- Bank of England (BOE) Governor Bailey said in a statement today after growing concerns about the global banking sector that guaranteeing all bank deposits should not be the norm. .

- In his speech, European Central Bank (ECB) Member Muller stated that headline inflation continues to cause concern, that they should still be worried about upward inflation and that there may be different opinions at the next meeting.

- The Trade Balance in the US, which we tracked for February, came in at -91.63 billion, slightly more than the expected 91 billion level. The Trade Balance had a deficit of -91.08 billion dollars in January. The Housing Price Index, another economic data announced in the USA, decreased by 0.5% monthly and increased by 2.5% annually.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

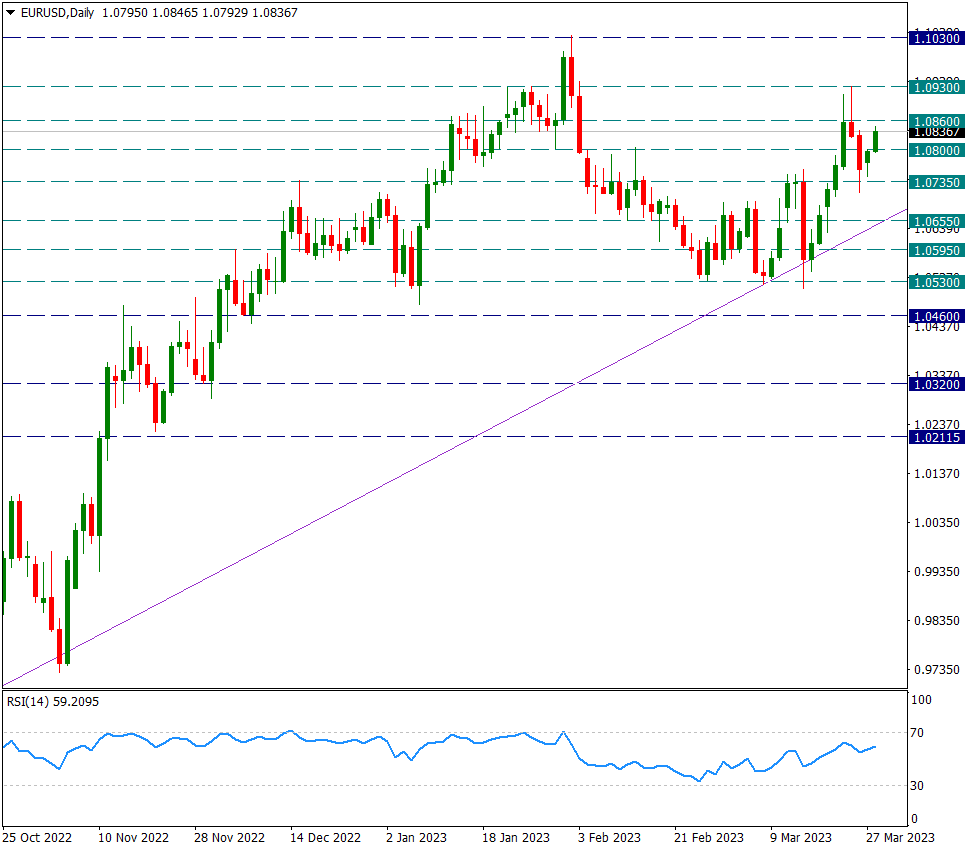

EUR/USD

EUR/USD – The Weekend Reaction Continues Today…

The pair continues to maintain its bullish trend at the beginning of the week. However, it is far from the 1.0930 level it saw last week. We will continue to watch 1.0735 as the main support in intraday movements. Possible daily candle closings below this level may trigger the move in favor of the dollar further and bring up the uptrend line from 0.9550.

In the last two days’ reactions, we will watch 1.0930 as the main resistance.

XAU/USD

XAU/USD – We Watch Formation Formations and 1970 in the Short Term…

The yellow metal showed itself with a double peak-like formation in the 2010/2003 region. The neck area of this formation corresponds to the 1935 level. There was mild backlash from 1945, after forming two hills and retreating. This reaction shows a reverse flag formation for now. If it fails to rise above the 1970 level, the possibility of a reverse flag formation may remain and the negative trend in the yellow metal may resume.

In the continuation of the possible declines, the 1935 level will be extremely important in terms of being the neck region of the double top formation.

In summary, as long as we remain below 1970, we can expect the continuation of the negative movement from the 2000 region. Under 1935, the 18xx region may come up again.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBP/USD

GBP/USD – 1.2310 Strongly Tested Again…

The pair continued to be priced between 1.2310/1.2200 for about 6 working days. Today, 1.2310 resistance is struggling with slight weakening in Dollar index. Above this resistance was tested last week, but daily candle closes remained below 1.2310. If a candle closes above 1.2310, it may technically be possible to continue the movements in favor of Sterling in the pair. We will watch this.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

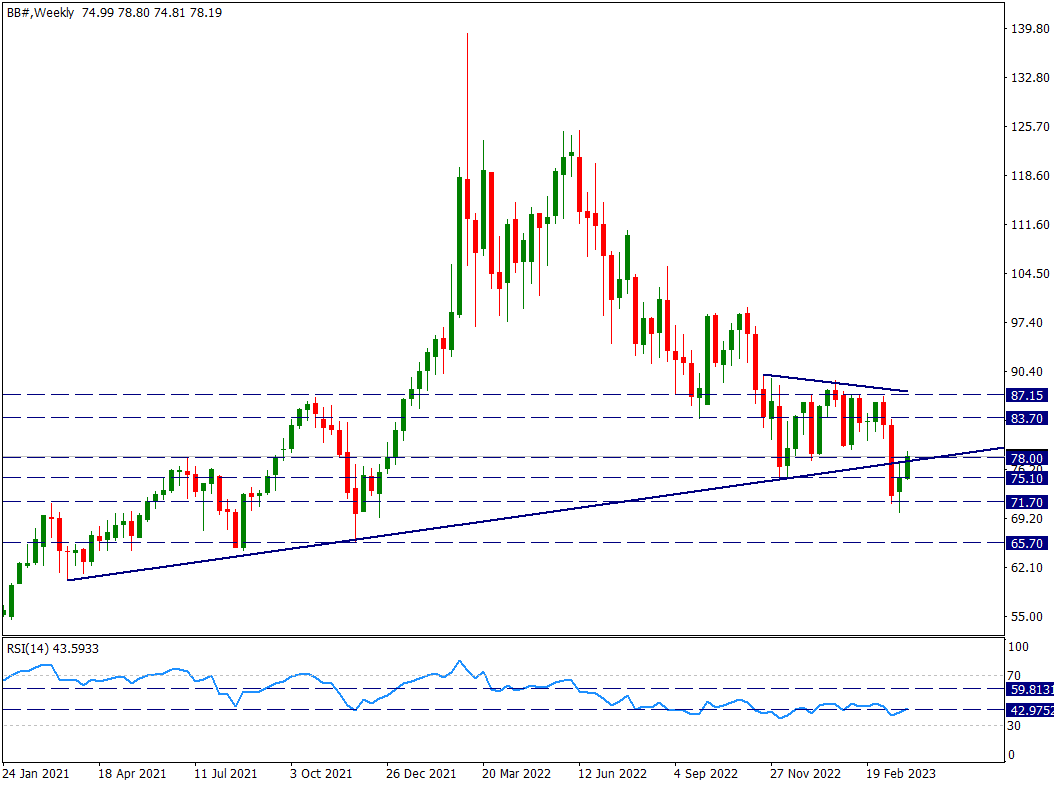

BRENT

BRENT – Reacted to 78 Resistance and We Will Watch Here…

Oil prices have retreated rapidly in recent weeks. Brent futures price also retreated to the 71.70 level. After this rapid decline, there has been a reaction for the last two weeks. As a result of this reaction, it rose again to 78 resistance. If daily closings or weekly closings start to occur above 78, the 87 region may start to come to the fore again. For this reason, we will follow 78 carefully.

Contact Us

Please, fill the form to get an assistance.