In Turkey, the Current Account Balance for November, announced today, posted a deficit of $3.67 billion, more than expected. The data was expected to give a deficit of 3.27 billion. Following this data, the Current Account Deficit for the January-November period became 41.81 billion dollars.

In his speech, European Central Bank (ECB) Member Holzmann said that interest rates will still need to rise significantly to ensure that inflation falls to the target in a timely manner and that there are no signs in the market that inflation expectations are anchored.

While there was not a very heavy data traffic on the 3rd trading day of the week, the Dollar Index rose slightly before the inflation rates to be announced tomorrow in the USA. While US inflation is not expected to change on a monthly basis, it is expected to decline from 7.1% to 6.5% on an annual basis. If inflation declines as expected, the Dollar Index may lose value with the expectations that the FED will slow down the rate hike process even more. On the contrary, if inflation increases, we can see gains in the Dollar Index.

Agenda of the day;

- 18:30 (GMT+3) US Crude Oil Stocks

- 21:00 (GMT+3) US 10-Year Bond Auction

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

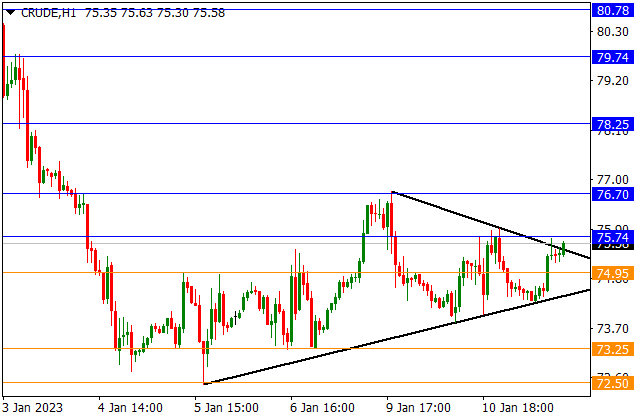

CRUDE

CRUDE – The Upper Band of the Formation Is Being Tested…

Contrary to expectations, API Crude Oil Stocks, which we monitor in the USA, increased by 14,865 million barrels. Stocks were expected to decrease by 2.375 million barrels. After the increasing stocks, there was a decrease to the lower band of the symmetrical triangle formation that we watched in the hourly period. With the support from the lower band, the upper band of the formation is being tested. If the formation is exited upwards, 75.74 and 76.70 can be viewed as resistance. In retracements, 74.95 and the lower band of the formation can form support.

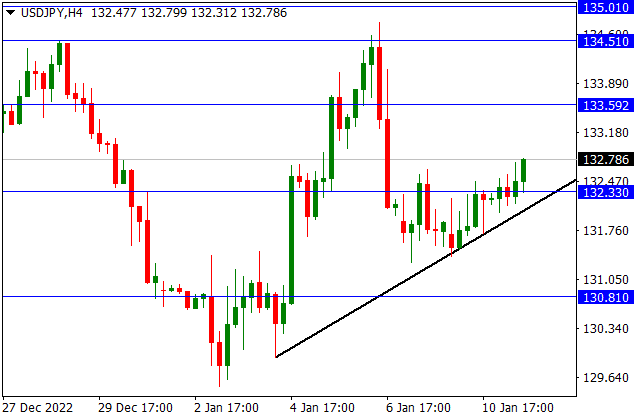

USD/JPY

USD/JPY – Rising with the Support of Rising Price Trend…

The USDJPY pair is rising on the back of the rising price trend we watch in the 4-hour period. In the continuation of the rise, 133,592 and 134.51 can be viewed as resistance. In pullbacks, 132.33 and rising price trend can form support. In case of a downward trend from the rising price trend, the declines can gain momentum.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

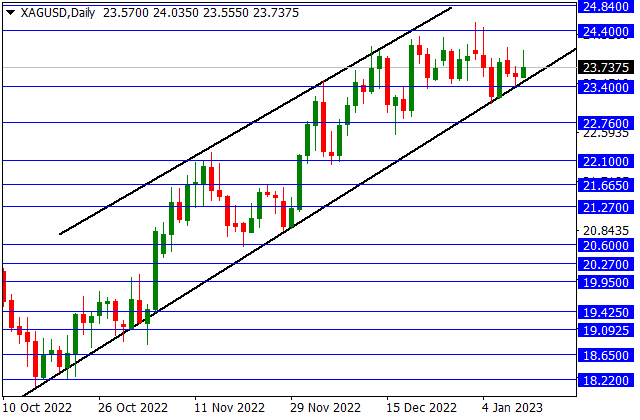

XAG/USD

XAG/USD – Rising Again With Support From 23.40 Level…

After the pullbacks, silver is rising again from the 23.40 level and with the effect of the support from the lower band of the rising price channel. In the continuation of the rise, 24.40 and 24.84 can be viewed as resistance. In pullbacks, the lower band of the ascending price channel can form significant support. In case of a downward exit from the channel, the declines may gain momentum.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.