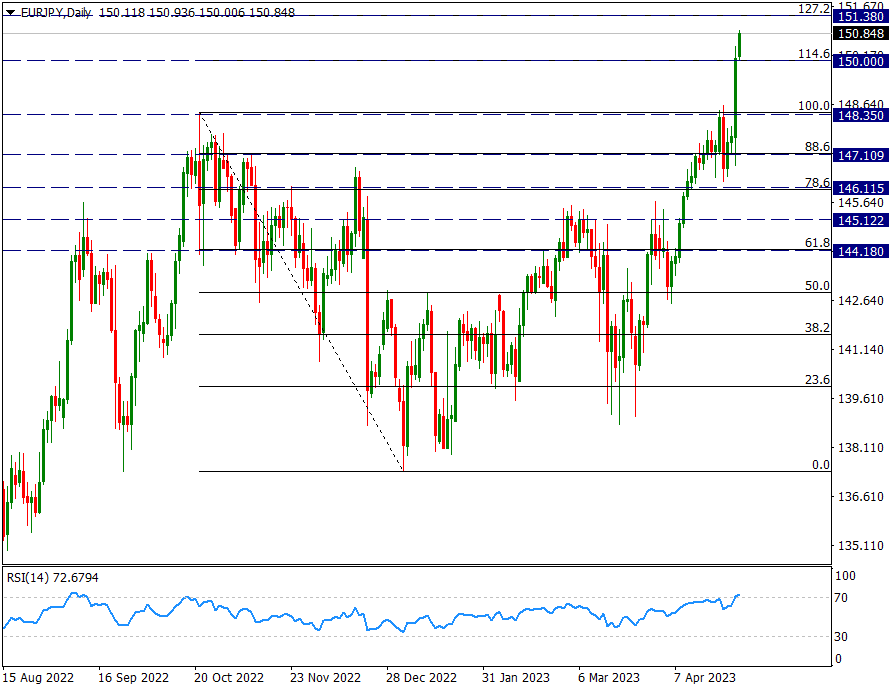

EURJPY

EURJPY – Yen Depreciates, Pair Rises Rapidly…

While the Japanese Yen rapidly depreciated after the decisions of the Bank of Japan on Friday morning, the Euro side is recovering worldwide. Together with these two opposite currencies, the EURJPY parity has reacted from 148.00 levels to 150.90 as of today.

The double peak of 148.35, seen in October 2022 and April 2023, was exceeded as of last Friday. We will check how far the attacks can go with the Fibonacci extensions of the 148.35/137.38 drop. Now here it coincides with the level of 151.38, which coincides with the Fibonacci 127.2 extension, and this area could be the first technical target for the pair.

In possible declines, the main support is 148.35.

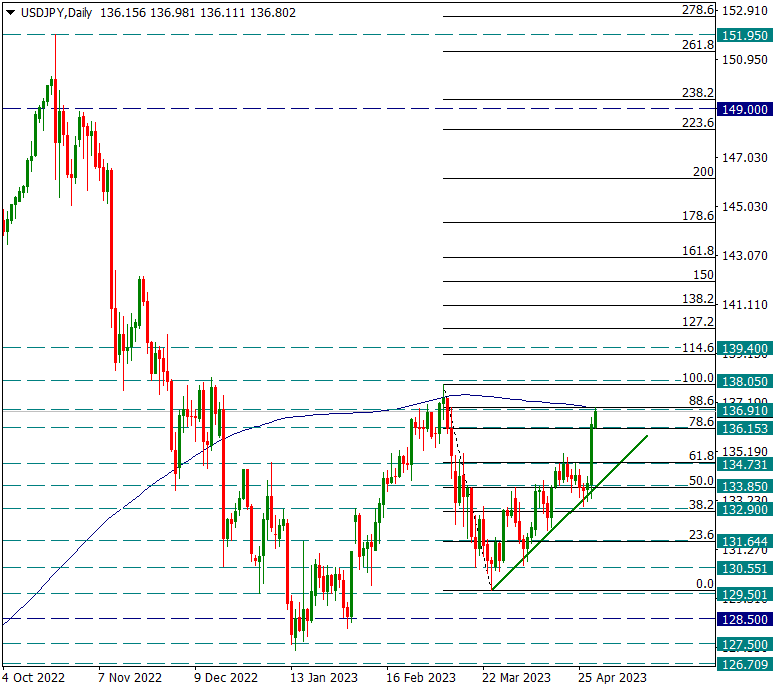

USDJPY

USDJPY – BOJ Effect Continues, Tests 200-Day Average…

Last week, the Bank of Japan’s policy decision to keep the 10-year bond rate ceiling fixed at 0.5%, as well as the statements that a looser policy could be implemented if necessary, caused rapid depreciation on the Japanese Yen side. Moreover, while there is a loss in the dollar index. Because the expectations that the BOJ could increase the bond interest ceiling were also in the majority, but when the opposite statements came, the Yen depreciated.

The USDJPY pair, which was at 133.85 on Friday morning before the decision, is strongly testing the 200-day average at 136.90 as of today. Possible daily candle closures above the 200-day average may continue the rally in the parity.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

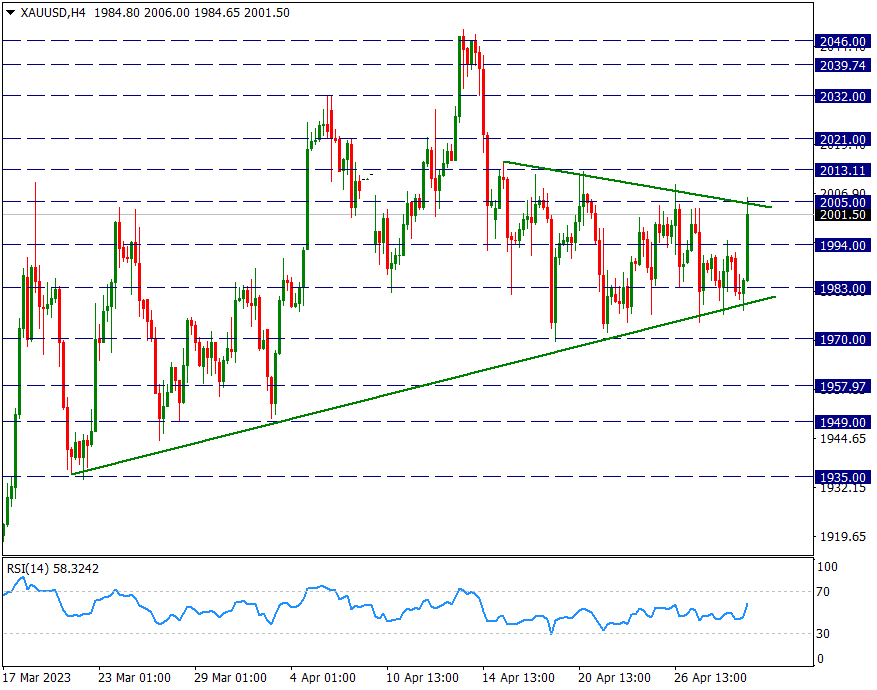

XAU/USD

Ounce Gold – Strong Rise From The Lower Band Of The Triangle To The Upper Band…

The yellow metal had been stuck inside the contracting triangle for a while, and this compression now forced the lower band of the triangle downwards. Having started this week in the lower band as well, the yellow metal received a daily reaction of around $20 and climbed to the 2005 resistance.

In 2005 resistance, the bullish break has stopped for now because as can be seen, this region coincides with the upper band of the triangle. Technically speaking, it would be premature to talk about a certain trend start, unless the upper or lower band of the triangle, that is, the 2005 levels above and the 1983 levels below, are not broken by the four-hour candle closes.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.